Your Path to Texas Adjuster Certification Success

Claims adjuster certification Texas opens doors to a rewarding career in one of America’s most active insurance markets. Whether you’re seeking stable employment with insurance companies or the flexibility of independent catastrophe work, Texas offers multiple licensing pathways to match your goals.

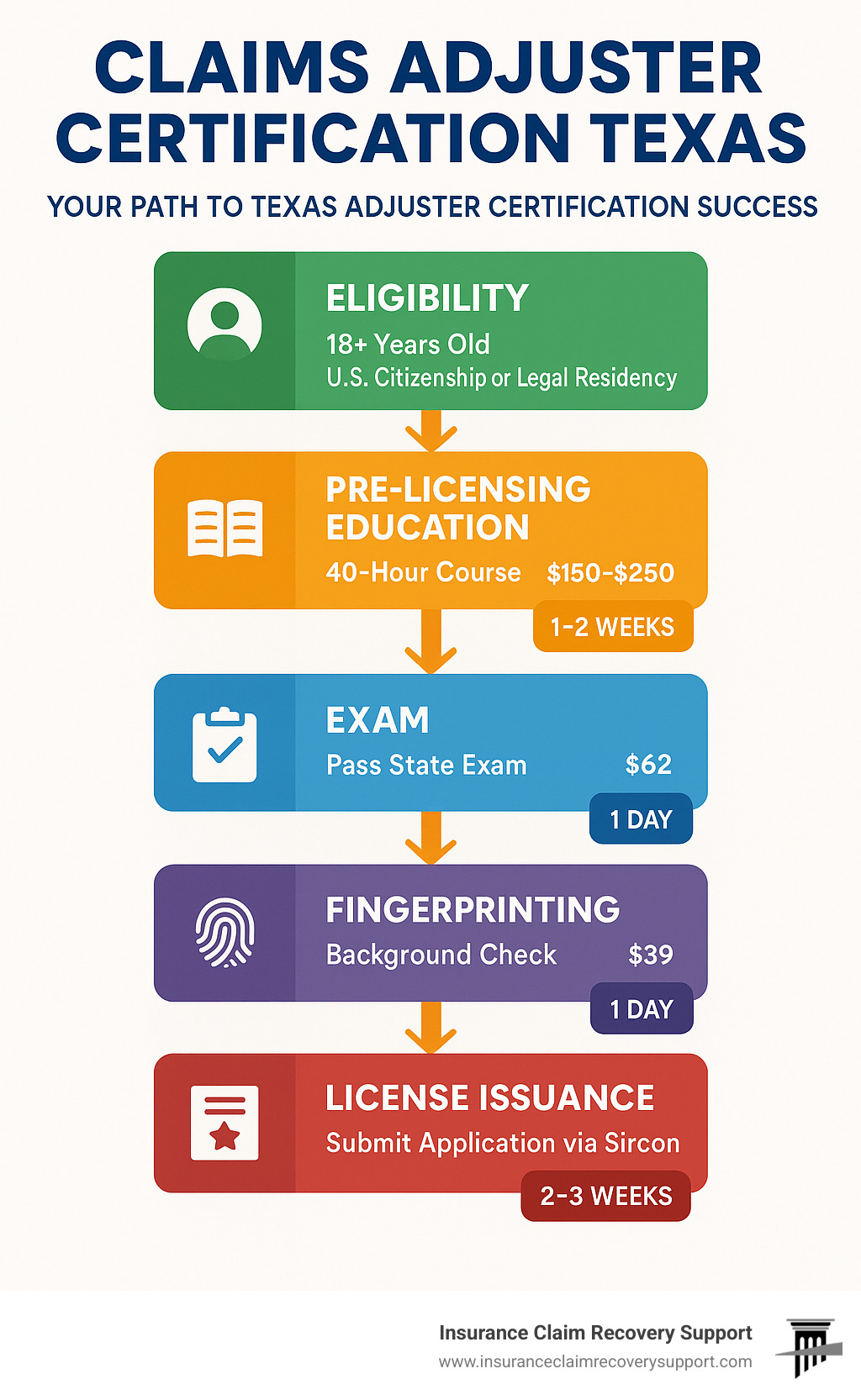

Quick Answer: Texas Adjuster Certification Requirements

– Age: 18+ years old

– Citizenship: U.S. citizen or work-authorized resident

– Education: 40-hour pre-licensing course (32 hours online + 8 hours homework)

– Exam: 150 questions, 70% passing score

– Background: Fingerprint check via IdentoGO

– Application: Submit through Sircon within one year of passing

– Total Cost: $289-$349 (course + fees + fingerprinting)

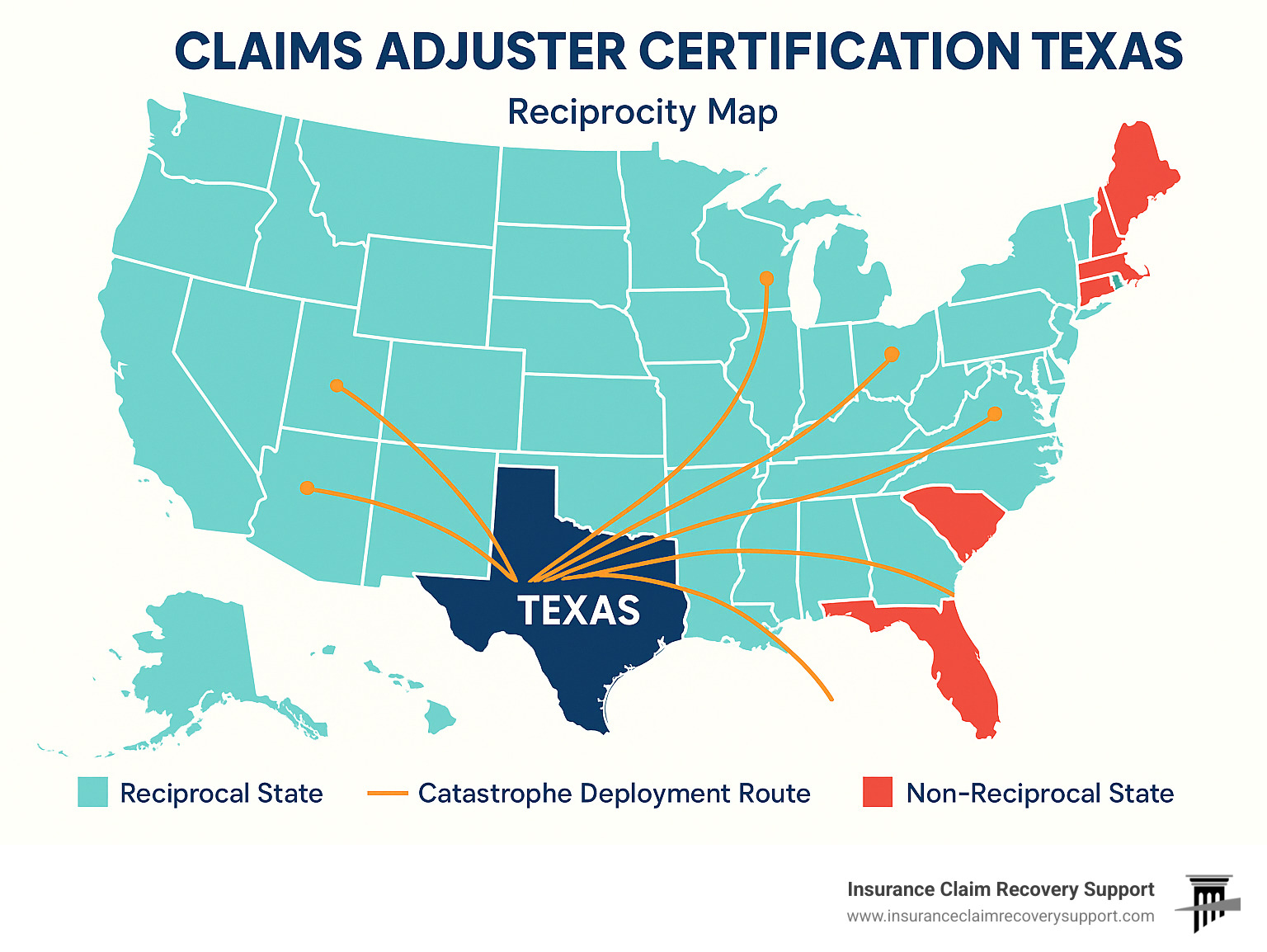

The Texas All-Lines Adjuster License stands out as one of the most respected certifications nationwide, offering reciprocity in 30+ states. This makes it invaluable for adjusters who want to work catastrophe claims across multiple states or build a portable career.

Entry-level staff adjusters in Texas earn $48,000-$60,000 annually, while independent adjusters can make $350-$600 per claim or $500-$600 per day during storm season. The demand surges after major weather events – from Gulf Coast hurricanes to Panhandle storms.

I’m Scott Friedson, a multi-state licensed public adjuster and CEO of ICRS LLC, having settled over $250 million in property damage claims throughout my career. My experience with claims adjuster certification Texas requirements and the insurance industry’s demands will guide you through every step of this licensing process.

What Is “Claims adjuster certification Texas” and Why It Matters

Claims adjuster certification Texas is your official ticket to one of the most dynamic careers in the insurance industry. The Texas Department of Insurance (TDI) oversees this licensing process, which authorizes you to investigate, evaluate, and settle insurance claims throughout the Lone Star State.

When a homeowner in Austin faces fire damage, or a business in Houston deals with hurricane destruction, or a family in Dallas finds storm damage on their roof, they need someone who knows how to properly assess the situation and determine fair compensation. That someone could be you – once you’re properly certified.

Texas offers three main types of adjuster licenses. The All-Lines Adjuster License is the gold standard – it covers homeowners claims, commercial property, auto, farm & ranch, inland marine, ocean marine, and workers’ compensation. Most importantly, it gives you the broadest reciprocity with other states, meaning you can work almost anywhere in the country.

The Property & Casualty (P&C) License covers most property damage claims but excludes workers’ compensation. The Workers’ Compensation License is specifically for workplace injury claims – you can get this standalone or it’s automatically included with your All-Lines certification.

Texas is an incredible place to build an adjusting career because our state gets hit with everything Mother Nature can throw at us. The Gulf Coast cities like Houston and Galveston face hurricane season every year. The Dallas-Fort Worth metroplex sits right in tornado alley. Austin, San Antonio, Georgetown, Lakeway, and Round Rock experience severe storms that can dump golf ball-sized hail in minutes.

Head up to Lubbock or out to San Angelo, and you’ll find communities dealing with everything from devastating storms to wildfire threats. Even smaller cities like Waco see their share of weather-related property damage. All of this activity means consistent demand for skilled adjusters.

Staff, Independent, Public—Know Your Lane

Staff adjusters work directly for insurance companies as regular employees. You’ll have a steady paycheck ranging from $48,000 to $60,000 when you’re starting out, plus all the traditional benefits like health insurance and paid vacation. It’s stable, predictable work with room for advancement.

Independent adjusters work as contractors for independent adjusting firms. These firms get hired by insurance companies when claim volume spikes or during major catastrophes. You might earn $350 to $600 per claim or $500 to $600 per day during busy periods. During storm season, you might handle three to four claims daily and work extensive hours, then take time off when things are quiet.

Public adjusters represent policyholders exclusively – they’re the advocates who work directly for property owners, not insurance companies. We at Insurance Claim Recovery Support LLC specialize in this role throughout Texas. When families in Austin face fire damage, or businesses in Dallas-Fort Worth deal with storm destruction, or homeowners in San Antonio, Houston, or Lubbock find their insurance company’s settlement offer seems too low, that’s where public adjusters step in to fight for maximum compensation.

The independent adjuster path offers particular appeal for those who want flexibility and higher earning potential. More info about becoming independent provides detailed guidance on building this type of career.

Step-by-Step: How to Earn Your Texas Adjuster License

Getting your claims adjuster certification Texas is straightforward when you follow the right steps in the right order.

Start with the basics: You need to be at least 18 years old and either a U.S. citizen or have legal work authorization. The Texas Department of Insurance also runs a background check, so any serious criminal history could be a roadblock – though minor infractions typically won’t disqualify you.

The education requirement is where most people spend their time. Texas requires 40 hours of approved pre-licensing education, which breaks down into 32 hours of online instruction plus 8 hours of state-mandated homework. The coursework covers everything from basic insurance principles and policy interpretation to claims investigation procedures and Texas-specific regulations.

You must pass the state exam to move forward. Most approved courses include this exam as part of their curriculum. The exam has 150 multiple-choice questions, and you need a 70% score to pass. The questions focus more on applying knowledge to real situations than memorizing textbook definitions.

Background checks come next. You’ll need to visit an IdentoGO location for fingerprinting, which costs around $70. This step must be completed before you can submit your license application, and the fingerprint results are only valid for 90 days – so timing matters.

The final step involves submitting your application through the Sircon portal within one year of passing your exam. The application fee is $50, and processing typically takes 2-4 weeks.

Claims adjuster certification Texas checklist

Choosing your license type makes a huge difference in your career flexibility. The All-Lines course gives you the broadest options, covering everything from homeowners and commercial property to workers’ compensation. If you’re unsure about your long-term plans, this is usually the smart choice.

The Property & Casualty course works well if you know you want to focus on property damage claims and don’t need workers’ comp authority. Some people add the Workers’ Comp certification later as their career evolves.

Course format has become much more flexible. Online courses let you work at your own pace and are available 24/7, which works great for people with busy schedules.

Pay attention to the technical requirements during your coursework. Each timed module must be completed in one sitting. The final exam requires a 70% passing score, and you’ll need your certificate of completion for your license application.

Claims adjuster certification Texas online exam tips

The Texas adjuster exam doesn’t have to be stressful if you know what to expect.

The format is consistent: 150 multiple-choice questions with a 3-hour time limit. You need 70% to pass, which means you can miss up to 45 questions and still succeed. About 70% of the questions test your ability to apply concepts to real scenarios, while 30% focus on memorizing key facts and figures.

Most people now take the exam online through their course provider, which eliminates the hassle of driving to a Pearson VUE testing center. You’ll need a reliable internet connection, a webcam, and a quiet space where you won’t be interrupted.

Several groups can skip the exam entirely. If you hold a CPCU or AIC designation, you’re already exempt. People with current adjuster licenses from reciprocal states can often transfer without retesting. Veterans who’ve passed any Texas insurance exam since February 2019 can get their exam fees reimbursed through the VA.

Special accommodations are available if you need them. ESL candidates can request additional time or translation assistance. People with qualifying disabilities can arrange alternative testing formats.

Both online and in-person testing give you immediate results, so you’ll know right away whether you passed. If you don’t pass on the first try, don’t panic – most course providers allow retakes, and many people succeed on their second attempt.

Costs, Exams & Background Checks Explained

Understanding the complete cost structure helps you budget properly for your claims adjuster certification Texas:

Course Fees: $169-$349 depending on provider and package selected

– Basic online course: $169-$289

– Comprehensive packages with additional training: $299-$349

– Xactimate software training bundles: $500-$650

State Fees:

– License application: $50

– Fingerprint background check: $70

– License renewal (every 2 years): $50

Additional Costs:

– Continuing education (24-30 hours every 2 years): $100-$300

– Late renewal penalties: varies

– Reinstatement fees: $75 if renewed within one year of expiration

Total Budget Range: $289-$349 for initial licensing

For public adjusters specifically, additional requirements include special contract forms. The Texas TDI Public Insurance Adjuster Contract Form outlines the mandatory contract provisions for public adjuster services.

Fingerprint & Background Requirements

The fingerprint and background check process is straightforward but must be completed correctly:

IdentoGO Process:

1. Visit the TDI website to initiate your background check request

2. Receive instructions and authorization code

3. Schedule appointment at nearest IdentoGO location

4. Complete fingerprinting and pay $70 fee

5. Receive receipt showing completion

6. Submit receipt copy with your license application

Exemption Rules:

You may be exempt from fingerprinting if you:

– Currently hold an active Texas resident insurance license

– Are a non-resident applicant with a current good-standing license in your home state

– Have submitted fingerprints for another Texas license within the past few years

Important Timing:

– Complete fingerprinting before submitting your license application

– Fingerprint results are typically valid for 90 days

– Criminal history review may add processing time to your application

Funding Help for Veterans & Military Spouses

Texas and federal programs provide significant support for military personnel pursuing adjuster certification:

VA Exam Fee Reimbursement:

Veterans can receive reimbursement for exam fees through the Department of Veterans Affairs for tests taken on or after February 1, 2019. This benefit covers the cost of pre-licensing courses and state exams, making the career transition more affordable.

Military Spouse Benefits:

– Application fee waivers available for active-duty military spouses

– Expedited processing in some cases

– Portable career benefits that transfer with military assignments

Accelerated Career Paths:

Military experience in logistics, investigation, or project management translates well to claims adjusting. Many veterans find the structured approach and attention to detail required in claims work aligns with their military training.

For complete details on veteran benefits, see the Latest research on veteran licensing benefits.

License Renewal, Reciprocity & DHS Secrets

Your claims adjuster certification Texas must be renewed every two years. Complete 24 hours of continuing education (CE)—including 2 hours in ethics or consumer protection—and pay the $50 renewal fee before your license expires. Texas allows a 90-day grace period; after that you have up to one year to reinstate for a $75 fee instead of retaking the exam.

The Texas All-Lines license enjoys reciprocity in 30+ states. Only a handful—such as California, Hawaii, and New York—don’t honor it.

Multi-State Power With a Texas DHS License

If you live in a state that doesn’t issue adjuster licenses (e.g., Colorado, Illinois, Kansas), choose Texas as your Designated Home State (DHS). A DHS license lets you keep all CE and renewal requirements in one place while deploying nationwide for catastrophe work.

Continuing Education Made Simple

Online CE providers make compliance painless. Finish courses early, upload your completion certificates, and you’re done—late CE triggers automatic fines and possible suspension.

For public adjusters who exclusively represent policyholders (like Insurance Claim Recovery Support LLC), see our Texas Public Adjuster guide for additional contract and disclosure requirements.

Career Outlook & Resources for New Adjusters

Texas’s active weather and booming real-estate market create steady demand for licensed adjusters.

- Staff adjusters: $48k-$60k starting salaries, with senior roles topping $90k.

- Independent adjusters: $350-$600 per claim or $500-$600 per day during catastrophes.

Master Xactimate, understand construction basics, and communicate clearly with policyholders. Join networking groups in Austin, Dallas-Fort Worth, Houston, San Antonio, and Lubbock to learn about deployments and mentorship opportunities.

Texas Storm & Fire Hotspots

Hail-prone North Texas (Dallas-Fort Worth, Plano, Frisco); hurricane-exposed Gulf Coast (Houston, Galveston, Corpus Christi); flash-flood-risk Central Texas (Austin, San Antonio, Georgetown, Lakeway); and wildfire-threatened West Texas (San Angelo, Abilene) keep adjusters busy year-round. Keep a go-bag ready, watch weather alerts, and maintain relationships with multiple adjusting firms for rapid deployments.

For a policyholder-centric view of the process, explore our resource on Good Claim Public Adjusters.

Frequently Asked Questions about Claims Adjuster Certification Texas

What happens if I fail the Texas adjuster exam?

Take a deep breath – failing your first attempt at the claims adjuster certification Texas exam happens to many successful adjusters. It’s not a career-ending setback, just a learning opportunity.

Most approved pre-licensing courses include unlimited retakes of their exam at no extra cost. You simply log back into your online classroom and take another shot at those 150 questions. The beauty of this approach is that you can review the material between attempts and focus on the areas where you struggled.

If you took your exam at a Pearson VUE testing center, you’ll need to wait 24-48 hours before rescheduling and pay the exam fee again. Use this waiting period wisely – review your weak areas and take practice exams to identify knowledge gaps.

The 70% passing score means you only need to get about 105 questions right out of 150. Focus on understanding the application-based scenarios rather than memorizing every detail, since these make up 70% of the exam questions.

How long does it take to get licensed in Texas?

The timeline for your claims adjuster certification Texas varies based on how quickly you move through each step, but most people complete the process in 4-10 weeks.

Here’s what typically happens: The pre-licensing course takes 1-4 weeks depending on whether you’re studying part-time or diving in full-time. Since it’s 32 hours of online instruction plus 8 hours of homework, you could technically finish in a few days if you’re motivated.

The fingerprint appointment usually takes 1-2 weeks to schedule and complete through IdentoGO. Pro tip: Start this process early since appointment availability varies by location, especially in busy cities like Austin, Dallas, Houston, and San Antonio.

Once you submit your complete application through Sircon, the Texas Department of Insurance typically processes it within 2-4 weeks. The key word here is “complete” – missing documents or incomplete fingerprint results will slow things down significantly.

You can speed up the entire process by scheduling your fingerprint appointment as soon as you start your course, submitting your application immediately after passing the exam, and double-checking that all required documents are included with your initial submission.

Do I need an All-Lines license to handle workers’ comp claims?

Yes, absolutely. In Texas, you need either an All-Lines Adjuster License or a specific Workers’ Compensation Adjuster License to handle workplace injury claims. The Property & Casualty license specifically excludes workers’ compensation coverage – it’s right there in the fine print.

We strongly recommend going for the All-Lines license instead of the P&C option. Here’s why this makes financial sense: the All-Lines license automatically includes workers’ comp authority, provides broader reciprocity with other states, offers maximum flexibility for career advancement, and qualifies you for more adjuster positions.

Think about it this way – you’re already investing the time and money in pre-licensing education and testing. The small additional cost for All-Lines versus P&C certification pays huge dividends in career opportunities and earning potential. You’ll thank yourself later when you’re qualified for that perfect job opportunity that requires workers’ comp authority.

Plus, if you ever want to work as an independent adjuster during catastrophe season, the All-Lines license opens doors that the P&C license simply can’t. Insurance companies and adjusting firms prefer adjusters with the broadest possible authority, especially when they’re deploying teams quickly after major storms hit areas like the Gulf Coast or North Texas.

Conclusion

Your claims adjuster certification Texas journey doesn’t end with getting your license – it’s really just the beginning of an exciting career that puts you right in the middle of helping people rebuild their lives after disasters. Whether you’re drawn to the steady paycheck of working as a staff adjuster, the travel and higher pay of independent catastrophe work, or the rewarding advocacy role of representing property owners as a public adjuster, Texas gives you more opportunities than almost any other state.

That initial investment of $289-$349 and those 4-10 weeks of preparation time? They’re your ticket to a profession where you’ll never be bored, where every day brings new challenges, and where your work genuinely matters to real people facing real problems.

Getting started is simpler than you might think. Pick your pre-licensing course and decide whether you want the comprehensive All-Lines license or the more focused Property & Casualty option. Complete your 40 hours of education while scheduling that fingerprint appointment. Pass your exam with confidence, submit your Sircon application, and before you know it, you’ll be holding that Texas adjuster license.

The timing couldn’t be better. Texas continues to grow, bringing more properties that need coverage and more claims when storms hit. From the hurricane-prone Gulf Coast around Houston and Corpus Christi to the storm-heavy corridors through Dallas-Fort Worth and Austin, from wildfire risks in West Texas near San Angelo to flash flood zones in the Hill Country around Georgetown and Lakeway, our state keeps certified adjusters busy year-round.

As adjusters, we serve as the crucial link between devastating losses and financial recovery. At Insurance Claim Recovery Support LLC, we’ve witnessed how proper claims handling can mean the difference between a family getting back on their feet or facing financial ruin. When fire tears through a home in Round Rock, when storms pound a business in Lubbock, or when floods damage properties in San Antonio, skilled adjusters become the heroes who help people rebuild.

The insurance industry desperately needs more ethical, knowledgeable adjusters who understand that behind every claim number is a real person dealing with one of the worst days of their life. Your claims adjuster certification Texas empowers you to be that professional who makes things right.

For those interested in exclusively advocating for property owners rather than insurance companies, our professional adjuster services show how public adjusters fight to maximize settlements for policyholders dealing with fire, storm, flood, and other property damage throughout Texas and beyond.

The path forward is clear, the opportunities are abundant, and the need for qualified adjusters has never been greater. Your Texas certification isn’t just a license – it’s your key to a career that combines good pay, job security, and the deep satisfaction of helping people when they need it most.