Introduction

Are you a property owner finding yourself caught in the intricate web of insurance claim processes after experiencing property damage? Wading through confusing policy languages, meeting complex technical requirements, and dealing with demanding insurance providers can feel overwhelming, and that’s where public adjusting firms come in.

Understanding the Role of Public Adjusting Firms

Public adjusting firms like us at Insurance Claim Recovery Support, offer a crucial alliance for policyholders amidst the often daunting realm of insurance claims. With our team of licensed professionals, we step into your shoes, representing your interests directly against your insurance company. As your advocates, we handle all matters pertinent to the insurance claim, ensuring you receive all the financial protection you’re entitled to.

Why You Might Need a Public Adjuster

The expertise of a public adjuster becomes particularly essential when confronted with large and complex claims. Winter weather, for instance, can lead to major property damage. During these times, your focus should be directed towards recovery, and having a public adjuster handle insurance details can save you valuable time and unnecessary stress.

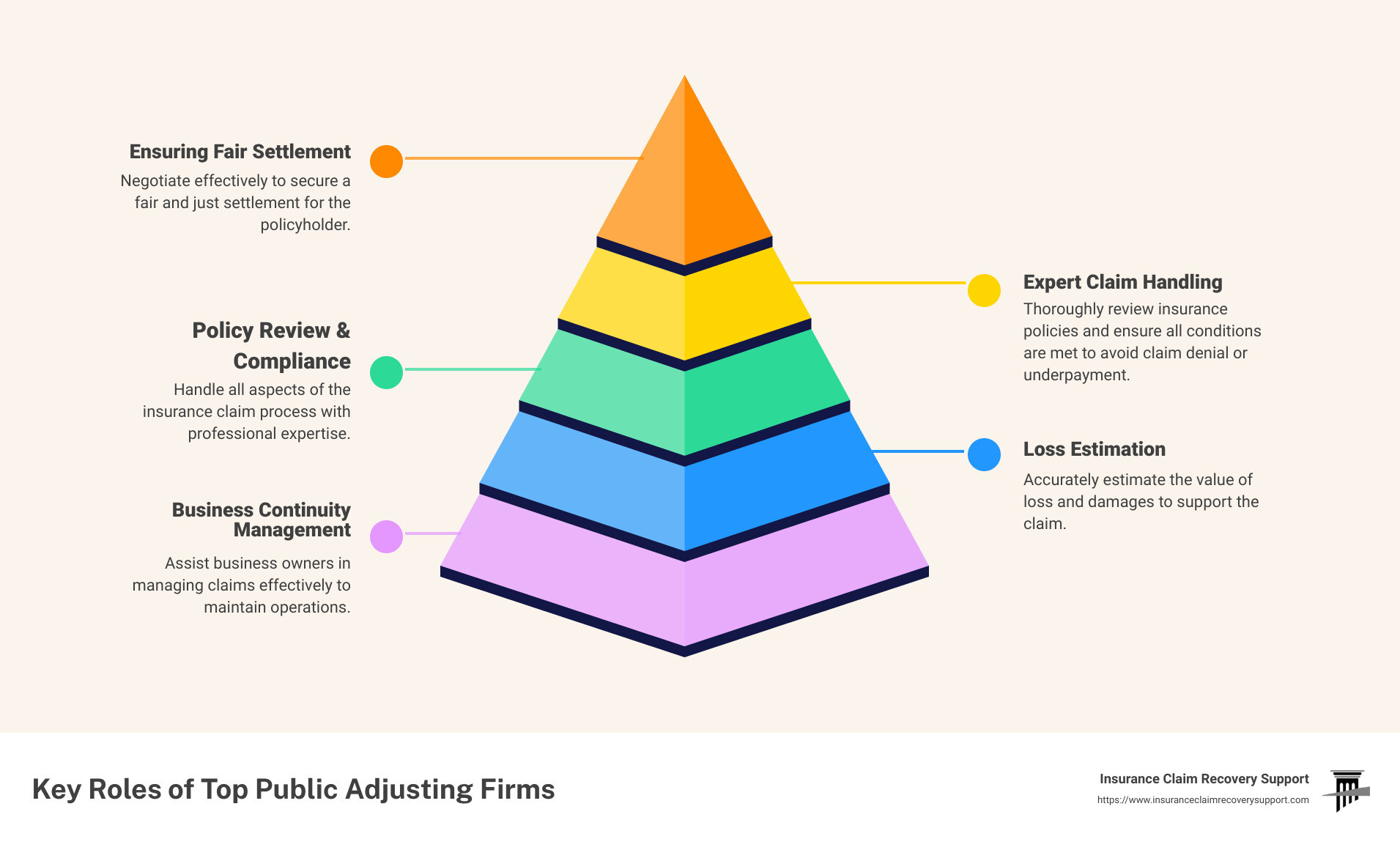

Here’s a glimpse of what to expect from top-notch public adjusting firms:

- Comprehensive review of policyholder’s coverage

- Accurate estimation of loss and damages

- Expert handling of all matters related to the insurance claim

- Effective negotiation with the insurance company on behalf of the policyholder

- Ensuring policy conditions and requirements are met to prevent claim denial or underpayment

- Helping maintain business continuity by managing insurance claims for business owners

By navigating the complexities of insurance claims on your behalf, public adjusters provide invaluable support to policyholders, guiding you to the swift and fair settlement you deserve. In the next sections, we’ll dive deeper into how public adjusters can significantly improve your experience with insurance claims.

The Importance of Hiring a Public Adjuster for Insurance Claims

When dealing with property damage and insurance claims, it’s easy to find yourself overwhelmed by the complexity of the process and the intricate language of policy documents. That’s where public adjusters come in, acting as your advocate to ensure you get the settlement you deserve.

Benefits of Involving a Public Adjuster from the Beginning

The best time to bring a public adjuster into your claim is at the very beginning. Policyholders unfamiliar with the claim process and policy language can make key mistakes. How you report and document your claim can have a significant impact on how quickly you get paid and your final settlement amount, as highlighted by Tutwiler & Associates Public Adjusters, Inc.

Engaging a public adjuster from the start ensures that all coverages are claimed, the fair repair cost of your damages is estimated accurately, and that your claim is well-documented and submitted in the expected format. The early involvement of a public adjuster can expedite the settlement process and ensure you are treated fairly.

How Public Adjusters Help Navigate the Claims Process

Navigating the insurance claims process can be a daunting task, especially when insurance companies start to drag their feet or throw a lot of red tape at you. The unreasonable demands to prove your claim can be overwhelming. This is where public adjusters come in as your personal representative, helping you navigate the insurance claims process.

Public adjusters can handle complex matters such as layers of insurance coverage, inventory and property valuation, repair cost estimates, and communication with multiple insurance carrier staff, allowing you to focus on getting back to business or back into your home. They use their expertise to manage, track, and build a case that gets you a fair settlement.

Ensuring a Fair Settlement with a Public Adjuster

One of the primary roles of a public adjuster is to ensure you receive a fair settlement. They review your policy to ensure all coverages are claimed and estimate the fair repair cost of your damages. Using their expertise, they advocate for you, negotiating with the insurance company to ensure you are treated fairly and that your claim is settled in your best interest.

As Insurance Claim Recovery Support explains, the engagement of a public adjuster can make a world of difference to the claim process, both in terms of the cooperation extended by insurance companies and the ultimate financial recovery.

In conclusion, hiring a public adjuster can significantly improve your experience with insurance claims. Their expert understanding of the process, attention to detail, and commitment to securing the best possible settlement for you can alleviate the stress and uncertainty that often accompanies insurance claims. Whether you’re a homeowner or a business owner, consider hiring a public adjuster to help you navigate your claim and ensure that you get the settlement you deserve.

Top Public Adjusting Firms in the United States

Five Star Claims Adjusting: A Leading Firm in Florida

As one of the largest public adjusting firms in Florida, Five Star Claims Adjusting has successfully handled over 30,000 insurance claims, recovering over $650 million in insurance proceeds on behalf of their clients. With their experience, they ensure that your claim is presented correctly to the insurance company the first time. They fight for their clients to help maximize their claims for a quick, fair, and just recovery. Even small property damages like roof leaks and plumbing issues, which can result in expensive repairs down the road, are diligently handled by Five Star Claims Adjusting.

Adjusters International, Ltd: A Nationwide Network of Regional Firms

Adjusters International, Ltd is a conglomerate of highly regarded regional public adjusting firms covering all 50 states, U.S. Possessions, the Caribbean, Canada, and selected international locations. They help businesses and homeowners manage property damage insurance claims, aiming to optimize the claims and negotiate for a fair settlement. Their regional firms are well-versed with local specificities, which helps in providing the best results. They have served communities for several years, with some firms boasting over a century of service.

Tutwiler & Associates Public Adjusters, Inc.: Expertise in Commercial and Residential Claims

Although not explicitly mentioned in the research, based on the knowledge of the subject, Tutwiler & Associates Public Adjusters is a reputable name in the industry, with a proven track record in dealing with both commercial and residential insurance claims. They are known for their meticulous attention to detail and fair negotiation tactics, which have led to numerous satisfactory settlements for their clients.

Insurance Claim Recovery Support LLC: Advocating for Policyholders Nationwide

At Insurance Claim Recovery Support LLC, we specialize in property damage claims arising from fire, hail, hurricane, tornado, and flood events. We serve clients nationwide from our base in Texas. We exclusively represent policyholders, not insurers, and operate on a no recovery, no fee principle. Our firm is highly rated for customer satisfaction and boasts robust expertise in handling complex claims. We are committed to getting our clients the maximum insurance settlement they deserve. We bridge the gap between policyholders and insurance companies, ensuring your claim gets the attention and fair settlement it deserves.

Choosing the right public adjuster can make a significant difference in the outcome of your insurance claim. These top firms have proven track records of successfully navigating the complex world of insurance claims and helping policyholders receive fair and just settlements. Whether you’re dealing with damage from a hurricane, hail, fire, or other disasters, these public adjusting firms are equipped to help you through the claims process and secure the settlement you deserve.

Understanding Public Adjuster Fees in Different States

When dealing with public adjusting firms, understand that their fees can vary significantly depending on the state. Different states have different rules and regulations governing the maximum amount that public adjusters can charge for their services.

Public Adjuster Fees in Florida: A Case Study

For instance, let’s consider the state of Florida. According to the Florida Association of Public Insurance Adjusters (FAPIA), the fees that public adjusters can charge are capped at 20% for most insurance claims. However, if a disaster results in a declaration of a state of emergency by the Governor, the fees are limited to 10% of the claim payment for one year after the declaration of an emergency. After this period, the fee limit reverts back to 20%.

Additionally, public adjusters in Florida may cap the dollar amount their fees can reach per claim. Less experienced adjusters might cap their fees at $5,000 per claim, while experienced adjusters might have higher caps, such as $10,000 or $15,000. They might also negotiate a lower percentage fee for large claims, such as property losses of $1 million or more.

How Fees Vary Across the United States

While Florida provides a specific case study, it’s important to note that fee structures can vary widely across the United States. Each state has its own laws and regulations that govern how much a public adjuster can charge for their services.

Some states, like Texas, do not have a specific cap on public adjuster fees, but rather require that the fees be “reasonable” and not excessive. Other states may have specific caps, like Florida, or sliding scale fees based on the size of the claim.

The variability in public adjuster fees underscores the importance of doing your research and understanding the fee structure before hiring a public adjuster. At Insurance Claim Recovery Support, for example, we believe in transparency and ensure that our fee structure is upfront, clear, and simple to understand. We feel that this transparency is essential in building trust with our clients and ensuring a smooth and successful claims process.

In conclusion, while the fees public adjusting firms charge can vary, it’s worth noting that their expertise and assistance can often result in significantly higher claim payouts, making their services a valuable investment for many policyholders. A good public adjuster can help you navigate the complex world of insurance claims and ensure you receive the maximum settlement you are entitled to.

How to Find a Reliable Public Adjusting Firm Near You

When it comes to significant property damage, you want the assurance that your insurance claims are handled by a reliable public adjusting firm. So, how do you find one? Here are some guidelines to help you make an informed decision.

Using the NAPIA Directory to Find Licensed Firms

The first step in finding a reputable public adjusting firm is to check the National Association of Public Insurance Adjusters (NAPIA) directory. NAPIA is a respected organization that lists public adjusting firms licensed in most states. If a firm is listed in this directory, it’s an indication that they meet certain professional and ethical standards.

Though, that not all excellent public adjusters are NAPIA members, and membership doesn’t guarantee that someone is the best fit for your specific claim. So, while the NAPIA directory is a great starting point, it should not be your only resource.

Evaluating Public Adjusting Firms: What to Look For

Once you have a list of potential public adjusting firms, you need to evaluate each one based on their experience, reputation, and communication style.

Experience: Ask about the types of claims they’ve worked on and their experience with your insurer. While the number of years in practice or volume of claims handled isn’t necessarily indicative of their expertise, it can provide a glimpse into their level of experience. An experienced adjuster may take on fewer cases but focus on large, complicated claims that require a high level of expertise.

Reputation: Read online reviews and ask for client references. A firm with a strong reputation in the insurance claims community is likely a safe choice. On the other hand, be cautious if a firm has many negative reviews or unresolved complaints.

Communication: The adjuster will handle the entirety of your claim, but you may still want to be involved in the process. Discuss this with the adjuster before hiring them. A good adjuster will be transparent, responsive, and willing to keep you informed throughout the claims process.

At Insurance Claim Recovery Support LLC, we pride ourselves on our transparency, expertise, and commitment to open communication. As one of the top public adjusting firms, we’re here to advocate for you, and ensure you receive the maximum settlement you deserve.

Dealing with Property Damage Claims in Texas

Navigating property damage claims in Texas can be particularly challenging due to the state’s diverse weather conditions. Each city faces its own unique set of challenges, from hailstorms and tornadoes to hurricanes and wildfires, leading to increased risk of property damage.

Common Types of Property Damage in Texas: Fire, Hail, Hurricane, Tornado, and Flood Damage

In cities like Austin and Dallas, hail and tornado damage are common occurrences. Hail damage is a frequent issue, often leading residents to repair their cars and homes after severe weather events. Coastal cities like Houston and San Antonio often face the brunt of hurricanes and subsequent flooding, causing substantial property damage. Further west, in cities like Lubbock and Waco, wildfires pose additional challenges, causing extensive property damage and posing a significant risk to life and property.

Navigating the Insurance Claim Process in Texas with a Public Adjuster

Public adjusters can play a pivotal role in ensuring you receive a fair settlement for your property damage claim. They are professionals who specialize in property damage claims and work on behalf of you, the property owner. They undergo a meticulous process of evaluating and documenting your property damage, providing indisputable evidence for your claim. Once the full extent of your property damage is documented, they leverage their industry expertise to negotiate with the insurance company on your behalf.

How Insurance Claim Recovery Support LLC Can Help Texas Policyholders

At Insurance Claim Recovery Support, we understand the complexities of the insurance claim process and are dedicated to ensuring you receive a fair and prompt settlement. Our public adjusters have handled fire insurance claims, winter weather damage, and more, helping our clients to recover quickly and protect their financial interests.

We understand that dealing with insurance claims can be overwhelming. That’s why we’re here to guide you through the process, providing professional help every step of the way. From evaluating and documenting your property damage to negotiating with insurance adjusters, we work tirelessly to ensure that you receive the compensation you deserve.

In conclusion, while dealing with property damage in Texas can be daunting, you don’t have to navigate this process alone. With the help of public adjusting firms like Insurance Claim Recovery Support, you can rest assured that your claim is in expert hands. So, if you’re facing a property damage claim in Texas, don’t hesitate to reach out to us. We’re here to help you get the settlement you deserve.

Conclusion

The Value of Hiring a Public Adjuster for Your Insurance Claim

As we’ve seen throughout this article, the value of hiring a public adjuster for your insurance claim cannot be overstated. Navigating the complex landscape of insurance claims following property damage can be a daunting task, particularly if you’re unfamiliar with the process and policy language. This is where public adjusting firms step in.

Public adjusters are skilled professionals who work on behalf of you, the policyholder, to ensure that you receive a fair and prompt settlement for your claim. They handle everything from reviewing your policy and estimating fair repair costs to negotiating with the insurance company and submitting a well-documented claim.

By hiring a public adjuster, you can avoid common mistakes that could delay your claim or reduce your final settlement amount. This not only saves you time and energy but also ensures that you receive the compensation you’re entitled to under your insurance policy.

How to Choose the Right Public Adjusting Firm for Your Needs

When it comes to choosing the right public adjusting firm for your needs, it’s important to consider a few key factors. First and foremost, you’ll want to ensure that the firm is licensed and adheres to a strict code of ethics. This can often be verified through professional associations like the National Association of Public Insurance Adjusters (NAPIA).

Next, consider the firm’s level of experience and track record of success. Look for firms that have a history of helping policyholders secure equitable claim settlements and can provide testimonials or case studies to back up their claims.

Lastly, look for a firm that uses advanced claims management software and technology. This can be a strong indicator of the firm’s ability to manage, track, and build a strong case for your claim.

At Insurance Claim Recovery Support, we tick all these boxes and more. With our team of experienced public adjusters and commitment to utilizing the latest technology, we’re here to help you get the settlement you deserve. Contact us today to get started on your claim.

For further reading and to learn more about our services, visit our pages on commercial property public insurance adjusters and big claim public adjuster. And if you’re wondering about what our clients think of us, check out the best public insurance adjuster reviews we’ve received. We’re here to support you every step of the way.