Filing a Fire Insurance Claim in the Texas Panhandle: A Simplified Guide

If you’re a homeowner, commercial building property owner, multifamily complex, apartment real estate investor, or affiliated with religious organizations in the Texas Panhandle, facing the aftermath of a wildfire can be devastating and overwhelming. Wildfires in this region, known for their sudden onset and expansive damage, leave property owners with the daunting task of navigating the complex insurance claim process. This brief guide aims to simplify that process, making it more manageable and ensuring you’re on the right path to recovery.

Wildfires not only pose a tremendous threat to life and property but also bring a multitude of safety and recovery challenges. Understanding your insurance coverage, documenting damage meticulously, and filing your claim promptly are critical steps in the recovery process. Immediate attention to safety issues, returning home cautiously, and beginning the cleanup and documentation process are paramount in laying a solid foundation for your insurance claim.

Safety should be your first priority. Following local authorities’ guidance during evacuation and return is essential. Upon safely returning, assessing and documenting damage becomes your immediate focus, alongside securing temporary housing if necessary. Moving forward requires an understanding of your insurance coverage, knowing what steps to take immediately after the disaster, and how to effectively document and file your claim to facilitate a smooth recovery process.

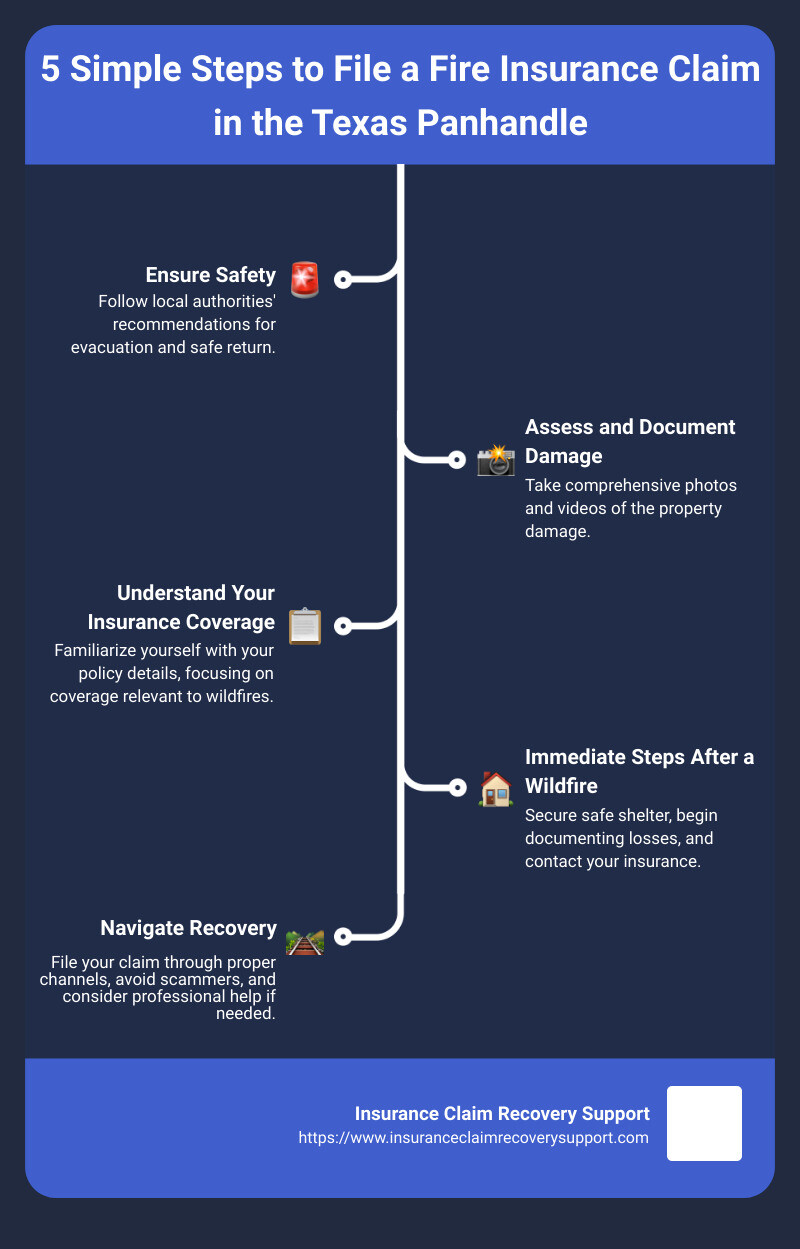

- Ensure Safety: Follow local authorities’ recommendations for evacuation and return.

- Assess and Document Damage: Take comprehensive photos and videos of the property damage.

- Understand Your Insurance Coverage: Familiarize yourself with your policy details, focusing on coverage relevant to wildfires.

- Immediate Steps After a Wildfire: Secure safe shelter, begin documenting losses, and contact your insurance.

- Navigate Recovery: File your claim through proper channels, avoid scammers, and consider professional help if needed.

For additional details, including safety and recovery resources, consider exploring the rich information available on sites like The Texas Tribune, CoreLogic’s Hazard HQ, and Texas A&M’s recent publications. These platforms provide valuable, up-to-date insights on the Panhandle wildfires, safety protocols, and recovery steps.

Sources

- Texas Wildfire Live Updates – The Texas Tribune

- Wildfires in Northern Texas – Hazard HQ, CoreLogic

- Panhandle Wildfires: Safety and Recovery Information for Homeowners – Texas A&M

Understanding Your Insurance Coverage

When a wildfire sweeps through areas like the Texas Panhandle, understanding your insurance coverage becomes crucial. Let’s break down what you need to know about insurance coverage, focusing on key aspects such as Texas Farm Bureau Insurance, State Farm, coverage details, temporary housing, and additional living expenses.

Texas Farm Bureau Insurance and State Farm are among the insurers offering property insurance in Texas. Each company has its own set of policies and coverage options, so it’s important to know exactly what your policy covers.

Coverage typically includes the cost to repair or rebuild your home if it’s damaged by a fire. However, the extent of coverage can vary significantly from one policy to another. For instance, some policies might cover the cost of replacing your home entirely, while others may only cover the current value of your home, which could be less than the cost to rebuild.

Temporary Housing and Additional Living Expenses (ALE): If your home is uninhabitable due to wildfire damage, your insurance policy may cover the cost of temporary housing. This is often referred to as ALE coverage. It can cover hotel bills, meals, and other expenses above your usual living costs while your home is being repaired or rebuilt. The amount of coverage for ALE can vary, so check your policy or speak with your insurer to understand the limits and conditions.

It’s also wise to review your policy periodically, especially after significant life changes or improvements to your property. This ensures that your coverage keeps pace with the value of your home and possessions.

For those in the Panhandle dealing with the aftermath of a wildfire, understanding your insurance coverage is the first step in the recovery process. Knowing what your policy includes helps set realistic expectations and prepares you for discussions with your insurance provider.

The Texas Department of Insurance provides guidance on wildfire-related insurance claims, which can be a valuable resource. Additionally, the Texas Tribune’s live updates, CoreLogic’s Hazard HQ, and Texas A&M’s safety and recovery information offer up-to-date information and advice for those affected by wildfires in Texas.

Understanding your insurance coverage is not just about knowing what’s included; it’s about ensuring you have the protection you need when disaster strikes. If you find your coverage lacking, consider discussing additional options with your insurer to better protect your home and family in the future.

Lead directly into the next section…

Immediate Steps After a Wildfire

When a wildfire has swept through your area, the aftermath can feel overwhelming. Before you do anything else, it’s crucial to prioritize safety and carefully plan your return home. Here’s a straightforward guide on how to navigate this challenging time, focusing on safety issues, returning home, contaminated water, structural damage, and electrical or gas issues.

Safety First

Before you even consider returning to your property, ensure that local authorities have declared it safe to do so. Wildfires can leave behind numerous hazards, from unstable structures to live electrical wires.

Contaminated Water: Wildfires can damage water pipes and infrastructure, leading to potential contamination. It’s advisable to use bottled water for drinking and cooking until local health officials confirm the water supply is safe.

Structural Damage: Inspect your property for visible signs of damage to the foundation, walls, and roof. If you’re unsure about the structural integrity of your home, seek a professional assessment before entering.

Electrical and Gas Issues: Wildfires can damage gas lines and electrical systems, posing serious risks. Do not attempt to turn gas or electricity back on by yourself. Contact your utility providers for a thorough inspection and clearance.

Returning Home

When authorities give the green light to return, approach your property with caution. Wear protective clothing, including gloves, long sleeves, and masks to avoid contact with potentially hazardous materials.

Document Everything

As you assess your property, document all damages with photos and videos. This will be crucial for your Panhandle texas fire insurance claim. Look out for not just the obvious damages but also more subtle ones like smoke and ash residue.

Smoke Damage: Even if the fire didn’t directly impact your structure, smoke could have infiltrated and caused hidden damage. Pay attention to smells, discoloration, and any residue on surfaces.

Ash Cleanup: Ash can be toxic, so it’s important to handle it carefully. Avoid stirring up ash clouds. Wet down ash for easier and safer removal. Ash from burned buildings may contain hazardous materials and should be treated as such.

Utilities and Services

Contact your utility providers to report your return and any damages. If your home is uninhabitable, inform your postal service, and other essential service providers, to hold or redirect your services and mails.

Reach Out for Help

Finally, remember you’re not alone. Reach out to local disaster recovery services for assistance with shelter, supplies, and recovery information. Websites like Texas A&M AgriLife Extension offer valuable resources for those affected by wildfires.

Taking these immediate steps after a wildfire can help ensure your safety and set the foundation for your recovery process. The journey to recovery may be long, but taking it one step at a time can make it more manageable.

Documenting the Damage

After ensuring your safety and once it’s safe to return, the next crucial step in dealing with a Panhandle Texas fire insurance claim is documenting the damage thoroughly. This step is vital for a smooth insurance claim process. Here’s how to do it effectively:

Photographing Damage

Start by taking clear, detailed photos and videos of all the damage. This includes both the exterior and interior of your property. Make sure to capture:

- Burned areas

- Damaged belongings

- Structural damage

Photos and videos provide undeniable evidence for your insurance claim.

Inventory of Losses

Next, create a comprehensive inventory of all your losses. List every item that was damaged or destroyed, along with:

- A description of the item

- Its age

- Its estimated value

This list will be crucial for your insurance claim.

Smoke Damage

Smoke damage can be less visible but just as harmful. Document:

- Stains on walls and ceilings

- Damage to furniture and fabrics

- Any lingering odors

Smoke damage often requires professional cleaning, so it’s important to note it in your claim.

Ash Cleanup

Ash can contain hazardous materials and should be documented before cleanup begins. Photograph areas with significant ash deposits. It’s advisable to hire professionals for ash cleanup to avoid health risks.

Hazardous Waste

Wildfires can leave behind hazardous waste, including:

- Burned chemicals

- Damaged propane tanks

- Destroyed electronic devices

Document these carefully and avoid handling them. Your local authorities should provide guidance on hazardous waste disposal.

Remember: While documenting, wear protective clothing to avoid contact with hazardous materials.

After documenting the damage, keep all your records, photos, and inventory lists safe. These documents are essential when filing your Panhandle texas fire insurance claim. They serve as proof of your losses and are critical for receiving a fair settlement.

For more detailed guidance on documenting wildfire damage and navigating the insurance claim process, visit the Texas Department of Insurance and the Texas A&M AgriLife Extension . These resources offer valuable information for homeowners affected by wildfires in Texas.

By taking these steps to document the damage, you’re laying a solid foundation for your fire insurance claim. This meticulous approach will help streamline the claims process, ensuring you receive the compensation needed to recover and rebuild.

Filing Your Claim

After a wildfire, filing an insurance claim is a critical step towards recovery. Here’s how to navigate the process effectively in Panhandle, Texas.

Contact Your Insurer

As soon as it’s safe, reach out to your insurance company to initiate your claim. Time is of the essence. Insurance companies often operate on a first-come, first-served basis after widespread disasters like wildfires. Provide them with your policy number and a general overview of the damage.

Understanding the Claims Process

Your insurance company will explain the next steps. Typically, this involves filling out claim forms and preparing for an adjuster’s visit. Make sure you understand the timeline and what is expected from you. Ask questions if anything is unclear.

The Role of an Adjuster

An adjuster will be assigned to assess the damage to your property. It’s important to be present during their visit to point out all the damages. They are your direct link to the insurance company and will play a crucial role in determining the outcome of your claim.

Making Temporary Repairs

If immediate repairs are needed to prevent further damage, go ahead, but keep it to just what’s necessary. Save all receipts related to repairs and temporary housing, as these costs may be reimbursable under your policy.

Keep All Receipts

Retain receipts for any expenses related to the wildfire damage. This includes temporary repairs, hotel stays, meals, and other living expenses incurred if you’re displaced from your home. These receipts will be crucial for reimbursement.

Texas Department of Insurance (TDI)

The TDI can be a valuable resource. They offer guidance on handling insurance claims and your rights as a policyholder. If you encounter issues with your claim, they can provide assistance or mediation services.

TDEM iStat Portal

For additional support, the Texas Division of Emergency Management’s iStat portal allows Texans to report personal or business property losses directly. While not a substitute for filing a claim with your insurance, it’s a useful tool for documenting your losses and may assist in state recovery efforts.

Remember: Patience is key. The process can be slow, especially after a major disaster with many claims being filed. Stay organized, keep detailed records of all communications, and follow up regularly. If you feel overwhelmed or encounter difficulties with your claim, consider seeking assistance from a professional advocate like Insurance Claim Recovery Support.

By following these steps, you’re taking control of your recovery process after a wildfire. It’s not just about filing a claim; it’s about ensuring you have the support and resources to rebuild your life in Panhandle, Texas.

For more detailed information on safety and recovery, refer to the following resources:

– Texas Wildfire Live Updates

– Wildfires in Northern Texas

– Panhandle Wildfires: Safety and Recovery Information for Homeowners

Navigating the Recovery Process

After filing your Panhandle texas fire insurance claim, the journey towards recovery begins. It’s crucial to navigate this process wisely to ensure your path to rebuilding is smooth and effective. Here’s how:

Beware of Scammers and Unscrupulous Contractors

Unfortunately, disasters attract individuals looking to take advantage of those in a vulnerable state. Follow these tips to protect yourself:

– Verify Credentials: Always check the credentials of any contractor or repair service. A legitimate professional should have no issue providing proof of their qualifications.

– Get Multiple Quotes: Don’t settle for the first offer. Get several quotes to ensure you’re getting fair pricing for any repair work.

– Avoid Upfront Payments: Be cautious of contractors requesting significant upfront payments before starting work. It’s standard to pay a portion upfront, but a request for full payment beforehand is a red flag.

Stay on Top of Mortgage and Property Taxes

Even though your property might be damaged, it’s important to continue making mortgage and property tax payments to avoid additional financial complications.

– Communicate with Your Lender: If you’re facing financial difficulties due to the disaster, reach out to your lender. They may offer solutions or temporary relief options.

Understand Your Flood Risk and Insurance Needs

Wildfires can significantly alter the landscape, leading to an increased risk of flooding. Here’s what you need to know:

– Evaluate Flood Risk: Consult with experts or use resources like FEMA’s Flood Map Service to understand your new flood risk.

– Consider Flood Insurance: Standard homeowners policies do not cover flood damage. If your risk has increased, purchasing flood insurance could be a wise decision.

Navigating Insurance Recovery with APCIA Tips

The American Property Casualty Insurance Association (APCIA) offers valuable advice for those in the recovery phase:

– Keep Detailed Records: Document all interactions with your insurance company and keep receipts for any repairs or temporary accommodations.

– Understand Your Policy: Be clear on what your insurance covers. Don’t hesitate to ask your adjuster to explain anything that’s unclear.

– Be Proactive: If you disagree with the assessment or settlement offer, know that you have the right to negotiate.

Navigating the recovery process after a wildfire involves being vigilant against scams, staying financially responsible, understanding your changing risk landscape, and effectively managing your insurance claim. By following these guidelines, you can pave a smoother path to rebuilding your life and home in Panhandle, Texas.

For more detailed information on safety and recovery, refer to the following resources:

– Texas Wildfire Live Updates

– Wildfires in Northern Texas

– Panhandle Wildfires: Safety and Recovery Information for Homeowners

Moving forward, let’s explore how Insurance Claim Recovery Support LLC can assist you in maximizing your claim, ensuring you receive the support and resources needed for a full recovery.

Conclusion

Navigating the aftermath of a wildfire, especially in the Texas Panhandle, can be an overwhelming and daunting process. The path to recovery is fraught with complex insurance claims, the need for accurate damage documentation, and the potential risk of dealing with unscrupulous contractors. However, you’re not alone in this journey. At Insurance Claim Recovery Support LLC, we’re committed to standing by your side, providing the expertise and support you need to navigate these challenges successfully.

Our team specializes in helping policyholders like you understand the intricacies of their insurance policies, document the extent of the damage accurately, and file comprehensive claims. We ensure that your rights are protected and that you receive the maximum compensation you’re entitled to. Our goal is to alleviate the stress and burden of the claims process, allowing you to focus on what truly matters – rebuilding and recovery.

The recent wildfires in the Texas Panhandle have underscored the importance of being prepared and knowing how to respond effectively in the face of such disasters. As highlighted by valuable resources such as the Texas Wildfire Live Updates, Wildfires in Northern Texas, and Panhandle Wildfires: Safety and Recovery Information for Homeowners, staying informed and prepared is crucial.

In the wake of such events, remember that you have options and resources available to help you through the recovery process. Whether it’s understanding the latest updates on wildfire containment, learning about the best practices for fire damage recovery, or seeking professional assistance with your insurance claim, resources are available to guide you every step of the way.

At Insurance Claim Recovery Support LLC, we’re more than just a service provider; we’re your partner in recovery. We understand the emotional and financial toll that fire damage can take on individuals and families, and we’re here to help lighten that load. If you’re dealing with the aftermath of the Texas Smokehouse Creek fire or any other wildfire, reach out to us for a free, no-risk consultation. Together, we can navigate the path to recovery and rebuild stronger than before.

In the face of disaster, you’re not alone. With the right support and resources, you can overcome the challenges and emerge resilient.