Introduction

When your property is hit by disaster, figuring out your next steps can feel overwhelming. The question often boils down to: Should I hire a Public Adjuster or a Plaintiff Insurance Attorney? Let’s simplify this.

Legal disclaimer: This article is for informational purposes only and does not constitute legal advice. We are not attorneys and do not provide legal services.

Understanding the Difference

-

- Public Adjuster: Specializes in evaluating property damage and negotiating with your insurance company to ensure you get the maximum settlement. Ideal for the early stages of an insurance claim.

-

- Plaintiff Insurance Attorney: Steps in when legal action is needed. If your claim is denied, underpaid, or involves complex legal issues, an attorney can provide the necessary legal firepower.

Choosing the Right Support

Choosing between a public adjuster and an insurance attorney depends on the specifics of your situation. If you’re facing property damage evaluation, negotiations with insurance, or navigating the aftermath of a Texas storm or fire, a Public Adjuster is your go-to. For legal disputes, claim denials, or when litigation is on the table, an attorney becomes essential.

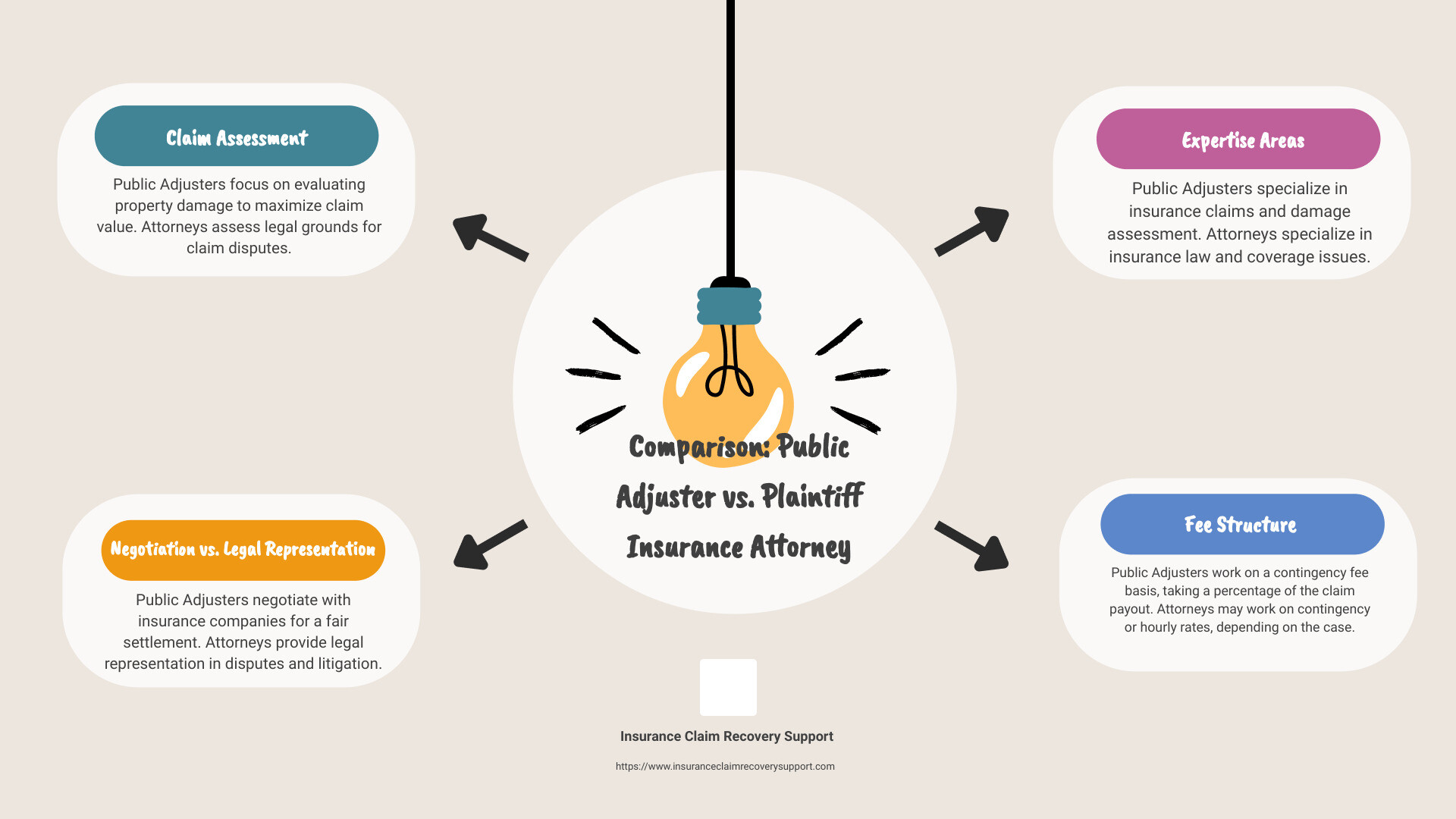

To make your decision easier and clearer, check out this detailed infographic that breaks down when to opt for each professional’s expertise:

By understanding these distinctions and identifying the right professional support early on, you can alleviate some of the frustrations of the insurance claim process and move towards a fair and prompt settlement.

Understanding Public Adjusters

When you’re navigating the aftermath of property damage, knowing whether to choose a Public Adjuster or Plaintiff Insurance Attorney can profoundly impact your insurance claim’s outcome. Let’s break down what public adjusters do, their process, benefits, how they’re paid, with a focus on Texas, where weather-related damages are common.

Role

Public adjusters are professionals who work for you, not the insurance company. They’re experts in insurance policies and the claim process. Their role is to assess the damage to your property, prepare an estimate, and negotiate with the insurance company on your behalf to ensure you get the maximum settlement you’re entitled to.

Process

The process begins when you hire a public adjuster after experiencing property damage. They start by thoroughly inspecting the damage and reviewing your insurance policy to understand what coverages may apply. They then compile a detailed report that includes their assessment of the damage and an estimate for repairs. With this information in hand, they negotiate with the insurance company to reach a settlement that fairly compensates for your losses.

Benefits

-

- Expertise: Public adjusters understand the ins and outs of insurance policies and claims processes.

-

- Time-saving: They handle the legwork of preparing and negotiating your claim, saving you time and stress.

-

- Higher Settlements: Often, public adjusters can secure higher settlements than policyholders might on their own, as they know how to accurately document and value damages.

Contingency Fees

Public adjusters generally work on a contingency fee basis, meaning their payment is a percentage of the insurance settlement. In Texas, this is typically up to 10% of the final settlement amount. This fee structure aligns their interests with yours: the better the outcome they achieve for you, the more they are paid.

Texas Focus

Given Texas’ susceptibility to storms and other natural disasters, public adjusters here are well-versed in handling claims related to such events. They’re familiar with Texas-specific insurance laws and regulations, which can be crucial in effectively managing your claim.

Choosing a public adjuster can be a wise decision, especially in the early stages of an insurance claim when accurate damage assessment and swift negotiation with the insurance company are critical. They serve as your advocate, striving to ensure that your claim is fairly and promptly settled.

Moving forward, it’s also essential to understand when it might be more appropriate to engage a Plaintiff Insurance Attorney, especially in cases where legal disputes arise or claims are unjustly denied.

Exploring Plaintiff Insurance Attorneys

When the negotiation table with your insurance company becomes a battleground, it’s time to consider bringing in a legal expert. Here, we dive into Plaintiff Insurance Attorneys, focusing on their role in legal representation, the litigation process, how they work on a contingency basis, and most importantly, when you should consider hiring one.

Legal Representation

Unlike public adjusters, Plaintiff Insurance Attorneys are licensed to practice law and can represent you in court. This means they can go beyond just negotiating with insurance companies; they can file lawsuits, represent you in court, and handle legal disputes related to your insurance claim. Their expertise in insurance law makes them invaluable in complex cases where legal intricacies come into play.

Litigation

Sometimes, negotiations fail, or an insurance company acts in bad faith by unjustly denying a claim or offering a settlement far below what’s fair. In such instances, litigation might be the only path forward. Plaintiff Insurance Attorneys specialize in taking these disputes to court, presenting your case, and fighting for your rights under the law.

Contingency Basis

One of the significant advantages of hiring a Plaintiff Insurance Attorney is that, like public adjusters, many work on a contingency fee basis. This means they only get paid if you win your case or settle, and their fee is a percentage of your recovery. This arrangement aligns their interests with yours, as they are motivated to maximize your settlement.

When to Hire

Deciding when to hire a Plaintiff Insurance Attorney is crucial. Here are some scenarios where their services become indispensable:

-

- Claim Denial: If your claim has been unjustly denied, an attorney can help challenge the decision and present evidence in your favor.

-

- Legal Disputes: Any legal disputes regarding your insurance policy or coverage typically require the expertise of an attorney.

-

- Coverage Issues: Complex issues around what your policy covers, especially in cases of significant property damage or liability claims, often necessitate legal interpretation.

- Statute of Limitations: The statute of limitations is the legal time limit within which a lawsuit must be filed. If this deadline is missed, the policyholder may lose the right to bring a lawsuit against the insurance company. An attorney can help ensure that all necessary paperwork is filed before the statute of limitations expires, preserving the policyholder’s legal rights.

-

- Litigation Process: When it becomes clear that your dispute with the insurance company will not be resolved without legal action, it’s time to hire an attorney.

While public adjusters are experts in handling the claims process and negotiations, there are times when the situation escalates beyond their scope. That’s when a Plaintiff Insurance Attorney steps in, bringing their legal expertise to bear. Whether it’s through litigation or complex legal negotiation, they play a critical role in ensuring you receive the justice and compensation you deserve.

Transitioning from the possibility of hiring a public adjuster, understanding when to opt for a Plaintiff Insurance Attorney can be the key to navigating the more challenging aspects of insurance claims. We’ll delve into the key differences between Public Adjusters and Attorneys to further clarify whom to engage and when during the claims process.

Key Differences Between Public Adjusters and Attorneys

When facing the aftermath of property damage, the decision between hiring a Public Adjuster Or Plaintiff Insurance Attorney can significantly impact the outcome of your insurance claim. Understanding the differences in claim assessment, legal negotiation, areas of expertise, and knowledge of insurance law is crucial.

Claim Assessment

Public Adjusters specialize in accurately assessing property damage. They are experts in identifying, documenting, and quantifying damages to ensure you receive a fair settlement from your insurance company. Their role primarily involves a thorough on-site evaluation of the damages to your property.

Attorneys, on the other hand, may not conduct these assessments themselves. They rely on the assessments provided by public adjusters or other experts when building a legal case. Their focus is more on the interpretation of the insurance policy and the law rather than the physical assessment of damage.

Legal Negotiation

One of the most significant differences lies in legal negotiations. Public Adjusters are skilled at negotiating with insurance companies to maximize your claim settlement. However, their ability to negotiate is limited to the claims process. They cannot file lawsuits or represent you in court.

Plaintiff Insurance Attorneys excel in legal negotiations. They can take your case to court if negotiations fail, providing a level of leverage that public adjusters cannot. Attorneys are essential when dealing with denied claims, bad faith insurance practices, or when legal action is necessary to resolve your claim.

Expertise Areas

Public Adjusters have a deep understanding of the insurance industry and claims process. Their expertise is particularly valuable in interpreting your insurance policy’s complexities and ensuring that the insurance company treats your claim fairly and pays out appropriately.

Attorneys have a broader scope of expertise, focusing on legal issues surrounding insurance claims. They are well-versed in insurance law, contract law, and the litigation process. Their expertise is crucial when your claim involves legal disputes or requires interpretation of the law.

Insurance Law

Understanding and navigating insurance law is where Plaintiff Insurance Attorneys truly shine. They are equipped to handle cases where the dispute centers around the interpretation of insurance policy language or legal rights under the policy.

While Public Adjusters have a strong understanding of insurance policies, their knowledge of insurance law is not as extensive as that of attorneys. They cannot provide legal advice or represent you in legal matters.

Deciding whether to hire a Public Adjuster or a Plaintiff Insurance Attorney comes down to the specific needs of your insurance claim. If your claim is straightforward but requires expert assessment and negotiation with the insurance company, a Public Adjuster might be your best choice. However, if your claim involves legal complexities, has been denied, or you’re facing bad faith tactics from your insurer, consulting with a Plaintiff Insurance Attorney is advisable.

In some cases, utilizing both professionals can provide a comprehensive approach to managing and resolving your insurance claim effectively. The goal is to ensure that you are fairly compensated for your losses, and choosing the right professional support can make all the difference.

For more insights on navigating the complexities of insurance claims, consider exploring further topics such as When to Choose a Public Adjuster.

When to Choose a Public Adjuster

When you’re dealing with property damage, especially in the early stages of an insurance claim, deciding between a Public Adjuster or Plaintiff Insurance Attorney can feel overwhelming. However, understanding when it’s most advantageous to opt for a Public Adjuster can streamline your decision and ensure you’re taking the right steps toward a fair settlement.

Early Claim Stages

The initial phase of your insurance claim is crucial. It’s when you’re gathering evidence of the damage and presenting your case to the insurance company. A Public Adjuster shines in these early stages. They have the expertise to accurately assess the damage, ensuring that every detail is documented and accounted for. This thorough documentation is vital for a strong start to your claim.

Property Damage Evaluation

Evaluating property damage isn’t just about putting a price tag on the visible damage. It’s about understanding the full extent of the damage, including potential future issues that may arise from it. Public Adjusters are trained to look beyond the surface, providing a comprehensive evaluation that captures the true scope of the damage. This is essential for ensuring you’re not left undercompensated.

Insurance Company Negotiations

Negotiating with insurance companies can be daunting. Public Adjusters are adept at speaking the language of insurance. They know how to navigate these negotiations effectively, aiming to secure a fair settlement on your behalf. Their experience in dealing with insurance companies can be a significant advantage in ensuring your voice is heard and your claim is taken seriously.

Texas Storm and Fire Damage

Texas is no stranger to storms and fires, each bringing its unique challenges to property owners. In the aftermath of such events, having a Public Adjuster on your side can be invaluable. They’re familiar with the local landscape, including specific challenges and regulations in Texas. This local expertise can be particularly beneficial in addressing the complexities of storm and fire damage claims in the state.

In conclusion, choosing a Public Adjuster is often the best course of action in the early claim stages, for thorough property damage evaluation, during insurance company negotiations, and particularly for Texas storm and fire damage claims. Their expertise not only aids in accurately documenting and valuing your claim but also in navigating the intricate process of insurance negotiations. Make sure you’re setting your claim up for success by considering a Public Adjuster for these critical early steps.

When to Opt for a Plaintiff Insurance Attorney

There are times when your journey through the insurance claim process hits a wall. Maybe your claim got denied, you’ve found yourself tangled in legal disputes, facing complex coverage issues, or you’re considering the litigation process. This is when you might need to bring in a Plaintiff Insurance Attorney. Let’s dive into why and when opting for an attorney could be your best move.

Claim Denial

If you’ve received the dreaded denial letter from your insurance company, it’s a clear sign to consider legal support. An attorney can review your claim denial, advise you on the validity of the denial, and potentially help you overturn it. Denial isn’t the end of the road; it’s just a detour.

Legal Disputes

Sometimes, the issue isn’t about the damage or the claim itself but about legal interpretations of your policy. Disputes over policy terms or the insurer’s obligations can escalate quickly. A Plaintiff Insurance Attorney speaks the language of insurance law and can navigate these disputes effectively, advocating for your rights under the policy.

Coverage Issues

Understanding the nuances of what your policy covers can be challenging. If your insurer is claiming that your damage isn’t covered under your policy, an attorney can help. They can analyze your policy’s fine print, argue against restrictive interpretations, and fight for the coverage you deserve.

Litigation Process

In some cases, the only way to resolve your claim might be through litigation. This process can be lengthy and complex, requiring a thorough understanding of legal procedures, evidence gathering, and courtroom tactics. An attorney is equipped to guide you through this process, represent your interests in court, and work towards a favorable outcome.

In summary, when facing claim denial, embroiled in legal disputes, dealing with ambiguous coverage issues, or when litigation seems imminent, it’s time to consider a Plaintiff Insurance Attorney. Their expertise in insurance law and the legal system can be invaluable in these scenarios. While public adjusters are suited for the initial stages of a claim and negotiating with insurance companies, attorneys are your go-to for legal battles and pushing back against unfair claim denials or inadequate settlement offers.

The goal is to ensure you receive the compensation you’re entitled to under your policy. Whether through a Public Adjuster or Plaintiff Insurance Attorney, you have options to advocate for your rights and secure a fair resolution to your insurance claim.

Moving into the next section, we’ll tackle some of the most Frequently Asked Questions about Insurance Claims to further demystify this complex process.

Frequently Asked Questions about Insurance Claims

When navigating the aftermath of property damage, making informed decisions is crucial. Here are some common questions and straightforward answers regarding insurance claims, focusing on Public Adjusters and Plaintiff Insurance Attorneys.

What are the negatives of using a public adjuster?

-

- Cost: Public adjusters charge a percentage of your claim settlement. While rates vary, in Texas, they often charge around 10%. This fee can feel steep, especially on large claims.

-

- Process Length: Some policyholders find that their claims take longer to resolve when working with a public adjuster. The comprehensive documentation and negotiation process, while thorough, can extend the timeline.

-

- Potential for Conflict: On rare occasions, hiring a public adjuster might lead to conflicts with your insurance company, potentially complicating the claims process.

How much can a public adjuster charge in Texas?

In Texas, public adjusters typically charge a contingency fee, which is a percentage of the claim settlement. This rate can vary but generally hovers around 10%. Texas has regulations in place to protect policyholders from excessive charges, ensuring that public adjusters operate within a fair and reasonable fee structure.

What is the difference between a claims adjuster and an insurance adjuster?

The term “insurance adjuster” can refer to any professional who assesses insurance claims, but there’s a crucial distinction between the types:

-

- Claims Adjuster (or Insurance Adjuster): This is often an employee of the insurance company. Their primary role is to evaluate the claim from the insurer’s perspective, aiming to settle it fairly but also keeping the company’s interests in mind.

-

- Public Adjuster: Unlike claims adjusters who work for the insurance companies, public adjusters are hired by and only represent the interests of the policyholder. They assess the claim with the goal of maximizing the settlement amount for the policyholder, ensuring that they receive a fair and just compensation for their loss.

Understanding these roles can significantly impact how you approach your insurance claim, especially when faced with damage assessments and settlement negotiations. Whether you lean towards hiring a Public Adjuster or opting for a Plaintiff Insurance Attorney, being equipped with the right information is key to navigating the claims process effectively.

In the next section, we’ll wrap up our guide with a conclusion that aims to empower you with knowledge and confidence as you seek the best possible outcome for your insurance claim.

Conclusion

As we wrap up our ultimate guide to choosing between a Public Adjuster or Plaintiff Insurance Attorney, we hope you feel more equipped to navigate the complexities of the insurance claims process. The journey towards recovering from property damage can be daunting, but with the right support, maximizing your settlement becomes a more attainable goal.

Insurance Claim Recovery Support LLC stands out as a beacon of guidance and expertise in the often turbulent seas of insurance claims. Our commitment to serving our clients is unwavering, whether you’re facing the aftermath of a storm in Texas or dealing with fire damage. Our specialized knowledge in settling property damage claims ensures that you have an advocate on your side, fighting for the compensation you rightfully deserve.

Choosing the correct support, be it a Public Adjuster or a Plaintiff Insurance Attorney, is crucial in this endeavor. Public Adjusters are invaluable in the early stages of a claim, especially when it comes to accurately assessing property damage and navigating negotiations with insurance companies. On the other hand, Plaintiff Insurance Attorneys become essential when facing claim denials, legal disputes, or when the path forward involves litigation.

In Texas, where storms and fire damage are not uncommon, having a trusted partner like Insurance Claim Recovery Support LLC can make all the difference. Our nationwide service ensures that no matter where you are in the Lone Star State, you can count on us to be there, providing the support and advocacy you need to secure a fair settlement.

Whether you choose a Public Adjuster or a Plaintiff Insurance Attorney, the goal remains the same: to maximize your settlement and aid in your recovery. Our team at Insurance Claim Recovery Support LLC is here to guide you through every step of the process, ensuring that you are not alone in this journey.

Thank you for trusting us with your insurance claim needs. Together, we can navigate the complexities of the claims process and work towards the successful recovery you deserve.