Feeling overwhelmed by the aftermath of property damage? Wondering who can help you navigate the labyrinth of insurance claims to ensure you receive the fair settlement you deserve? You’re not alone.

Understanding Public Adjusting, Importance of Representation:

– What is a Public Adjuster? A licensed professional dedicated to representing you, the policyholder, in insurance claim negotiations.

– Why Representation Matters: Expert assistance can significantly increase your claim settlement, reduce stress, and expedite the claims process.

Many property owners, particularly those managing commercial, multifamily, or apartment properties, find themselves frustrated with the insurance claim process following damage due to fire, hail, or severe weather events. The intricacies can be daunting, leading to delays, underpayment, or even wrongful denial. This is where a National Public Adjuster steps in, offering specialized knowledge to not just navigate but effectively manage your claim for a better outcome.

Simple and to the point, if you’re searching for someone to take the helm of your insurance claims and steer you towards a more beneficial resolution, understanding the value of hiring a National Public Adjuster is your first step.

Why Hire a National Public Adjuster?

When you’re faced with property damage, whether it’s from fire, hail, hurricane, tornado, or flood, the aftermath can be overwhelming. Your primary focus is to get back on your feet as quickly as possible, but the insurance claim process can be a major hurdle. Here’s where a National Public Adjuster comes in, offering expertise and advocacy that can significantly benefit you during this challenging time. Let’s break down the reasons why hiring one could be the best decision for your claim:

Maximize Settlement

The primary goal of a public adjuster is to ensure you receive the maximum settlement possible under your insurance policy. We have the expertise to identify and list dozens of items you might have overlooked, ensuring every aspect of your claim is thoroughly documented and accounted for. A study from The Office of Program Policy Analysis and Government Accountability (OPPAGA) showed that on average, claims handled with the assistance of public adjusters result in a net claim amount eight times greater than those managed by homeowners alone.

Expertise

National public adjusters are licensed professionals specialized in property damage and insurance policy interpretation. We possess a deep understanding of the insurance industry’s complexities, including the fine print of policies and the latest regulations. This knowledge is crucial in navigating the claim process efficiently and effectively, ensuring that policyholders receive all the benefits they’re entitled to.

Stress Reduction

Dealing with the aftermath of property damage is stressful enough without the added burden of handling insurance claims. Home and business public adjusters take over the management of your claim, freeing you to focus on recovery and rebuilding. Our expertise not only in claim preparation and negotiation but also in reducing the emotional toll the process can take on you.

Timely Claim Process

Insurance claims can be time-consuming, often involving back-and-forth negotiations and extensive documentation. The public adjusters have the experience and skills to expedite these negotiations, ensuring your claim is processed in a timely manner. By making sure that all deadlines & guidelines are met, we help avoid unnecessary delays that can hinder your financial recovery.

In conclusion, hiring a certified public adjuster means enlisting a knowledgeable and experienced ally in your corner. Whether it’s dealing with home insurance public adjusters for residential claims or navigating commercial property damage, the right adjuster can make all the difference. From maximizing your settlement to reducing stress and ensuring a timely claim process, the benefits are clear. Insurance companies have experts working for them; you should have experts working for you, too.

Key Services Offered by Top National Public Adjusters

When facing property damage, the journey to recovery can feel overwhelming. That’s where national public adjusters step in. Here’s a breakdown of the essential services they provide, ensuring you’re not navigating this complex process alone.

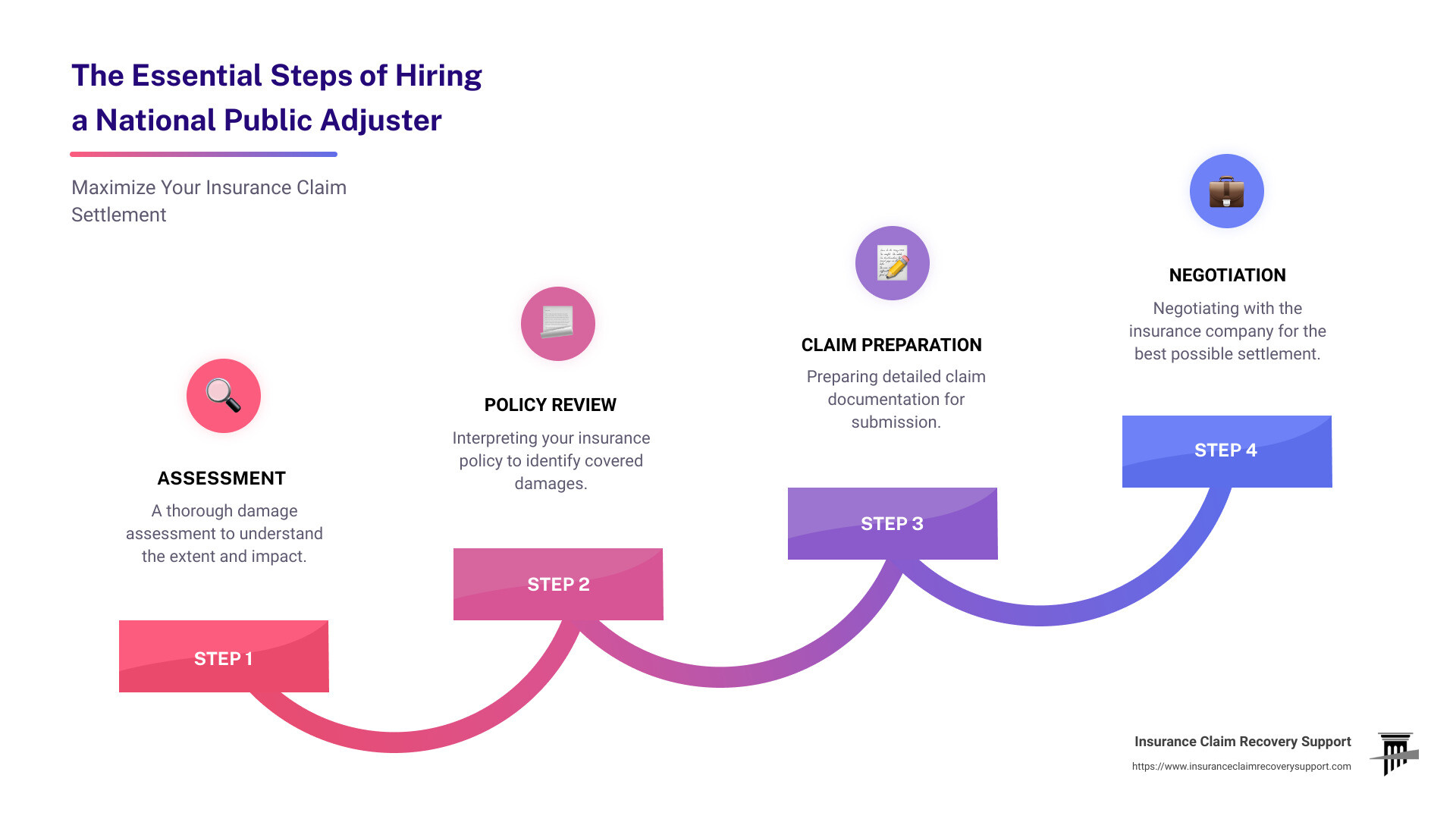

Damage Assessment

First things first, understanding the full extent of your damage is crucial. National public adjusters are skilled in thoroughly assessing property damage. This isn’t just about the obvious damages you can see. Often, there are hidden issues you might miss. These professionals are trained to identify both visible and hidden damages, ensuring nothing is overlooked.

Policy Interpretation

Insurance policies are not exactly light reading. They can be dense, complex, and full of jargon. A public adjuster becomes your interpreter in these situations. They have the expertise to decode your policy, highlighting coverage you might not have been aware of. This ensures that you fully understand your entitlements under your insurance policy.

Claim Preparation

Preparing an insurance claim requires meticulous attention to detail. It’s not just about submitting a claim; it’s about submitting a well-documented, thorough claim that covers all bases. National public adjusters gather evidence, organize documentation, and ensure that every aspect of your loss is accounted for. This preparation is key to a successful claim.

Negotiation

Negotiating with insurance companies can be daunting. Fortunately, national public adjusters are seasoned negotiators. They represent your interests, aiming to secure the best possible settlement. With their knowledge and experience, they can effectively communicate with insurance companies, advocating on your behalf.

Settlement Maximization

The goal of hiring a public adjuster is to maximize your settlement. These professionals leverage their expertise to ensure you receive the maximum payout allowed under your policy. They’re committed to securing a fair and prompt settlement, so you can focus on recovery and rebuilding.

By enlisting the services of a certified public adjuster, you’re not just hiring help; you’re investing in peace of mind. From the initial damage assessment to finalizing a maximized settlement, national public adjusters guide you through every step of the claim process. Whether it’s for home and business public adjusters, independent public adjusters, or personal public adjusters, having expert support can make a significant difference in your recovery journey.

At Insurance Claim Recovery Support, we understand the challenges you’re facing. That’s why we offer comprehensive services tailored to meet your needs, ensuring you receive the support and advocacy you deserve. You don’t have to face this alone. We’re here to help you navigate the complexities of the insurance claim process, working tirelessly to secure the best outcome for your situation.

Evaluating the Best National Public Adjusters

When you’re dealing with property damage, the right support can make all the difference. That’s why choosing among national public adjusters is a crucial step. Here’s what to consider:

Experience

Experience is key. You want a public adjuster who has seen it all and handled various claims, from fire damage to hurricanes. This ensures they know how to navigate complex situations and advocate effectively on your behalf.

Licensing and Bonding

Always check for proper licensing and bonding. This is your assurance that you’re dealing with professionals who are recognized and regulated by industry standards. It’s a layer of protection for you, the policyholder.

Success Rate

The success rate of the public adjusters speaks volumes. Look for adjusters who have a track record of securing favorable settlements for their clients. This often indicates their level of skill and dedication to their clients’ best interests.

Client Testimonials

What others say matters. Client testimonials give you insight into the adjuster’s professionalism, communication skills, and overall performance. Positive feedback from past clients can be a strong indicator that you’re making the right choice.

Areas of Specialization

Specialization can be a game-changer. Whether it’s home and business public adjusters, certified public adjuster, or independent public adjuster, finding someone with specific expertise in your type of claim can lead to better outcomes.

For example, if you’ve suffered from a hurricane, the best public adjuster for you would be one with experience in handling hurricane damage claims.

At Insurance Claim Recovery Support LLC, we pride ourselves on meeting all these criteria. Our team of national public adjusters is experienced, licensed, and has a strong track record of success. We specialize in property damage claims, ensuring that whether you’re a commercial, multifamily, or apartment property owner, you receive the expert representation you need.

Our client testimonials reflect our commitment to excellence and our ability to secure fair settlements promptly. Plus, our nationwide service, with a particular focus on Texas, means we bring local expertise alongside national reach.

Choosing the right public adjuster is about finding someone who understands your needs and is committed to your best interests. With us, you’re not just getting an adjuster; you’re gaining an advocate dedicated to ensuring you receive the maximum settlement you deserve.

Insurance Claim Recovery Support LLC: A Closer Look

Advocacy for Policyholders

We stand out as advocates for policyholders. This means we’re always on your side. When you’re dealing with property damage, the last thing you want is to fight for what you’re rightfully owed. That’s where we come in. We take the burden off your shoulders, ensuring your voice is heard and your claim is taken seriously.

Specialization in Property Damage Claims

Our team specializes in a wide range of property damage claims. Whether it’s fire, hail, hurricane, tornado, or flood damage, we’ve got you covered. Our expertise isn’t just broad; it’s deep. This allows us to navigate the complexities of each specific type of claim, ensuring nothing is overlooked and maximizing your settlement.

Nationwide Service, Texas Focus

While we offer nationwide service, we have a deep focus in Texas. This unique combination allows us to bring our specialized knowledge of Texas insurance laws to policyholders across the country. Whether your property is in Austin, Dallas, Houston, or beyond, we understand the challenges you face and are prepared to help you overcome them.

Unique Selling Proposition

Our unique selling proposition lies in our commitment to policyholders only. Unlike some national public adjusters, we don’t serve insurance companies. This means our allegiance is to you and you only. Our goal is to ensure your insurance policy is fully leveraged to your benefit, protecting your interests against insurance company tactics designed to minimize your claim. With over 15 years of experience and over $300M in large loss claims settled, our track record speaks for itself.

At Insurance Claim Recovery Support LLC, we’re more than just certified public adjusters; we’re your partners in recovery. We understand the stress and confusion that comes with property damage and insurance claims. That’s why we’re dedicated to making the process as smooth and successful as possible for our clients.

Choosing us means choosing a team that’s committed to your success. Let us handle the complexities of your claim, so you can focus on what truly matters—recovering from your loss and moving forward.

Frequently Asked Questions about National Public Adjusters

When navigating the complexities of insurance claims, many property owners find themselves seeking the expertise of national public adjusters. Below are answers to some of the most frequently asked questions about what national public adjusters do, the types of claims they handle, and how they are compensated.

Can I handle my insurance claim on my own?

Yes, it’s possible to handle your insurance claim on your own. However, managing a claim without professional assistance can be challenging, especially for large or complex cases. National public adjusters bring expertise in insurance policy language, damage assessment, and negotiation techniques, which can significantly impact the outcome of your claim. While some policyholders manage to navigate the process independently, hiring a certified public adjuster can lead to a more favorable settlement, often with less stress and in a more timely manner.

What types of claims do public adjusters handle?

Public adjusters handle a wide range of property damage claims on behalf of both homeowners and businesses. This includes damage from:

- Fire and smoke

- Hail and storms

- Hurricanes and tornadoes

- Floods

- Other covered perils under your insurance policy

Whether you’re a commercial property owner dealing with extensive damage from a natural disaster or a homeowner facing the aftermath of a fire, national public adjusters have the expertise to manage your claim. Their role is to ensure that all aspects of your loss are thoroughly evaluated and that your insurance company honors the coverage stipulated in your policy.

How do public adjusters get paid?

Most national public adjusters, including those specializing as home and business public adjusters, operate on a contingency fee basis. This means that they receive a percentage of the insurance settlement. No upfront costs are involved, and if for some reason they are unable to secure a settlement, you owe them nothing. The percentage can vary, typically ranging from 2% to 25%, depending on the claim’s complexity and size. This fee structure motivates public adjusters to achieve the best possible settlement for you. It’s important to discuss and understand the fee arrangement before signing a contract with a public adjuster.

In conclusion, while handling an insurance claim independently is an option, the expertise and guidance of national public adjusters can be invaluable, particularly for complex or significant claims. They handle a variety of claims and are compensated based on the settlement they secure, aligning their interests with yours. Whether you’re considering a home insurance public adjuster, an independent public adjuster, or personal public adjusters, choosing the right professional can make a substantial difference in your claim’s outcome.

Conclusion

Choosing the Right Public Adjuster, Importance of Expert Representation

Navigating the aftermath of property damage can be daunting. It’s a time filled with uncertainty, stress, and a multitude of decisions. Among these decisions, choosing the right public adjuster stands out as crucial. This choice can significantly impact the speed, ease, and outcome of your insurance claim process.

At Insurance Claim Recovery Support, we understand the importance of expert representation. Our team embodies the qualities of the best public adjuster, combining expertise, dedication, and a genuine commitment to our clients’ welfare. Whether you’re looking for national public adjusters, home and business public adjusters, or a certified public adjuster, the goal remains the same: to secure the most favorable outcome for your claim.

Why Expert Representation Matters

- Maximize Your Settlement: The expertise of a public adjuster can uncover details and damages that may be overlooked, ensuring you receive a comprehensive settlement.

- Reduce Stress: Handling a claim can be overwhelming. A public adjuster takes this burden off your shoulders, managing every aspect of the process.

- Timely Claim Resolution: With a professional navigating the claim process, deadlines are met efficiently, leading to a quicker resolution.

- Avoid Pitfalls: The complex language of insurance policies can be tricky. A public adjuster ensures you don’t fall into common traps that could affect your claim’s success.

Choosing a public adjuster is more than a contractual agreement; it’s a partnership for navigating one of the most challenging times you may face as a property owner. It’s about trust, assurance, and the peace of mind that comes from knowing your claim is in capable hands.

At Insurance Claim Recovery Support, we pride ourselves on being more than just public adjusters; we are advocates for policyholders. Whether you’re dealing with fire, hail, hurricane, tornado, or flood damage, our team is equipped to support you. Our specialization in property damage claims, combined with our nationwide service and Texas focus, positions us uniquely to serve your needs.

As you consider your options for representation, remember the significance of choosing a public adjuster aligned with your best interests. The right adjuster will act as your champion, tirelessly working to ensure that your claim is settled fairly and promptly.

In conclusion, the journey to recovery after property damage is fraught with challenges, but with the right public adjuster by your side, the path becomes clearer and less daunting. At Insurance Claim Recovery Support, we are committed to providing that clarity, support, and expertise, ensuring that each of our clients receives the best possible outcome for their claim. Let us be your advocates, fighting for the full policy benefits you deserve, so you can focus on moving forward.