Faced with a catastrophic event like a fire or natural disaster, have you ever felt lost in the complexities of the insurance claim process? Navigating through the intricate web of damage evaluations, claim negotiations, and settlement procedures can be an overwhelming ordeal. It’s at these times that the expertise of a public loss adjuster comes into play.

Public loss adjusters are independent insurance professionals who work solely for policyholders like you. They serve as your ally against insurance companies, simplifying the claim process, and striving to secure the most favorable settlement possible for you. This allows you to focus on recovery, saving you from unnecessary stress and complexities.

Here’s a quick overview (in structured form) for anyone searching for ‘public loss adjuster’:

- What: Public loss adjusters are licensed insurance professionals who represent policyholders in settling an insurance claim.

- When: It’s advisable to hire one when you have a large or complex claim, such as major damage to your property.

- Benefits: They possess the professional know-how to handle complex claims procedures, ensuring you get best possible claim payout.

- Cost: Typically, a public adjuster charges a fee that’s a percentage (up to 15%) of the claim payout.

At Insurance Claim Recovery Support, we are committed to helping you successfully navigate through the arduous insurance claim process. We understand the pain points involved and strive to find solutions to mitigate them effectively.

As we delve deeper into this guide, we will explore the various aspects of hiring a public loss adjuster, essential tips and considerations, and how we can assist you in this process.

What is a Public Loss Adjuster?

A public loss adjuster, also known simply as a public adjuster, is a licensed professional who advocates for policyholders during the insurance claim process. They are independent insurance professionals you can hire when you need assistance in settling an insurance claim, especially when the claim involves substantial damage to your property.

The Difference Between a Public Adjuster and a Regular Adjuster

To fully understand the role of a public loss adjuster, distinguish them from a regular or insurance adjuster. The key difference lies in who they represent.

An insurance adjuster, also known as a company adjuster, is employed by your insurance company. Their primary role is to assess the damage to your property and determine the payout for your claim. They represent the interests of the insurance company and their primary goal is to minimize the company’s payout.

In contrast, a public adjuster is hired by you, the policyholder. They work on your behalf, representing your interests throughout the claim process. Their aim is to maximize your claim settlement, ensuring that you get a fair payout that covers the costs of your property damage or loss.

The Role of a Loss Adjuster in Insurance Claims

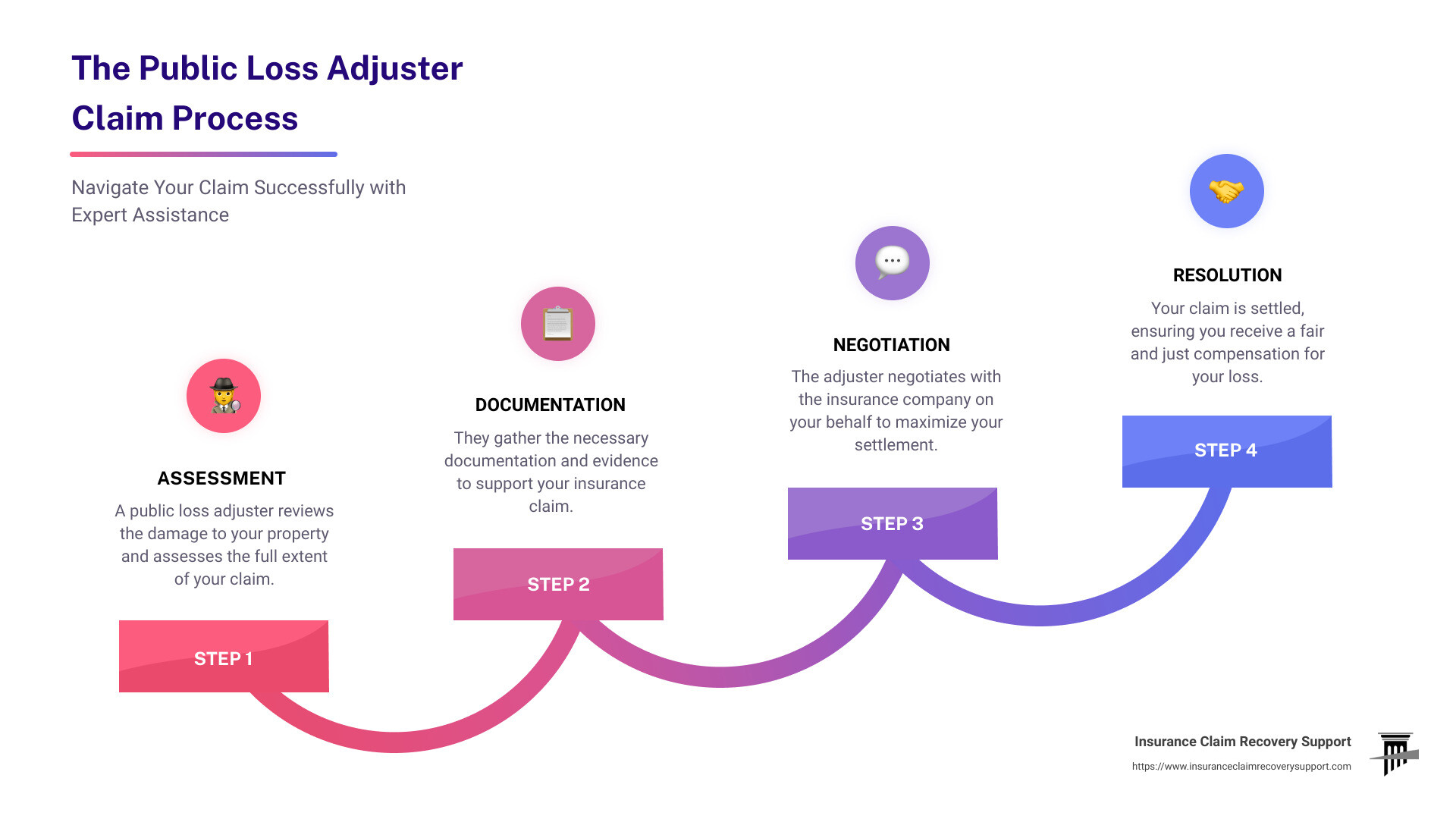

A public loss adjuster serves as your advocate during the insurance claim process. Their roles and responsibilities include conducting a thorough evaluation of the damage or loss, preparing an accurate estimate of repair costs, and negotiating with the insurance company on your behalf. They also ensure that all relevant documentation is submitted to support your claim.

These professionals specialize in handling large and complex property damage claims. They are experts in dealing with large-scale disasters such as fires, hail, wind, tornadoes, lightning, floods, hurricanes, or earthquakes. Public loss adjusters work to ensure that their client’s interests are protected throughout the entire claims process. With a large claim public adjuster on your side, you can rest assured that you will receive a fair settlement for any damages incurred under your coverage plan.

In conclusion, a public loss adjuster is a valuable advocate to have on your side when you’re dealing with an insurance claim, especially if the claim involves significant damage or loss. They work in your best interest, striving to ensure that you receive the maximum payout possible under your insurance policy. At Insurance Claim Recovery Support, we have a team of experienced public loss adjusters ready to help you navigate the complexities of the insurance claim process.

When Should You Consider Hiring a Public Loss Adjuster?

Navigating the labyrinth of insurance claims can be a daunting task, particularly when you’re dealing with the aftermath of a significant loss. While every situation is unique, there are certain scenarios where the expertise and advocacy of a public loss adjuster can be invaluable.

Dealing with Large and Complex Claims

Insurance claims involving extensive property damage or significant loss amounts often require a more nuanced approach. A large loss public adjuster specializes in handling such complex claims, which usually involve substantial sums of money, intricate coverage issues, and extensive damage assessment.

These types of claims necessitate thorough evaluation of all damage aspects, including structural damage, business interruption costs, and lost or destroyed contents. A public loss adjuster brings the necessary experience and knowledge to meticulously assess these damages and effectively negotiate with the insurance company on your behalf.

Hiring someone inexperienced in managing large claim cases could result in financial losses, delays, unnecessary litigation, and added stress. Therefore, if you’re dealing with a large and complicated claim, consider enlisting the services of a public loss adjuster.

Navigating the Claim Process After Major Disasters

Major disasters such as hurricanes, floods, or fires can leave property owners grappling with enormous losses and emotionally devastated. The claim process in such situations is usually labor-intensive and time-consuming, involving legwork, paperwork, understanding insurance rules, and negotiation.

In the aftermath of a catastrophic event, you may find it challenging to handle your claim alone, especially if the insurer is uncooperative or your personal or professional situation makes it difficult to deal with all the details. This is where a public loss adjuster can step in to take the insurance claim challenges off your plate, allowing you to focus on recovery and rebuilding.

A public loss adjuster will handle the entire claim process on your behalf, from documenting and valuing everything that was damaged or destroyed to meeting with adjusters, inspectors, and contractors, and reviewing their reports and estimates. More importantly, they will negotiate a fair claim settlement, ensuring you receive what you rightfully deserve under your insurance policy.

In conclusion, consider hiring a public loss adjuster if you’re dealing with a large and complex claim or trying to navigate the claim process after a major disaster. The benefits of having a professional advocate on your side can far outweigh the costs, providing you with peace of mind and ensuring a fair and prompt settlement.

The Pros and Cons of Hiring a Public Loss Adjuster

When considering hiring a public loss adjuster, weigh the benefits against the potential drawbacks. Here are some key advantages and disadvantages to consider.

Potential for Larger Settlements

One of the primary reasons to hire a public loss adjuster is the potential for securing a larger settlement from your insurance claim. Public adjusters are experienced in identifying and documenting all forms of damage, even those that might go unnoticed by the insurance company’s adjuster. They can negotiate on your behalf, aiming to secure the most generous possible payout. As public loss adjusters, we at Insurance Claim Recovery Support work tirelessly to ensure that you receive every dollar you’re entitled to.

Saving Time and Receiving Guidance

Another significant benefit of hiring a public loss adjuster is the time and energy you save. Dealing with insurance claims can be a complex process, requiring meticulous paperwork and communication with the insurer. Having an experienced adjuster on your side can take much of this burden off your shoulders. Additionally, public adjusters can provide expert guidance to help you better understand your coverage, navigate the claims process, and even guide you in disputing a settlement if you’re unsatisfied with your insurer’s offer.

The Constraints of Policy Limits and Fees

While there are considerable advantages to hiring a public loss adjuster, there are also some potential drawbacks to consider. One of these is that public adjusters can’t get you more money than your policy limit. No matter how skilled or experienced the adjuster, they are bound by the terms of your insurance policy.

Also, public adjusters work for a fee, which is typically a percentage of the claim settlement. While this can be a worthwhile investment for large, complex claims, it’s an added cost that you’ll need to consider. It’s crucial to understand the fee structure before hiring a public adjuster, as their fee will reduce your final payout.

To summarize, hiring a public loss adjuster can be a strategic move, especially in the case of large, complex claims. Their expertise and dedication can result in a larger settlement and save you significant time and stress. However, understand your policy limits and the adjuster’s fee structure before making a decision. At Insurance Claim Recovery Support, we’re here to answer your questions and guide you through this process.

How to Find a Good Public Loss Adjuster

When it comes to handling your property damage claim, having the right public loss adjuster can make all the difference. But with so many options available, how do you find the right one? Here are some steps to guide you through the process.

Getting Referrals and Checking Licensing

Start your search by getting referrals from friends, family, or professional networks who have previously used public adjusters. Their personal experience can provide valuable insights into an adjuster’s professionalism, responsiveness, and effectiveness.

Once you have a few names, it’s crucial to verify that they are licensed to practice in your state. A licensed adjuster has fulfilled the necessary training and requirements to ensure they are equipped to handle your claim. You can usually check this information through your state’s Department of Insurance or the National Association of Insurance Commissioners. This step helps you avoid fraudulent adjusters or those who operate under someone else’s license.

Asking for References and Reviewing the Contract

Before making a decision, ask for at least three references from past clients who had a similar claim to yours. When speaking with these references, ask about the adjuster’s communication skills, professionalism, and the overall satisfaction with the claim outcome. This resource provides a list of questions you might consider asking references.

Once you’re satisfied with the referrals and licensing checks, it’s time to review the contract. A good public loss adjuster should provide a contract that clearly outlines their fees, responsibilities, and how they will handle your claim. In many states, public adjusters operate on a contingency fee basis, which means their payment is a percentage of the claim payout. Be sure to understand and agree with the fee structure before signing the contract.

At Insurance Claim Recovery Support, we ensure transparency in our contracts and make it our mission to guide our clients through the claim process with professionalism and expertise.

Hiring a public loss adjuster is an important decision that requires careful consideration. Take the time to do your research, ask the right questions, and choose an adjuster who best fits your needs and expectations.

Tips for Hiring a Public Loss Adjuster in Texas

When it comes to hiring a public loss adjuster, property owners in Texas face some unique challenges. The Lone Star state is prone to a variety of natural disasters, from hailstorms and tornadoes to hurricanes and wildfires, which can result in complex insurance claims.

Understanding the Unique Challenges of Texas Fire and Storm Damage Claims

In Texas, cities like Austin and Dallas often face hail and tornado damage, whereas Houston and San Antonio, located close to the Gulf Coast, are more prone to hurricanes and subsequent flooding. On the other hand, cities like Lubbock and Waco also have to contend with wildfires. Each of these disasters and the damage they cause present their own set of hurdles in the claims process.

For example, businesses in coastal cities like Houston and San Antonio often have to purchase separate insurance for windstorm and hail damage, as many insurers exclude these from standard commercial property insurance. This can complicate the claim process, making the role of a public loss adjuster even more crucial.

Handling such claims requires not just knowledge of insurance policies and claims processes, but also a deep understanding of the local conditions and the specific challenges they present. This is where a local public loss adjuster can bring immense value.

Finding a Public Loss Adjuster in Major Texas Cities (Austin, Dallas, Fort Worth, San Antonio, Houston, Lubbock, San Angelo, Waco, Round Rock, Georgetown, Lakeway)

When hiring a public loss adjuster in Texas, it’s advisable to find one who is locally-based or has extensive experience in your city. The adjuster’s local knowledge and understanding of the specific conditions can be incredibly beneficial in handling your claim.

At Insurance Claim Recovery Support, we understand the unique challenges and requirements of various Texas cities. We maintain a local presence in multiple cities including Austin, Dallas, Fort Worth, San Antonio, Houston, Lubbock, San Angelo, Waco, Round Rock, Georgetown, and Lakeway. Our local public adjusters understand the specific requirements of these areas, offering a personalized service that takes local factors into account.

We have a wide network of experienced field Public Adjusters (PAs) who live and work in the communities we serve. This allows us to provide a local touch, understanding the unique market conditions and building relationships with local companies for a streamlined process.

So, if you’re seeking a public loss adjuster in Texas, consider hiring a local expert who understands your specific needs and the unique challenges of your area. And remember, whether your property is located in the bustling city of Austin or the serene locale of Lakeway, we bring the same level of dedication, expertise, and customer service to ensure you receive a fair settlement.

How Insurance Claim Recovery Support LLC Can Help

Advocating for Policyholders Nationwide

We at Insurance Claim Recovery Support LLC are committed to standing up for policyholders like you across the nation. Our goal is to assist you in securing the rightful settlement you deserve, safeguarding your rights, compelling insurers to fulfill their obligations, and ensuring your insurance claims are resolved fairly and promptly.

With over a decade of experience and more than $200M+ in settling large loss claims, our team is skilled in navigating the complex processes of insurance claims. We work on contingency, meaning if we don’t recover, there’s no fee. This makes us not just your advocates, but partners invested in your success.

Specializing in Settling Property Damage Claims

Our expertise lies primarily in settling property damage claims resulting from a variety of incidents including fire, hail, flood, wind, water, and hurricane damage among others. We handle claims for residential multifamily and apartment complex policyholders, as well as commercial property owners.

Our team is well-versed in interpreting ambiguous insurance policy language and familiar with building code upgrades, ADA and OSHA laws, and insurance code statutes. We make sure that Overhead and Profit are included where applicable in your Pro-Policyholder claim package submissions.

No matter how large or complex your claim is, we strive to get you the fair and prompt settlement you deserve. We take the stress out of dealing with insurance claim processes and ensure you don’t waste valuable time playing claim games with your insurer.

Our mission is to serve as your dedicated partner, helping you navigate the complexities of insurance claims. From the moment damage occurs to your property, we’re there to support, guide, and advocate for you until a satisfactory settlement is reached. Contact us today to request a free claim evaluation and discover how we can help you maximize your insurance coverage with the help of a public loss adjuster.

Conclusion: Maximizing Your Insurance Coverage with a Public Loss Adjuster

Navigating the complexities of an insurance claim, especially one involving substantial property damage, can be a daunting task. With numerous policy provisions, documentation requirements, and potential disputes with your insurance company, the process can be time-consuming and overwhelming. That’s where a public loss adjuster comes into play.

A public loss adjuster serves as a professional advocate for policyholders in the insurance claim process. They work independently from the insurance company to ensure that you, the policyholder, receive a fair and prompt settlement for damages incurred under your coverage plan.

Consider this: insurance companies have experts working for them, should you not have the same? Hiring a public loss adjuster can bring peace of mind and assurance that an expert is advocating for your interests throughout the claim process. By providing professional documentation, negotiating on your behalf, and ensuring all relevant documentation is submitted, a public loss adjuster can be a valuable ally in maximizing your insurance coverage.

The goal is not just about getting the compensation you deserve, but also about rebuilding your life after an unfortunate event. It’s about recovering all the financial benefits that you are entitled to under the terms and conditions of your policy and the laws in your state.

Before hiring a public loss adjuster, consider their experience, check their references, ensure they are licensed, and understand their fee structure. Be confident in your decision and selection, as this professional will be part of your insurance recovery process for as long as it takes to settle the claim.

At Insurance Claim Recovery Support, we are committed to helping you navigate the complexities of your insurance claim. Our team of experienced public adjusters are here to help you understand your policy, document your losses, and negotiate with your insurance company.

So, when it comes to maximizing your insurance coverage, remember this ultimate checklist: get a public loss adjuster on your side. They can make all the difference in ensuring you recover every dime you’re owed under your insurance policy.

For further information on how public adjusters can assist in your claim, read our article on “Why You Need a Public Adjuster for Commercial Claims” or check out our “Professional Help Directory” to locate professionals in your area.

We hope this guide has helped you understand the role of a public loss adjuster and why they are a valuable asset to have on your side in the claims process. If you have any further questions or need assistance with your claim, do not hesitate to contact us. At Insurance Claim Recovery Support, we’re here to help you every step of the way.