General Adjuster Definition: At its core, a general adjuster is an insurance expert whose primary role is to investigate property damage. They determine the insurance company’s financial responsibility for incidents involving property or physical damage. This quick answer is for anyone needing immediate clarity on what a general adjuster does.

When you’re dealing with the aftermath of damage to your property, whether it’s due to fire, hail, hurricane, or any other disaster, navigating the insurance claim process can feel like a second catastrophe. It’s overwhelming, time-consuming, and fraught with fine print that can make or break your claim’s success. That’s where a general adjuster comes in. Their job is to take a deep dive into your claim, examining every angle of the property damage, interviewing witnesses, and crunching numbers to figure out just how much the insurance owes you.

They’re the bridge between your loss and the coverage your insurance promises to provide. And in a world where insurance paperwork feels designed to confuse, they’re your translator, guide, and advocate rolled into one.

Why should you care? Because, without a general adjuster’s expertise, you risk leaving money on the table or facing unnecessary delays in restoring your property. They are your ace in the hole in ensuring you get fair treatment and a prompt settlement that reflects the true cost of your losses.

In this guide, you’ll get a comprehensive look at the role and responsibilities of general adjusters. We aim to demystify their work and show how they can be indispensable allies in your quest to recover from property damage. Let’s dive in.

What is a General Adjuster?

At its heart, the general adjuster definition revolves around being a specialist within the insurance industry. These professionals are the backbone of handling complex property and physical damage claims. Their role is critical in determining financial liability for insurance companies and ensuring that policyholders receive a fair settlement based on their policy coverage.

Insurance Professional

A general adjuster is much more than just an employee of an insurance company. They are highly trained professionals with a deep understanding of insurance policies, property damage assessment, and the nuances of financial liabilities. Their expertise allows them to navigate the often complex terrain of insurance claims with precision and care.

Financial Liability

One of the primary roles of a general adjuster is to determine the financial liability of the insurance company in the event of property or physical damage. This involves a thorough analysis of the damage, the circumstances surrounding the incident, and the coverage provided by the policyholder’s insurance contract. It’s a meticulous process that requires a keen eye for detail and a solid understanding of insurance law and practices.

Property Damage

When we talk about property damage, we’re referring to any harm or destruction that occurs to buildings, homes, and other structures. General adjusters step in to assess the extent of this damage, which can range from minor repairs to total losses. Their assessment is crucial in determining how much the insurance company should pay out to the policyholder for repairs or replacement.

Physical Damage

Beyond the buildings themselves, general adjusters also look into physical damage. This can include damage to personal property within a building, such as furniture, electronics, and other belongings. The adjuster evaluates these losses to ensure that policyholders are compensated not only for structural damage but also for the personal items that make their spaces livable and functional.

General adjusters bridge the gap between policyholders and insurance companies. They are tasked with the responsibility of ensuring that claims are settled fairly and according to the terms of the insurance policy. Their work involves a blend of investigative research, detailed analysis, and strong interpersonal skills to navigate the often emotional process of recovering from property damage.

It’s important to understand not just the role of a general adjuster, but also how they differ from other insurance professionals. This distinction is crucial for anyone looking to pursue a career in this field or those who find themselves needing to work with a general adjuster after experiencing property damage.

Roles and Responsibilities of a General Adjuster

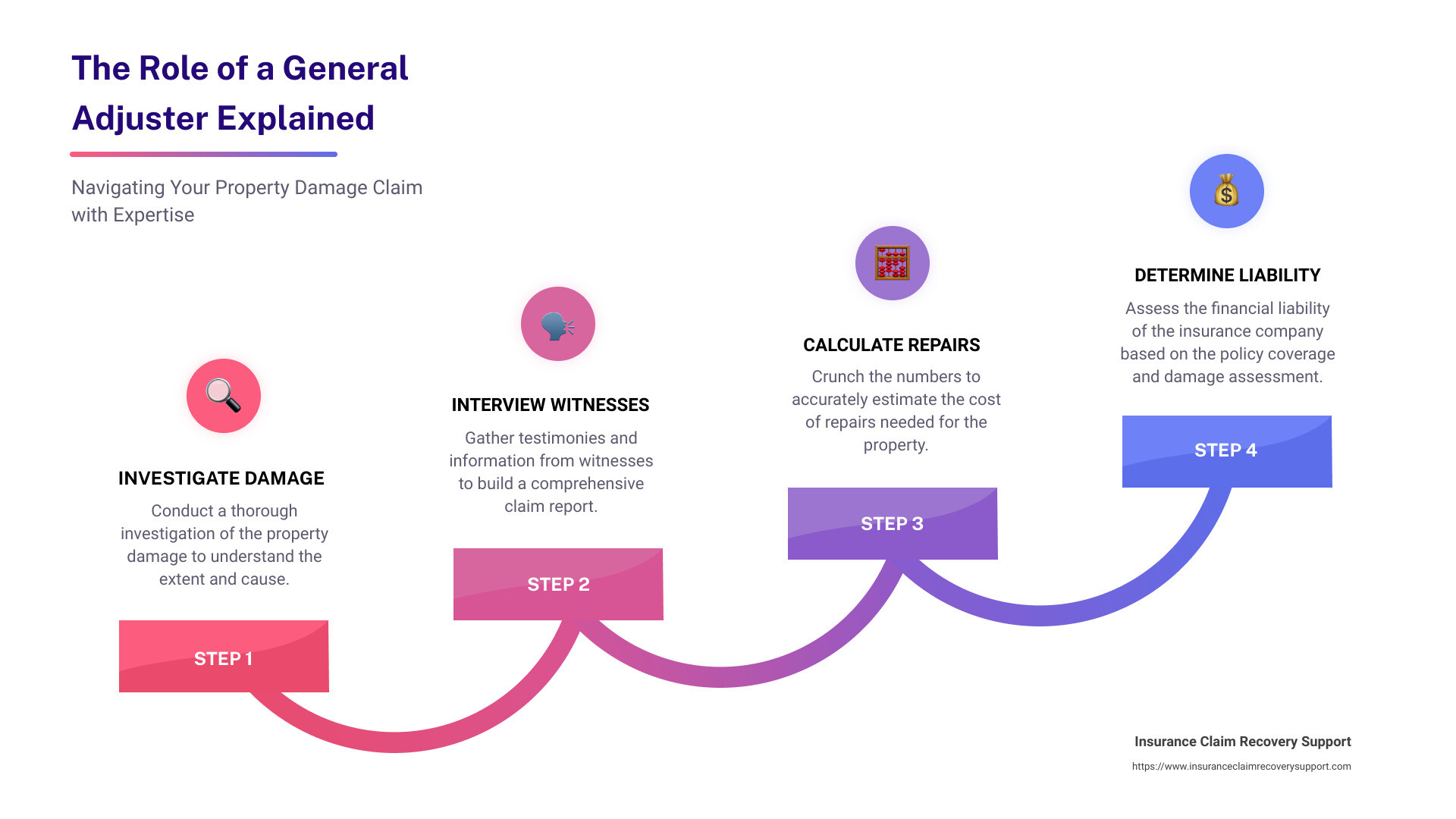

When it comes to understanding the general adjuster definition, dive into the core of what these professionals do. A general adjuster plays a pivotal role in the insurance industry, especially when dealing with property damage claims. Their responsibilities are vast and require a unique blend of skills. Let’s break these down:

Incident Analysis

First and foremost, a general adjuster is like a detective for insurance claims. They start by analyzing the incident that led to the claim. This means looking at the what, when, where, and how of the damage. It’s their job to piece together the story from the evidence available. This could involve visiting the site of the incident, examining the extent of the damage firsthand, and determining what happened.

Cost of Repairs

After understanding the incident, a general adjuster calculates the cost of repairs. This isn’t just about adding up numbers. It involves understanding the materials, labor, and time needed to make the repairs. They use up-to-date insurance cost software to prepare detailed damage reports. These reports are crucial for making an accurate offer of settlement to the insured.

Interviews

A key part of a general adjuster’s role involves conducting interviews. They might talk to law enforcement officers, medical professionals, eyewitnesses, and anyone else who can shed light on the incident. These interviews help the adjuster gather facts and perspectives that are vital for a thorough investigation.

Investigative Research

Investigative research goes hand in hand with interviews. A general adjuster needs to dig into records, consult police and hospital reports, and inspect property damage closely. This research is essential for understanding the full scope of the claim and ensuring that the insurance company’s financial liability is accurately determined.

Interpersonal Skills

Last but certainly not least, interpersonal skills are critical for a general adjuster. They need to communicate effectively with a wide range of people – from those making a claim to repair professionals. Strong communication helps in negotiating settlements and ensuring that all parties understand the process.

The role of a general adjuster is multifaceted. They are part investigator, part analyst, part negotiator, and part communicator. Their work is crucial for the insurance industry, helping to ensure that claims are handled fairly and efficiently.

Moving forward, it’s important to understand the pathways one can take to become a general adjuster and the qualifications required. This knowledge is not only useful for those aspiring to enter the field but also offers valuable insights to those who may need to work with a general adjuster in the future.

Differences Between General Adjusters and Other Insurance Professionals

When navigating insurance, it’s easy to get lost in the sea of titles and roles. However, understanding the specific duties and responsibilities of each role is crucial, especially when it comes to general adjusters. Let’s break down the differences in simple terms.

Claims Adjuster vs. Insurance Agent

First up, let’s talk about claims adjusters and insurance agents. While both are pivotal in the insurance industry, their roles are quite distinct.

-

Insurance Agents are the folks you meet when you’re looking to buy insurance. They’re the salespeople of the insurance world. Their main job is to help you find the best insurance policy that fits your needs and budget. They work with you to understand what kind of coverage you’re looking for and then help you purchase that policy.

-

Claims Adjusters, on the other hand, come into the picture after you’ve made a claim on your insurance. They’re the investigators. If, say, a storm damages your roof, a claims adjuster would be the one to assess the damage, decide how much the insurance company should pay for repairs, and make sure you get that money. General adjusters are a specialized type of claims adjuster who handle the more complex and high-value claims.

Claims Agent vs. Claims Adjuster

Now, you might be wondering about claims agents and how they fit into the picture. The term “claims agent” isn’t as commonly used and can sometimes be confused with claims adjusters. Generally, a claims agent can refer to someone who works in the claims process, but the key role we’re focusing on here is the claims adjuster. They’re the ones who do the detailed work of assessing claims.

Sales vs. Settlement Process

To put it simply:

-

Sales Process involves insurance agents. Their goal is to guide you through purchasing an insurance policy. They’re all about getting you set up with the coverage you need before anything goes wrong.

-

Settlement Process is where claims adjusters, including general adjusters, come in. This process is all about what happens after something goes wrong. Their job is to figure out how much money the insurance company should pay out to cover the damage or loss you’ve experienced.

In conclusion, while insurance agents help you buy the best policy, claims adjusters help ensure you’re fairly compensated when you need to use that policy. General adjusters, with their specialized skills, play a critical role in handling the more complicated cases that come their way. Understanding these differences helps demystify the insurance process, making it easier for you to navigate through it when the need arises.

It’s essential to keep these distinctions in mind, especially when working with a general adjuster for property damage claims. Their expertise and role in the insurance industry are vital in ensuring that claims are handled efficiently and fairly, providing peace of mind to policyholders in their time of need.

How to Become a General Adjuster

Becoming a general adjuster is a path that requires dedication, learning, and a clear understanding of the insurance industry. Let’s break down the steps and requirements, focusing on licensing, certification, continuing education, and specific guidelines for Texas, as these elements are crucial in shaping a successful career in this field.

Licensing Requirements

The journey to becoming a general adjuster begins with obtaining the right license. While requirements can vary by state, most states require passing an examination that covers a broad range of insurance topics. For instance, to become licensed, you might need to demonstrate knowledge of insurance laws, policy types, and the ethics of claim handling.

Key Steps:

1. Pre-Licensing Education: Some states require a certain number of hours in pre-licensing education to ensure you’re well-prepared for the exam.

2. State Examination: A comprehensive test that evaluates your understanding of insurance fundamentals.

3. Application Submission: After passing the exam, you’ll submit an application to your state’s insurance department.

Certification

While not always mandatory, obtaining certifications can significantly enhance your credibility and expertise as a general adjuster. Certifications like the Associate in Claims (AIC) or the Chartered Property Casualty Underwriter (CPCU) are highly regarded in the industry. These programs cover in-depth topics such as claims handling, ethics, and fraud detection, providing a solid foundation for your career.

Continuing Education

The insurance industry is always evolving, with new laws, technologies, and methodologies emerging. Continuing education is not just a requirement for maintaining your license; it’s a necessity to stay ahead in the field. Most states require a certain number of continuing education credits every renewal period. These courses keep you updated on the latest trends, laws, and tools used in insurance adjusting.

Texas Specific Guidelines

Texas, like many states, has its own specific guidelines and requirements for insurance adjusters. For those looking to work in Texas, here are a few key points:

– Texas All-Lines Adjuster License: This license is comprehensive and allows you to handle a wide range of claims. To obtain it, you must pass the Texas insurance adjuster exam.

– Reciprocity: Texas has reciprocity agreements with several states. If you’re licensed in a reciprocal state, you may be able to obtain a Texas license without taking the Texas exam.

– Fingerprinting and Background Check: As part of the licensing process, you’ll need to undergo a background check and submit your fingerprints.

Remember, becoming a general adjuster is a journey of continuous learning and adaptation. The role requires a unique blend of analytical skills, empathy, and a deep understanding of the insurance industry. With the right education, certifications, and dedication to ongoing learning, you can build a rewarding career helping individuals and businesses navigate the complexities of insurance claims.

It’s essential to recognize the impact that general adjusters have on the recovery process following property damage. Their expertise is not only crucial in assessing and managing claims but also in guiding policyholders through one of the most challenging times of their lives.

Working with a General Adjuster for Property Damage Claims

When disaster strikes, the aftermath can feel overwhelming. Whether it’s fire, hail, or a hurricane, the damage to your property is more than just physical—it’s emotional. In Texas, where the weather can be as unpredictable as a coin flip, understanding how to work with a general adjuster for property damage claims is crucial.

Fire Damage

Fires can devastate homes and businesses, leaving behind ashes and uncertainty. A general adjuster steps in to assess the damage thoroughly, ensuring that the financial compensation matches the loss you’ve experienced.

Hail Damage

Texas is no stranger to hail storms. These icy projectiles can cause significant damage to roofs, windows, and vehicles. General adjusters are skilled in identifying the often-overlooked damages, ensuring your claim covers all necessary repairs.

Hurricane Damage

The power of a hurricane can tear through communities, leaving a path of destruction. General adjusters work diligently to evaluate all aspects of the damage, from water intrusion to structural integrity, advocating for a fair settlement to rebuild your life.

Tornado Damage

Tornadoes can strike with little warning, causing immense damage in a matter of seconds. A general adjuster’s role is to quickly and accurately assess the destruction, helping to expedite the claims process so recovery can begin sooner.

Lightning Damage

Lightning strikes can cause fires, power surges, and other electrical damages. General adjusters understand the complexities of such incidents, ensuring that both visible and hidden damages are accounted for in your claim.

Freeze Damage

Texas’s rare but severe freezes can burst pipes and damage homes. General adjusters are familiar with the unique challenges freeze damage presents, working to ensure your claim includes all aspects of the necessary repairs.

Flood Damage

Floods can leave homes uninhabitable and businesses inoperable. With their expertise, general adjusters help navigate the often-complicated flood insurance claims, advocating for a settlement that reflects the true scope of the damage.

Texas Fire and Storm Damage News

In recent years, Texas has seen an uptick in natural disasters. From the wildfires in the Hill Country to the hurricanes along the Gulf Coast, general adjusters have been at the forefront, helping Texans rebuild their lives one claim at a time.

Cities like Austin, Dallas, Fort Worth, San Antonio, Houston, Lubbock, San Angelo, Waco, Round Rock, Georgetown, and Lakeway have all faced their share of challenges. In each instance, general adjusters have provided the expertise and support needed to navigate the complexities of insurance claims, ensuring that those affected receive the compensation they deserve.

Working with a general adjuster means having an advocate on your side. Someone who understands the general adjuster definition and applies their knowledge and skills to your benefit. They are not just processing claims; they are helping to rebuild lives and communities.

As we look to the future, it’s clear that the role of general adjusters will continue to be vital in the recovery process following property damage. Their expertise not only ensures fair financial compensation but also provides peace of mind during one of the most stressful times in a policyholder’s life.

Frequently Asked Questions about General Adjusters

When it comes to navigating the complexities of insurance claims, especially after property damage, understanding the role and qualifications of a general adjuster can be a game-changer. Here, we simplify some of the most common queries related to general adjusters.

What Qualifications are Needed to Become a General Adjuster?

To step into the shoes of a general adjuster, a combination of education, experience, and specific skills is essential. Here’s a quick breakdown:

- Education: A high school diploma is the bare minimum, but having a bachelor’s degree, especially in fields related to finance, business, or law, can give you an edge.

- Experience: Hands-on experience in insurance or a related field can be crucial. Some states or companies might require a few years of experience before you can qualify as a general adjuster.

- Licensing: Most states in the U.S. require you to pass a licensing exam. The specifics can vary from state to state.

- Skills: Strong investigative research abilities and excellent interpersonal skills are non-negotiable. You’ll often be piecing together information from various sources and communicating with different stakeholders.

How Do General Adjusters Determine the Financial Liability of the Insurance Company?

General adjusters follow a methodical process to ascertain the insurance company’s financial liability. Here’s a simplified overview:

- Incident Analysis: They start by thoroughly analyzing the incident to understand what happened and why.

- Review Policies: Next, they review the insurance policy in detail to determine what’s covered and what’s not.

- Assess Damage: They physically inspect the damage and often consult with experts to estimate the repair costs.

- Calculate: Using all gathered information, they calculate the cost of repairs minus any deductibles or policy limits.

- Negotiate: Sometimes, they might also negotiate with contractors or repair services to ensure the cost estimate is accurate.

What is the Difference Between a Public Adjuster and a General Adjuster?

While both public and general adjusters play crucial roles in the insurance claims process, they serve different interests:

- Public Adjuster: Represents you, the policyholder. Their main goal is to ensure you get the maximum compensation possible for your claim. They are paid a percentage of the claim settlement.

- General Adjuster: Works for the insurance company. They are tasked with determining the extent of the insurer’s financial liability in a claim. Their focus is on making sure the settlement is fair but within the policy’s terms.

A general adjuster definition revolves around their role as the insurance company’s representative in assessing and settling large or complex claims. They ensure that the settlement process is conducted fairly and according to the policy terms, balancing the needs of both the insurer and the policyholder.

As we continue to navigate the intricacies of insurance claims, especially in the wake of property damage, the distinction between general adjusters and other insurance professionals becomes increasingly important. Understanding these roles ensures that all parties involved can navigate the claims process more effectively, leading to fair and timely resolutions.

Conclusion

Navigating the complex landscape of insurance claims, particularly when it comes to property damage, can be a daunting task. This is where the role of a general adjuster becomes pivotal. With a clear understanding of the general adjuster definition, policyholders are better equipped to engage with the claims process and advocate for their rights.

At Insurance Claim Recovery Support LLC, we specialize in standing up for policyholders, ensuring that the settlement you receive is not just fair but also justly reflects the extent of your losses. Our team of expert general adjusters brings a wealth of experience and a deep understanding of insurance policies and the claims process. This expertise allows us to effectively navigate the often complex negotiations with insurance companies, ensuring that your voice is heard and your claim is treated with the seriousness it deserves.

Our commitment to policyholders extends beyond just filing claims. We work tirelessly to ensure that every aspect of your claim is thoroughly investigated, accurately assessed, and vigorously negotiated. We understand the stress and uncertainty that comes with property damage and strive to provide a beacon of support and guidance during these challenging times.

In conclusion, the journey through an insurance claim, especially following property damage, requires a knowledgeable and experienced ally. Insurance Claim Recovery Support LLC embodies this role, offering unparalleled advocacy and support to policyholders. Our dedication to maximizing your claim and ensuring a fair settlement is at the heart of everything we do. As you consider your next steps after experiencing property damage, remember the critical role a general adjuster plays in the process and consider reaching out to us. Let us be your advocate, your guide, and your support as you seek to recover and rebuild.

In insurance claims, knowledge, expertise, and a dedicated advocate can make all the difference. That’s why we’re here – to ensure that when the unexpected happens, you’re not just a policy number; you’re a person whose rights are respected, and whose recovery is our priority.