Texas Tornadoes: A Quick Guide for Property Owners

When a tornado strikes in Texas, the aftermath can leave property owners facing significant damage. Understanding the types of property damage caused by tornadoes and knowing how to navigate the insurance claims process are crucial first steps towards recovery. In this guide, we provide valuable insights into Texas tornadoes, provide tips on tornado preparedness, and detail the path through the complex insurance claims process.

Tornadoes across Texas can cause a wide range of damage to homes, commercial buildings, and multifamily properties. This includes, but is not limited to, roof damage, broken windows, compromised structural integrity, interior water damage, damage to the landscape and exterior, and vehicle damage.

Navigating the insurance claims process post-tornado can often be as turbulent as the storm itself. Property owners frequently face common insurance claim disputes such as coverage disputes, undervaluation of damages, delayed claims, denials of claims, and exclusions and limitations. These disputes can severely impact the recovery process, leaving property owners feeling frustrated and overwhelmed.

Tornado preparedness involves more than just having a safe space to go to during a storm; it requires a comprehensive approach including emergency kits, structural reinforcements, safety plans, staying aware of community alerts, and a thorough insurance review to ensure adequate coverage. Being well-prepared can significantly mitigate the damage and streamline the recovery process.

In the wake of a tornado, understanding your rights and knowing how to assert them is crucial. This guide aims to empower Texas property owners with the knowledge and tools needed to effectively deal with tornado damage and ensure a fair and prompt settlement from their insurance company.

Types of Property Damage Caused by Tornadoes

When a Texas tornado sweeps through, it leaves a trail of destruction that can be overwhelming. Here’s a breakdown of the typical property damage caused by tornadoes, which is crucial to understand for filing insurance claims accurately.

Roof Damage

– Most common and visible damage. Tornadoes can strip off roofing materials or lift entire roofs off the structure.

– Leads to further interior water damage.

Window Breakage

– Windows are highly vulnerable to flying debris, leading to breakage.

– This also compromises the building’s structural integrity and exposes the interior to the elements.

Structural Integrity

– Tornadoes can cause walls to buckle, foundations to shift, and even collapse entire sections of a building.

– Inspecting structural damage requires professional assessments to ensure safety and proper repair.

Interior Water Damage

– Following roof and window damage, water can infiltrate, damaging ceilings, walls, and personal property.

– Often results in mold if not addressed promptly.

Landscape and Exterior

– Tornadoes can uproot trees, destroy gardens, and toss outdoor furniture miles away.

– Significant clean-up and landscaping restoration may be needed.

Vehicle Damage

– Cars, trucks, and other vehicles can be tossed around, crushed by debris, or severely dented.

– Comprehensive auto insurance is typically required to cover tornado damage to vehicles.

Common Tornado Insurance Claim Disputes

- Coverage Disputes: Disagreement over what damages are covered under your policy.

- Undervaluation: Insurers may underestimate the cost to repair or replace damaged property.

- Delayed Claims: Slow response times can exacerbate property damage, leading to frustration.

- Denial of Claims: Sometimes, insurers may deny a claim based on exclusions or claim the damage was pre-existing.

- Exclusions and Limitations: Certain types of damage may not be covered, or there may be caps on how much the insurer will pay.

Remedies

If you face any of these disputes, consider these steps:

– Documentation: Keep detailed records and photos of the damage and your claim submissions.

– Public Adjusters: Hire an independent adjuster to provide a second opinion on the damage and repair estimates.

– Legal Action: As a last resort, legal action can be taken against insurance companies that unfairly deny claims or undervalue damages.

– State Insurance Department: Filing a complaint with the state insurance department can sometimes help resolve disputes.

Understanding the extent and types of damage caused by Texas tornadoes is essential for property owners to navigate the insurance claims process effectively. Being prepared with documentation and knowing your rights can significantly impact the outcome of your claim. For more detailed guidance on handling tornado damage claims in Texas, visit Insurance Claim Recovery Support.

In the next section, we will delve into the specifics of how to document and file your tornado insurance claim, ensuring you’re well-prepared to secure the compensation you deserve.

Common Tornado Insurance Claim Disputes

When a Texas tornado strikes, the aftermath can be devastating for homeowners, commercial property owners, and multifamily property managers alike. Navigating the insurance claim process can add an additional layer of stress during an already difficult time. Understanding the common disputes that arise can help you be better prepared.

Coverage Disputes

One of the first hurdles you might encounter is a dispute over what your policy covers. Insurance companies may argue that certain types of damage aren’t covered under your policy. For example, they might say wind damage is covered, but water damage caused by rain entering through a wind-damaged roof isn’t.

Undervaluation

Another common issue is undervaluation, where the insurance company’s estimate of the damage is far lower than the actual repair costs. This can be particularly problematic when it comes to repairing or replacing roofs, windows, and ensuring the structural integrity of the building is restored.

Delayed Claims

Time is of the essence after a tornado, but sometimes insurance companies drag their feet, causing frustrating delays. These delays can be particularly challenging for commercial properties and multifamily units, where extensive damage can impact business operations and displace residents.

Denial of Claims

In some cases, insurance companies might deny claims outright. Reasons for denial can include claiming the damage was pre-existing or due to poor maintenance rather than the tornado itself. This can be a significant setback, especially if you’re facing extensive property damage.

Exclusions and Limitations

It’s also important to be aware of any exclusions or limitations in your policy. For instance, some policies have specific clauses that limit coverage for “acts of God,” which can include tornadoes. Understanding these limitations ahead of time can help you adjust your coverage to ensure you’re adequately protected.

Navigating Disputes

Public Adjusters: Hiring a public adjuster can help you get a fair assessment of the damage and ensure your claim is properly documented and filed. Public adjusters work on your behalf, not the insurance company’s.

Mediation: If you’re unable to resolve the dispute directly with your insurance company, mediation can be a less adversarial way to come to an agreement.

Appraisal: This is a process where you and the insurance company each hire an appraiser to determine the value of your loss. If the appraisers can’t agree, an umpire is brought in to make a final decision.

Legal Action: As a last resort, you may need to consider legal action. This can be a lengthy and costly process, so it’s generally best to explore all other options first.

State Insurance Department: Filing a complaint with the state insurance department can sometimes help resolve disputes. They can offer guidance and, in some cases, intervene on your behalf.

Understanding these common disputes and knowing how to address them can make a significant difference in the outcome of your claim. For more detailed guidance on navigating the complexities of tornado insurance claims in Texas, visit Insurance Claim Recovery Support.

In the next section, we will delve into the specifics of how to document and file your tornado insurance claim, ensuring you’re well-prepared to secure the compensation you deserve.

How to Document and File Your Tornado Insurance Claim

When a Texas tornado strikes, the aftermath can be overwhelming. However, taking the right steps to document and file your insurance claim can significantly impact the recovery process. Here’s how to navigate this crucial phase.

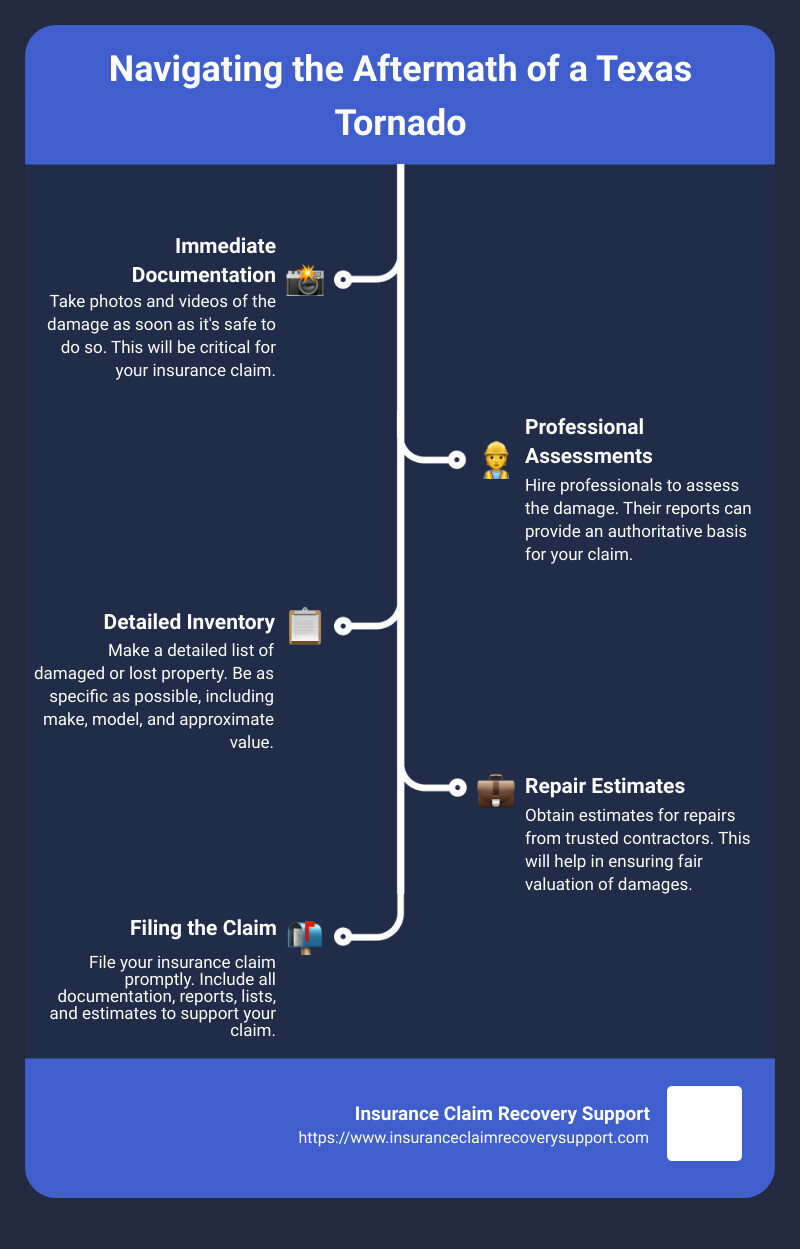

Immediate Documentation

As soon as it’s safe to do so, start documenting the damage. Use your smartphone or camera to take clear, detailed photos and videos of all affected areas. Capture multiple angles to provide a comprehensive view of the damage, including roof damage, broken windows, structural issues, interior water damage, and any harm to the landscape, exteriors, or vehicles.

Professional Assessments

Consider hiring professionals to conduct thorough assessments of your property. Roof inspectors, structural engineers, or water damage specialists can provide expert opinions on the extent of the damage. Their reports can be invaluable when filing your claim, offering an authoritative perspective that supports your case.

Detailed Inventory

Make a detailed inventory of all damaged or destroyed property. This list should include everything from large pieces of furniture to smaller personal items. If possible, include the purchase date, cost, and any receipts you have. This detailed inventory will help ensure that you claim the full value of your losses.

Repair Estimates

Obtain repair estimates from reputable contractors. These estimates should detail the scope of the repairs needed and the associated costs. Having multiple estimates can strengthen your position when negotiating with your insurance company.

Filing the Claim

Contact your insurance company as soon as possible to file your claim. Be prepared to provide them with all the documentation you’ve gathered, including photos, videos, professional assessments, your detailed inventory, and repair estimates. Your insurer will likely assign an adjuster to evaluate the damage.

Communication with Insurer

Maintain open and continuous communication with your insurance company throughout the claims process. Keep records of all conversations, including names, dates, and key points discussed. Promptly respond to requests for additional information or documentation to avoid delays in processing your claim.

Documenting and filing a tornado insurance claim in Texas requires attention to detail and persistence. For assistance at any stage of the process, consider reaching out to professionals like Insurance Claim Recovery Support, who specialize in helping policyholders navigate the complexities of insurance claims.

By following these steps diligently, you can improve your chances of receiving fair compensation for your losses, helping you on the path to recovery after a Texas tornado.

Remedies for Disputed Tornado Insurance Claims

After a Texas tornado, navigating the aftermath can be as daunting as the storm itself, especially when facing insurance claim disputes. Understanding your options can empower you to seek the fair settlement you deserve. Here are effective remedies to consider:

Public Adjusters

Public adjusters are professionals who advocate for you, the policyholder, during the insurance claim process. They possess the expertise to accurately assess property damage, prepare detailed claims, and negotiate with insurance companies on your behalf. Hiring a public adjuster can be particularly beneficial if your claim involves complex assessments of tornado damage to your home, commercial building, or multifamily property. They ensure that your claim accurately reflects the extent of the damage and that you receive a fair settlement. For more information on how a public adjuster can assist with your Texas tornado claim, visit Insurance Claim Recovery Support.

Mediation

Mediation offers a way to resolve disputes with your insurance company through the help of a neutral third party. It’s a less formal and often less costly alternative to legal action. Both parties discuss their viewpoints and work toward a mutually acceptable resolution. It’s a valuable option when communication breakdowns occur, or when there’s a specific aspect of the claim causing contention.

Appraisal

An appraisal can be requested if you disagree with the insurance company’s valuation of your damages. In this process, both you and the insurer select independent appraisers. These appraisers then choose an umpire. If the appraisers can’t agree on the value of your claim, the umpire makes the final decision. This process can help resolve disputes about the extent or value of the property damage.

Legal Action

Legal action may be considered as a last resort. If your insurance company denies your claim unfairly, offers a settlement far below what’s needed to repair the damage, or violates the terms of your policy, consulting with an attorney who specializes in insurance law might be necessary. A lawyer can provide guidance on your rights and the strength of your case, and represent you in court if needed.

State Insurance Department

Filing a complaint with the State Insurance Department can be an effective step if you believe your insurance company is not adhering to regulations or is treating you unfairly. The department oversees insurance operations and can investigate your claim, mediate disputes, and ensure that insurance practices are just and compliant with state laws.

In the wake of a Texas tornado, knowing these remedies can provide pathways to resolving disputes and securing a fair insurance settlement. It’s important to act promptly and keep detailed records throughout the process. If you’re navigating these challenges, consider reaching out to professionals like Insurance Claim Recovery Support, who specialize in helping policyholders navigate the complexities of insurance claims.

Preventative Measures and Tornado Preparedness

When it comes to tornado preparedness, taking proactive steps can significantly minimize the damage to your home, commercial, or multifamily properties. Let’s dive into essential preventative measures and preparedness tips that can safeguard your property against the destructive force of a Texas tornado.

Emergency Kits

Always be prepared. An emergency kit is your first line of defense. It should include:

- Water and non-perishable food for at least 72 hours.

- First-aid supplies, medications, and personal hygiene items.

- Flashlights, batteries, and a weather radio to stay informed.

- Important documents (insurance policies, identification, and bank account records) in a waterproof, portable container.

Structural Reinforcements

Strengthen your property. For homes and buildings, consider:

- Installing storm shutters to protect windows from breaking.

- Reinforcing your garage door; it’s often the first structure to fail.

- Securing heavy furniture and appliances to the walls.

- For new constructions or renovations, consulting with a structural engineer about tornado-resistant design features.

Safety Plans

Know what to do when a tornado strikes. Develop a safety plan that includes:

- Identifying a safe room or area in your home or building, away from windows and on the lowest floor.

- Practicing tornado drills at least once a year.

- Ensuring everyone knows the difference between a tornado watch and a warning.

Community Alerts

Stay informed. Sign up for your community’s warning system. The Emergency Alert System (EAS) and NOAA Weather Radio provide emergency alerts. Familiarize yourself with the siren warning tones in your area.

Insurance Review

Understand your coverage. Annually reviewing your insurance policy ensures:

- You have adequate coverage for tornado-related damages.

- Understanding of what is and isn’t covered under your policy.

- Knowledge of your deductible and how claims will affect your future premiums.

By implementing these measures, you not only protect your physical property from the devastating impact of a tornado but also ensure the safety and well-being of those who reside within. The key to tornado preparedness lies in planning ahead and staying informed. For further guidance on protecting your property and ensuring you’re comprehensively covered, reach out to professionals like Insurance Claim Recovery Support, who offer expert advice and support tailored to your specific needs.

Conclusion

When it comes to navigating the aftermath of a Texas tornado, the road to recovery can be long and fraught with challenges. However, with the right knowledge and support, you can make this journey smoother and more manageable. Insurance Claim Recovery Support stands as your steadfast ally in this process, specializing in helping property owners recover from storm damage.

Tornadoes can wreak havoc on homes, commercial buildings, and multifamily properties, leaving behind a trail of destruction that includes roof damage, broken windows, compromised structural integrity, interior water damage, and much more. The path to rebuilding begins with a comprehensive understanding of your insurance policy and the claims process. Yet, the road is often marked by common hurdles such as coverage disputes, undervaluation of damages, delayed claims, outright denials, and the intricate maze of exclusions and limitations.

In such times, the expertise of Insurance Claim Recovery Support becomes invaluable. Our team of experienced public adjusters navigates these challenges daily, armed with the knowledge and skills needed to advocate for your rights as a policyholder. Whether it’s through meticulous documentation, professional assessments, or direct negotiations with insurance companies, we’re here to ensure that your claim is not only heard but also fully compensated.

For those facing disputes that seem insurmountable, we offer remedies ranging from mediation and appraisal to legal action and assistance in contacting the state insurance department. Our goal is to see you through to a successful recovery, minimizing the stress and burden along the way.

As we close this discussion on Texas tornadoes and the critical importance of being prepared, let us reiterate: Insurance Claim Recovery Support is more than a service provider; we’re your partner in recovery. Our commitment to you extends beyond the claims process. We advocate for preventative measures, including regular insurance reviews, emergency kits, structural reinforcements, and comprehensive safety plans.

Tornado preparedness is not just about bracing for the storm but also about ensuring a resilient recovery. Let us help you stand strong in the face of adversity, with the assurance that when the winds die down, we’ll be there to help you rebuild.

For more information on how we can assist in your recovery from Texas tornado damage, visit our service page. Together, we can navigate the complexities of the insurance claim process and work towards a swift and favorable resolution.