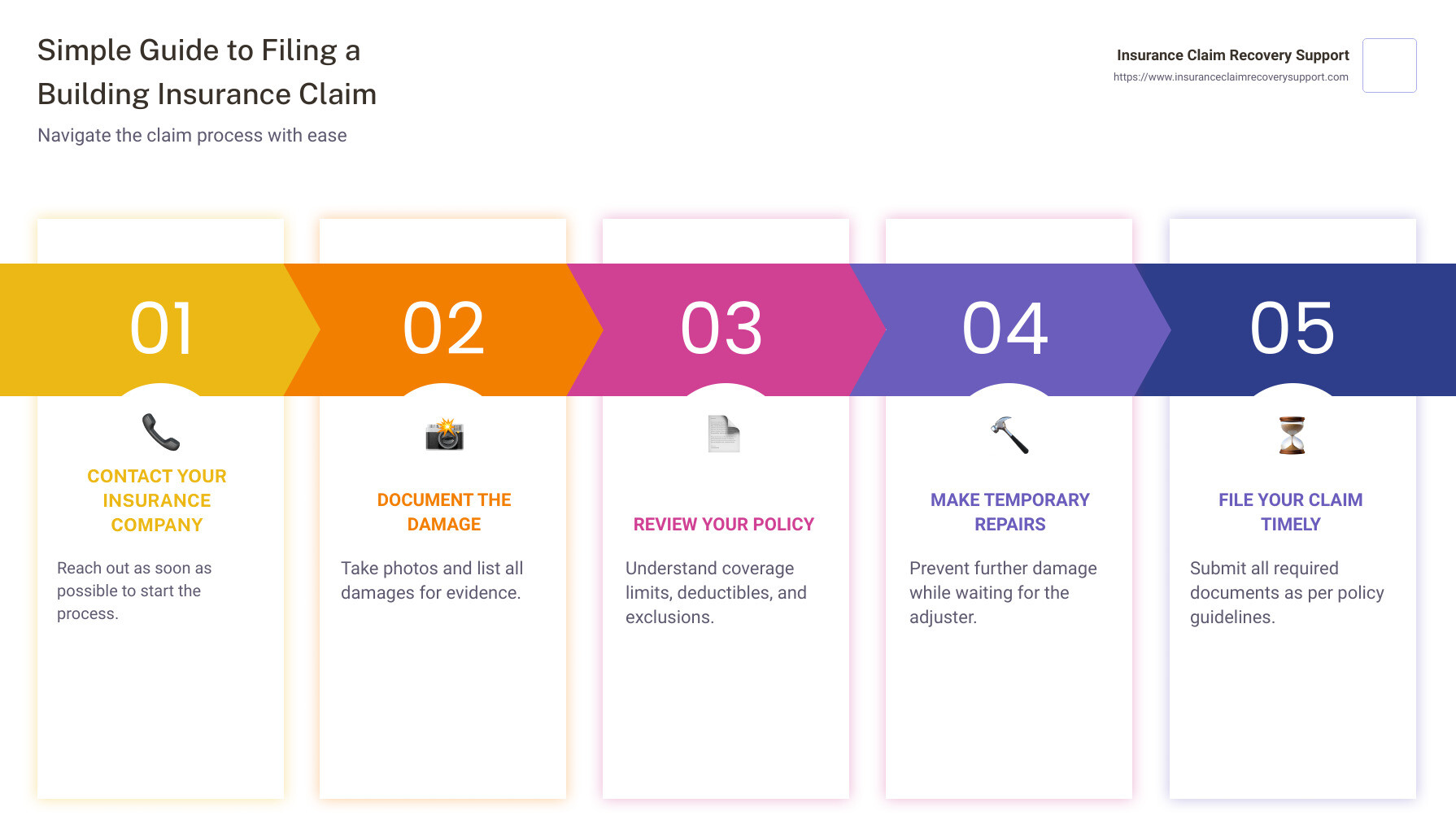

Filing a building insurance claim can feel daunting, but taking the right steps early on can streamline the process and help ensure you receive a fair settlement. Here’s a quick guide to get you started:

- Contact your insurance company as soon as possible.

- Document the damage thoroughly.

- Review your policy for coverage details.

- Make temporary repairs if necessary, to prevent further damage.

- File your claim in a timely manner, according to your policy’s guidelines.

Understanding your insurance policy’s coverage limits, deductibles, and the process for filing a claim is crucial. Equally important is acting swiftly to file your claim, as delays can impact the outcome. Whether it’s damage from a natural disaster or a sudden accident, knowing how to navigate the claim process can ease some of the stress involved.

Filing a claim involves a few key steps: reporting the damage to your insurer, documenting what happened, and working with an adjuster to assess the damage. However, the overarching goal is always to restore your property to its pre-damage condition as smoothly and quickly as possible.

Keep reading as we break down these initial steps in more detail, and guide you through understanding your coverage, preparing to file your claim, navigating the claim filing process, understanding the settlement, and, if necessary, seeking professional help to maximize your claim settlement.

Understanding Your Coverage

Before you dive into filing a building insurance claim, it’s crucial to grasp what your policy covers. This knowledge can significantly impact how you approach your claim and set realistic expectations for the outcome.

Policy Details

Your insurance policy is like a contract between you and your insurance company. It outlines what’s covered, what’s not, and under what conditions. Make sure you read it carefully. If anything is unclear, don’t hesitate to ask your insurance provider for clarification.

Exclusions

Not everything is covered by your insurance policy. These are known as exclusions. Common exclusions might include damage from earthquakes, floods, or normal wear and tear. Knowing what your policy does not cover helps you understand the limits of your insurance protection.

Deductibles

Your deductible is the amount you pay out of pocket before your insurance kicks in. Higher deductibles usually mean lower premiums, but it also means paying more upfront when you file a claim. Consider your financial comfort with the deductible you’ve chosen.

Replacement Cost vs. Actual Cash Value

This is where it gets a bit technical but stay with me:

-

Replacement Cost policies pay the cost of replacing your damaged property without factoring in depreciation. This means if your roof needs to be replaced after a storm, the insurance will cover the full cost of installing a new one, up to your policy’s limit.

-

Actual Cash Value takes depreciation into account. So, if that same roof is 10 years old, the payout would reflect the roof’s current value, not the cost of a brand new one.

Understanding the difference between these two can significantly affect your claim’s payout and how much you’ll need to contribute to repairs or replacements.

By now, you should have a clearer picture of your coverage, including the fine print on deductibles, exclusions, and how payouts are calculated. This knowledge is your first line of defense in ensuring you’re fairly compensated in a claim.

Next, we’ll guide you through preparing to file your claim, ensuring you have all necessary documentation and understand the steps to mitigate further damage, making the claim process smoother and more efficient.

Preparing to File a Claim

Filing a building insurance claim can seem daunting, but with the right preparation, it can be a straightforward process. Here’s how you can prepare effectively:

Documentation

Start early with documentation. The moment you notice damage to your building, begin by taking photos or videos from multiple angles. This visual evidence is crucial for your insurance company to understand the extent of the damage.

Keep a log of all the damages you’ve observed. Note the date and time you first noticed each issue. This can be as simple as jotting down notes on your phone or keeping a dedicated notebook.

Home Inventory

Create or update your home inventory. This is a detailed list of everything in your building, especially items that were damaged. If you haven’t made one before, now is the time to start. List items room by room, and include:

- Descriptions,

- Purchase dates,

- Estimated values.

For items that were damaged, make a separate list. This will make it easier for the insurance company to process your claim.

Immediate Repairs

Sometimes, you need to make immediate repairs to prevent further damage. This could be covering broken windows with plywood or stopping a leak to prevent water damage. Keep all receipts from these repairs. Your insurance company may reimburse you for these expenses.

Mitigate Further Damage

Mitigating further damage is a key responsibility for homeowners. After documenting the initial damage, take reasonable steps to prevent it from getting worse. This doesn’t mean you need to make all repairs immediately, but you should secure the property. For example:

- Turn off water to prevent flooding,

- Cover holes in roofs or walls temporarily.

Remember, the goal during this phase is to stabilize the situation, not to start on permanent repairs. Your insurance company will guide you on how to proceed with those.

By taking these steps, you’re not just preparing to file a claim; you’re also ensuring that the process can move as quickly and smoothly as possible. Documentation and mitigation are your best tools in the early stages of a building insurance claim. Keep everything organized and accessible, as you’ll be referring to this information throughout the claim process.

Next, we’ll walk you through the claim filing process itself, from contacting your insurance to dealing with adjusters and getting repair estimates.

The Claim Filing Process

Filing a building insurance claim can seem daunting, but breaking it down into manageable steps can make the process smoother and less stressful. Here’s how to navigate through each step effectively.

Contact Insurance

- Act Fast: As soon as you notice damage to your building, contact your insurance company. Most policies require prompt reporting of damages to ensure coverage.

- Know Your Policy Number: Have your policy number and relevant documents at hand. This speeds up the process and ensures you can answer any initial questions the insurance company may have.

Police Report (if applicable)

- When to File: If the damage to your building involves theft, vandalism, or other criminal activities, it’s crucial to file a police report immediately.

- Why It Matters: A police report provides an official record of the incident, which can be vital for your insurance claim. It adds credibility to your claim and can help expedite the settlement process.

Claim Forms

- Fill Out Promptly: Your insurance company will likely require you to fill out claim forms. Do this as accurately and promptly as possible. Inaccuracies or delays can hinder your claim.

- Keep Copies: Always keep a copy of any forms you submit for your records. This helps avoid any discrepancies down the line.

Insurance Adjuster

- Expect a Visit: An insurance adjuster will be assigned to assess the damage to your building. They play a crucial role in determining how much compensation you’ll receive.

- Be Prepared: Have your documentation, photos, and any other evidence of damage ready to show the adjuster. The more information they have, the better they can assess your claim.

Repair Estimates

- Get Multiple Estimates: Obtain several repair estimates from reputable contractors. This gives you a clearer picture of the repair costs and can be used to negotiate with your insurance company if necessary.

- Share with Your Insurer: Provide these estimates to your insurance company. They often have preferred contractors but knowing the market rate ensures you’re getting a fair assessment.

Moving Forward

After completing these steps, your insurance company will process your claim and propose a settlement. It’s important to review this offer carefully to ensure it covers the necessary repairs or replacements. If the offer seems unfair, don’t hesitate to negotiate or seek professional help.

In the next section, we’ll delve into how to navigate the settlement process, including understanding initial payments and handling multiple checks. Staying informed and proactive are key to successfully managing a building insurance claim.

Navigating the Settlement

Navigating the settlement of a building insurance claim can feel like walking through a maze. But don’t worry, we’re here to guide you through it. This step is crucial in ensuring you get the compensation you deserve to repair or rebuild your property. Let’s break down the essentials: initial payment, multiple checks, lender involvement, direct payment to contractors, and replacement value.

Initial Payment

The first check you receive from your insurance company is usually an advance, not the final payment. Think of it as a part of the whole amount you’re entitled to. This is important because if you find additional damages later, you can request more funds. Most policies have a time limit for filing claims, so keep an eye on the calendar.

Multiple Checks

Don’t be surprised if you receive more than one check. Your insurance may issue separate checks for different types of damage — one for the structure of your home and another for personal belongings. If you’re temporarily living elsewhere due to repairs, there’s also a check for Additional Living Expenses (ALE). Each check serves a specific purpose, so manage them wisely.

Lender Involvement

If you have a mortgage, things get a bit more complicated. The check for repairs will likely be made out to both you and your mortgage lender. This is because the lender wants to ensure the repairs are indeed made to protect their investment. You might need to endorse the check over to them, or they could place the funds in an escrow account and release them as repairs are completed.

Direct Payment to Contractors

Sometimes, your insurance company might pay your contractor directly. This can simplify the process for you but be cautious. Always read any “direction to pay” forms carefully to ensure you’re not signing over your entire claim. And, as always, make sure the work is completed to your satisfaction before the final payments are made.

Replacement Value

Understanding the difference between Actual Cash Value (ACV) and Replacement Cost Value (RCV) is key. ACV takes into account depreciation, meaning you’ll get the current market value for damaged items, which might not be enough to replace them. RCV, on the other hand, provides you with the amount needed to buy new replacements. If your policy covers RCV, you might need to pay upfront and get reimbursed later. Keep all receipts!

Navigating the settlement of your building insurance claim is about staying organized, understanding the process, and knowing your rights. With this knowledge, you’ll be better equipped to manage the complexities of the settlement and ensure that you’re fairly compensated for your loss.

In the next section, we’ll explore how to prevent future claims through regular maintenance and upgrades, helping you safeguard your property and potentially lower your insurance premiums.

Preventing Future Claims

After navigating the complexities of a building insurance claim, it’s natural to want to minimize the risk of future claims. Not only can this help protect your property, but it can also potentially lower your insurance premiums. Here’s how you can take proactive steps to safeguard your building:

Maintenance Tips

- Regularly Inspect Roofs and Gutters: Ensure they are free of debris to prevent water damage.

- Check Plumbing Regularly: Look for leaks and address them immediately to avoid water damage.

- Inspect HVAC Systems: Regular maintenance can prevent fires and improve energy efficiency.

Regular Inspections

- Annual Building Inspections: Have a professional inspect your building annually to catch issues early.

- Seasonal Checks: Before each season, check for potential problems specific to upcoming weather conditions.

Upgrading Building Materials

- Fire-Resistant Materials: Use materials that are less likely to catch fire or spread flames.

- Impact-Resistant Roofing: Consider upgrading to materials that can withstand hail and severe weather.

Weatherproofing

- Seal Windows and Doors: Prevent water intrusion and improve energy efficiency by sealing gaps.

- Proper Insulation: Ensure your building is adequately insulated to prevent pipes from freezing and bursting.

- Landscaping for Protection: Plant trees and shrubs in strategic locations to act as windbreaks and to direct water away from the building.

By implementing these strategies, you can significantly reduce the likelihood of having to file future building insurance claims. Regular maintenance and upgrades not only protect your property but can also provide peace of mind knowing that you’ve taken steps to mitigate potential risks.

In the next section, we’ll discuss when it might be necessary to seek professional help with your insurance claim, including the services offered by Insurance Claim Recovery Support LLC and the benefits of working with a public adjuster.

When to Seek Professional Help

Sometimes, filing a building insurance claim can feel like navigating a maze in the dark. That’s where professional help can make all the difference. Let’s talk about when it might be time to call in the experts.

Insurance Claim Recovery Support LLC

Insurance Claim Recovery Support LLC is a beacon for those lost in the insurance claim process. They specialize in guiding policyholders through the complexities of filing a claim, ensuring that you understand every step and maximize your settlement. Their expertise lies in handling all types of building insurance claims, providing a much-needed ally in your corner.

Public Adjuster vs. Claim Adjuster

Understanding the difference between a public adjuster and a claim adjuster is crucial. A claim adjuster is employed by the insurance company. Their job is to assess the damage and determine how much the insurance company should pay out. On the other hand, a public adjuster works for you, the policyholder. They advocate on your behalf, aiming to get you the highest possible settlement. They bring an unbiased eye to your claim, often uncovering damages that the insurance company’s adjuster might overlook.

- Claim Adjuster: Works for the insurance company.

- Public Adjuster: Works for you, the policyholder.

Advocacy for Policyholders

Why might you need an advocate? The truth is, insurance policies can be complex, filled with jargon and clauses that can be hard to interpret. A professional like a public adjuster not only understands these policies inside and out but also knows how to negotiate with insurance companies. They ensure that your rights are protected and that you receive fair compensation for your losses.

Insurance Claim Recovery Support LLC and similar firms offer this advocacy, providing a voice for policyholders who might otherwise be overwhelmed by the claim process. They can help with:

- Assessing the damage accurately to ensure nothing is missed.

- Filing the claim with all the necessary documentation.

- Negotiating with the insurance company to secure a fair settlement.

When to Seek Professional Help

Consider seeking professional help if:

- Your claim is large or complex: Big claims or those involving extensive damage can benefit from a professional’s attention to detail.

- You’re not confident in the insurance company’s offer: If the payout seems low, a public adjuster can help you fight for more.

- You’re overwhelmed by the process: Insurance claims can be stressful. Professionals can take the burden off your shoulders, guiding you through the process.

By enlisting the help of experts like Insurance Claim Recovery Support LLC or a public adjuster, you ensure that your building insurance claim is in capable hands. Their goal is to advocate for you, helping you navigate the claim process smoothly and effectively.

Next, we’ll wrap up with some final thoughts on maximizing your settlement and the importance of professional help in the insurance claim process.

Conclusion

Filing a building insurance claim can often feel like navigating a maze without a map. It’s complex, filled with potential pitfalls, and requires a detailed understanding of insurance policies. But it’s crucial to remember that you don’t have to walk this path alone. The right professional help can turn a daunting process into a manageable one, ensuring that you maximize your settlement.

Maximizing Your Settlement

Maximizing your settlement is about more than just getting a fair payout; it’s about ensuring that you have the resources needed to rebuild and recover. Here are a few key points to keep in mind:

- Understand Your Coverage: A thorough understanding of what your policy covers is the foundation of a successful claim.

- Document Everything: From the damage to repairs and every communication with your insurance, keep detailed records.

- Mitigate Further Damage: Take immediate steps to prevent further damage to your property, as this can affect your settlement.

- Get Professional Estimates: Professional repair estimates provide a clear picture of the costs involved, strengthening your claim.

The Importance of Professional Help

Navigating an insurance claim can be overwhelming, especially when dealing with the aftermath of a disaster. This is where professional help becomes invaluable. Companies like Insurance Claim Recovery Support specialize in guiding policyholders through the insurance claim process. Here’s why professional help is crucial:

- Expertise: Professionals have a deep understanding of the insurance industry and can navigate its complexities with ease.

- Advocacy: A professional advocate works for you, not the insurance company, ensuring your interests are prioritized.

- Negotiation: Professionals have the skills to negotiate with insurance companies, often resulting in a better settlement.

- Peace of Mind: Perhaps most importantly, having an expert on your side provides peace of mind, allowing you to focus on recovery.

In conclusion, while filing a building insurance claim can be challenging, the right preparation and professional assistance can significantly impact the outcome. You’re not alone in this process. Professional help, like that offered by Insurance Claim Recovery Support, can provide the expertise, advocacy, and support needed to navigate the claims process effectively, ensuring you receive the maximum settlement possible. It’s not just about rebuilding structures; it’s about rebuilding lives. Let professionals help you lay the foundation for recovery.