The hurricane insurance claim process can be daunting, especially after the devastation of powerful storms like Hurricane Helene and Hurricane Milton. Recent hurricanes have left countless property owners scrambling to file claims and recover damages. Here’s a quick glance at what you need to keep in mind:

- Survey and Document: Check for damage immediately.

- File Promptly: Contact your insurer without delay.

- Photograph Thoroughly: Capture every detail.

- Understand Your Policy: Know what is covered.

- Seek Expert Help: Consider a public adjuster if needed.

Insurance Claim Recovery Support is dedicated to assisting policyholders in navigating claims to ensure prompt and fair settlements.

As Scott Friedson, a multi-state licensed public adjuster with experience in the hurricane insurance claim process, I have overseen the settlement of hundreds of claims exceeding $250 million. Let’s dive into how you can achieve a successful claim without unnecessary problems.

Key terms for hurricane insurance claim process:

– Apartment and Multifamily Claims

– Houston property damage claims

– fire mitigation

Understanding the Hurricane Insurance Claim Process

Steps to File a Claim

Filing a hurricane insurance claim might feel overwhelming, but breaking it down into simple steps can make the process manageable.

-

Document the Damage: Start by taking clear photos and videos of all damage. This includes broken windows, roof damage, and interior flooding. Make sure to document everything before you start cleaning up.

-

Make a List of Damaged Items: Create a detailed inventory of all damaged belongings. Include appliances, furniture, and electronics. This will help in assessing the value of your loss.

-

Contact Your Insurer: Reach out to your insurance company as soon as possible. The sooner you report the damage, the faster the claims process can begin. You can typically do this online or by phone.

-

File Your Claim Online: Many insurers offer an online claims filing system. This can be a quick and efficient way to get your claim in the system. Make sure to include all necessary documentation and information.

-

Keep Receipts for Emergency Repairs: If you need to make temporary repairs to prevent further damage, save all receipts. These costs might be reimbursable under your policy.

By following these steps, you lay the groundwork for a smoother claims process.

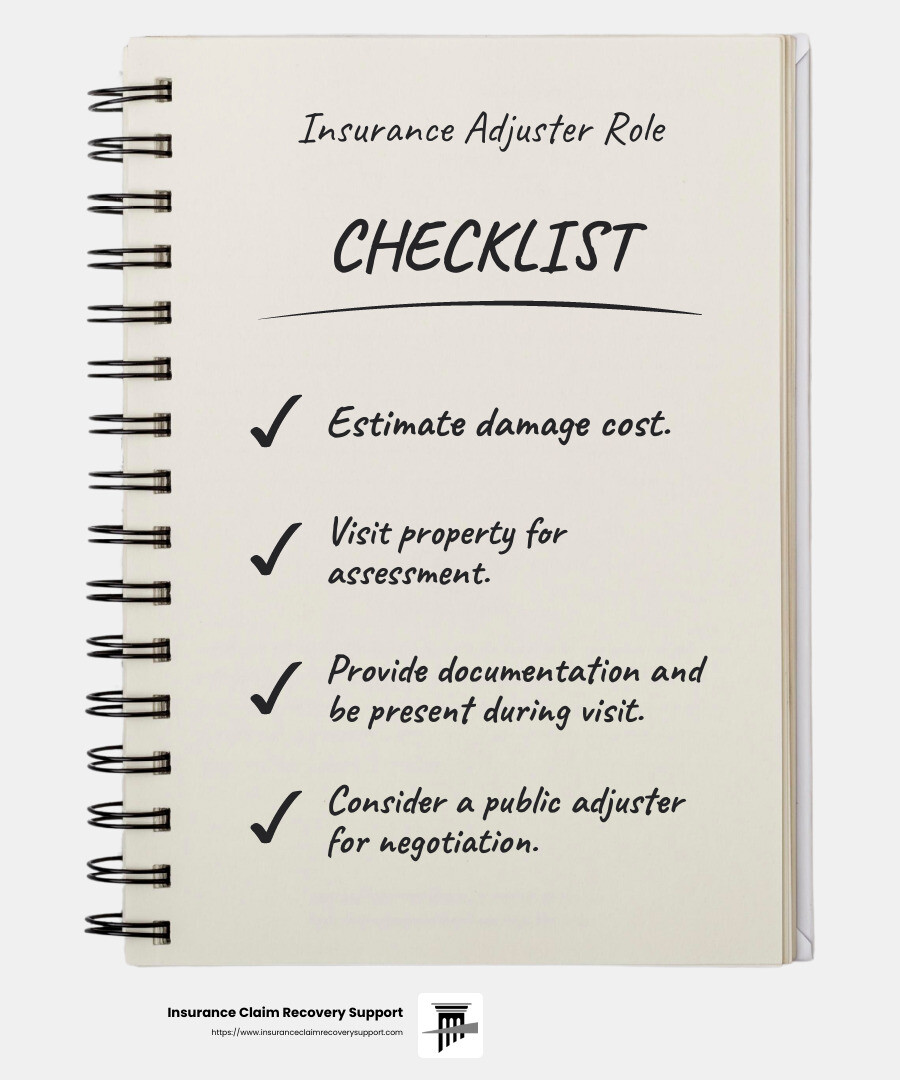

Role of an Insurance Adjuster

Once your claim is filed, an insurance adjuster will be assigned to assess the damage. Understanding their role is crucial for a successful claim.

-

Estimate Damage: The adjuster will visit your property to evaluate the extent of the damage. They will determine the cost of repairs or replacement.

-

Adjuster Visit: Be present during the adjuster’s visit if possible. This allows you to point out all areas of damage and provide additional documentation.

-

Public Adjuster: If you disagree with the insurance company’s assessment, consider hiring a public adjuster. Unlike company adjusters, public adjusters work on your behalf to negotiate a fair settlement.

A public adjuster can be a valuable ally in ensuring you receive the compensation you deserve. They can guide you through the process and help you understand your policy’s fine print.

Navigating the hurricane insurance claim process doesn’t have to be daunting. With the right steps and support, you can move from storm to settlement with confidence.

Preparing for a Hurricane Claim

When a hurricane hits, having a plan for documenting damage and taking preventive measures can make a big difference in your claim process.

Documenting Damage

Photos and Videos: Right after the storm, grab your camera or smartphone. Take clear pictures and videos of every corner of your property. Capture the exterior first—roof, windows, and siding. Then, move inside to document each room. Don’t forget to zoom in on individual items like furniture or electronics that have been damaged. This visual evidence is key to support your claim.

Home Inventory: Having a detailed inventory of your belongings can be a lifesaver. List down all your appliances, furniture, and other valuables. Note their condition before the storm. This helps you and your insurer understand the extent of your loss.

Receipts: Keep all receipts for purchases related to your home. This includes big-ticket items like electronics or furniture. These will help prove the value of items lost or damaged in the hurricane.

Preventing Further Damage

Once the storm passes, your priority shifts to preventing further damage. Here’s how you can do it:

Tarps and Plywood: Use tarps to cover any holes in the roof or broken windows. Secure them with plywood if possible. This will prevent rain and debris from causing more harm.

Dehumidifiers: If there’s water inside, use dehumidifiers to dry out the area. This helps prevent mold growth, which can be costly to remove.

Emergency Supplies: Keep essential supplies like plastic sheeting, duct tape, and basic tools handy. These can help you make quick fixes until professional repairs can be done.

Emergency Repairs: Sometimes, you might need to make immediate repairs to stop ongoing damage. Cover broken windows or patch up leaks temporarily. Remember to keep all receipts for materials used in these repairs, as they might be reimbursable.

Being proactive in documenting and preventing further damage not only safeguards your home but also strengthens your hurricane insurance claim process. With everything in place, you’ll be ready to tackle the next phase of recovery.

Next, let’s explore how to steer the settlement process and ensure you receive the compensation you deserve.

Navigating the Settlement Process

Once you’ve filed your hurricane insurance claim, the next step is navigating the settlement process. Understanding your policy and knowing how to handle disputes can make a big difference.

Understanding Your Policy

Coverage Limits: Every insurance policy has limits. These are the maximum amounts the insurer will pay for covered losses. Know your policy limits so you aren’t caught off guard by unexpected out-of-pocket costs.

Deductibles: This is the amount you pay before your insurance kicks in. Hurricane deductibles can be higher than regular ones, often a percentage of your home’s insured value. Check your policy to know how much you’ll need to cover.

Exclusions: Not everything is covered. Common exclusions might include flood damage, which requires separate flood insurance. Understand what’s excluded to avoid surprises.

Disputing a Claim

Sometimes, insurance companies might not agree with the amount you claim, or they might deny your claim altogether. Here’s how to handle these situations:

Second Opinion: If you disagree with the insurance adjuster’s assessment, consider getting a second opinion from an independent or public adjuster. They can provide an unbiased evaluation of the damage.

Appeal Process: If your claim is denied, don’t give up. Most insurers have an appeal process. Gather all your documentation, including photos, videos, and estimates, and submit a formal appeal.

Bad Faith Insurance: If you suspect your insurer is not acting in good faith—like denying your claim without a proper investigation or misrepresenting policy language—you might need legal assistance. Understanding bad faith practices can help you protect your rights.

Legal Assistance

If disputes become complicated, seeking legal help can be beneficial. An attorney experienced in insurance claims can help you steer complex issues, negotiate with your insurer, and ensure you receive a fair settlement.

Navigating the settlement process can be challenging, but with the right knowledge and resources, you can ensure that your insurance claim is handled fairly.

Next, we’ll answer some frequently asked questions about hurricane insurance claims to further clarify the process.

Frequently Asked Questions about Hurricane Insurance Claims

How long does an insurance company have to settle a hurricane claim?

Insurance companies typically face a high volume of claims after a major hurricane, which can delay the settlement process. However, most states require insurers to acknowledge a claim within 15 days and make a decision on acceptance or denial within 30 to 45 days. That complex cases might take longer. Staying in touch with your insurer and being proactive can help expedite the process.

What if my claim is denied?

If your claim is denied, it’s essential to understand why. Insurance companies must provide a written explanation for their decision. Review your policy to ensure the denial aligns with its provisions. Sometimes, claims are denied due to insufficient documentation or misunderstandings about coverage.

Steps to take if your claim is denied:

- Review your policy and denial letter: Ensure you understand the reason for denial.

- Gather documentation: Collect photos, videos, and any other evidence that supports your claim.

- Consider a second opinion: Hiring a public adjuster can provide an independent assessment of the damage.

- Appeal the decision: Submit a formal appeal with all your documentation.

- Seek legal advice: If needed, consult an attorney specializing in insurance claims.

What is a hurricane deductible?

A hurricane deductible is a special out-of-pocket cost that applies specifically to hurricane-related claims. Unlike regular deductibles, which are a fixed amount, hurricane deductibles are often a percentage of your home’s insured value—commonly 2% to 5%. This means if your home is insured for $200,000, and you have a 2% hurricane deductible, you would pay the first $4,000 of any hurricane-related damage.

Key points to remember:

- Hurricane deductibles are separate from regular deductibles and only apply to hurricane damage.

- Be prepared: Ensure you have enough savings to cover this cost in the event of a hurricane.

- Check your policy: Know your deductible percentage and how it will affect your claim.

Understanding these aspects of the hurricane insurance claim process can help you steer the aftermath of a storm more effectively. In the next section, we’ll dig deeper into how Insurance Claim Recovery Support can assist you in maximizing your settlement.

Conclusion

When a hurricane wreaks havoc, the path to recovery can feel daunting. At Insurance Claim Recovery Support, we understand the challenges policyholders face during this difficult time. Our mission is to advocate for you and ensure you receive the maximum settlement you’re entitled to.

Why Choose Us?

We are a dedicated team of public insurance adjusters who work exclusively for policyholders—not insurance companies. Our focus is on helping you steer the hurricane insurance claim process with ease and confidence. We have experience in dealing with property damage claims, from hurricanes to floods, and we know how to get results.

Our Approach

-

Policyholder Advocacy: We stand by your side, ensuring your voice is heard and your rights are protected. Our experts carefully review your policy, document every detail of your loss, and negotiate aggressively on your behalf.

-

Maximizing Settlements: Our goal is to secure the full compensation you deserve. We leverage our expertise to challenge underpayments and denials, ensuring nothing is overlooked in your claim.

-

Guidance and Support: From initial damage assessment to final settlement, we guide you through every step of the process. Our transparent communication ensures you’re informed and empowered throughout your claim journey.

Real Results

Our track record speaks for itself. We’ve helped countless policyholders in Texas and beyond, from Austin to Houston, recover from devastating storms. Our commitment to excellence and client satisfaction is what sets us apart.

Don’t let the aftermath of a hurricane overwhelm you. With Insurance Claim Recovery Support, you have a trusted partner to help you rebuild and restore. Visit our multi-family insurance claims page to learn more about how we can assist you.

Together, we can turn a challenging situation into a manageable recovery process. Let us help you get back on your feet with the financial support you need.