Quick Steps After a Claim Settlement:

1. Understand the payment process of your settlement.

2. Start the remaining repairs and rebuilding of your property.

3. Document all post-settlement activities diligently.

4. Handle any potential disputes or negotiations professionally.

5. Re-evaluate your homeowners insurance policy and ensure all future potential damage is covered.

Have your property damage insurance claim finally been settled and now you’re wondering, “What next?” That’s a question we hear a lot at Insurance Claim Recovery Support. Navigating the insurance claims process can be complex and overwhelming, especially when you’re dealing with the stress of property damage. But guess what? The completion of your property damage insurance claim settlement isn’t necessarily the end of the road. There are crucial steps to take following a settlement to ensure a full recovery and optimal preparation for any future claims.

We’re going to take you through the necessary steps to take after your insurance claim has been settled. Whether it’s understanding the payment process or making remaining repairs, dealing with mortgage servicers or lenders, or even handling disputes and negotiations following the settlement, we’ve got you covered. Learning about these steps is important because, let’s face it, the better prepared and informed you are, the smoother your recovery journey will be. Being proactive in this regard can save you a lot of stress, time, and money in the long-run. Let’s dive in…

Understanding the Property Damage Insurance Claim Settlement Process

Navigating the intricacies of a property damage insurance claim settlement can be overwhelming, especially when you are already dealing with the stress of the damage itself. This is where we, at Insurance Claim Recovery Support, come in to help. Let’s break down the process into easier-to-understand pieces.

The Role of a Public Adjuster in the Claim Settlement Process

In any property damage insurance claim, having a trusted ally can make a world of difference. A public adjuster plays a crucial role in the claim process. Unlike the adjusters representing the insurance company, public adjusters, like us at Insurance Claim Recovery Support, exclusively represent your interests.

We help in interpreting insurance policies, assessing property damage, and negotiating with insurance companies to ensure a fair and prompt settlement. We’re experts in dealing with insurance claims, which enables us to quickly identify and address potential challenges that could slow down the claim process.

The Four Phases of the Claim Process: Adjudication, Submission, Payment, and Processing

The insurance claim procedure is a four-phase cycle: adjudication, submission, payment, and processing. Here’s a brief overview of each stage:

- Adjudication: This is the decision-making stage, where your claim is evaluated for validity.

- Submission: In this phase, the claim details are gathered and formally submitted to the insurance company.

- Payment: Once the claim is approved, the insurance company determines the payout amount.

- Processing: This is the final stage of settling the claims payment. The insurance company sends the payment, marking the end of the claim process.

The Importance of Immediate Safety Measures and Emergency Repairs

When your property is damaged, your immediate focus should be on safety. This might involve turning off the main power if there’s a risk of electrical fires, blocking off dangerous areas, or even evacuating the building if necessary.

Once safety is ensured, it’s crucial to document the damage and make emergency repairs to prevent further damage. However, before you proceed with any repairs, be sure to contact your insurance company first as some policies have rules about unauthorized repairs.

Understanding these steps to take after a property damage insurance claim is settled is crucial to navigate the process smoothly. At Insurance Claim Recovery Support, we’re committed to guiding you through each stage, ensuring that you receive the maximum settlement you deserve with minimum time delays and stress.

Steps to Take After Your Property Damage Insurance Claim is Settled

After settling your insurance claim, it’s crucial to understand the next steps to ensure a smooth transition to rebuilding your property. Here’s what you need to know:

Reviewing the Settlement and Understanding the Payment Process

Once your property damage insurance claim is settled, you’ll receive a sum from your insurance company. This sum is often an advance against the total settlement amount, and not the final payment. If you discover additional damage later, you can “reopen” the claim and request an additional amount.

It’s worth noting that if your home structure and personal belongings are damaged, you’ll generally receive two separate checks from your insurance company. You’ll also receive a separate check for any additional living expenses incurred while your home is being renovated.

The payout process typically starts with a check for the actual cash value of the damaged items. Once you replace these items and provide receipts to your insurer, you can receive the remainder of your personal property settlement.

Making Remaining Repairs and Rebuilding Your Property

After receiving your settlement, it’s time to bring your property back to its pre-loss condition. Hiring a reputable contractor is critical. Word of mouth, local Home Builders Association, Better Business Bureau, or Chamber of Commerce are excellent resources to find a trustworthy contractor. Don’t fall victim to disaster fraud; always ensure your contractor is licensed and adequately insured.

Dealing with Mortgage Servicers or Lenders in the Settlement Process

If you have a mortgage on your property, the check for repairs will generally be made out to both you and the mortgage lender. The lender gets equal rights to the insurance check to ensure that necessary repairs are made to the property. They typically put the money into an escrow account and pay for the repairs as the work is completed. It’s important to keep your mortgage lender informed throughout the repair process, as they may want to inspect the finished job before releasing the funds for payment to the contractor.

Understanding the Role of Replacement Cost and Actual Cash Value in the Settlement

Understanding the difference between Replacement Cost and Actual Cash Value (ACV) is vital. If you have a replacement cost policy for your personal possessions, you’ll need to replace the damaged items before your insurance company will pay. If you decide not to replace some items, you’ll be paid their actual cash value.

Your insurance company will generally allow you several months from the date of the cash value payment to replace the items and collect the full replacement cost. It’s crucial to know how many months you’re allowed and plan accordingly.

At Insurance Claim Recovery Support, we’re here to help you navigate the steps to take after a property damage insurance claim is settled. Our team of experts, led by Scott Friedson, will ensure that you understand your settlement, the payment process, and help you embark on the journey to repair and rebuild your property. We’ll guide you through the entire process, making sure you get the maximum settlement you deserve.

Navigating the Post-Settlement Phase

After successfully settling your property damage insurance claim, you might assume that the hard work is over. However, the journey isn’t quite finished yet. There are still several crucial steps to take after a property damage insurance claim is settled.

The Importance of Documenting All Post-Settlement Activities

One crucial aspect of the post-settlement phase is maintaining thorough documentation of all related activities. This involves keeping track of all repair or replacement work carried out on your property, the expenses incurred, and any additional communications with the insurance company.

Ensure to retain copies of all receipts, invoices, and contracts with contractors. This information might prove invaluable should any disputes arise in the future or should you need to provide proof of the work done on your property.

How to Handle Disputes and Negotiations After the Settlement

Even after your claim is settled, there might be instances where disputes arise. For instance, you might discover additional damage that wasn’t initially included in the settlement, or you might disagree with the insurance company about the value of certain repairs. In such cases, it’s crucial to approach the situation calmly and strategically.

You have the right to dispute the settlement and negotiate for a fairer amount. If you are not comfortable handling the disputes and negotiations yourself, consider seeking professional help. At Insurance Claim Recovery Support, we have a team of professionals led by Scott Friedson who can guide you through the negotiation process and ensure your rights are protected.

The Role of Appraisers in Resolving Disputes Over the Amount of Loss

In cases where disputes over the amount of loss cannot be resolved through negotiation, you might need to involve an appraiser. Appraisers play a crucial role in assessing the extent of the damage and determining the cost of repairs or replacement.

That you have the right to hire an independent appraiser if you believe the insurance company’s estimate is too low. The appraiser can provide a detailed assessment of the damage and an estimate of the repair costs, which can be beneficial when negotiating a fairer settlement with the insurance company.

By being proactive, organized and informed, navigating the post-settlement phase can be a smoother process. Always remember that you don’t have to go through it alone. At Insurance Claim Recovery Support, we are here to guide you every step of the way, ensuring you get the fair treatment and settlement you deserve.

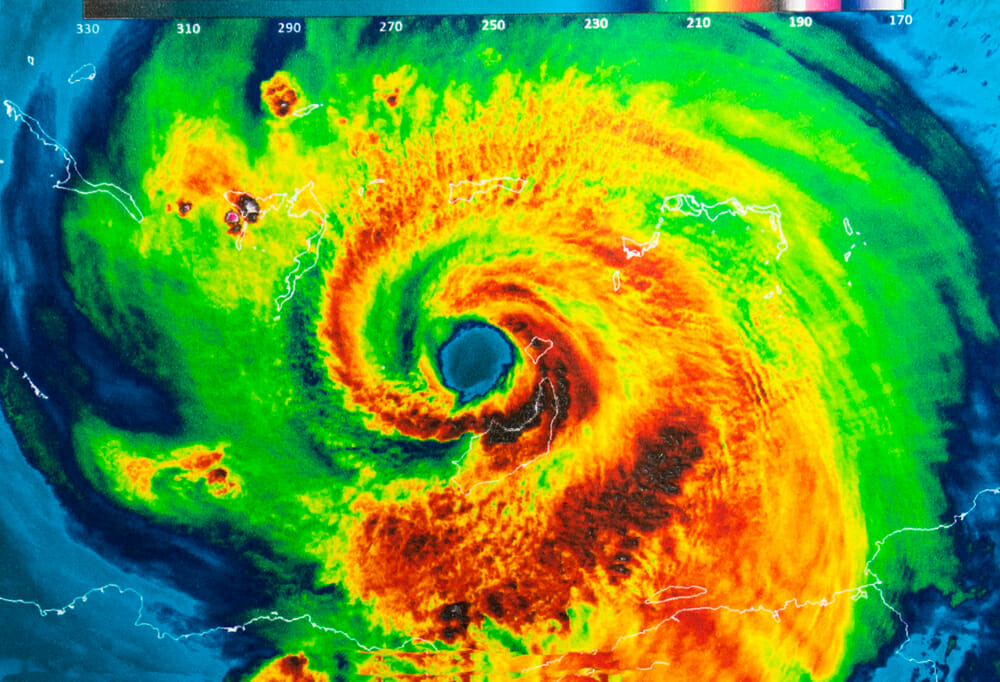

Special Considerations for Texas Property Owners

As a property owner in Texas, you face unique challenges when dealing with property damage claims due to the state’s variable weather patterns and specific state regulations. This section will offer some insights into the specific concerns for Texas property owners after a property damage insurance claim is settled, focusing on fire and storm damage claims and understanding the state’s laws and regulations.

Dealing with Fire and Storm Damage Claims in Texas Cities like Austin, Dallas, Fort Worth, San Antonio, Houston, Lubbock, San Angelo, Waco, Round Rock, Georgetown, and Lakeway

In 2020 alone, Texas witnessed nearly 8,000 fires, leading to over $636 million in property damage claims (Texas Department of Insurance). We at Insurance Claim Recovery Support understand that the aftermath of such incidents can be overwhelming. In cities like Austin, Dallas, Fort Worth, San Antonio, Houston, Lubbock, San Angelo, Waco, Round Rock, Georgetown, and Lakeway, wildfires and storms can cause significant property damage and disrupt the regular course of your business or daily life.

After a property damage insurance claim in Texas is settled, it is crucial to document all the repairs and restoration activities to ensure transparency. Additionally, understanding the nature of the damage, such as smoke, soot, water damage due to firefighting efforts, or storm damage, can help you ensure that all damages have been adequately addressed in the claim and repairs process.

Understanding Texas State Laws and Regulations Related to Property Damage Insurance Claims

Every state in the U.S. has specific laws and regulations that govern the claim process, and Texas is no different. As a property owner, understanding these regulations can go a long way in ensuring your claim process goes smoothly.

In Texas, insurance companies must acknowledge receipt of your claim within 15 days and approve or deny the claim within 15 business days of receiving all necessary documentation. In cases of severe weather, these deadlines may be extended to up to 45 days. If a claim is approved, the insurance company must pay the claim within five business days.

That failing to comply with these regulations could lead to penalties for the insurance company. If you feel your claim isn’t being handled fairly, you can seek assistance from an insurance professional or a lawyer.

At Insurance Claim Recovery Support, our team of experts is well-versed in Texas laws and regulations related to property damage insurance claims. We can help you understand these regulations and ensure that your claim is handled properly and promptly.

In conclusion, as a Texas property owner, understanding the specific considerations for fire and storm damage claims and the state’s laws and regulations can make the process of navigating the steps to take after a property damage insurance claim is settled less daunting. You are not alone in this process, and seeking professional help can ensure that you get a fair settlement for your property damage claim.

Re-evaluating Your Homeowners Insurance Coverage After a Claim Settlement

After your property damage insurance claim is settled, it’s crucial to re-evaluate your homeowners insurance coverage. This post-settlement phase offers an opportunity to assess your policy, ensuring it continues to provide adequate protection for your property.

The Need for Regular Policy Reviews and Updates

Regular policy reviews are essential to remain adequately insured. As our Insurance Claim Recovery Support expert Scott Friedson often notes, policyholders should assess their coverage periodically to ensure it matches their current needs.

During these reviews, consider changes in the value of your property or personal possessions. For instance, if you’ve made significant improvements to your property, it might be necessary to increase your coverage. Similarly, if you’ve acquired valuable items since your last review, ensure they are adequately covered.

The Role of Additional Living Expenses Coverage in Your Policy

It’s equally important to understand the role of Additional Living Expenses (ALE) coverage in your policy. ALE coverage is designed to cover temporary expenses incurred due to a covered loss making your property uninhabitable. These can include costs like temporary rent, pet boarding, and increased commuting expenses.

ALE benefits are typically paid on a reimbursement basis, so you’ll have to pay for the expense first and then submit receipts to your insurance company for reimbursement. If you’ve recently used your ALE coverage, consider whether the limits provided were adequate or if an increase may be necessary.

Understanding the Coverage for Damage to Vehicles, Trees, Shrubbery, and Water Damage

Your homeowners insurance policy might also provide coverage for damage to vehicles, trees, shrubbery, and water damage. It’s crucial to understand the limits and deductibles for each coverage type. For example, if a fire partially damages your home, causing smoke or water damage, your policy should cover the costs of mitigation, such as drying out affected areas to prevent mold growth.

Your policy should ideally return your property to a “uniform and consistent appearance,” even if that means replacing undamaged items like roof tiles or carpeting.

In conclusion, re-evaluating your homeowners insurance coverage after a claim settlement helps ensure that you’re adequately protected in the event of future property damage. By regularly reviewing and updating your policy, understanding the role of ALE, and familiarizing yourself with coverage for various types of damage, you can better navigate the steps to take after a property damage insurance claim is settled. If you need assistance in understanding these complexities, Insurance Claim Recovery Support stands ready to help.

Conclusion

Navigating through the process of a property damage insurance claim can be a daunting task, especially when you’re dealing with the aftermath of property damage. But with the right guidance and knowledge, you can ensure you are rightfully compensated for your loss and get back on track to recovery.

Once you’ve completed the necessary steps to take after a property damage insurance claim is settled, review your insurance policy thoroughly. Understand your coverage limits and exclusions, and consider consulting with a specialist to ensure all potential future damages are covered. This will help you be prepared and protected for any future incidents.

It’s also critical to keep all relevant documentation. This includes correspondence with your insurance company, receipts, photos, and any other pertinent information. This documentation may be crucial for tax purposes, or in case of future disputes or claims.

Moreover, if you feel your claim wasn’t handled fairly, don’t hesitate to seek advice from a lawyer or insurance professional, like our expert Scott Friedson at Insurance Claim Recovery Support. We are committed to helping policyholders navigate through the complexities of the insurance claim process, ensuring a fair and prompt settlement.

The ultimate goal is to rebuild and recover. Whether it’s repairing or replacing damaged items, or dealing with mortgage servicers or lenders in the settlement process, every step taken post-settlement should lead you towards that goal.

Lastly, don’t underestimate the importance of re-evaluating your homeowners’ insurance coverage after a claim settlement. Regular policy reviews and updates can help you stay ahead of the curve and protect your property against potential damages in the future.

Navigating the aftermath of property damage can be overwhelming, but remember, you don’t have to do it alone. At Insurance Claim Recovery Support, we’re here to help you every step of the way.

For more information on how to navigate the steps to take after a property damage insurance claim is settled, don’t hesitate to contact us or visit our blog for more resources.