Have you ever experienced the frustration of having an insurance claim denied despite believing your claim was valid? This can be particularly distressing for commercial, multifamily, or apartment property owners dealing with property damage due to fire, hail, hurricane, tornado, or flood. Not only must owners confront the physical and emotional toll of these natural disasters, but they are also faced with the complexities of the insurance claim process.

Relax, you’re not alone, and there is a solution. Welcome to the definitive guide on insurance dispute resolution, an essential route to navigate these challenging scenarios. Understanding the ins and outs of insurance dispute resolution can seem complex, but we at Insurance Claim Recovery Support are here to simplify the process — so that you can secure a fair and expedient settlement.

Let’s consider a quick summarized view on the essence of insurance dispute resolution:

-

What Is It? Insurance dispute resolution is a process to settle disagreements between insurance companies and policyholders over issues such as the amount due on a claim, denial of a claim, or misunderstandings over policy terms.

-

When Is It Needed? This process becomes relevant when an insurance claim has been denied or partially paid, and the policyholder believes that the decision is unfair or the interpretation of policy clauses is incorrect.

-

How Is It Done? Resolution methods may include negotiation, appraisal, mediation, arbitration or, in some cases, litigation. In many instances, professional advocates like public adjusters and lawyers can guide and support this process.

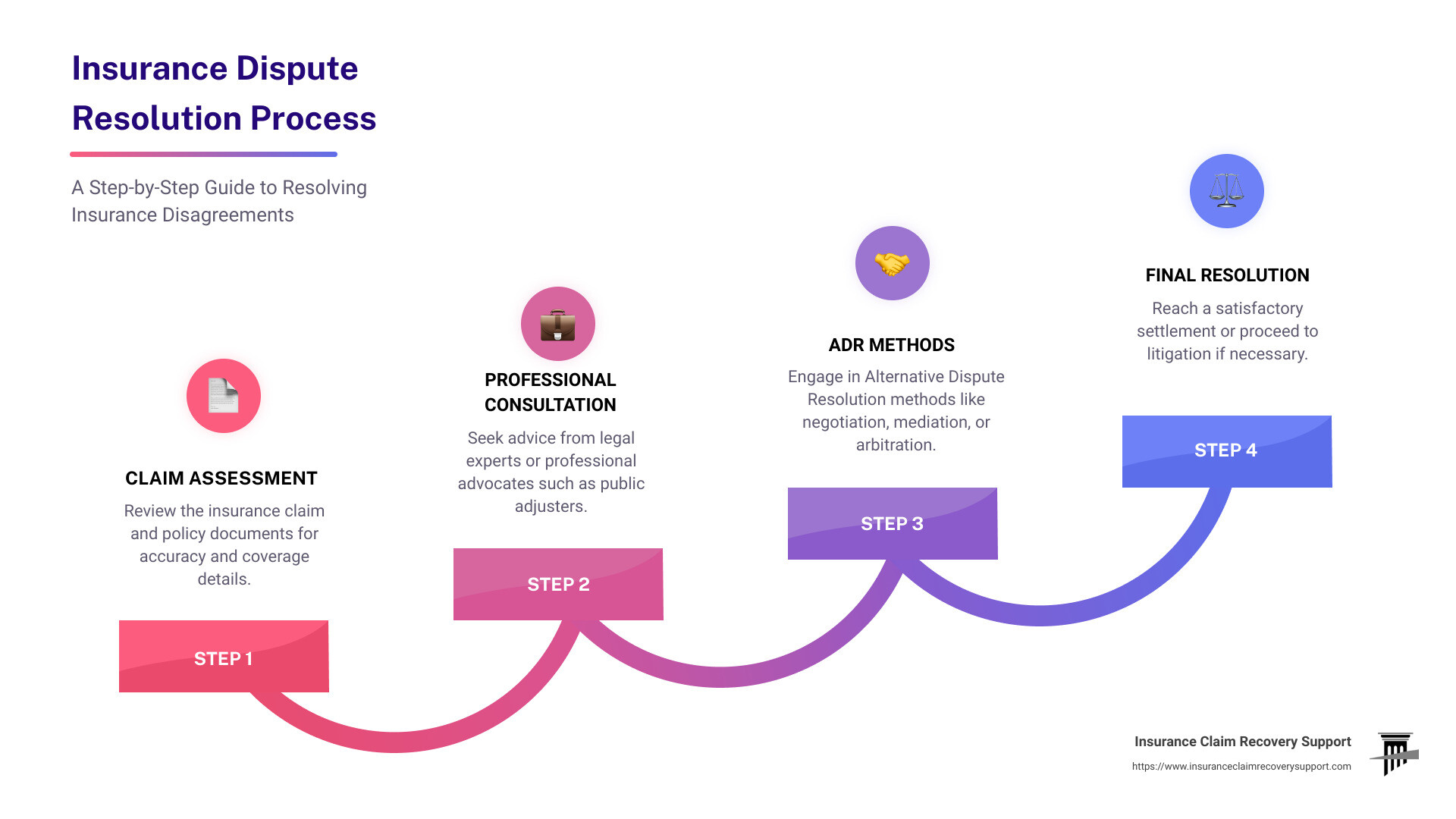

Here is a visual representation to make the concept more understandable:

In this guide, we will break down the key aspects of insurance dispute resolution, discuss different types of disputes, and help you maneuver through the path to a fair settlement. Whether you’re a first-timer or have encountered insurance disputes before, our expert knowledge and insights will provide the guidance you need. Let’s journey through this together.

Understanding Insurance Disputes

For many property owners, insurance disputes are all too common and can be quite frustrating. To better navigate these disputes, understand the common types, the reasons they arise, and the impact of policy clauses on them.

Common Types of Insurance Disputes

Insurance disputes can vary widely, but certain types occur more frequently than others. These include home insurance disputes, which often revolve around compensation for fire damage or theft. Home contents insurance disputes are common amongst tenants and leaseholders, particularly following a break-in or burglary.

Weather damage to properties is another common source of insurance disputes. According to research by the Association of British Insurers (ABI), as many as one in five home insurance claims are rejected, often leading to disputes.

Reasons for Insurance Disputes

One of the primary reasons insurance disputes arise is due to the differing interpretation of policy clauses by the insurer and the insured. This can result in claims being rejected and disputes arising, leading to dissatisfaction and frustration for the policyholder.

Insurance claim disputes often revolve around two key aspects: scope and price. Let’s break down these terms:1.

Scope:

The scope of an insurance claim refers to the extent of the damage or loss covered by the insurance policy.

Disputes related to scope arise when the insurance company and the policyholder disagree on what should be included in the claim. This may involve determining the cause and extent of the damage.

Adjusters, who are representatives of the insurance company, assess the damage and decide what falls within the policy coverage.

Price:

The price aspect of a claim dispute involves disagreements about the valuation of the covered loss.

Insurance policies typically specify how losses will be valued, but there can still be disputes over the actual cost of repairs or replacement. This can include disagreements about the cost of labor, materials, code upgrades, general contractor overhead and profit (GCOP), OSHA, supervision, scaffolding, licensed trades, depreciation, and other related factors.

Policyholders may feel that the insurance company’s valuation is too low to cover the actual cost of restoring or replacing the damaged property.

Common Issues:

Underestimation of Damage: Policyholders may argue that the insurance company has underestimated the extent of the damage, leading to a lower payout than necessary.

Policy Exclusions: Disputes can arise if the insurance company claims that certain aspects of the damage are not covered by the policy.

Pricing Disagreements: Differences in opinion regarding the cost of repairs or replacements can lead to disputes over the final settlement amount.

Resolution:

Public adjusters can provide several advantages in resolving insurance claim disputes for policyholders and help avoid escalating your claim. Here are some key benefits:

1. Expertise in Insurance Policies:

Public adjusters are professionals who specialize in understanding insurance policies and claim procedures. They have extensive knowledge of the terms and conditions of various insurance contracts.

Their expertise allows them to interpret policy language and advocate for the policyholder’s rights, ensuring that all covered damages are considered in the claim.

2. Thorough Damage Assessment:

Public adjusters conduct thorough and independent assessments of the damage. They work to identify all aspects of the loss that may be covered under the insurance policy.

Their detailed evaluations help ensure that the scope of the claim is accurately represented, minimizing the risk of overlooked damages.

3. Negotiation Skills:

Public adjusters are experienced negotiators. They can engage with insurance company adjusters on behalf of the policyholder to reach a fair settlement.

Their negotiation skills can be crucial in securing a higher payout, especially when there are disagreements over the valuation of damages.

4. Documentation and Claim Presentation:

Public adjusters assist policyholders in preparing and presenting their claims. They ensure that all necessary documentation is provided and that the claim is presented in a clear and compelling manner.

Proper documentation helps strengthen the policyholder’s case and increases the likelihood of a favorable outcome.

5. Time and Stress Savings:

Handling an insurance claim can be time-consuming and stressful. Public adjusters take on the responsibility of managing the entire claims process, allowing policyholders to focus on other priorities.

Their involvement can expedite the resolution process, helping policyholders receive their claim payouts more quickly.

6. Maximizing Claim Settlements:

Public adjusters are motivated to maximize the claim settlement for the policyholder. Since they often work on a contingency fee basis, where they earn a percentage of the final settlement, they have an incentive to secure the best possible outcome for their clients.

7. Advocacy in Disputes:

In the event of a dispute, public adjusters can act as strong advocates for policyholders. They understand the claims process and can navigate disputes with the insurance company, increasing the chances of a fair resolution.

It’s important for policyholders to carefully choose a reputable and licensed public adjuster. Working with a qualified professional can significantly improve the likelihood of a successful and fair resolution to an insurance claim dispute.

Appraisal Process: Many insurance policies have an appraisal process where an independent appraiser is brought in to assess the loss. The appraiser’s decision is usually binding.

Mediation or Arbitration: In some cases, disputes can be resolved through mediation or arbitration, avoiding the need for a court trial.

Legal Action: If other methods fail, policyholders may choose to pursue legal action to resolve the dispute.

It’s crucial for both the insurance company and the policyholder to thoroughly review the policy terms and documentation to understand their rights and obligations. Clear communication and documentation of the damages can help prevent and resolve disputes.

Another reason is the denial of an insurance claim that the policyholder believes to be valid. This belief could be based on the wording of the policy documents, which can be complex and confusing. Misunderstandings or misinterpretations can lead to disputes, especially when a substantial amount of money is involved.

The Impact of Policy Clauses on Insurance Disputes

Policy clauses significantly impact insurance disputes. They are often interpreted differently by the insurer and the insured, resulting in differing views on claim validity. In some instances, strict clauses with limitations can be damaging to policyholders, and insurance companies may use these to their advantage in disputes.

For example, some insurers include a clause in their policies requiring parties to attempt compulsory Alternative Dispute Resolution (ADR) before proceeding to court. While this may seem like a quicker resolution method, it can sometimes be exploited by insurance companies to gain an unfair advantage in disputes.

Understanding your policy’s clauses is vital in navigating insurance disputes. At Insurance Claim Recovery Support, we help you understand these complex clauses, ensuring you’re well-equipped in any insurance dispute resolution process.

The Process of Resolving Insurance Disputes

Navigating the labyrinthine process of insurance dispute resolution can feel overwhelming, especially when dealing with the aftermath of property damage. However, with the right steps and guidance, you can effectively manage your insurance dispute.

Reviewing Policy Documents and Seeking Legal Advice

The first step in the dispute resolution process is to review your insurance policy documents thoroughly. Grasp the coverage details, deductibles, limits, and any exclusions. Understand the wording and how it applies to your claim.

Sometimes, insurance policy documents can be complex and confusing. It’s often beneficial to seek legal advice from experts in insurance matters. They can help clarify the complex jargon and ensure your policy covers the issue you’re trying to claim. If your claim is denied, this legal expertise can help you identify and understand the reasons for the denial.

At Insurance Claim Recovery Support, we can provide expert guidance, helping you make sense of your policy and advising you on the best course of action.

The Role of Insurance Loss Adjusters

After filing a claim, your insurance company will send a loss adjuster to evaluate the damage. They verify the claim, determine the cause, and estimate the repair or replacement cost. However, their primary allegiance is to the insurance company.

Be Present During the Assessment: Try to be available during the adjuster’s visit. You can then highlight all the damage and provide any additional information that may be helpful.

Provide Your Documentation: Hand over your documentation to the adjuster. Your photos, videos, and receipts can reinforce your claim and help ensure a fair assessment.

The Importance of Expert Legal Guidance

If your claim is denied or you feel the settlement is undervalued, consider hiring a public adjuster. Unlike insurance adjusters, a public adjuster works for you. They can conduct their own assessment, help you understand your policy, and negotiate with the insurance company on your behalf.

At Insurance Claim Recovery Support, we understand the intricacies of the claim process. Our team of experienced public adjusters can help you navigate the complexities of insurance dispute resolution and ensure you receive a fair and prompt settlement.

The road to resolving an insurance dispute can be challenging, but with expert guidance and a robust understanding of your insurance policy, you can navigate this process effectively. By staying involved, providing necessary documentation, and leveraging professional help, you can increase your chances of a favorable resolution.

Alternative Dispute Resolution (ADR) in Insurance Disputes

The journey to a successful insurance claim doesn’t have to end in a courtroom. If you’re grappling with an insurance dispute, it’s important to understand the role of Alternative Dispute Resolution (ADR) in this process. ADR refers to a set of practices designed to resolve disagreements without litigation.

The Concept of ADR and Its Relevance in Insurance Disputes

ADR is a crucial element of insurance dispute resolution. It offers a more streamlined, cost-effective, and less adversarial way of resolving disputes compared to traditional courtroom litigation. Many insurance policies even have clauses that require parties to attempt compulsory ADR before resorting to court proceedings.

However, understanding these clauses is crucial, especially when it comes to arbitration. Some policies contain strict clauses with limitations for policyholders, and insurance companies can use these to gain unfair advantages in disputes. Therefore, while ADR can be a faster and less costly way of resolving disputes, policyholders must tread carefully and seek expert guidance.

Different Methods of ADR: Negotiation, Mediation, and Arbitration

There are several methods of ADR, each with its unique approach to resolving disputes:

-

Negotiation: This is usually the first approach taken before resorting to other ADR methods. The parties involved communicate directly to resolve the dispute, often leading to a mutually beneficial resolution.

-

Mediation: In mediation, a neutral third party (mediator) assists the disputing parties in reaching an agreement. The mediator doesn’t make decisions but facilitates dialogue and helps the parties find common ground.

-

Arbitration: In arbitration, an arbitrator (or panel of arbitrators) makes a binding decision after hearing arguments and reviewing evidence from both parties. This is a more formal method that resembles traditional court proceedings, but it’s usually faster and less costly.

The Advantages and Disadvantages of ADR in Insurance Disputes

ADR comes with several benefits. It’s typically faster, more cost-effective, and gives parties more control over the resolution process compared to litigation. Furthermore, ADR tends to be less adversarial, which can help maintain business relationships between disputing parties.

However, ADR also has its drawbacks. For instance, in arbitration, the decision is binding and there is generally no right to appeal. Also, some insurance companies might use ADR clauses to their advantage, potentially limiting the policyholder’s options for dispute resolution.

At Insurance Claim Recovery Support, we can help you navigate the complexities of ADR in insurance disputes. Our team of experts understands the nuances of these processes and can guide you to achieve the best possible outcome for your claim.

The goal isn’t just to resolve the dispute, but to secure a fair and prompt settlement. Whether it’s through negotiation, mediation, or arbitration, ADR can be a powerful tool in your insurance dispute resolution toolkit.

The Role of Regulatory Bodies in Insurance Dispute Resolution

In insurance, disputes are inevitable. But knowing you have regulatory bodies and procedures in place to protect your rights can offer you some peace of mind. These bodies play a crucial role in keeping insurance companies in check and ensuring that policyholders like you are treated fairly.

The Department of Insurance and Insurance Complaints

The Department of Insurance can be a key player in the insurance dispute resolution process. When you’ve exhausted all avenues with your insurance company, this is the entity you turn to. They step in to review your case independently and make a decision based on the facts presented.

In Conclusion

Navigating insurance disputes can be challenging, but knowing the role of key regulatory bodies can make the process less daunting. These entities exist to protect your rights and ensure fairness in the insurance industry.

At Insurance Claim Recovery Support, we are well-versed in dealing with these regulatory bodies and can help guide you through the insurance dispute resolution process. We’re here to ensure you get the fair and prompt settlement you deserve.

Case Study: Insurance Dispute Resolution in Texas

Navigating the complex world of insurance disputes can be daunting. To simplify it, let’s look at a case study focusing on Texas, a state that experiences diverse weather conditions, leading to a myriad of insurance claims and subsequent disputes.

The Role of Public Adjusters in Texas

In Texas, property claim adjusters deal with a wide range of challenges, from hail and tornado damage in Austin and Dallas, to hurricane-induced flooding in coastal cities like Houston and San Antonio. These professionals are tasked with assessing, documenting, and evaluating the damage caused by these events. This often involves understanding the complexities of windstorm and hail damage insurance, which many businesses need to purchase separately from their standard commercial property insurance.

Public adjusters play a crucial role in the insurance dispute resolution process. They help policyholders navigate through the insurance claims process, ensuring they get the settlement they deserve for damages to their property and any business interruption income losses sustained. Their duties range from conducting detailed investigations into claims, interpreting policy language, to negotiating a fair settlement.

Texas Fire and Storm Damage: Insurance Claims and Dispute Resolution

The process of resolving insurance disputes arising from fire and storm damage in Texas often begins with filing a complaint with the state agency that regulates insurance companies. This step serves to officially record your dissatisfaction with the insurance settlement offered. While the agency may not necessarily resolve the dispute, it provides a platform for your grievances to be heard.

However, the dispute resolution process can be lengthy and often involves technical and legal issues. This is where alternative dispute resolution (ADR) methods such as negotiation, mediation, and arbitration come into play. These processes aim to settle disputes without resorting to costly and time-consuming lawsuits.

The Experience of Insurance Claim Recovery Support LLC in Resolving Disputes

At Insurance Claim Recovery Support, we have extensive experience in handling large and complex property damage insurance claims in Texas. We understand the stress and frustration that often come with filing insurance claims. Our goal is to make the insurance claim process as smooth and stress-free as possible for our clients.

We have successfully settled hundreds of millions in insurance claims, exclusively on behalf of policyholders. Our commitment to professional documentation, representation, and negotiation skills ensure our clients avoid unnecessary delays, underpayments, and litigation.

Disputes can arise for various reasons in the claims process, from disagreements over the scope of the claim to the cost of repairs. Our expertise allows us to anticipate potential pitfalls and proactively address issues before they escalate into significant problems. We act as your advocate, ensuring that your interests always come first.

In conclusion, insurance dispute resolution in Texas, just like in other states, can be a complex process. However, with the right support and guidance, policyholders can navigate this process successfully and obtain the fair settlements they deserve.

Conclusion: Key Takeaways in Insurance Dispute Resolution

When it comes to resolving insurance disputes, there are several important takeaways that policyholders should keep in mind.

Knowledge is Power

Understanding your insurance policy, the reasons for disputes, and the impact of policy clauses is vital. As we’ve seen, insurance disputes can arise for a multitude of reasons, often influenced by the interpretation of policy clauses. This is why thoroughly reviewing your policy documents and seeking legal advice is crucial.

The Role of Professionals

Professional help can significantly simplify the process of insurance dispute resolution. A public adjuster or an insurance claim dispute resolution lawyer can help level the playing field, especially when dealing with large insurance companies. They can question the legitimacy of your insurer’s position, dispute items such as excessive depreciation, provide expert opinions, and make a reasonable demand for payment to the insurance company.

Alternative Dispute Resolution (ADR)

ADR methods such as negotiation, mediation, and arbitration can provide a faster, more cost-effective, and confidential way of resolving disputes compared to litigation. However, these methods also have their drawbacks, so understand their advantages and disadvantages.

Regulatory Bodies

Regulatory bodies play a significant role in insurance dispute resolution. They provide a platform for resolving disputes and impose regulations that protect the rights of the insured. For instance, the No Surprises Act, enforced by the Departments of Health and Human Services, Labor, and Treasury, provides a forum to resolve disputes about out-of-network care payments.

The Power of Advocacy

Lastly, always remember that you don’t have to navigate the complexities of insurance dispute resolution alone. At Insurance Claim Recovery Support, we believe strongly in the power of advocacy. We work tirelessly on behalf of policyholders, ensuring that your rights are protected, and that you receive the maximum settlement under your policy.

In closing, insurance dispute resolution may appear daunting, but it doesn’t have to be. With the right knowledge, professional help, and understanding of the dispute resolution process, policyholders can confidently navigate their way to a fair and prompt settlement.