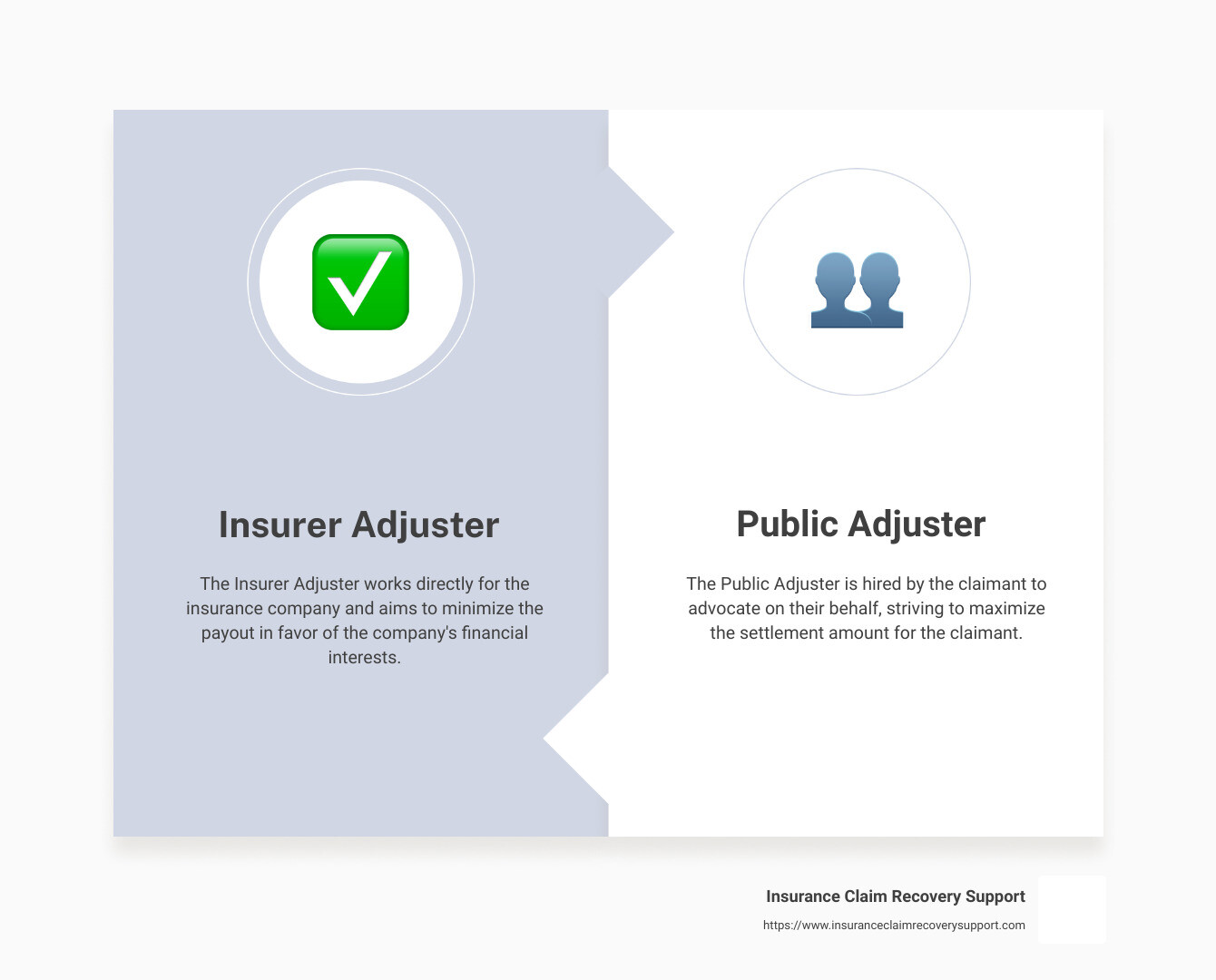

Quick Answer: An insurance adjuster is a professional who evaluates insurance claims to determine the insurance claim liability. Their main goals are to assess the damage, determine the insurance cover, and negotiate a settlement. They come in three types: insurer adjuster, public adjuster, and independent adjuster.

- Insurer Adjuster: Works for the insurance company.

- Public Adjuster: Hired by the insured and works on behalf of policyholders.

- Independent Adjuster: May work for multiple insurance companies or self-insured entities.

Understanding the role and goals of an insurance adjuster is crucial, especially if you’re navigating through the complexities of property damage insurance claims. Whether you’re dealing with damage due to fire, hail, or any other unfortunate event, knowing how adjusters operate can significantly impact the outcome of your claim.

An insurance adjuster’s primary role involves evaluating your claim to help decide how much the insurance company should pay out. However, it’s important to note an insurance company representatives’ main goal is often to minimize the amount the insurance company pays, which may not always align with your interests as the claimant.

This introduction is designed to simplify these concepts, making them easier to grasp for commercial building property owners, religious organizations, and others experiencing property damage. With the right knowledge, you can confidently navigate the insurance claim process, ensuring you receive a fair and prompt settlement.

The Role of an Insurance Adjuster

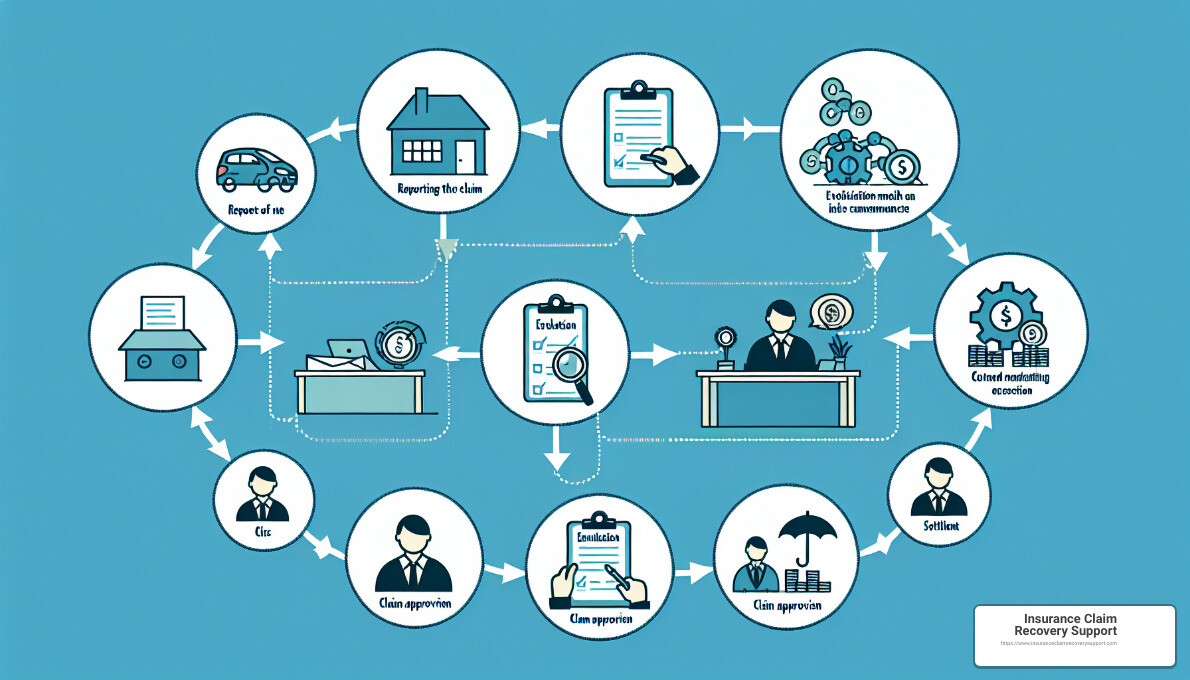

When you’re dealing with an insurance claim, whether it’s due to property damage or a liability issue, you’ll likely encounter a insurance adjuster. Understanding their role is crucial to navigate the insurance claim process effectively. Let’s break it down into simple terms.

Property Claims

When your property is damaged, whether it’s from a storm, fire, or another incident, a insurance adjuster steps in to assess the damage. They are responsible for:

- Inspecting the damage: They physically inspect your property to understand the extent of the damage.

- Reviewing your policy: They check your insurance policy to see what’s covered and what’s not.

- Estimating repair costs: They estimate how much it will cost to repair or replace the damaged property.

Their goal is to determine how much the insurance company should pay you for the damage.

Settlement Negotiation

Whether it’s a property or liability claim, settlement negotiation is a critical part of an adjuster’s job. Here’s what it involves:

- Making an initial offer: After assessing the claim, the adjuster will often make an initial settlement offer. This might be lower than what you were expecting.

- Negotiating: You have the right to negotiate. This is where understanding your policy and the extent of your damages or liability is crucial.

- Reaching a settlement: The goal is to arrive at an amount that’s fair to both you and the insurance company. This can take time and may require some back and forth.

Insurance adjusters are skilled negotiators trained to settle claims quickly and for as little as possible. This isn’t because they’re bad people; it’s simply their job. Independent, staff, and/or general adjusters represent the insurance company’s interests, which is why being informed and prepared is your best strategy.

The role of an insurance adjuster is complex, involving a delicate balance between assessing claims fairly and protecting the insurance company’s bottom line. By understanding their role in property claims, liability claims, and settlement negotiation, you’re better equipped to navigate the claims process and advocate for a fair settlement.

Now that we’ve outlined the role of an insurance adjuster who works for the interests of an insurer, let’s move on to strategies you can employ to ensure you’re dealing with them effectively, ensuring your rights are protected and you receive the settlment you deserve.

Strategies Employed by Insurance Adjusters

When you file an insurance claim, you’ll likely deal with a insurance adjuster employed the your insurance company. Their job is to assess your claim and determine the settlement. However, it’s important to remember that they work for the insurance company, not for you. Here are some strategies adjusters might use and how you can prepare for them.

Lowball Offers

One of the first strategies you might encounter is the lowball offer. This is when the adjuster offers you a settlement amount that’s far less than what your claim is worth. They’re hoping you’ll accept this offer quickly, especially if you’re in a tough financial situation.

Delay Tactics

Adjusters might also use delay tactics. This could mean taking a long time to respond to your calls or emails, claiming they need more information before they can proceed, or saying they’re still reviewing your claim. The goal here is to frustrate you and make you more likely to accept a lower settlement out of desperation.

Information Gathering

Another strategy is extensive information gathering. The adjuster may ask for a lot of personal information or details about the incident. While some of this is necessary, they might also be looking for information they can use to reduce your claim’s value or deny it altogether.

Settlement Formulas

Adjusters use settlement formulas to decide how much to offer you. They start with a base amount for your type of damage or injury and then adjust it based on factors like the severity of your injuries, your recovery time, and any lasting effects. Understanding how these formulas work can help you negotiate more effectively.

How to Prepare:

- Be Informed: Know the value of your claim. Research similar cases or speak to a professional to understand what a fair settlement looks like.

- Document Everything: Keep detailed records of all interactions with the insurance company, as well as all expenses related to your claim.

- Patience and Timing: Don’t rush to accept the first offer. Give yourself time to consider it and consult with a professional if needed.

- Reject Low Offers in Writing: If you receive a lowball offer, reject it in writing. Explain why the offer is not acceptable and provide evidence to support your claim value.

- Public Adjuster Representation: A public insurance adjuster (PIA) is a private, independent, licensed, bonded, and professional claims adjuster who settles property damage insurance claims exclusively on behalf of the policyholder. A good public adjuster can often help policyholders head off issues, resolve disputes, and avoid unnecessary litigation.

- Legal Representation: Consider hiring a lawyer. An experienced attorney can negotiate on your behalf and help you get a fair settlement.

By understanding these strategies, you’re better equipped to deal with handling adjusters. Like any business, there are good ones and bad ones. The goal is to settle your claim fairly and promptly. Reaching that goal requires dispute resolution policyholders bear in the form of proving their claim for damages. The stronger the evidence supporting the policyholders position early in the insurance claim process, the greater the likelihood of reaching a fair and prompt settlement agreement.

Bad faith insurance claim handling practices can carry steep penalities in certain states if an adjuster is overreaching and trying to force a policyholder to settle for as little as possible. Your goal is to get the fair settlement you deserve. Stay informed, be prepared, and don’t hesitate to seek professional advice.

In the next section, we’ll delve into the impact of legal representation on your claim and how an attorney can help you navigate the negotiation process for a better outcome.

How to Effectively Deal with an Insurance Adjuster

Dealing with a insurance company’s adjuster can feel like navigating a maze. But with the right strategies, you can ensure you’re not left feeling lost. Here’s how to approach this process:

Be Informed

Knowledge is power. Understand your insurance policy inside and out. Know what coverage you have and any limitations or exclusions that apply. This will arm you with the necessary information when discussing your claim with the adjuster.

Document Everything

Keep a detailed record of all interactions with the insurance company. This includes dates, times, names, and summaries of conversations. Also, gather and organize all documents related to your claim, such as photos of the damage, repair estimates, and medical bills. This documentation will be crucial in supporting your claim.

Patience and Timing

Insurance claims can be a slow process. Adjusters may use delay tactics, hoping you’ll accept a quick, low offer. Resist the urge to settle too soon. Your patience can pay off in a more substantial settlement, especially if new damages or needs arise.

Reject Low Offers in Writing

If you receive a lowball offer, reject it in writing. A written response shows you’re serious and organized. It also provides a record of your interaction. In your letter, restate the facts of your claim, the evidence supporting your case, and the amount you believe is fair.

Representation

Consider hiring a public adjuster. Both a public adjuster or an attorney can negotiate on your behalf, using their expertise to counter the insurance company’s tactics. Either can also draft the rejection letter for a lowball offer, ensuring it’s compelling.

The goal is not just to deal with the handling adjuster but to do so in a way that gets your claim settled for a fair value in a timely manner. Insurance adjusters are skilled at minimizing payouts. By being informed, documenting everything, being patient, rejecting low offers in writing, and possibly hiring representation, you can level the playing field.

Be sure to check out our article, The Ultimate Guide to Choosing a Public Adjuster or Plaintiff Insurance Attorney.

In the next section, we’ll explore how legal representation can impact your insurance claim, from negotiation tactics to maximizing your settlement.

Legal Representation and Its Impact

Hiring a Lawyer

When you’re dealing with an insurance claim and have reached an impasse, your statute of limitations is about to run out of time, your claim is denied, or if your claim is very complex. One way to ease this burden is by hiring a lawyer. A lawyer steps in to handle all communications and negotiations with the handling adjuster. This means no more stressful calls or trying to figure out what to say and not say. Your lawyer does all that for you.

Attorney Negotiation

Lawyers are trained negotiators. Unlike most of us, they’ve spent years learning the ins and outs of law, including insurance law. They know the tactics that handling adjusters use and how to counter them. For example, if an adjuster makes a lowball offer, your lawyer will know whether this is a standard starting point and how much room there is to negotiate up. It’s not just about arguing; it’s about understanding what is fair and reasonable and using the law to back up these claims.

Maximizing Settlement

Perhaps the most critical aspect of hiring a lawyer is their ability to help maximize your settlement. Several studies and anecdotes suggest that claimants with legal representation typically receive higher settlements than those who go it alone. This is because lawyers can accurately calculate the true cost of your damages, including future expenses you might not have considered. They also understand the value of non-economic damages, such as pain and suffering, which can significantly increase a settlement.

A lawyer’s involvement signals to insurance companies that you are serious about getting a fair deal. It can prevent the handling adjuster from attempting to use tactics that might work on less informed claimants. Plus, if your claim needs to go to court, a lawyer will be indispensable.

In summary, hiring a lawyer can significantly impact your insurance claim process. They handle the stress of negotiation, understand the tactics of handling adjusters, and work to maximize your settlement. While there’s no guarantee of a specific outcome, having legal representation improves your chances of a favorable one.

In the next section, we’ll delve deeper into understanding your rights and your insurance policy, ensuring you’re fully equipped to navigate the claims process.

Understanding Your Rights and Insurance Policy

When dealing with insurance claims, especially after experiencing property damage, it’s crucial to have a solid grasp of your rights and the details of your insurance policy. This knowledge is your shield and sword in the battle for a fair settlement.

Policy Details

Every insurance policy is a contract between you and your insurance provider. This contract outlines what is covered, the limits of coverage, and your responsibilities as a policyholder. Understanding these details is vital. For instance, knowing the difference between replacement cost and actual cash value can significantly affect your claim’s outcome.

- Replacement Cost provides you with the amount needed to replace a damaged item with a new one.

- Actual Cash Value, however, considers depreciation, meaning you’ll get the current value of the item before it was damaged.

Coverage Claims

Your policy lists various types of coverages, such as dwelling coverage, personal property coverage, and liability coverage. Each type plays a specific role:

- Dwelling coverage protects the structure of your home.

- Personal property coverage looks after your belongings within the home.

- Liability coverage shields you if someone is injured on your property and you’re found responsible.

Understanding which coverages apply to your situation is crucial when filing a claim.

Rights Protection

As a policyholder, you have rights. Insurance companies are bound by law to act in good faith, meaning they must handle your claim fairly and promptly. Here are a few rights to keep in mind:

- Right to a timely response: Insurance companies must acknowledge and act on claims within a reasonable time frame.

- Right to a fair evaluation: Adjusters should provide a fair assessment of damages without undervaluing your claim.

- Right to appeal: If you disagree with the settlement offer, you have the right to appeal the decision.

Being aware of these rights can empower you when dealing with handling adjusters. If you feel your claim isn’t being handled fairly, you may need to seek legal advice.

Remember, knowledge is power. Understanding your policy inside and out, knowing what coverage you have, and being aware of your rights as a policyholder place you in a stronger position to navigate the claims process successfully. Armed with this information, you’re better prepared to advocate for a fair settlement and protect your interests.

In the next section, we’ll explore the intricacies of navigating Texas insurance claims for property damage, giving you a closer look at how to maneuver through local regulations and processes to ensure your claim is handled correctly.

Navigating Texas Insurance Claims for Property Damage

When it comes to dealing with property damage in Texas, the landscape can be as varied as the state itself. From the bustling streets of Austin to the historic paths of San Antonio, each city has its unique challenges. Add to that the unpredictable Texas weather, which can bring anything from hailstorms in Dallas to wildfires near Lubbock, and you’ve got a complex insurance claim environment to navigate.

City-Specific Challenges

- Austin, Round Rock, Georgetown: These areas are known for their rapid growth and development. The challenge here often lies in dealing with property damage amidst ongoing construction and urban sprawl.

- Dallas, Fort Worth: Hailstorms and severe weather events are common. Property owners need to be vigilant about roof and structural damage.

- Houston: Flooding is a significant concern, especially given the city’s history with hurricanes and tropical storms. Understanding flood insurance is crucial.

- Lubbock, San Angelo: These areas face the threat of wildfires and severe storms, making comprehensive coverage a must for homeowners.

- Waco, Lakeway: Being somewhat more rural, these locations can experience a mix of issues, from storm damage to challenges related to accessing repair services quickly.

Texas Fire and Storm Damage News

Recent years have shown that Texas is prone to extreme weather events, from devastating hurricanes hitting Houston to hailstorms damaging thousands of homes in Dallas. Staying updated with local weather and fire news is not just about preparedness; it directly impacts your ability to file timely and accurate insurance claims.

The Insurance Claim Process in Texas

- Immediate Action: Protect your property from further damage and document the initial state of the damage.

- Documentation is Key: Take detailed photographs and keep a log of all damage. This will be invaluable when filing your claim.

- Understand Your Policy: Knowing what your insurance covers, including the limits and exclusions, can empower you during the claim process.

- File Promptly: Timeliness can be crucial, especially in areas hit by widespread natural disasters. Insurers will be dealing with a high volume of claims.

- Seek Professional Help: In cities like Austin or Dallas, where specific regulations may apply, having a professional by your side can make a significant difference. Companies like Insurance Claim Recovery Support can advocate for your best interests, ensuring you’re not left navigating the complex claim process alone.

Why Professional Support Matters

Insurance policies and the claims process can be daunting to understand. Add to that the stress of dealing with property damage, and it’s clear why many Texans seek professional help. A handling adjuster works to minimize the payout for the insurance company. In contrast, firms like Insurance Claim Recovery Support public adjusters work for you—helping ensure you receive the settlement you deserve to restore your property and move forward.

Navigating Texas insurance claims for property damage requires a detailed understanding of local challenges, staying informed about weather-related risks, and knowing the ins and outs of the insurance claim process. Whether you’re in Austin, Dallas, or any Texas city, professional assistance can provide the guidance and support you need to navigate these complex situations effectively.

In the following section, we’ll delve deeper into understanding your rights and insurance policy, ensuring you’re fully equipped to protect your interests in any claim situation.

Conclusion

Navigating the complex world of insurance claims, particularly when dealing with property damage in Texas, can be a daunting task. The role of an insurance adjuster is crucial in this process, and understanding how to interact with them effectively can significantly impact the outcome of your claim. However, remember that you don’t have to face this challenge alone.

At Insurance Claim Recovery Support LLC, we specialize in advocating for policyholders’ rights. Our team of experienced public adjusters understand the intricacies of insurance claims and is dedicated to ensuring that you receive the fair settlement you’re entitled to. Whether you’re dealing with the aftermath of a fire, storm damage, or any other property damage, our expertise can guide you through the process with confidence.

Our approach is centered on offering personalized support, from reviewing your insurance policy and understanding your coverage, to negotiating with insurance adjusters on your behalf. We’re here to take the burden off your shoulders, allowing you to focus on what matters most – your recovery and peace of mind.

Knowledge is power. Being informed about your rights and the details of your insurance policy is the first step toward protecting your interests. But when the going gets tough, having an advocate by your side can make all the difference.

In Texas cities such as Austin, Dallas, Fort Worth, San Antonio, Houston, Lubbock, San Angelo, Waco, Round Rock, and Georgetown, we’ve helped countless policyholders navigate their insurance claims successfully. Our commitment to our clients is unwavering, and our track record speaks for itself.

Don’t let the complexity of insurance claims overwhelm you. With Insurance Claim Recovery Support LLC, you have a dedicated partner ready to fight for your rights every step of the way. Contact us today for a consultation, and let us help you secure the settlement you deserve.

In conclusion, dealing with insurance claims, especially in the face of property damage, requires a thorough understanding of your rights and a strategic approach in dealing with handling adjusters. While it may seem like an uphill battle, you’re not alone. With the right support and guidance, you can navigate these challenges successfully and emerge with the compensation you rightfully deserve.