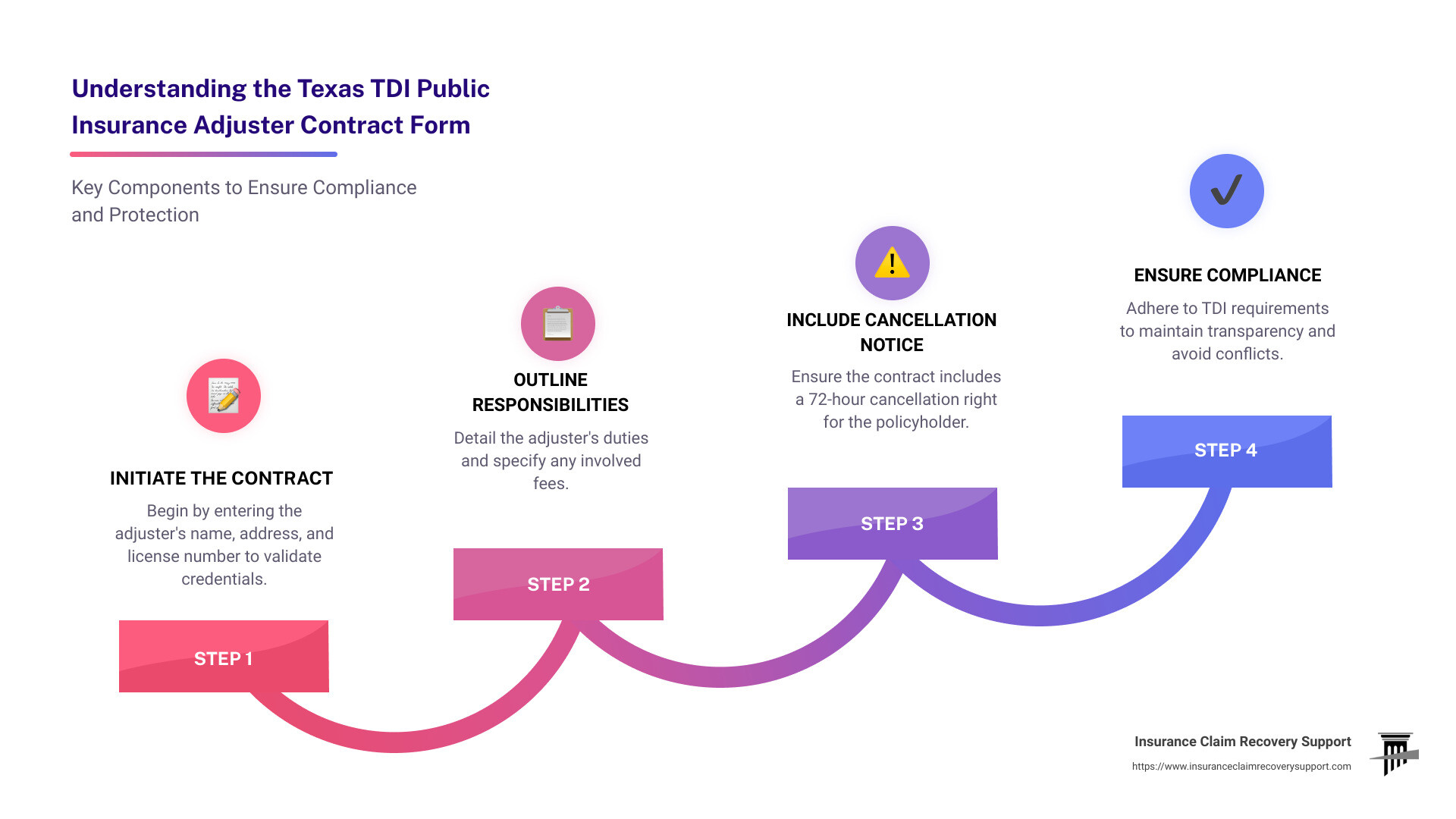

If you’re looking to understand the texas tdi public insurance adjuster contract form, you’ve come to the right place. This contract is essential for anyone involved in insurance claims in Texas, ensuring that public insurance adjusters and policyholders have a clear, regulated agreement. Here’s what you need to know:

- Purpose: The contract formalizes the working relationship between public insurance adjusters and policyholders, safeguarding both parties’ interests.

- Key Inclusions: It specifies the adjuster’s duties, fees, and crucial cancellation rights for the policyholder within 72 hours.

- Compliance: Adhering to the Texas Department of Insurance requirements, the form prevents conflicts of interest and ensures transparency in the claims process.

For those dealing with significant property damage, from commercial buildings to multifamily complexes, this form is crucial for a fair and prompt settlement.

I’m Scott Friedson, a multi-state licensed public adjuster with experience in using the texas tdi public insurance adjuster contract form. Having settled over 500 large loss claims valued at over $250 million, I have the expertise to guide you through the complexities of insurance claims, ensuring you avoid unnecessary litigation and maximize your settlement.

Understanding the Texas TDI Public Insurance Adjuster Contract Form

The Texas TDI Public Insurance Adjuster Contract Form is a vital document for anyone involved in the insurance claims process in Texas. This form is not just a formality; it is a legal requirement that ensures both policyholders and public insurance adjusters have a clear and regulated agreement. Here’s a breakdown of its key elements and legal obligations:

Key Elements of the Contract

-

Name and Address: The contract must include the full name and address of the public insurance adjuster. This information is crucial for transparency and accountability.

-

License Number: Every page of the contract should prominently display the adjuster’s license number. This ensures that you are working with a licensed professional recognized by the Texas Department of Insurance.

-

Cancellation Notice: The contract must contain a clear statement that the policyholder can cancel the contract within 72 hours of signing, for any reason. This provides a crucial safety net for policyholders to reconsider their decision without penalties.

“NOTICE: The insured may cancel this contract by written notice to the public insurance adjuster within 72 hours of signature for any reason.”

Legal and Ethical Requirements

-

Compliance: The contract must adhere to the standards set by the Texas Department of Insurance. This ensures all practices are lawful and the policyholder’s rights are protected.

-

Ethical Conduct: The adjuster must act ethically, avoiding any actions that could be seen as a conflict of interest. This includes not participating in the repair or restoration of the property they are adjusting.

“A public insurance adjuster may not participate directly or indirectly in the reconstruction, repair, or restoration of damaged property that is the subject of a claim adjusted by the public insurance adjuster…”

- Conflict of Interest: The contract explicitly prohibits the adjuster from engaging in activities that might present a conflict of interest. This includes not accepting any remuneration from firms connected to the claim.

Understanding these elements and requirements is crucial for anyone entering into an agreement with a public insurance adjuster in Texas. It ensures that both parties are protected and that the process is conducted fairly and transparently. Next, we’ll explore how to fill out the form efficiently and securely.

How to Fill Out the Texas TDI Public Insurance Adjuster Contract Form

Filling out the Texas TDI Public Insurance Adjuster Contract Form is a straightforward process, but it’s important to ensure your information is protected. Here’s how to complete the form while keeping your data secure:

E-Signature and Online Submission

Digital signatures have made signing documents more convenient and legally binding, provided they meet certain standards. When you fill out your contract form online, make sure to use a reliable e-signature tool. This tool should comply with key legal frameworks like ESIGN and UETA, which ensure that your electronic signature is valid.

-

E-Signature: Choose a tool that offers a digital certificate to authenticate your identity. This certificate acts as a digital stamp, proving that you are who you say you are.

-

Online Submission: Many insurance forms can now be submitted online. This method is not only faster but also provides an audit trail, documenting every step of the process.

Security Measures

Protecting your personal information during the form submission is crucial. Here are some security measures to consider:

-

Encryption: Ensure that any platform you use encrypts your data. 256-bit encryption is a strong standard that keeps your information safe from unauthorized access.

-

Dual-Factor Authentication: This adds an extra layer of security. It requires you to verify your identity using two different methods, such as a password and a text message code.

-

Audit Trail: Use a service that offers an audit trail. This feature records every action taken on the document, including identity verification and timestamps. It provides a clear record if you ever need to prove the form’s authenticity.

By following these steps, you can complete the Texas TDI Public Insurance Adjuster Contract Form with confidence, knowing your information is secure. Next, we’ll discuss the benefits and drawbacks of hiring a public insurance adjuster.

Benefits and Drawbacks of Hiring a Public Insurance Adjuster

When dealing with insurance claims, especially after a disaster, you might consider hiring a public insurance adjuster. They can be a valuable ally, but it’s important to weigh both the pros and cons.

When to Consider Hiring a Public Adjuster

Advantages

-

Maximized Claim Settlement: Public adjusters often secure higher settlements compared to what you might achieve alone. Their expertise in evaluating claims ensures every aspect of your loss is documented. For instance, after a hurricane, they can determine which damages are covered under different policies.

-

Expertise in Complex Claims: Insurance policies can be confusing. Public adjusters understand these intricacies and can steer the claims process for you. This is especially beneficial for complex claims where damages are not immediately obvious.

-

Policyholder Representation: Unlike insurance company adjusters who aim to minimize payouts, public adjusters work solely for you. They advocate on your behalf to maximize your claim, which is crucial if the insurer’s offer seems unfair.

Disadvantages

-

Cost of Services: Public adjusters typically charge a percentage of the settlement, often around 10%. While this fee may be worthwhile for large claims, it might not be justified for smaller, straightforward ones.

-

Focus on Major Claims: Many adjusters prefer large-scale claims because their fee is based on a percentage of the settlement. This focus might mean less interest in smaller claims, which could be a drawback if your claim isn’t substantial.

-

Potential for Slower Settlement: While adjusters can speed up the process with their knowledge, involving another party might also slow it down. Negotiations between the public adjuster and the insurance company’s adjuster could extend the time to settle your claim.

When to Hire

Consider hiring a public adjuster if you’re facing significant payouts or complex claims. Their representation can be invaluable in ensuring you receive the full compensation you’re entitled to. However, for smaller claims, the cost might outweigh the benefits.

Hiring a public insurance adjuster can be a strategic decision, particularly for complex or large claims. Next, we’ll tackle some frequently asked questions about Texas public insurance adjusters.

Frequently Asked Questions about Texas Public Insurance Adjusters

How do I get out of a public adjuster contract in Texas?

Canceling a contract with a public adjuster in Texas is straightforward if you act quickly. You have 72 hours from signing to cancel without penalty. To do this, send a written notice to the adjuster. It’s crucial to use certified mail so you have proof of sending and receiving. This protects your rights and ensures the cancellation is processed correctly.

Can a public adjuster be a contractor in Texas?

In Texas, public adjusters cannot be contractors on the same claim they are adjusting. This rule prevents any conflict of interest. Adjusters must keep their roles separate to ensure they act solely in the policyholder’s interest. Engaging in repairs or reconstruction on a claim they adjust is strictly prohibited. This separation helps maintain the integrity of the claims process and protects policyholders from potential exploitation.

What are the negatives of using a public adjuster?

While public adjusters can be beneficial, there are potential downsides:

-

Financial Considerations: Adjusters typically charge a fee, often around 10% of your settlement. For smaller claims, this can be a significant portion of the payout, sometimes making it less cost-effective.

-

Focus on Larger Claims: Adjusters may prioritize large claims due to higher fees. If your claim is small, they might not be as motivated to invest time and resources.

-

Potential for Slower Process: Involving a public adjuster can sometimes slow down the settlement process. Negotiations between the adjuster and the insurance company can extend the timeline, especially if disputes arise.

Understanding these aspects can help you decide if hiring a public adjuster is the right choice for your situation.

Conclusion

Navigating the complexities of insurance claims, especially after storm damage, can be overwhelming. At Insurance Claim Recovery Support, we are dedicated to advocating for policyholders, ensuring you receive the maximum settlement you deserve. Our expertise in the Texas market, from Austin to Dallas and beyond, empowers us to handle claims with precision and dedication.

Our team of public insurance adjusters works exclusively for you, not the insurance companies. This means our focus is on maximizing your payout, not minimizing it. We understand the nuances of the Texas TDI Public Insurance Adjuster Contract Form and use this knowledge to safeguard your interests throughout the claims process.

Why Choose Us?

- Policyholder Advocacy: We stand by your side, ensuring your claim is handled with the utmost care and attention.

- Expert Guidance: Our team offers expert advice, helping you steer the intricacies of your claim.

- Maximum Settlement: We aim to secure the highest possible settlement, leveraging our deep understanding of insurance policies and claims processes.

If you’re dealing with property damage in Texas, don’t face the insurance giants alone. Let us be your advocate and partner in recovery. With our help, you can confidently pursue the settlement you deserve and move forward with peace of mind.

Contact us today for expert assistance with your insurance claim. Together, we can ensure a fair and favorable outcome.