Introduction

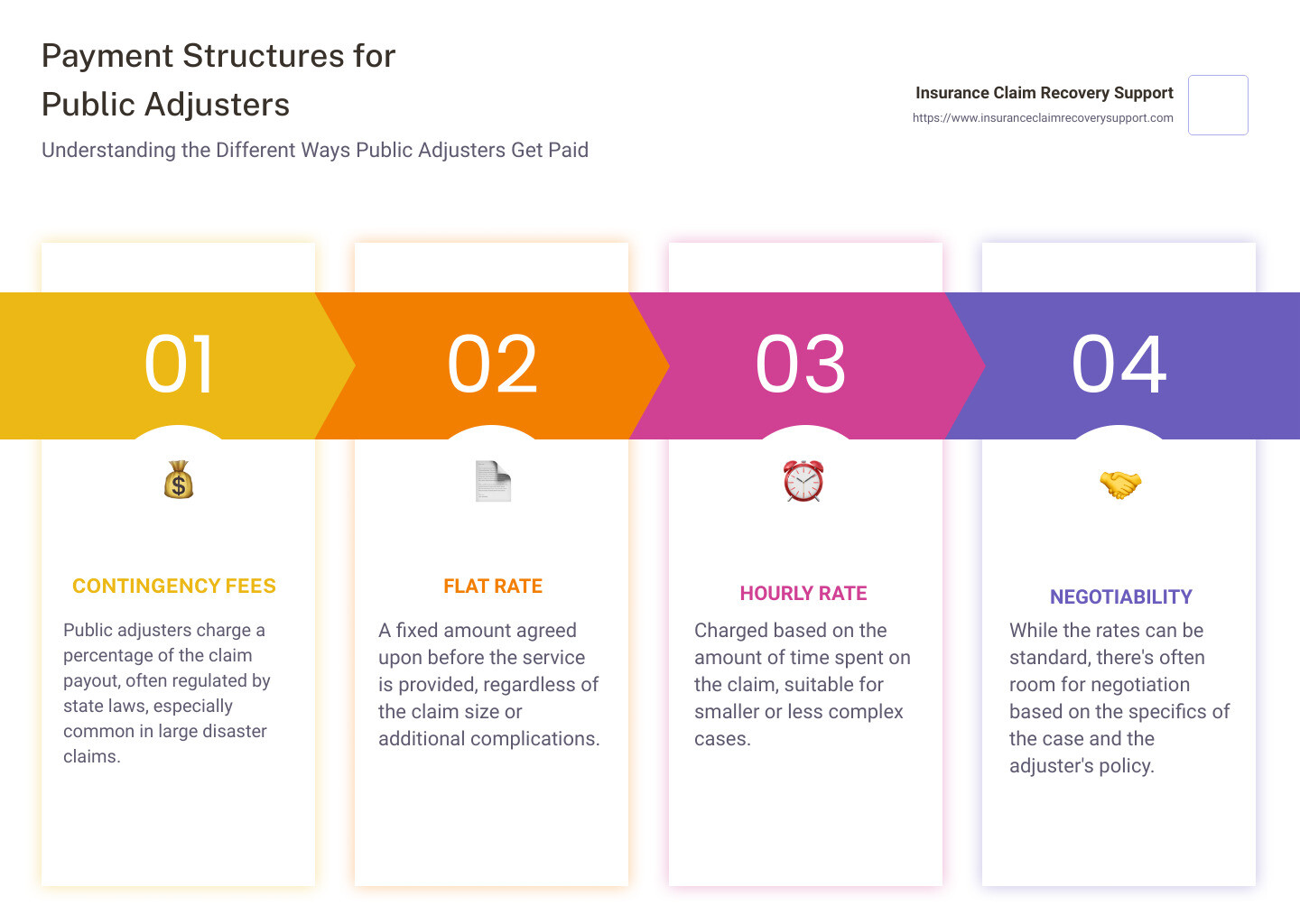

How do public adjusters get paid? Wondering if you should hire a public adjuster? Public adjusters are crucial allies for property owners navigating the complex insurance claim process. These professionals are typically compensated in three primary ways: contingency fees, flat rates, and hourly rates. Typical terms are no recovery, no fee and when a check is issued by your insurer, the public adjuster charges a fee based on the payment issued by your insurance company. Understanding the fee structure for public adjusters is key to making informed decisions when hiring one.

Public adjusters play a pivotal role, especially when dealing with claims related to fire, hail, hurricane, tornado, flood, lightning, or other disasters that impact commercial and residential properties. They work exclusively for the policyholder, not the insurance company, ensuring that the claim is handled fairly and efficiently. This not only helps in securing a just settlement but also in alleviating the stress associated with insurance claims.

For property owners, whether you’re overseeing an apartment complex, commercial building, homeowner association, hospital, school, or industrial facility, knowing when and how your adjuster gets paid can influence your decision in selecting the right professional for your needs. Let’s break down their payment schemes more clearly.

Types of Public Adjuster Fees

When you’re considering hiring a public adjuster, understanding how do public adjusters get paid is crucial. The fee structure can greatly influence your decision and the overall financial outcome of your claim. Here are the main types of fees that public adjusters may charge:

Contingency Fees

Most commonly, public adjusters work on a contingency fee basis. This means they receive a percentage of the claim payout. The specifics can vary by state and by the complexity of the claim. Most states like Texas cap the fee at 10% of the settlement. In Florida, the fee is capped at 20% of the claim payout, but this drops to 10% for claims related to declared emergencies. This fee structure motivates public adjusters to obtain the highest possible settlement for your claim.

Flat Rate

Some public adjusters charge a flat rate. This is less typical but may be used for small, straightforward claims where the outcome is fairly predictable. The flat fee should be agreed upon before the adjuster begins work, and it’s important to clarify what this fee covers to avoid any hidden costs.

Hourly Rate

Though less common, some adjusters also work on an hourly rate. This might be the case where the scope of the claim is limited or very specific. Hourly rates can vary based on the adjuster’s experience and the geographic location.

Understanding these fee structures is not just about knowing what you’ll pay, but also about gauging the adjuster’s motivation and ensuring it aligns with your best interests. With this knowledge, you can proceed confidently, knowing how your choice impacts both the process and the outcome of your insurance claim.

Contingency Fees Explained

When considering how do public adjusters get paid, one of the most common methods is through contingency fees. This means the adjuster’s payment is directly tied to the claim payout. Here’s how it works and what you need to know:

Percentage of Claim Payout

Public adjusters typically receive a percentage of the insurance claim payout. This rate can vary but generally ranges between 5% and 20%. The actual percentage depends on several factors including the complexity of the claim, the total amount of the settlement, and the adjuster’s level of expertise.

State Regulations

Each state has its own set of regulations governing how much a public adjuster can charge. For instance, in Florida, public adjusters are limited to charging no more than 20% on non-disaster claims and 10% if it’s a disaster-related claim. These regulations are designed to protect consumers from being overcharged during vulnerable times.

Disaster Declarations

Following a disaster declaration, many states impose stricter limits on the fees that public adjusters can charge. This is to prevent exploitation of affected property owners when they might be most vulnerable. For example, after a declared disaster, fees might be capped at a lower percentage to facilitate easier recovery for the community.

Understanding these aspects of contingency fees helps you anticipate the potential cost when hiring a public adjuster and ensures transparency in your working relationship. This fee structure also motivates the adjuster to strive for the highest possible settlement, as their payment increases with the claim amount. However, it’s crucial to discuss all these details upfront to avoid any surprises once the claim is settled.

Flat and Hourly Rates

When considering hiring a public adjuster, understanding the different payment options, such as flat and hourly rates, is crucial. Each has its specific uses, benefits, and drawbacks.

Situational Use

Flat Rates are typically chosen for straightforward, larger claims where the outcome is more predictable. This might include cases with clear-cut policy coverage and minimal dispute over the extent of the damages. For example, if a fire destroys a well-documented and insured property, a flat rate might cover all the adjuster’s work without the need for extensive negotiations.

Hourly Rates are less common but can be beneficial in scenarios where the adjuster’s time cannot be easily predicted. These cases often involve extensive research, such as claims where the damage assessment is complicated or when there are multiple areas of dispute between the policyholder and the insurance company.

Negotiability

Both flat and hourly rates can sometimes be negotiated based on the complexity of the claim, the experience of the adjuster, and the estimated hours needed to resolve the claim. It’s important for policyholders to discuss these rates in detail and agree upon them before formalizing any agreements. This ensures both parties understand the scope of the payment and the expected services.

When Do Public Adjusters Get Paid?

When navigating the complex world of insurance claims, understanding how do public adjusters get paid is crucial for policyholders. Let’s dive into the key moments and motivations that influence their payment.

Payment Acceptance

Public adjusters typically receive their payment after any check issued by your insurance company. This means that if you’re working with a public adjuster, they will get paid once you receive any settlement draft from your insurer.

Insurance Claim Settlement Process

The process begins when you file a claim and engage a public adjuster to assess the damage and start negotiations with your insurance company. The adjuster works on your behalf to ensure that all damages are properly documented and that the claim reflects the true scope of the damage.

Throughout the negotiations, the adjuster pushes for a fair and often higher settlement than what might initially be offered by the insurance company. They navigate through the insurance policies, document damages, and communicate with insurance adjusters, aiming to maximize the claim payout.

Motivation for Higher Settlement

Public adjusters are motivated to secure higher settlement for several reasons:

- Direct Impact on Earnings: Since their payment is often a percentage of the settlement, higher compensation results in higher earnings for them.

- Client Satisfaction: Successful negotiations leading to better payouts can enhance their reputation and lead to future referrals.

- Ethical Commitment: Many adjusters are driven by a genuine desire to help policyholders receive fair treatment from insurance companies.

Public adjusters’ unique position of getting paid when you do, ensures they are highly motivated throughout the negotiation process. This setup aligns their interests with yours, as both parties benefit from the maximum settlement.

In conclusion, public adjusters play a pivotal role in the insurance claim process. They are compensated when a policyholder accepts any payment, which motivates them to strive for the highest possible settlement. Understanding this payment structure helps you appreciate the value they bring to your insurance claim handling. Let’s explore how public adjuster fees are structured in specific regions, starting with Texas.

Navigating Public Adjuster Fees in Texas

In Texas, the regulation of how do public adjusters get paid is clearly defined to protect property owners and ensure transparency in the insurance claim process. Here’s what you need to know about navigating public adjuster fees in the Lone Star State:

Texas Regulations

In Texas, public adjuster fees are capped by state law. Public adjusters cannot charge more than 10% of the claim settlement. This rule is designed to prevent excessive fees and ensure that the services provided by public adjusters are accessible to those who need them most, particularly after major disasters.

Regional Specifics in Texas Cities

- Austin, Dallas, Fort Worth, San Antonio, Houston: These major cities often face a variety of claims from storm damage to fire damage. Public adjusters here are well-versed in handling large and complex claims.

- Lubbock, San Angelo: These areas are more prone to experiencing severe weather events like tornadoes and hailstorms, making the role of public adjusters critical in helping residents recover.

- Waco, Round Rock, Georgetown, Lakeway: In these growing cities, public adjusters also deal with claims related to rapid construction and urban sprawl, which can lead to unique challenges in claim settlements.

Texas Fire and Storm Damage News

Texas is no stranger to natural disasters. From hurricanes along the coast to wildfires in the rural areas, the state’s diverse climate and geography make it susceptible to a wide range of natural threats. This reality makes the services of public adjusters especially valuable. Following major events, public adjusters in Texas are crucial in helping residents navigate the often overwhelming process of filing and settling claims. Their expertise ensures that claims are handled efficiently, and policyholders receive the compensation they are entitled to under their insurance policies.

In summary, understanding the regulatory environment and the specific challenges faced in various Texas cities can help you better navigate the process of hiring and working with a public adjuster. Whether you’re in the bustling streets of Dallas or the quiet neighborhoods of San Angelo, knowing these details ensures you can advocate for a fair settlement effectively. With this knowledge, Texans can feel more confident as they proceed with their property insurance claims, backed by the expertise of qualified public adjusters.

Let’s delve into some of the most common questions policyholders have about working with public adjusters.

Frequently Asked Questions about Public Adjusters

What percentage do public adjusters charge?

Public adjusters typically charge a percentage of the final insurance settlement. This rate can vary widely but generally ranges from 5% to 20%. The exact percentage depends on several factors including the complexity of the claim, the amount of work required, and the final recovery amount. In states like Texas, for example, public adjusters are legally capped at charging no more than 10% of the total claim amount.

How can hiring a public adjuster affect my claim payout?

Hiring a public adjuster can lead to a higher payout from your insurance company. Public adjusters are skilled in assessing damage thoroughly and in understanding the intricacies of insurance policies. They negotiate with insurance companies to ensure you receive the maximum possible compensation. A study by the Florida Association of Public Insurance Adjusters (FAPIA) found that homeowners who used a public adjuster received about $22,266 on average, compared to $18,659 for those who did not.

Are public adjuster fees negotiable?

Yes, public adjuster fees are negotiable. While there are typical rates, you can discuss and negotiate the fee structure with your public adjuster before signing a contract. It’s important to agree on a fee that reflects the complexity of your claim and the amount of work anticipated. Always ensure that the agreed-upon fees are clearly documented in the contract to avoid any confusion later on.

Navigating the details of public adjuster fees and understanding their impact on your claim can empower you to make informed decisions. By knowing what to expect and what you can negotiate, you place yourself in a better position to maximize your claim’s outcome.

Conclusion

At Insurance Claim Recovery Support LLC, we are dedicated to demystifying the process of how public adjusters get paid and ensuring that you, as the policyholder, are fully supported throughout your insurance claim process. Our goal is to ensure that you receive the maximum settlement you deserve, and we stand by your side every step of the way.

Our commitment to transparency and client education sets us apart. We believe that informed clients are empowered clients. That’s why we take the time to explain the different fee structures, such as contingency fees, flat rates, and hourly rates, and how these can affect your overall claim settlement. We ensure that all fees are agreed upon upfront and documented clearly to avoid any surprises.

Moreover, our team of experienced public adjusters is well-versed in navigating the complexities of insurance claims across various types of damage, from fire to water and beyond. We understand the intricacies of state regulations and leverage this knowledge to advocate effectively on your behalf.

Choosing to work with us means opting for a partner who values integrity and your satisfaction above all else. We operate on a contingency fee basis, which means we only get paid when you do. This aligns our interests directly with yours, motivating us to secure the best possible outcome for your claim.

For more detailed information on how we can assist with your specific needs and to learn more about our services, please visit our public adjuster services page.

Navigating insurance claims doesn’t have to be a journey you take alone. With Insurance Claim Recovery Support LLC, you have a knowledgeable and passionate team ready to ensure that your rights are protected and that you receive the compensation you deserve. Let us help you rebuild not just your property, but also your peace of mind.