Introduction

Have you found yourself burdened under the weight of an insurance claim for hurricane damage? The aftermath of such a disaster is overwhelming on its own, and dealing with the complexities of insurance claims can add another layer of stress to an already challenging situation. One solution to this problem is working with a public adjuster, a professional who can manage your claim, save you time, negotiate higher payouts, and guide you through the ins and outs of your insurance policy. In this guide, we will discuss how to choose a public adjuster for hurricane damage that will represent your best interests and help you recover the compensation you deserve.

Professional public adjusters possess expertise, provide time savings, have the capacity to negotiate higher payouts, and have a thorough understanding of policy language. Diane Swerling, vice president of Swerling Milton Winnick Public Insurance Adjusters Inc. brilliantly summarizes their mission, “We provide a service so you can get back to your kids and your jobs.” Certainly a noble endeavor, but how can you be sure you’re choosing the right professional for your specific situation?

Brief Overview of Public Adjusters

Public Adjusters are:

– Licensed, bonded independent professionals who negotiate property damage insurance on behalf of the policyholder.

– Skilled in the logistics of the claims process and strategic risk management.

– Negotiators who communicate, meet and correspond with your insurers’ representatives to settle your property damage insurance claim fairly, promptly, and without unnecessary litigation.

– Experts in interpreting policy language and ensuring maximum claim coverage.

Importance of Hiring a Public Adjuster for Hurricane Damage Claims

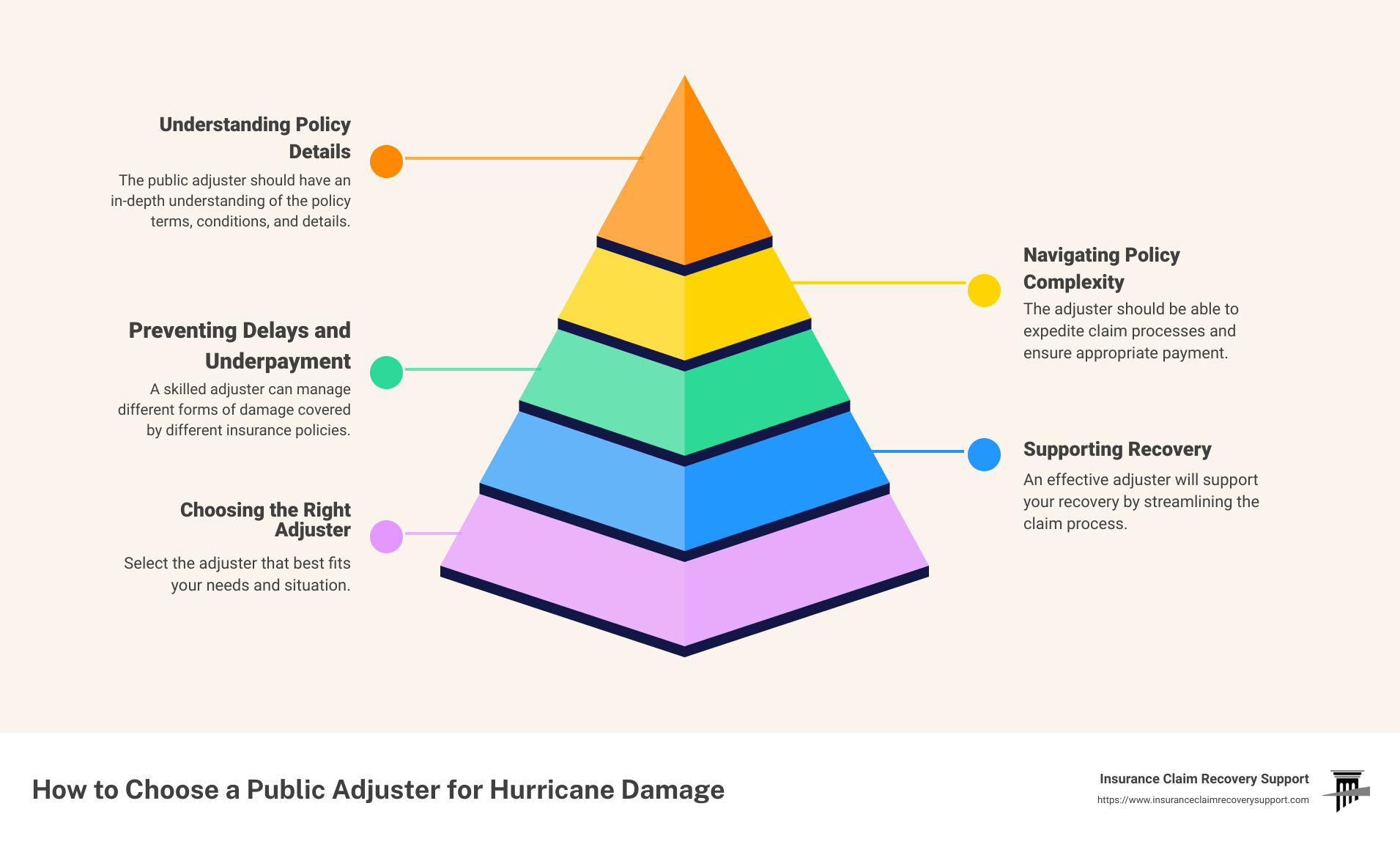

Hurricane damage can be particularly devastating and complex, often presenting unique challenges:

– Different insurance policies cover different forms of damage (e.g., a separate policy for flood damage vs. wind damage) and navigating this complexity can be overwhelming.

– Claims can be delayed or underpaid, which can lead to loss of revenue and further financial distress.

– Understanding the details, terms, conditions, and facts of your policy can be overwhelming, especially as you try to rebuild your life after such a major disaster.

Choosing the appropriate public adjuster for hurricane damage can make a significant difference in the speed and outcome of your claim process. Our goal is to provide you with the tools necessary to make an informed choice that will best support your recovery.

Understanding the Role of a Public Adjuster

Public adjusters are licensed professionals who specialize in handling insurance claims on behalf of policyholders. Their role is to represent the policyholder’s interests, not the insurance company’s. When you’ve experienced a disaster such as a hurricane, understanding the role of a public adjuster for hurricane damage claims can help you navigate the complex claim process and reach a fair and prompt settlement.

How Public Adjusters Assist in Insurance Claims

Public adjusters offer a range of valuable services during the claim process. They conduct a thorough review of your coverage, accurately estimate loss and damages, and manage all matters pertinent to the insurance claim. Their in-depth understanding of the insurance industry allows them to present the claim to the insurance company in the most proficient and effective manner, ensuring that all policy conditions and requirements are met, and reducing the risk of claim denial or underpayment.

Public adjusters are experts at documenting and substantiating each aspect of the claim, allowing them to negotiate more effectively with the insurance company. They are instrumental in preventing the insurer from undervaluing the claim, which is a key aspect of their role. Their involvement can also speed up the settlement process, significantly reducing the time it takes to receive the settlement amount.

Public adjusters perform a crucial role in terms of business continuity as well. By taking over the management of insurance claims, they allow business owners to focus on what they do best — running their business.

The Difference Between a Public Adjuster and a Claim Adjuster

It’s important to note the difference between a public adjuster and a claim adjuster. A claim adjuster, also known as an insurance adjuster, is an employee or contractor of the insurance company. They represent the insurer’s interests and their job is to assess the damage, investigate the claim, and determine how much the insurance company should pay out.

In contrast, a public adjuster is hired by the policyholder and works on your behalf. They represent your interests in the claim process, helping you navigate the complexities of the claim, negotiate with the insurance company, and aim to get you the maximum payout to which you’re entitled under your policy.

Choosing the right public adjuster for hurricane damage can be a game-changer in your recovery process. At Insurance Claim Recovery Support, we’re committed to helping you navigate this crucial decision so that you can focus on rebuilding and recovering.

When to Hire a Public Adjuster for Hurricane Damage

The decision to hire a public adjuster for hurricane damage claims largely depends on two factors: the size and complexity of your claim, and the timing of your decision.

Assessing the Size and Complexity of Your Claim

Public adjusters are particularly valuable when dealing with large, complex claims that require a detailed understanding of insurance policies and claim procedures. They can help decipher the confusing jargon and fine print of insurance policies, accurately estimate your losses, and ensure that you’re adequately reimbursed according to your policy.

A common reason for hiring a public adjuster is when you have suffered substantial property damage due to a hurricane. As per the research, hurricanes can cause billions in damages, making the claims process more complicated. If your property falls into this category, hiring a public adjuster could be beneficial. They can help you navigate the intricate process of filing and negotiating a large claim, ensuring you get the settlement you deserve.

However, remember that public adjusters prefer cases with significant payouts, as their earnings are often based on a percentage of the final settlement amount. Therefore, for smaller claims, they might not be financially worthwhile.

Timing: When is it Too Late to Hire a Public Adjuster?

The timing of hiring a public adjuster is also crucial. Ideally, you should consider hiring one as soon as possible after the hurricane damage. This is because the sooner they can start documenting the damage and begin the claims process, the better.

However, it’s never too late to bring a public adjuster on board. If you’ve already started your claim process but are feeling overwhelmed, or if you feel that your insurance company isn’t treating you fairly, a public adjuster can step in at any time. They can provide a fresh, professional perspective, and help resolve any disputes or delays in the claim settlement process.

That being said, don’t rush into hiring a public adjuster. Take your time to research and choose a reputable public adjuster. At Insurance Claim Recovery Support, we’re here to assist you in navigating these crucial decisions, helping you recover from the hurricane damage as quickly and effectively as possible.

The goal is to ensure that your claim is handled properly, giving you the financial resources needed to rebuild and recover from the devastating effects of a hurricane.

How to Choose a Reputable Public Adjuster

Choosing a reputable public adjuster for your hurricane damage claim is a crucial step in ensuring you receive a fair and prompt settlement. Here are some important factors to consider when deciding on the right public adjuster.

Checking Licenses and Complaints

First and foremost, verify that the public adjuster is licensed to operate in your state. This can usually be done via your state’s insurance department’s online platform. A licensed public adjuster will have the necessary knowledge and skills to guide you through the complex insurance claim process.

In addition, it’s advisable to check for any complaints filed against the adjuster with the Better Business Bureau. This will give you a clearer picture of their track record and reputation among past clients.

Asking the Right Questions: Experience, References, and Current Caseload

When choosing a public adjuster, it’s important to ask the right questions to gauge their competence and suitability for your claim. Some key questions to ask include:

- How long have they been a public adjuster?

- What types of claims do they specialize in?

- Can they provide references from past clients or industry professionals?

- How heavy is their current workload?

These questions can give you insight into their experience, expertise, and capacity to handle your claim effectively. Be wary of public adjusters who seem overly busy or unable to answer these questions satisfactorily.

Understanding Public Adjuster Fees: The Case of Florida

The fees charged by public adjusters can vary greatly, with some charging a percentage of the claim payout. In Florida, the maximum fee a public adjuster can charge is 20% of the claim payout after the contract is signed. However, this fee is reduced to 10% for claims made within the first year following an officially declared emergency.

It’s important to understand and agree on the fee structure before signing a contract with a public adjuster. Avoid public adjusters who demand an upfront fee or pressure you to sign a contract immediately.

At Insurance Claim Recovery Support, we work on a contingency basis – meaning, if you don’t receive a settlement from your insurance company, we don’t collect a fee. Our goal is to make the insurance claim process as stress-free and fair as possible, and we’re dedicated to fighting for your full policy benefits. Get a free consultation on your damage insurance claim today.

Preparing for an Insurance Adjuster After a Hurricane

After experiencing hurricane damage, the next critical phase is preparing for the insurance adjuster’s visit. This stage is crucial in determining the value of your claim and ensuring you receive a fair settlement. Here’s how to prepare:

Documenting Damage: Importance of Photos and Videos

The first step in preparing for the adjuster’s visit is to document the damage extensively. This involves taking photos and videos of all the damaged areas in your property. These visuals will serve as concrete evidence of the damage sustained, supporting your claim.

It would be best if you included all forms of damage, such as roof, window, siding, and interior moisture damage. This documentation should also include any items damaged, such as personal or business property.

Your insurance company will only compensate for the damage you can prove. Therefore, thorough documentation is key.

Making Temporary Repairs: Working with Licensed Contractors

To prevent further damage to your property, it may be necessary to make temporary repairs. However, avoid making permanent repairs until the insurance adjuster has had a chance to assess the damage.

If you need to make immediate repairs, we recommend getting at least two repair estimates from licensed and reputable general contractors. The estimates should detail the cost to rebuild your home to its pre-loss condition. Do not sign any work authorization contract until you and the insurance company agree upon a damage value.

Creating a Detailed List of Damaged Property

In addition to documenting the physical damage to your property, compile a list of damaged personal or business property.

This should be done on a spreadsheet and include details such as the item description, age, quantity, and cost to replace. This list will help establish the value of your lost property and ensure you receive adequate compensation for it.

At Insurance Claim Recovery Support, we understand the complexities of preparing for an insurance adjuster’s visit after a hurricane. If you’re unsure of how to choose a public adjuster for hurricane damage, we’re here to guide you. Reach out to us for professional advice and help in navigating the claim process.

Avoiding Public Adjuster Pitfalls and Scams

Choosing the right public adjuster for hurricane damage claims is a crucial step. However, it’s also essential to understand that, like any industry, the field of public adjusters also has its share of pitfalls and scams. By being aware and informed, you can protect yourself and your property from potential fraud, ensuring a smoother and more successful insurance claim process.

Recognizing Red Flags: Upfront Fees and Pressure to Sign Contracts

A reputable public adjuster will never pressure you to sign a contract without giving you ample time to review it. Be wary of any public adjuster who pushes you to sign a contract before you’ve had a chance to understand its terms and conditions.

Another red flag is the demand for upfront fees. Public adjusters usually work on a contingency basis, which means their payment is a fixed percentage of the claim payout. In Florida, for instance, this fee is capped at 20% of the claim paid, reduced to 10% for claims made in the first year after a declared emergency by the Governor’s office. If an adjuster asks for payment upfront, this should raise alarm bells.

Understanding the Limitations of Public Adjusters

While public adjusters play a significant role in settling insurance claims, they do have certain limitations. For example, they may not be as interested in smaller claims, as their earnings are based on the final settlement amount. It can be challenging to engage a public adjuster for smaller claims, as they might not find them financially worthwhile.

Secondly, public adjusters, while experts in insurance policy interpretation and negotiation, aren’t licensed contractors or engineers. They’re not qualified to make structural assessments or repair estimates. Therefore, it’s crucial to work with licensed contractors who can provide accurate repair estimates and help make temporary repairs if necessary.

At Insurance Claim Recovery Support, we’re here to help you navigate these complexities. Our team is committed to ensuring a fair and prompt settlement for your insurance claim. If you’re unsure of how to choose a public adjuster for hurricane damage, don’t hesitate to contact us. We’re ready to offer our expertise and guidance, ensuring you avoid unnecessary pitfalls and scams.

Conclusion

Recap of Key Points

In navigating the aftermath of a hurricane, the process of insurance claims can become overwhelming. The importance of hiring an experienced, licensed public adjuster to assist you with your hurricane damage claim cannot be overstated. These professionals bring a wealth of knowledge and expertise to the table, help reduce the burden on your shoulders, and ensure that you receive a fair settlement.

When choosing a public adjuster, consider their level of experience, licensing status, and the scope of claims they handle. Ask about their fee structure and ensure it aligns with your expectations. In Florida, the maximum fee a public adjuster can charge is 20% of the claim paid after signing the contract with them. It’s also worth noting that following a declared emergency, this fee is reduced to 10% for any claim made in the first year after the date of loss.

Importance of Making an Informed Decision When Hiring a Public Adjuster

Choosing the right public adjuster can make a world of difference in your insurance claim process. It’s essential to make an informed decision. Ask the right questions, check references, and ensure you’re comfortable with their fees and terms before signing any contract.

Avoid rushed decisions and high-pressure sales tactics. The goal is to ensure your loss is accurately measured, to maximize your insurance coverage, and to recover what you are owed.

How Insurance Claim Recovery Support LLC Can Help

At Insurance Claim Recovery Support LLC, we understand the intricacies of insurance claims, especially when it comes to hurricane damage. We can provide you with the support and expertise you need to navigate the complex insurance claim process. Our team of licensed public adjusters are experienced in handling a wide range of claims and are committed to ensuring you receive a fair settlement.

As public adjusters, we work for you, the policyholder, and not the insurance company. If you are dealing with a delayed or underpaid large loss property damage insurance claim from a hurricane, we are here to help. Our services include analyzing your insurance policy to ensure maximum claim coverage, inspecting the property damage and estimating all losses, and negotiating with your insurance company for a fair and equitable settlement.

We offer a risk-free loss recovery offer – no recovery, no fee. We value your privacy and do not sell, trade, or rent your personal information to others.

At Insurance Claim Recovery Support LLC, we are dedicated to helping you navigate the complexities of an insurance claim. For more information on how we can assist you, visit our Professional Help Directory. For an in-depth look at hiring a public adjuster, read our guide on “Hiring a Public Adjuster – The Inside Scoop”.

Choosing the right public adjuster is an important decision that should be made with care. We are here to help guide you through this process and ensure you receive a fair and prompt settlement. Contact us today for a complimentary consultation on your damage insurance claim.