Introduction

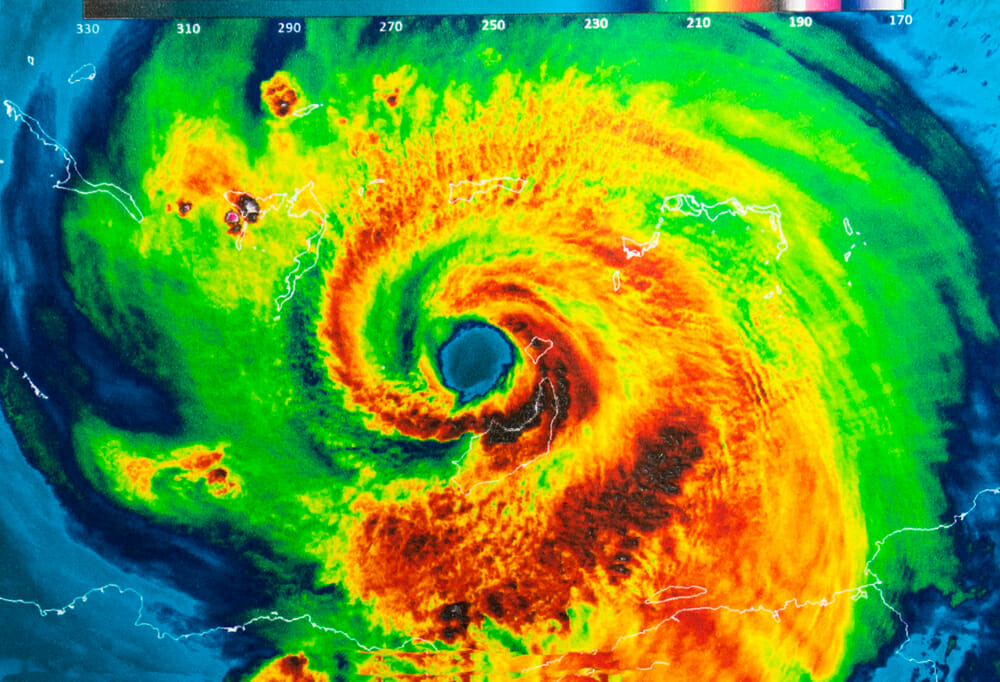

Have you recently experienced property damage and are feeling overwhelmed by the insurance claim process? If so, you’re not alone. Property owners across the world find themselves in a similar predicament, especially after significant damage due to fire, hail, hurricane, tornado, or floods. The complexity of the process, coupled with the tedious paperwork and daunting task of assessing your claim’s value, can lead to confusion and frustration. Here is where a licensed adjuster can serve as your guiding light.

Brief Overview of the Role of a Licensed Adjuster

A licensed adjuster is an insurance industry professional who investigates property damage claims, assesses the extent of the damage, and negotiates the payout on behalf of the policyholders or insurance companies. They effectively bridge the gap between policyholders and insurance companies and ensure that your claim is assessed accurately. They can significantly influence the payout amount and the length of the claim process. Their specialized knowledge and skills help guide you through what might otherwise be a complicated and challenging insurance claim process.

Importance of Hiring a Licensed Adjuster

Managing insurance claims post damager can be overwhelming for property owners. The appointment of a licensed adjuster can offer much-needed reassurance, especially in terms of claiming the fullest compensation possible. With profound understanding and expertise in managing different types of property damage claims, licensed adjusters are well versed in the subtleties of the insurance claim process.

To make things simpler for you, we’ve compiled a list of the Top 10 Licensed Adjuster Firms that offer exceptional service and support in navigating the insurance claim journey. Ready to dive in and explore?

Here’s your snapshot for quick referencing:

- Experience: Gauge their work depth in managing different property damage claims.

- Calculation Process: Understand how they calculate the full settlement amount.

- Negotiation Tactics: Learn how they maneuver the negotiation process with insurance companies.

- Client Feedback: Request client references or reviews.

- Fee Structure: Get an understanding of their fees.

Stay tuned as we begin our deep dive into the comprehensive overview and detailed reviews of the top licensed adjuster firms.

Understanding the Different Types of Adjusters

Navigating insurance claims adjustment can be complex, but understanding the different types of adjusters can help simplify the process. Essentially, insurance adjusters can be categorized into three main types: staff adjusters, independent insurance adjusters, and public adjusters.

Staff Adjusters

Staff adjusters are full-time employees of an insurance company. Their role is primarily to assess claims on behalf of the insurer and determine the payout for each claim. As they directly work for the insurance company, their ultimate responsibility is to protect the financial interests of their employer.

Independent Insurance Adjusters

Contrary to what their title might suggest, independent adjusters are not impartial third parties. They are contractors hired by the insurance company to handle claims. These adjusters often work for a third-party company, an Independent Adjusting Firm, contracted by multiple insurance carriers to help settle their claims. Independent adjusters can handle claims for any one of these insurers, often juggling multiple claims at once.

Public Adjusters

Public adjusters represent the policyholder in the claim process. These are independent insurance adjusters that customers hire to settle insurance claims, unlike staff and independent adjusters, public adjusters are not hired by insurance companies but by the claimants. They advocate for the policyholder, negotiating with the insurance company to secure the most generous possible payout.

Becoming a public adjuster requires obtaining a standard adjuster license, getting an appointment from a public adjusting firm, gaining work experience, and passing an additional exam.

Understanding these differences is crucial when dealing with insurance claims. It helps you know who is working for whom and can potentially save you time, heartache, and money. In the next section, we will look at the top licensed adjuster firms that can help you navigate this landscape and ensure you receive a fair settlement for your claim.

The Role of a Public Adjuster in Property Damage Claims

Unlike staff or independent adjusters who represent the interests of insurance companies, a public adjuster works solely for the policyholder. This distinction is critical when dealing with property damage claims, as it ensures your interests are prioritized and that you receive a fair settlement.

How Public Adjusters Advocate for Policyholders

Engaging a public adjuster like those at Insurance Claim Recovery Support can save you time, stress, and potentially a lot of money. Their role includes a thorough examination of your insurance policy, a comprehensive appraisal of damages, and negotiations with your insurance company.

Public adjusters are experts in insurance claims. They understand insurance policies and can help you comprehend your coverage, including any limitations or exclusions that may apply. They are adept at negotiating property damage insurance claims fairly and promptly, without unnecessary litigation.

A public adjuster exists to advocate for you, ensuring you receive a fair and prompt settlement. They navigate the complexities of the claims process on your behalf, giving you peace of mind and freeing up your time.

The Process of Settling Property Damage Claims

The process of settling property damage claims can be complex and time-consuming. It involves understanding your insurance policy, assessing the extent of the damage, documenting everything, and negotiating with the insurance company.

As your representative, a public adjuster will comprehensively review your insurance policy to understand what is covered and what is not. They will conduct a detailed appraisal of the damages to your property and compile this information into a factual report.

The negotiation process is where a public adjuster truly shines. They will negotiate with your insurance company to secure a fair and prompt settlement. Their extensive knowledge of the claims process and negotiation skills often result in a larger settlement than policyholders might achieve on their own.

In conclusion, a public adjuster plays a crucial role in settling property damage claims. They navigate the complex claims process, negotiate with the insurance company on your behalf, and advocate for your best interests. This ensures you receive a fair settlement, giving you the peace of mind to focus on recovering from the damage to your property.

Top 10 Licensed Adjuster Firms Nationwide

Now that we have a clear understanding of the role of a licensed adjuster and the value they bring to the table, let’s take a look at the top 10 licensed adjuster firms in the country. These firms are known for their expertise, professionalism, and dedication to advocating for policyholders.

Firm 1: AdjusterPro

AdjusterPro stands out for its comprehensive training programs and certification courses for new adjusters. With a focus on practical skills and industry know-how, AdjusterPro helps launch successful careers in the insurance adjusting industry. Their services also extend to providing advice on job searches and networking within the industry.

Firm 2: Claim Concepts

As a public adjuster firm, Claim Concepts brings a wealth of experience in handling complex property damage claims. They specialize in uncovering and documenting the full extent of damage, ensuring that policyholders are not shortchanged in their insurance settlements.

Firm 3: Insurance Schools, Inc.

Insurance Schools, Inc. offers comprehensive training materials for prospective claims adjusters, preparing students for their state’s licensing examinations. Their curriculum covers a wide array of topics, equipping students with the knowledge needed to excel in the insurance claims industry.

Firm 4: Business & Entrepreneurship Institute at SAC

The Business & Entrepreneurship Institute at SAC offers a course that readies students for the All Lines Adjuster License. Their program covers various aspects of insurance policies and adjusting losses, providing a solid foundation for budding adjusters.

Firm 5: Distance Education Accrediting Commission

For those who prefer to learn at their own pace, the Distance Education Accrediting Commission offers accredited online courses that provide comprehensive training for future claims adjusters.

Firm 6: Catastrophe Adjuster Training Institute (CATI)

The Catastrophe Adjuster Training Institute (CATI) is known for its practical approach to training. Their courses transform students into proficient property adjusters, instilling confidence and expertise.

Firm 7: Major Adjusting Firms

Some of the major adjusting firms provide opportunities to work with a variety of insurance companies. These firms are a great place to start your job search and to gain experience in the field.

Firm 8: Arizona Department of Insurance and Financial Institutions

The Arizona Department of Insurance and Financial Institutions oversees the licensing of adjusters in Arizona. They ensure that all adjusters are competent and adhere to the rules and regulations of the insurance industry.

Firm 9: National Insurance Producer Registry (NIPR)

The National Insurance Producer Registry (NIPR) is a valuable resource for all insurance professionals. They offer services for applying for licenses, renewing licenses, and updating contact details.

Firm 10: Insurance Claim Recovery Support LLC

Last but certainly not least, we at Insurance Claim Recovery Support LLC specialize in representing policyholders, not insurers. We are committed to getting our clients the maximum insurance settlement they deserve. We have a “no recovery, no fee” principle and are rated highly for customer satisfaction.

Each of these firms brings unique strengths to the table. It’s crucial to choose a firm that aligns with your needs and can provide the support you require in the claims process.

Spotlight on Insurance Claim Recovery Support LLC

After taking a closer look at the top licensed adjuster firms across the nation, let’s shift our focus to Insurance Claim Recovery Support LLC (ICRS). ICRS is a premier public adjustment firm that represents policyholders exclusively, helping them secure fair settlements for their insurance claims.

Overview of Insurance Claim Recovery Support LLC

Insurance Claim Recovery Support LLC is more than just a public insurance adjuster firm. We are a beacon of hope for policyholders navigating the complex seas of insurance claims. Our commitment is to the policyholder, not the insurance company.

With a nationwide service based out of Texas, we specialize in handling complex commercial and multifamily property insurance claims. We operate on a simple principle: no recovery, no fee. This means we’re as committed as you are to ensuring a successful claim. Our high rating for customer satisfaction is a testament to our dedication to our clients.

Services Offered by Insurance Claim Recovery Support LLC

We provide a range of services designed to support policyholders at every stage of the claims process. This includes evaluating, documenting, and negotiating insurance claims, leveraging our deep knowledge of policy language and claims procedures.

We’re experts at gathering evidence, taking proactive measures to prevent further damage, and being prepared for when the claims adjuster assesses your property’s damage. We refuse to give recorded statements without proper legal counsel and anticipate negotiations to ensure a fair settlement.

Unique Selling Proposition of Insurance Claim Recovery Support LLC

What sets us apart is our unwavering commitment to the interests of policyholders. We stand out from other public adjusters by exclusively representing policyholders, avoiding any potential conflicts of interest that may arise from serving both policyholders and insurance companies.

We take great measures to protect your interests against the insurance company representatives working to minimize your claim. Our team guides you through each step of your claim process, ensuring careful planning, meticulous documentation, and strategic negotiation.

In addition to our experience and dedication, our local knowledge further strengthens our position as a top licensed adjuster firm. Understanding the unique challenges presented by hailstorms in Texas cities, for instance, allows us to better advocate for our clients and ensure they get the compensation they deserve.

In conclusion, at Insurance Claim Recovery Support LLC, we’re not just your typical licensed adjuster—we’re your partner in ensuring a successful insurance claim process.

The Importance of Licensing and Certification in the Adjuster Industry

Navigating the intricate world of insurance claims requires a professional who is well-versed in the industry’s regulations and procedures. That’s where the importance of a licensed adjuster role comes in. A licensed adjuster is an individual or business entity that holds a valid license, authorized by a state insurance department to sell, solicit, or procure insurance under the established guidelines.

Licensing Requirements for Adjusters

Becoming a licensed adjuster involves meeting several requirements. For starters, a potential adjuster must complete a license application and pass a license examination unless exempt. The license application is a form that must be filled out to obtain a new license, an additional license, or a license reinstatement. The licensing process ensures that all adjusters are knowledgeable about the industry’s rules and regulations and are equipped to handle the complexities of the insurance claims process.

The Role of the National Insurance Producer Registry (NIPR)

Once an adjuster has been licensed, they receive a unique identification number from the National Insurance Producer Registry (NIPR). The NIPR is a nonprofit affiliate of the National Association of Insurance Commissioners (NAIC), offering an online platform for insurance professionals to apply for licenses, renew licenses, and update addresses and phone numbers. Each entity in the State Producer Licensing Database is assigned a unique National Producer Number (NPN) by the NIPR.

The Process of License Renewal for Adjusters

Just like with many professional licenses, an adjuster’s license must be renewed regularly. In Arizona, for example, adjusters can renew their license up to 90 days before the license expiration date. The renewal process involves paying a non-refundable fee and submitting a renewal application through the NIPR or by mail. If the Department of Insurance does not receive a complete and correct renewal application and the license fee on or before the expiration of the license, the license will expire.

At Insurance Claim Recovery Support LLC, we take the licensing and certification of our adjusters seriously. We believe that our clients deserve the best, and that means working with licensed professionals who are equipped to handle their insurance claims effectively and efficiently. We keep our licenses current and in good standing, ensuring that we’re always ready to help our clients when they need us most.

Conclusion

Recap of the Importance of Hiring a Licensed Adjuster

Throughout this article, we’ve highlighted the necessity of hiring a licensed adjuster to assist in the complex process of insurance claims. As we’ve seen, a licensed adjuster is a competent professional equipped with the necessary knowledge and experience to navigate the intricate insurance claim process. Their proficiency in negotiating with insurance companies, documenting damages, and interpreting insurance policies can ensure a fair and maximum settlement.

Whether it’s a staff adjuster, an independent insurance adjuster, or a public adjuster, their role is integral to the successful resolution of property damage claims. Their expertise, especially in working with specific types of claims such as hail damage, can make the claim process smoother and more efficient.

Final Thoughts on the Top 10 Licensed Adjuster Firms

In our review of the top 10 licensed adjuster firms nationwide, it’s clear that each firm has unique strengths and services. Whether it’s their extensive experience, excellent client reviews, or unique selling propositions, these firms demonstrate the high level of service that a licensed adjuster can provide.

However, we strongly believe in the quality of service we offer here at Insurance Claim Recovery Support LLC. Our team of licensed adjusters is dedicated to advocating for policyholders, ensuring that they receive a fair and prompt settlement for their property damage claims.

Remember, “Insurance companies have experts working for them. You should, too!”™ For more information on our services, explore our services page or read reviews from our satisfied clients.

In conclusion, hiring a licensed adjuster can make a significant difference in the outcome of your property damage claim. When selecting an adjuster, ensure they hold the proper licensing and certification, and consider their experience, reputation, and fee structure. With the right adjuster advocating for your rights, you can navigate the insurance claim process with confidence and peace of mind.