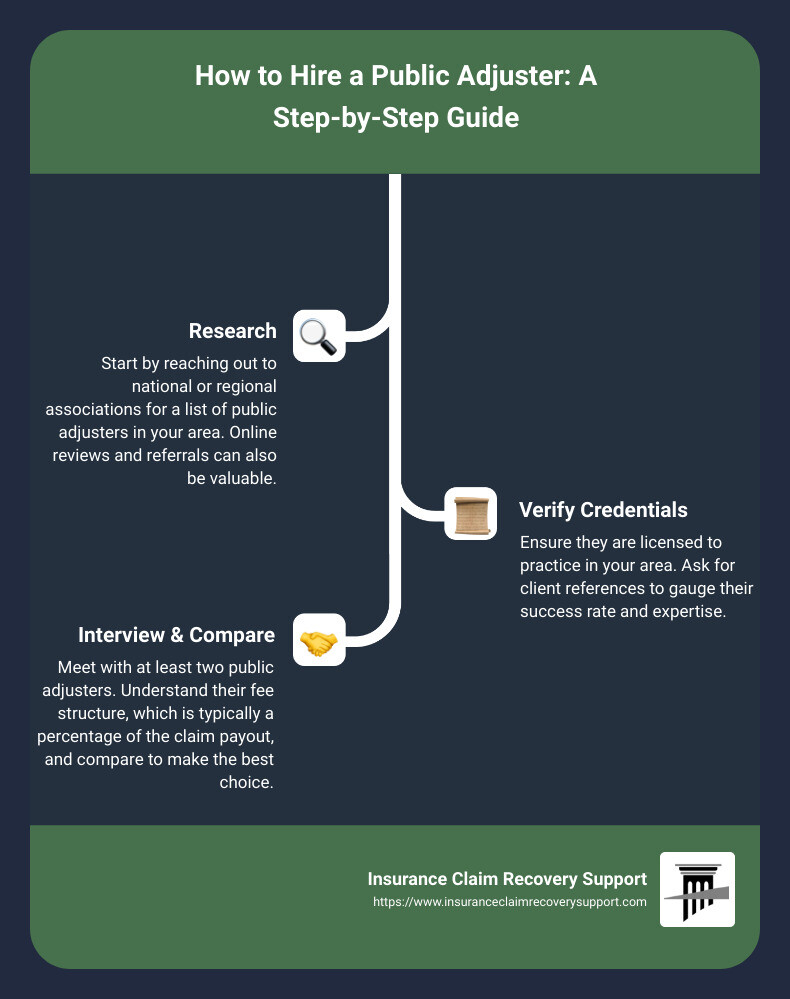

Quick Guide to Finding Public Adjusters:

– Reach Out: National or regional associations; ask for a list by area.

– Check Credentials: Ensure they are licensed. Ask for client references.

– Understand Fees: Typically charge a percentage of the claim payout.

– Interview: Meet with at least two to compare.

Are you feeling overwhelmed by the complex process of filing an insurance claim after your property has suffered damage? You’re not alone. Many property owners face challenges when dealing with insurance companies, from interpreting policy language to ensuring a fair settlement. This is where public adjusters step in.

Public adjusters are professionals who specialize in managing and negotiating insurance claims on behalf of policyholders. They are your advocates, striving to secure the best possible outcome for your claim. The right time to hire a public adjuster is immediately following property damage. This ensures all aspects of your claim are handled accurately and efficiently from the start, avoiding costly mistakes and delays.

Understanding the role of public adjusters and when to hire one can expedite your claim process, alleviate stress, and help you focus on recovery. Let’s delve into how public adjusters can be a game-changer for property owners navigating the insurance claim maze.

What is a Public Adjuster?

In the realm of insurance claims, navigating the process can be daunting. This is where a public adjuster steps in, a beacon for policyholders in the murky waters of insurance claims. Let’s break down their roles, how they represent you, and why their advocacy is crucial.

Roles

A public adjuster is a licensed professional with a very specific mission: to represent you, the policyholder, in your insurance claim. Unlike adjusters who work for insurance companies, public adjusters are on your side. They have one goal in mind: to ensure you receive the maximum settlement you’re entitled to under your policy.

Representation

Imagine having a seasoned guide by your side as you trek through the complexities of an insurance claim. That’s what a public adjuster does. They step in to handle all negotiations with your insurance company, armed with an in-depth understanding of insurance policies and the nuances of your claim. Their expertise allows them to argue on your behalf effectively, ensuring your voice is heard and your interests are protected.

Insurance Claims

When disaster strikes, assessing the damage and filing your claim accurately is paramount. Public adjusters are meticulous in this process. They conduct thorough investigations, document losses comprehensively, and prepare detailed repair estimates. By doing so, they build a robust case for your claim, minimizing the chances of disputes or underpayments.

Policyholder Advocacy

At the heart of a public adjuster’s role is advocacy. They are champions for policyholders, navigating the labyrinth of insurance policies, terms, and conditions on your behalf. Through their advocacy, they strive to level the playing field between you and your insurance company, ensuring fair treatment and just compensation.

In summary, a public adjuster serves as your ally in the often complex and frustrating process of insurance claims. They bring expertise, negotiation skills, and unwavering support to the table, all aimed at securing the best possible outcome for you, the policyholder. Whether it’s damage from fire, hail, hurricane, tornado, or flood, having a public adjuster by your side can make all the difference in your recovery journey.

At Insurance Claim Recovery Support, we understand the value of having a dedicated public adjuster in your corner. We’re here to guide you through every step of the claim process, ensuring your rights are protected and your settlement reflects the true extent of your losses.

Remember, when it comes to insurance claims, you don’t have to go it alone. A public adjuster can be your greatest asset in securing the compensation you rightfully deserve.

Why Hire a Public Adjuster?

When facing the aftermath of property damage, the process of filing an insurance claim can feel overwhelming. You may find yourself asking, “Why should I hire a public adjuster?” Here are four compelling reasons:

Maximize Settlement

The primary reason to consider hiring a public adjuster is the potential to maximize your settlement. Public adjusters are experienced in identifying and documenting every aspect of your loss. This meticulous attention to detail often results in a more comprehensive claim, which can lead to a higher settlement than you might achieve on your own.

- Expertise: Public adjusters understand the language of insurance policies inside and out. Their expertise allows them to navigate the complex claim process effectively, ensuring that your claim is accurately presented to the insurance company.

Stress Reduction

Dealing with property damage is stressful enough without the added burden of handling an insurance claim. Public adjusters take on the heavy lifting of managing your claim, from documenting damages to negotiating with the insurance company. This can significantly reduce your stress and allow you to focus on recovery and rebuilding.

- Claim Complexity: Some claims, especially those involving extensive damage or complex situations, can be particularly challenging to manage. Public adjusters have the experience and knowledge to handle these complex claims, ensuring that all aspects of your loss are thoroughly addressed.

Advocacy for Policyholders

Unlike insurance company adjusters, public adjusters work exclusively for you, the policyholder. They act as your advocate throughout the claim process, working diligently to protect your rights and interests. With a public adjuster on your side, you have a professional who is committed to securing the best possible outcome for your claim.

When to Consider Hiring a Public Adjuster

- Large or Complex Claims: If your property has sustained significant damage or if your claim involves complex issues, a public adjuster can be invaluable in managing the claim process and ensuring a fair settlement.

- Time Constraints: If you’re unable to dedicate the necessary time to manage your claim due to work, family commitments, or other reasons, a public adjuster can save you time and hassle.

- Disputed Claims: If you’re facing a dispute with your insurance company over the coverage or value of your claim, a public adjuster can provide the expertise needed to negotiate a favorable resolution.

At Insurance Claim Recovery Support, we understand the challenges policyholders face when dealing with property damage claims. Our team of skilled public adjusters is here to guide you through every step of the process, ensuring that your claim is handled professionally and efficiently. We’re committed to helping you achieve the maximum settlement possible, providing peace of mind during a difficult time.

Remember, hiring a public adjuster can make a significant difference in the outcome of your insurance claim. With their expertise, advocacy, and commitment to your best interests, public adjusters provide a valuable service for policyholders navigating the complex world of insurance claims.

Choosing the Right Public Adjuster

Choosing the right public adjuster is crucial for property owners looking to navigate the insurance claim process successfully. Here’s how you can make sure you’re picking the best possible advocate for your claim.

Licensing

First things first, always check that any public adjuster you’re considering is properly licensed. Licensing ensures they’ve met the necessary standards and regulations set by state insurance departments. You can verify this information through your state’s insurance department.

Experience

Experience matters. Look for a public adjuster with a solid track record of handling claims similar to yours. Ask potential adjusters about their experience, specifically with claims for fire, hail, hurricane, tornado, or flood damage if that’s what you’re dealing with. Experienced adjusters will have a deeper understanding of what’s required to navigate your claim successfully.

Fees

Understand the fee structure. Most public adjusters charge a percentage of the claim payout, which can vary but is typically up to 15%. Some might offer different arrangements such as flat fees or hourly rates. Make sure you’re comfortable with the fee and that it makes sense for the size and complexity of your claim. The goal is to increase your claim payout to cover these fees while still providing you with the maximum possible settlement.

Location

Choosing a local adjuster can be beneficial. They’re more familiar with the local regulations and building codes, which can play a significant role in your claim. Additionally, local adjusters have relationships with contractors and other professionals in your area that can be beneficial in assessing and repairing the damage.

Specialization in Property Damage

Look for a public adjuster who specializes in commercial, multifamily, or apartment property damage if that’s what you need. Specialization ensures they have the specific knowledge and expertise to handle the complexities of your particular claim type.

At Insurance Claim Recovery Support, we understand the intricacies of property damage claims. Our team is licensed, experienced, and specializes in a wide range of property damage types. We’re committed to advocating for your best interests, ensuring you receive a fair and prompt settlement. If you’re dealing with a challenging insurance claim and need professional assistance, we’re here to help.

Remember, the right public adjuster can significantly impact the outcome of your claim. By focusing on these key areas – licensing, experience, fees, location, and specialization – you can choose an adjuster who will work tirelessly on your behalf, ensuring you receive the settlement you deserve.

The Role of Public Adjusters in Texas Insurance Claims

In Texas, where the weather can be as unpredictable as flipping a coin, property owners often face the brunt of fire, hail, hurricanes, tornadoes, and floods. Each of these disasters brings its own set of challenges, especially when it comes to insurance claims. That’s where public adjusters step in. Let’s break down their role, focusing on the specifics of Texas fire and storm damage, the local regulations governing their work, and how the claim process varies across Texas cities like Austin, Dallas, Fort Worth, San Antonio, Houston, Lubbock, San Angelo, Waco, Round Rock, Georgetown, and Lakeway.

Texas Fire and Storm Damage

Fire and storm damages are not just about the immediate aftermath. The real challenge begins when you start the insurance claim process. Fires can lead to smoke, structural, and even water damage due to firefighting efforts. Storms, depending on their nature, can result in wind damage, flooding, or even hail damage.

Each type of damage requires a nuanced understanding of both the physical reconstruction needs and the intricacies of insurance policies. This is where public adjusters make a significant difference. They have the expertise to accurately assess the damage and ensure that the insurance claim covers all aspects of the damage.

Local Regulations

In Texas, public adjusters are regulated by the Texas Department of Insurance. This ensures that all practicing public adjusters are licensed and adhere to a strict code of ethics. For property owners, this provides a layer of security, knowing that the public adjuster you’re working with is both competent and regulated.

Claim Process in Texas Cities

The claim process can vary significantly across Texas due to the diverse weather patterns and local regulations. For instance:

- Austin and Dallas often face hail and tornado damage.

- Coastal cities like Houston and San Antonio are more prone to hurricane and flood damage.

- West Texas cities like Lubbock and Waco also have the added risk of wildfires.

This geographical diversity means that the expertise of your public adjuster needs to be just as varied. A public adjuster familiar with the specific challenges of your city or region can navigate the local nuances of insurance claims more effectively.

How Public Adjusters Can Help

Our team at Insurance Claim Recovery Support specializes in understanding these local nuances. Whether it’s negotiating with insurance companies, conducting detailed assessments of the damage, or ensuring that your claim is fully documented, we’re committed to representing your best interests.

For example, in coastal areas prone to hurricanes, we’re adept at navigating the complexities of flood insurance claims. In cities like Austin and Dallas, where hail and tornado damage are more common, we bring our expertise in assessing structural damages and negotiating fair settlements.

In conclusion, the role of public adjusters in Texas is crucial. Given the state’s susceptibility to a wide range of natural disasters, having a knowledgeable and experienced public adjuster by your side can make all the difference. From understanding the specific damage types to navigating local regulations and effectively managing the claim process across different Texas cities, public adjusters are invaluable in helping property owners recover from disaster. At Insurance Claim Recovery Support, we’re here to guide you through every step of the process, ensuring that you receive the settlement you deserve.

How Public Adjusters Can Help with Specific Types of Claims

When disaster strikes, the aftermath can be overwhelming. Whether it’s fire, hail, hurricane, tornado, or flood damage, each type of disaster presents unique challenges in the insurance claim process. Here’s how we at Insurance Claim Recovery Support can assist you with these specific types of claims, ensuring you get a fair and prompt settlement.

Fire Damage

Fire can ravage a property, leaving behind not just structural damage but also emotional turmoil. Public adjusters are skilled in assessing the extent of fire damage, navigating the complexities of your policy, and ensuring that your claim covers both visible and hidden damages. We document everything meticulously, from immediate damage to potential future issues, advocating for your maximum entitlement.

Hail Damage

Hail can cause significant damage to roofs, windows, and exteriors. Often, the full extent of hail damage isn’t immediately apparent. Public adjusters have the expertise to identify all affected areas, accurately estimate repair costs, and negotiate with insurance companies. We ensure that your claim encompasses all aspects of the damage, preventing overlooked damages that can lead to future problems.

Hurricane Damage

Hurricanes bring a combination of high winds and flooding, causing extensive property damage. The insurance claim process for hurricane damage can be particularly complex, involving multiple policies. Public adjusters navigate this complexity by accurately attributing damages to the correct cause—wind vs. water, for instance—and ensuring each policy is fully leveraged to your benefit.

Tornado Damage

The sudden and intense nature of tornadoes can leave properties devastated. Public adjusters step in to quickly assess the damage, compile comprehensive documentation, and expedite the claims process. Our goal is to reduce your stress and ensure a swift recovery by securing a settlement that truly reflects the scope of the tornado’s impact.

Flood Damage

Flood damage requires careful analysis to distinguish it from other water-related damages, which are often covered under separate policies. Public adjusters are adept at making these distinctions, providing clear, detailed documentation to support your claim. We aim to streamline the process, advocating for a settlement that addresses all aspects of the flood damage.

In conclusion, public adjusters play a crucial role in helping policyholders navigate the insurance claim process for various types of property damage. Our expertise not only maximizes your settlement but also significantly reduces the stress and time commitment on your part. At Insurance Claim Recovery Support, we specialize in advocating for commercial, multifamily, and apartment property owners, ensuring you receive the settlement you deserve without unnecessary delays or underpayments. If you’re struggling with a claim related to fire, hail, hurricane, tornado, or flood damage, reach out to us early in the process for the best outcome.

When to Contact a Public Adjuster

Deciding when to bring a public adjuster into the insurance claim process is crucial for ensuring you get the fair and prompt settlement you deserve. Here are key moments when contacting a public adjuster, like us at Insurance Claim Recovery Support, makes the most sense:

Early Engagement

The sooner you involve a public adjuster in your claim, the better. Early engagement means we can guide you from the start, ensuring all damage is accurately documented and your claim is properly filed. This proactive approach can prevent common pitfalls and delays.

Large Claims

For significant damage with high costs—like those from a fire, major storm, or flood—have an expert on your side. Large claims are complex and involve substantial financial stakes. A public adjuster brings the expertise needed to navigate these complexities, ensuring you’re not left shouldering costs that should be covered by your insurance.

Disputed Claims

If you find yourself at odds with your insurance company over the value of your claim or the coverage provided, it’s time to call in a public adjuster. We’re skilled in negotiation and understand the intricacies of insurance policies, helping to resolve disputes in your favor.

Complex Claims

Some claims involve complicated scenarios, such as determining the extent of water damage after a hurricane or figuring out liability in a fire. These situations benefit from the specialized knowledge a public adjuster offers. We can dissect your policy, assess the damage thoroughly, and advocate for the comprehensive coverage your situation warrants.

In each of these scenarios, our goal is to ensure you’re not navigating the insurance claim process alone. From assessing damage to negotiating with insurance companies, we’re here to advocate for your best interests, helping you avoid the common traps that can lead to underpaid or denied claims. The right time to reach out to a public adjuster is as soon as you realize you have a claim that might be more than you can handle on your own. Don’t wait until you’re overwhelmed—early engagement is key to a favorable outcome.

Frequently Asked Questions about Public Adjusters

Navigating the waters of insurance claims can be tricky, and that’s where public adjusters come into play. Let’s dive into some of the most common questions property owners like you might have about hiring public adjusters.

What Fees Do Public Adjusters Charge?

Public adjusters typically charge a percentage of the claim payout, which means their fee is contingent upon you receiving a settlement from your insurance company. This percentage can vary, but it’s usually up to 15%. For instance, if a public adjuster charges 10% and you receive a $100,000 payout, the adjuster’s fee would be $10,000.

Some adjusters might offer different fee structures, such as flat rates or hourly charges, but the percentage model is the most common. It’s important to discuss and understand the fee structure before signing a contract with a public adjuster. At Insurance Claim Recovery Support, we believe in transparency and will clearly explain our fees upfront.

How Do Public Adjusters Differ from Insurance Company Adjusters?

The key difference lies in who they represent. Insurance company adjusters, including independent adjusters, work on behalf of the insurance company. Their primary role is to assess the claim from the insurer’s perspective, which might not always align with your best interest.

Public adjusters, on the other hand, work directly for you, the policyholder. We advocate for your rights, aiming to ensure you receive the maximum payout entitled under your policy. We navigate the complexities of your claim, manage negotiations with the insurance company, and strive to expedite the settlement process.

Is It Ever Too Late to Hire a Public Adjuster?

Ideally, you should engage a public adjuster early in the claim process, especially if you’re dealing with a large, complex, or disputed claim. However, it’s rarely “too late” to seek professional assistance. Even if your claim has been underpaid, delayed, or denied, a public adjuster can review your situation and may still be able to help.

That said, there are timelines and deadlines within insurance policies and state laws that can affect your claim. Therefore, reaching out to a public adjuster sooner rather than later can be beneficial. At Insurance Claim Recovery Support, we can assess your specific situation during a free consultation and advise on the best course of action, even if you’re late in the claim process.

In conclusion, hiring a public adjuster can provide significant advantages in navigating the insurance claim process. Understanding the fees, the distinct roles between public and insurance company adjusters, and the timing for hiring a public adjuster can empower you as a policyholder to make informed decisions. Our goal is to advocate for you, ensuring you receive a fair and prompt settlement for your property damage claim.

Conclusion

Benefits, Making an Informed Decision, Advocacy for Policyholders

In wrapping up, the decision to hire a public adjuster can significantly impact the outcome of your insurance claim. As policyholders, especially in the face of property damage due to fire, hail, hurricane, tornado, or flood, navigating the insurance claim process can be daunting. That’s where the expertise of public adjusters comes into play.

Benefits of Hiring a Public Adjuster:

- Maximized Settlements: Public adjusters possess the expertise to accurately assess property damage and ensure that your claim reflects the true cost of repairs or replacements.

- Expertise and Experience: With a deep understanding of insurance policies and the claim process, public adjusters can navigate complex situations to advocate on your behalf.

- Stress Reduction: Handling an insurance claim can be stressful. Public adjusters take the burden off your shoulders, managing every aspect of the claim process.

- Advocacy: Public adjusters work exclusively for you, the policyholder. Their primary goal is to protect your interests and rights throughout the claim process.

Making an Informed Decision:

Choosing the right public adjuster is crucial. Look for adjusters with a proven track record of success, transparent fee structures, and the necessary licensure and experience to handle your specific type of claim. Don’t hesitate to ask for references and to verify their credentials.

Advocacy for Policyholders:

At Insurance Claim Recovery Support, we emphasize the importance of having an advocate who understands your needs and fights for your rights. We specialize in representing commercial, multifamily, and apartment property owners, ensuring they receive the fair and prompt settlement they deserve. Our team is dedicated to guiding you through every step of the claim process, advocating on your behalf, and providing the expertise necessary to navigate the complexities of insurance claims.

Hiring a public adjuster isn’t just about managing a claim; it’s about partnering with someone who has your best interests at heart. It’s a proactive step towards securing what you’re entitled to, ensuring that your property and your rights are protected. Our commitment to you goes beyond just settling claims. We believe in empowering policyholders through education, advocacy, and personalized support.

In conclusion, the role of public adjusters cannot be overstated. They serve as invaluable allies in the insurance claim process, ensuring that policyholders are not left to navigate this complex journey alone. Whether you’re dealing with damage from a natural disaster or any other property damage, understanding the benefits and importance of hiring a public adjuster is the first step towards making an informed decision. You don’t have to face this alone—we’re here to support and advocate for you every step of the way.