Learn how to handle an apartment fire with safety tips, immediate actions, and recovery steps. Essential reading for tenants!

Read MoreInsurance Claim Recovery Support (ICRS) Public Adjusters, headquartered in Austin, TX offers large loss claim documentation, negotiation, and settlement services for policyholders throughout Texas and many states in the U.S. Our extensive knowledge and success has been applied over 500+ claims and 15+ years of experience successfully settling hundreds of millions in property damage insurance claims on behalf of policyholders suffering damages caused by fire, hail, storm, hurricane, tornado, lightning, flood, water, freeze, business interruption, wind, and other disasters on the behalf of building owners of apartments, storage, offices, retail, multifamily syndicators, homeowner associations, property management companies & high-value homes.

If your property has suffered insured damages of $250,000 or more, we can help you navigate the property insurance claim process to get the settlement you deserve fairly and promptly.

It’s no secret that navigating the property insurance claims process can be tricky. Don’t take chances with your home or business. Make no mistake about it, your insurance company has experts working on their behalf.

Most Policyholders find hail, fire, and other storm damage insurance claims to be a complex and unfamiliar process. Disputes involving an underpaid or delayed settlement don’t necessarily need lawyers or attorneys to resolve differences between the policyholder and insurer. That’s why smart Policyholders dealing with large and complex property damage insurance claims trust the experienced public adjusters at Insurance Claim Recovery Support (ICRS) to deliver the settlement results they deserve without unnecessary litigation.

Our goal is to assist policyholders in securing the rightful settlement they deserve, safeguarding their rights, compelling insurers to fulfill their obligations, and ensure your insurance claims are resolved fairly and promptly.

We’ve had the privilege of settling claims totaling hundreds’ of millions of dollars for companies who manage up to $3 billion in assets.

Discover why Policyholders choose ICRS as the right public adjuster to settle large property damage insurance claims.

ICRS licensed public insurance adjusters settle fire, hail, flood, wind, water, freeze, hurricane damage, and other storm-related property damage insurance claims for residential multifamily and apartment complex policyholders.

We’re proud of our long-standing track record for successfully settling large and complex claims serving as zealous advocates on behalf of apartment owners, real estate syndicates, investors, assisted living facilities, homeowner associations, condominium associations, townhomes, student housing and multifamily property management companies.

Many insurance policies contain ambiguous language regarding exclusions, building code upgrades, ADA and OSHA laws. insurance code statutes, department of insurance bulletins as well as Overhead and Profit are included where applicable in your Pro-Policyholder claim package submissions from our licensed public adjusters.

Protect your assets, retain tenants, and get the settled fair and prompt settlement you deserve with the help of the best public insurance adjusters in the industry. Request a FREE claim evaluation!

Commercial property building damage insured for fire, hail, hurricane, tornado, flood or other perils to offices, hotels, schools, municipalities, retail centers, manufacturing and storage facilities, typically contain subjective insurance policy language that can negatively affect your business if your insurance claim is not handled promptly and adequately.

We help policyholders manage risk by helping you understand policyholder requirements and policy benefits but also assert your rights and submit Pro-Policyholder supporting evidence to substantiate your claim to your insurance company.

Set your claim up for success at the beginning of a loss or if your insurance claim has been improperly handled, we routinely overcome unreasonable delays and underpayments to get you the settlement you deserve! Don’t get stressed and waste valuable time playing claim games with your insurer.

Insurance Claim Recovery Support LLC licensed Public Insurance Adjusters exclusively represent policyholder’s interests, not insurers. We are licensed in Texas as well as several other states. As your policyholder advocates, we document, negotiate, and settle your insurance claim with your insurance company fairly and promptly. Get the maximum settlement, in minimum time! Tell us about your Commercial Property Damage Insurance Claim Now.

Insurance policy language for business interruption claims can be subjective. So save time and stress playing claim games! If a loss of business income insurance claim isn’t adjusted promptly and adequately, it can drastically affect your company. Market rents, leases, concessions, expenses, special provisions and reasonable restoration periods are important loss of business income factors to capture in your analysis of what is reasonably owed and payable under your policy.

ICRS Public Adjusters work exclusively on your behalf to get the settlement you deserve from your insurance company. Let us help you get back in business! Start your business interruption claim now.

Want more tips on how to navigate the insurance claim process and how ICRS public adjusters negotiate large loss property damage settlements pro-policyholders?

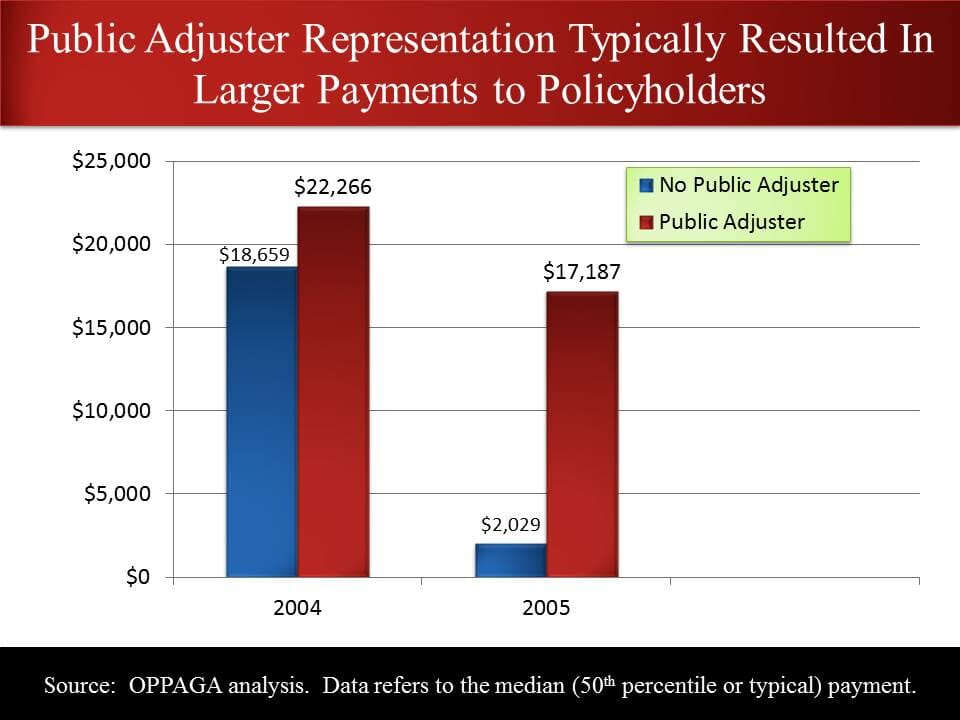

“547% higher payments with a public adjuster for claims.”

We Settle Big Property Damage Insurance Claims

Insurance Claim Recovery Support (ICRS) is a premier public adjustment firm that exclusively represents policyholders in their quest to achieve fair settlements for their insurance claims. With an unwavering commitment to the interests of policyholders, ICRS ensures that clients receive the maximum compensation they deserve. This unique focus on policyholders sets the company apart from other public adjusters, who often serve both the policyholders and insurance companies, creating potential conflicts of interest. ICRS stands out by prioritizing the needs of their clients above all else, making certain that their rights are protected throughout the claims process.

ICRS brings to the table an extensive understanding of the insurance industry, allowing them to effectively advocate for their clients. Their team of highly skilled public adjusters specializes in evaluating, documenting, and negotiating complex insurance claims on behalf of policyholders. By leveraging their deep knowledge of policy language and claims procedures, ICRS enables their clients to navigate the often confusing and time-consuming claims process with ease. The company’s primary goal is to ensure that their clients receive the compensation they are entitled to, which can be invaluable in helping them rebuild their lives and businesses after a loss.

The Single Best Way to Settle Commercial and Multifamily Property Damage Insurance Claims.

Insurance Claim Recovery Support Public Adjusters represent your interests, not the insurance company. We document and negotiate your insurance claim Pro-Policyholder so you get the maximum settlement you deserve in minimum time.

CEO | Public Insurance Adjuster

VP | Public Insurance Adjuster

With ICRS on your side, we represent you, not the insurance company. When you hire a public adjuster from ICRS, we present your insurance claim submissions Pro-Policyholder filled with facts and valuable documentation to support your claim for coverage under your policy submitted to your insurer on your behalf, representing your interests, not your insurance company. Our policyholder claims are placed on equal footing with your insurance company’s adjuster, engineer, and building consultants, who represent their interests, not yours. Our track record for successfully negotiating a fair and prompt settlement for insured policyholders is unmatched. If your insurer chooses to ignore evidence that supports your Pro-Policyholder claim and force you to sue, we have a network of insurance attorneys to whom we refer victims of bad faith insurance claim handling practices that typically work on a contingency basis. We prefer to reasonably settle all our insurance claims without litigation but unfortunately, not all insurers are reasonable, some act in bad-faith.

Here at ICRS, we help policyholders understand their rights. Discover the different types of insurance, the insurance claim process, and settlement tips from the National Association of Insurance Commissioners.

Receive a complimentary and insightful consultation regarding your large-loss property damage insurance claim. Experience our pressure-free, sales-pitch-free approach aimed at assisting you in making well-informed decisions about the best course of action for your claim. Our licensed public adjusters, who exclusively work with policyholders, boast years of invaluable experience. Opting to engage our services means operating on a contingency basis—no recovery, no fee. Rest assured, our proven and efficient insurance claim process gets results.

We also value your privacy, uphold strict standards and do not sell, trade, or rent your personal information to third parties.

It pays to know ICRS – “747% Higher Payments with a Public Adjuster for Claims related to a 2005 Hurricane”

Learn how to handle an apartment fire with safety tips, immediate actions, and recovery steps. Essential reading for tenants!

Read MoreDiscover key services, fees, and success rates of loss adjusting services. Ensure the best choice for your claims with our guide.

Read MoreDiscover what is a hurricane, how they form, and how to prepare with our in-depth guide covering impacts, safety tips, and recovery.

Read More2024 © Copyright - Insurance Claim Recovery Support LLC | All Rights Reserved. | Sitemap