Are you overwhelmed by the intricacies of an insurance claim process following significant damage to your property? Every commercial, apartment, or multifamily property owner knows the frustration of trying to obtain a fair, prompt settlement from their insurance company. That’s where we, at Insurance Claim Recovery Support, come to your aid as Independent Loss Assessors.

Many policyholders mistakenly equate an independent loss assessor with an insurance adjuster. In reality, there is a critical difference: while an insurance adjuster works on behalf of the insurance company to evaluate a claim, a loss assessor works exclusively for YOU. Licensed professionals, loss assessors are your personal advocates to navigate the complexities of the insurance claims process. We ensure you’re fully equipped to handle this daunting task, providing the reassurance of a fair settlement.

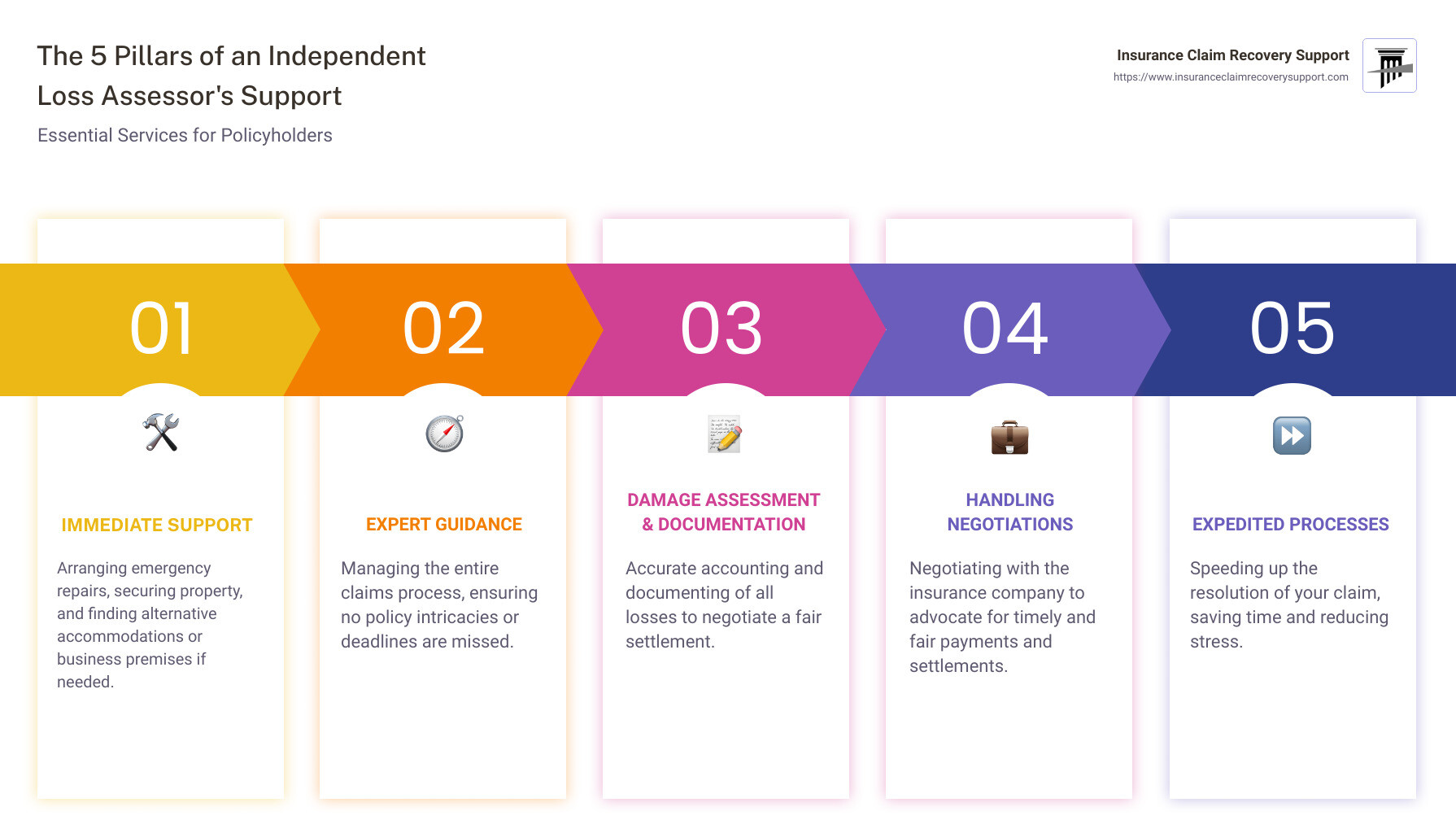

Importance of an Independent Loss Assessor:

-

Immediate Support: We arrange emergency repairs and secure your property, even finding you alternative accommodation or business premises if needed.

-

Expert Guidance: Knowledgeable about the intricacies of insurance policies, we manage the entire claims process, not missing any requirements or deadlines.

-

Damage Assessment & Documentation: We ensure all losses are accounted for, accurately documenting the damage to negotiate a fair settlement.

-

Handling Negotiations: As your representatives, we negotiate with the insurance company on your behalf, advocating for timely and fair interim payments, and ultimately, the ideal settlement.

-

Expedited Processes: Leveraging our expertise, we speed up the resolution of your claim, saving you time and stress.

By engaging an Independent Loss Assessor, you are spared the headache of the paperwork, communications, and negotiations inherent to insurance claims. You gain peace of mind and the freedom to focus on more pressing matters, confident that a dedicated professional team has your claim well in hand.

The Difference Between a Loss Assessor and a Loss Adjuster

When dealing with insurance claims, understand the distinction between a Loss Assessor and a Loss Adjuster. While both roles are instrumental in the claims process, their responsibilities and who they represent differ significantly.

How Loss Assessors Work for the Policyholder

An Independent Loss Assessor, also known as a public adjuster, is an insurance claim professional who works exclusively for you, the policyholder. They are hired to represent your interests during the claims process, using their expertise to ensure you receive the maximum payout possible.

At Insurance Claim Recovery Support, as independent loss assessors, we thoroughly examine your insurance policy, appraise damages comprehensively, and negotiate with your insurance company. Our goal is to prioritize your interests and secure a fair claim settlement.

Our role spans from assessing the extent of damage, estimating repair costs, to negotiating with insurance companies to ensure a fair and prompt settlement. We are equipped to handle insurance claims resulting from severe weather conditions like hailstorms, tornadoes, hurricanes, or fire damages.

How Loss Adjusters Work for the Insurance Company

Conversely, Loss Adjusters are employed by the insurance company. Their role involves evaluating insurance claims to determine the insurer’s liability.

An independent adjuster, while not directly employed by the insurance company, is hired as a third party to adjust claims on behalf of the insurer. They serve as a neutral party, ensuring perceived fairness to those filing a claim. However, their primary allegiance still remains with the insurance company.

While both loss assessors and loss adjusters evaluate and negotiate insurance claims, their allegiance is what sets them apart. A loss assessor works for the policyholder, advocating for a fair claim settlement, while a loss adjuster is engaged by the insurance company to determine their liability.

Understanding this difference is crucial in making an informed decision on who should represent your interests in the event of a property damage claim. As independent loss assessors, we at Insurance Claim Recovery Support prioritize your needs, ensuring that you receive a fair settlement.

The Importance of Hiring an Independent Loss Assessor

Navigating the complex world of insurance claims can be overwhelming, particularly when dealing with substantial property damage. It is in these situations where the role of an independent loss assessor becomes invaluable.

Immediate Support and Expert Guidance

One of the primary benefits of hiring an independent loss assessor is the immediate support and expert guidance they provide. An experienced loss assessor has an in-depth understanding of the insurance claims process and can provide clarity and direction in a stressful situation. They work on behalf of the policyholder, ensuring their interests are well-represented throughout the claims process. At Insurance Claim Recovery Support, we aim to provide our clients with personalized support, guiding them through each step of the process and answering any questions they may have.

Assessing and Documenting Damages

An independent loss assessor plays an essential role in assessing and documenting damages. They conduct a comprehensive review of the property damage, identifying and recording all relevant details. This includes taking clear photos and videos of the damage, interviewing witnesses if necessary, and consulting with repair professionals to determine the cost of repairs.

This thorough documentation is critical in establishing a strong insurance claim. As Investopedia explains, the insurance adjuster will create a report outlining the specific damages found and the financial loss suffered. This report is then presented to the insurance company for review.

Moreover, an experienced loss assessor can identify and document hidden damages that may not be immediately apparent. For example, water used to extinguish a fire can lead to subsequent water damage and mold growth. By accurately documenting these details, the loss assessor ensures you are adequately compensated for these additional damages.

Handling Negotiations and Expediting the Claims Process

Perhaps one of the most significant benefits of hiring an independent loss assessor is their ability to handle negotiations with the insurance company and expedite the claims process. They understand the insurer’s processes, strategies, and language, which allows them to navigate the claims process efficiently and effectively.

The loss assessor will negotiate on your behalf, ensuring you receive a fair and just settlement. They will challenge any undervaluation, underpayment, or wrongful denial by the insurance company, fighting for your best interests. As mentioned in Morgan Clark’s guide, a loss assessor who has established relationships with insurance companies and understands their processes can result in smoother negotiations.

In conclusion, hiring an independent loss assessor can significantly ease the burden of dealing with property damage and insurance claims. Their expertise, dedication, and commitment to your interests can make a world of difference in securing a fair settlement for your claim.

When Should You Hire an Independent Loss Assessor?

Navigating through the intricate world of insurance claims can be overwhelming, especially when you’re dealing with substantial losses. In such situations, an independent loss assessor can be an invaluable ally. But when exactly should you consider hiring an independent loss assessor? Here are some instances when their services can be highly beneficial.

Property Damage Claims

When you’re dealing with property damage due to incidents like a fire, hail, hurricane, tornado, or flood, the claims process can be complex and stressful. An independent loss assessor, with their expertise in handling property damage claims and calculating full settlement amounts, can be a crucial ally. They can assess the damage, handle negotiations with your insurance company, and expedite the claim process, ensuring you receive a fair settlement.

Business Interruption Claims

Business interruption claims focus on the financial losses businesses experience when an unexpected event disrupts their operations. These can be challenging to navigate due to the complexities involved in quantifying the financial impact. Independent loss assessors, like us at Insurance Claim Recovery Support, specialize in handling such claims and can ensure that you receive the maximum possible settlement.

Liability Claims

In situations where you are held liable for injury or damage, an independent loss assessor can provide expert guidance. They can assess the situation, understand the potential liabilities, and negotiate with the insurance company to secure a fair settlement. Their understanding of the intricacies of liability claims can be instrumental in protecting your interests.

Contents Claims

When dealing with claims related to the contents of your property, an independent loss assessor can help ensure you’re adequately compensated for your loss. They can meticulously assess the value of the damaged or lost items and negotiate on your behalf for a fair settlement.

Complex or Disputed Claims

Certain claims can become complex or disputed due to various factors such as the extent of damage, the involvement of multiple parties, or disagreements over policy interpretation. In such challenging scenarios, the expertise of an independent loss assessor can be critical. They can navigate the complexities, provide unbiased assessments, and vigorously advocate for your interests, helping you resolve the dispute and secure a fair settlement.

In conclusion, hiring an independent loss assessor can significantly enhance your chances of a successful outcome, especially in cases involving substantial losses. By choosing an experienced and reputable independent loss assessor, you can ensure that your interests are well-represented throughout the claims process.

The Cost of Hiring an Independent Loss Assessor

Choosing to hire an independent loss assessor is a decision that should be taken seriously, and understanding the cost is an integral part of that decision.

Understanding the Fee Structure

Loss assessors typically work on a contingency fee basis. This means that their fee is determined as a percentage of the claim payments they recover on your behalf. This contingency-based approach aligns the interests of the loss assessor with yours. They are motivated to recover the maximum possible settlement because their compensation is directly dependent on it. At Insurance Claim Recovery Support, for example, we only get paid if you get paid.

How Fees are Based on the Final Settlement Amount

The percentage charged by loss assessors can vary but is regulated by state law. In Texas, loss assessors can charge up to 10% of the total gross settlement for a claim. For supplemental claims, the fee limit is typically the lesser of either 20-25% percent of new money or 10% of the gross settlement, less the deductible.

Understanding how these fees are calculated can provide a helpful context for budgeting for the services of a loss assessor. It’s also crucial to clarify what services are included in this fee. At Insurance Claim Recovery Support, our comprehensive services from documenting damages to negotiating with insurance companies are all included in our fee.

While the cost of hiring a loss assessor may initially seem daunting, it’s important to consider the potential value they bring. They offer expertise that can help you avoid common pitfalls in the claims process, negotiate more effectively, and secure a higher settlement than you might achieve on your own. Many of our client testimonials attest that hiring a loss assessor significantly increased their claim payout, making the fees a worthwhile investment.

In short, the cost of hiring an independent loss assessor can be viewed as an investment in securing the best possible outcome for your insurance claim.

Choosing the Right Independent Loss Assessor

Selecting the right independent loss assessor is a crucial step in navigating the complexities of insurance claims. Consider these factors when making your choice:

Considering Experience and Expertise

Look for an independent loss assessor with a solid track record in handling claims similar to yours. Their experience and expertise will enable them to navigate the complexities of the claims process effectively. A knowledgeable assessor can better manage claims that are similar to yours, which can significantly enhance the chances of a successful outcome, especially in cases involving substantial losses.

Understanding Nationwide Coverage

It’s essential that the loss assessor operates nationwide or at least covers the area where your loss occurred. This ensures that they have a network of professionals and resources to handle your claim efficiently. At Insurance Claim Recovery Support, we have a wide coverage across Texas, including Austin, Dallas, Fort Worth, San Antonio, Houston, Lubbock, San Angelo, Waco, Round Rock, Georgetown, and Lakeway.

Checking Regulation and Authorization

Ensure that your chosen loss assessor is authorized and regulated by the Financial Conduct Authority (FCA). This guarantees that they adhere to strict standards and ethical practices in their work.

Evaluating Industry Knowledge and Reputation

Consider whether the loss assessor specializes in the type of claim you need assistance with. Different loss assessors may have expertise in specific areas such as property damage, business interruption, or liability claims. It’s also vital to research their reputation and read testimonials from past clients. This will provide insight into their professionalism and reliability, and the quality of their services.

Assessing Communication and Accessibility

Effective communication is crucial during the claims process. Assess the accessibility and responsiveness of the loss assessor. A professional who provides regular updates, promptly addresses your concerns, and is always accessible can make the claims process smoother.

Checking Professional Accreditations

Look for loss assessors who hold professional accreditations or memberships with relevant industry associations. This demonstrates their commitment to professional development and adherence to industry best practices.

Understanding Insurance Company Relationships

While an independent loss assessor should represent your interests, it’s beneficial if they have established relationships with insurance companies. An assessor who understands and can navigate the insurer processes and has a professional rapport can result in smoother negotiations.

In conclusion, hiring a reputable and experienced independent loss assessor can provide peace of mind knowing your interests are well-represented throughout the claims process. At Insurance Claim Recovery Support, we’re committed to delivering expert guidance, assessing damages, negotiating with insurance companies, and expediting the claims process for our clients.

The Role of Independent Loss Assessors in Texas

As an independent loss assessor firm, we at Insurance Claim Recovery Support have the vast expertise and knowledge to serve property owners throughout Texas. Our state has its fair share of extreme weather conditions, such as hail storms and fires, which can result in significant property damage. In such situations, dealing with complex insurance claims can be daunting, and that’s where we step in.

Dealing with Fire and Storm Damage Claims in Austin, Dallas, Fort Worth, San Antonio, Houston, Lubbock, San Angelo, Waco, Round Rock, Georgetown, and Lakeway

Whether you’re in Austin, Dallas, Fort Worth, San Antonio, Houston, Lubbock, San Angelo, Waco, Round Rock, Georgetown, or Lakeway, our team is ready to assist you. We’re not just experts in insurance claims; we understand the unique challenges each of these locations presents.

For instance, in Austin, we leverage our decades of experience dealing with various types of claims such as wind damage, hail storm damage, and fire and smoke claims. Our expertise has led to securing payouts up to 2 to 3 times higher than the initial offer made by the insurance company for our clients.

In Dallas, we offer professional assistance to policyholders dealing with property damage insurance claims. We have over a decade of experience successfully settling hundreds of millions in insurance claims exclusively on behalf of policyholders.

Our teams in other cities like Houston, San Antonio, Lubbock, and Amarillo, to name a few, are equally equipped and committed to securing maximum settlement benefits for policyholders.

Understanding the Insurance Claim Process in Texas

In Texas, the insurance claim process can be quite complex, especially if you’re dealing with property damage due to extreme weather conditions. As your independent loss assessors, we help you navigate this process, ensuring that your claim is thoroughly assessed, accurately documented, and fairly negotiated.

We handle the bulk of the paperwork, communications, and negotiations, allowing you to focus on other important matters. Our comprehensive understanding of the Texas insurance industry and the local market conditions allows us to provide a personalized service tailored to your specific situation.

In conclusion, when it comes to insurance claims in Texas, having an expert in your corner can make all the difference. At Insurance Claim Recovery Support, we’re committed to helping you navigate the complexities of the claims process and secure a fair and prompt settlement.

Conclusion: Maximizing Your Insurance Claim with an Independent Loss Assessor

Choosing to work with an independent loss assessor can be a game-changer in insurance claims. They provide invaluable guidance, assess damages with a keen eye, negotiate with insurance companies, and speed up the claims process. Not every situation may require a loss assessor, but in cases involving substantial losses or complex claims, their expertise can significantly enhance your chances of a successful outcome.

At Insurance Claim Recovery Support, we understand the challenges that come with navigating the insurance claim process, especially after a catastrophic event such as a fire, hail, hurricane, tornado, or flood. Our dedicated team of loss assessors is equipped with the knowledge and experience to handle these complex situations. We are committed to representing your interests and ensuring you receive the maximum settlement you are entitled to under your policy.

Our professional accreditations demonstrate our commitment to adhering to industry best practices. We operate with transparency, providing clear explanations of our fee structure and maintaining open lines of communication throughout the process. We have a strong track record of successful claims management, and our client testimonials speak volumes about our professionalism, reliability, and quality of service.

Whether you’re dealing with property damage claims, business interruption, liability claims, or contents claims, our team has the industry knowledge and expertise to support you. We understand the intricacies of the insurance claim process in Texas, and we have the resources to serve clients in Austin, Dallas, Fort Worth, San Antonio, Houston, Lubbock, San Angelo, Waco, Round Rock, Georgetown, and Lakeway.

Insurance companies have experts working for them; you should, too! With the right independent loss assessor by your side, you can navigate the complex world of insurance claims with confidence and peace of mind.

For more insights on the insurance claim process or to get a free claim evaluation, reach out to us. We’re here to help you maximize your insurance claim and restore your property to its pre-loss condition as quickly and efficiently as possible. No recovery, no fee – that’s our commitment to you.