Introduction

Have you recently witnessed the wrath of a hailstorm and are now dealing with visible property and roofing damages? You’re not alone, and encountering such situations can be overwhelming and stressful. Property damage from hail can range from minor dents on outdoor decorations to significant cracks on the roof, all potentially devaluing your property and disrupting your peace of mind. This is where having a professional hail damage adjuster at your side becomes crucial.

A hail damage adjuster offers expertise and support to navigate the often confusing and intricate process of a hail damage insurance claim. With varying insurance policies and claims procedures, it can be challenging to determine what you’re entitled to. The truth is, filing a property insurance claim and recovering your financial loss from hail damage can feel like a minefield of policy coverage issues and corporate discretion.

Why do you need a Hail Damage Adjuster?

- Provide a thorough inspection of your property to identify all hail damage.

- Compile comprehensive documentation of the damage to prove the extent of your loss.

- Interpret complex insurance policy language and helps you understand your coverage.

- Represent your interests in negotiations with your insurance company.

- Assist in recovering the maximum settlement that you’re entitled to under your policy.

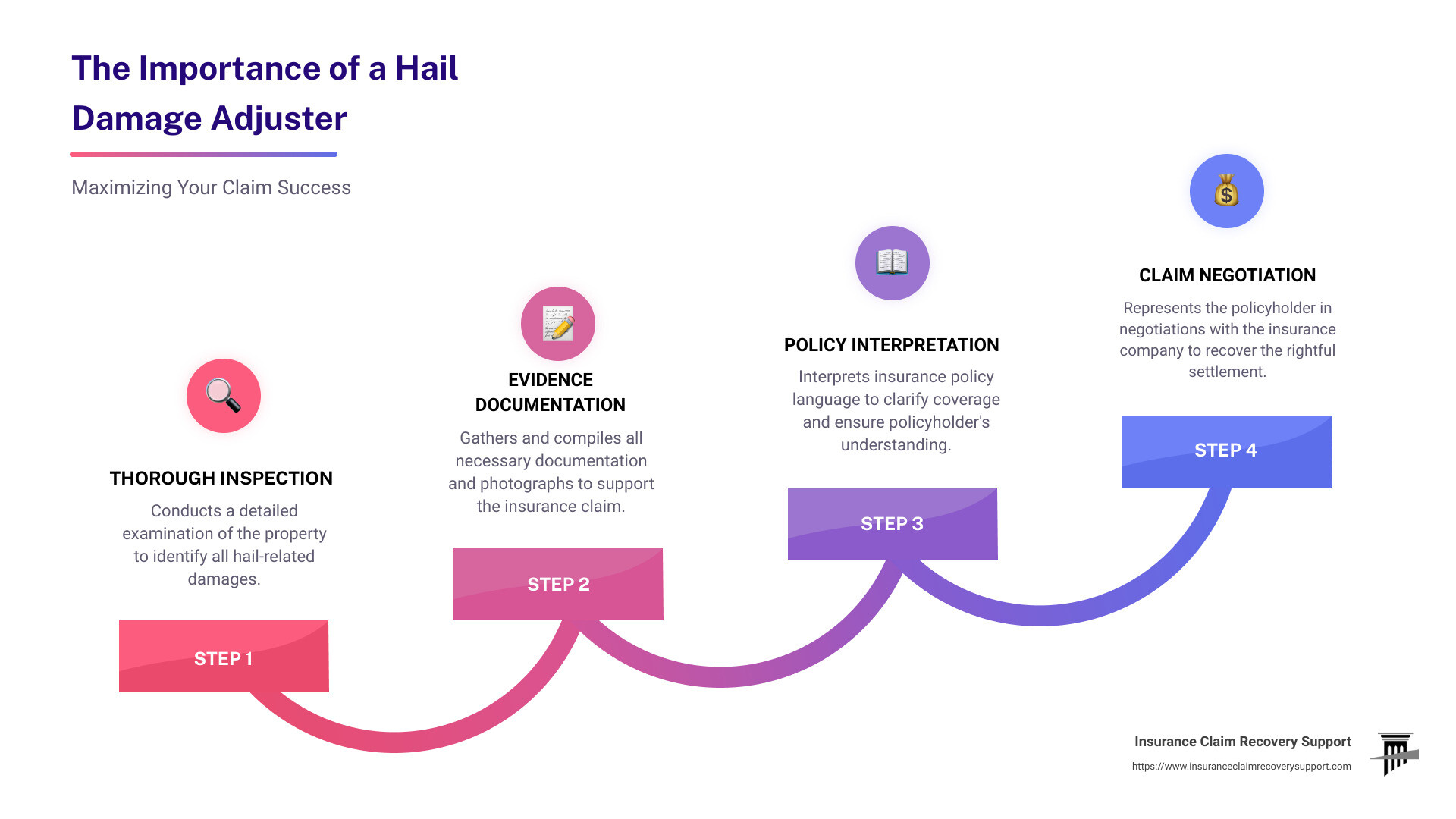

For a glance at these professionals’ importance to your hail damage insurance claim, check the infographic below:

With growing awareness and understanding of the role and potential benefits of a hail damage adjuster, you might find yourself more confident in moving forward with the steadiness and security that we at Insurance Claim Recovery Support can provide. We can be your advocate, ensuring you get the compensation you deserve. Navigating the post-hailstorm chaos doesn’t need to be done alone; a hail damage adjuster is here to help.

Understanding the Role of a Hail Damage Adjuster

Now, let’s dig deeper into hail damage adjusters to fully comprehend the pivotal role they play in securing your rightful compensation.

Difference Between a Public Insurance Adjuster and a Claim Adjuster

In the realm of insurance, you might come across two types of adjusters: the public insurance adjuster and the claim adjuster, also known as an insurance adjuster. These two roles, though similar in title, serve different purposes and, most importantly, different interests.

An insurance adjuster, as the name suggests, is an employee of the insurance company. Their primary role is to assess the damage to your property and determine the payout for your claim. However, their allegiance lies with the insurance company, and their objective is to minimize the company’s payout.

On the contrary, a public adjuster is hired by you, the policyholder. Their role is to support and represent you in the claim process and work diligently towards maximizing your claim settlement. They are the ones who’ll fight in your corner, ensuring that you get a fair settlement.

To put it simply, an insurance adjuster is the representative of the insurance company, while a public adjuster, such as a hail damage adjuster from Insurance Claim Recovery Support, represents you.

How a Hail Damage Adjuster Can Help in Maximizing Your Insurance Claim

The value of having a hail damage adjuster on your side cannot be overstated. Their proficiency and understanding of the insurance claim process play a pivotal role in how your claim is valued and settled.

A hail damage adjuster is well-versed in identifying and documenting damages caused by severe hailstorms. They understand that the visible damages are only the tip of the iceberg, and often, there are underlying issues that may go unnoticed by field adjusters.

Moreover, they are adept at dealing with the often challenging insurance policy coverage issues that arise, ensuring that your financial loss from hail damage is adequately covered. A hail damage adjuster will not let the insurance company dictate the terms and conditions of your payout.

For instance, a common issue that arises during hail damage claims is whether you will be paid to replace the complete roof or if a patch job will be offered as a partial repair. A hail damage adjuster will ensure that the depreciation applied to your roof is fair and reasonable.

The insurance company may attempt to dispute that the damages were even caused by hail, attributing it to previous wear and tear. This is a common dodge, and it’s in situations like these that a hail damage adjuster becomes invaluable. They can represent your best interests and get technical with your insurers’ claims staff, ensuring that your claim is handled professionally and you are properly indemnified for your loss.

In conclusion, a hail damage adjuster is not just there to guide you through the process; they are there to ensure you get the fair settlement you deserve.

When to Hire a Hail Damage Adjuster

When a hail storm has passed and the safety of everyone involved is assured, the next step is to assess the damage to your property. It’s at this point that you should consider engaging the services of a hail damage adjuster.

Identifying Hail Damage: What to Look for After a Hail Storm

Hail damage can take many forms and can affect various parts of your property. The most common type of damage during a hailstorm is roof damage. For instance, asphalt shingles may have fractures or punctures, often referred to as bruises, where the granules have been knocked off, and the underlying bitumen layer is exposed. Metal roofs might show dents or pockmarks where hail has struck. Also, roof vents, flashing, gutters, and downspouts, usually made of soft metal, can easily be dented by hail.

Keep in mind that roof inspections can be hazardous and should always be performed by a professional. At Insurance Claim Recovery Support, we recommend having your roof inspected prior to storm season to prevent exacerbating existing damages.

However, hail damage isn’t limited to the roof. Check also the siding, AC units, and other parts of your property that may have been exposed to the hail. The damage you can prove is the damage for which you’ll get compensated. Therefore, thorough documentation is key.

The Importance of Immediate Action: Contacting a Hail Damage Adjuster After a Hail Storm

Once you’ve identified hail damage, it’s crucial to act promptly. The sooner you contact a hail damage adjuster, the better your chances of receiving a fair settlement from your insurance company.

Why is immediate action important? First, it helps to document the damage while it’s fresh, leaving less room for dispute over the cause of the damage. Second, it kickstarts the claim process, which can sometimes be lengthy. Lastly, it helps to prevent further damage.

By contacting a hail damage adjuster like Insurance Claim Recovery Support promptly, you ensure that your claim is handled professionally and expediently, maximizing your chances of a fair and prompt settlement.

In the next section, we will guide you on how to deal with a hail damage adjuster during the claim process.

How to Deal with a Hail Damage Adjuster

Dealing with a hail damage adjuster can seem complex, but it doesn’t have to be. There are three key steps you need to follow: gather evidence, prepare for the assessment, and negotiate the settlement.

Gathering Evidence: Documenting the Storm and Its Severity

The first thing you need to do is gather all possible evidence of hail damage. This includes taking clear photos and videos of your property, especially of the damaged areas. Additionally, capture images of hailstones next to a ruler or coin for size reference. Don’t forget to document the number of hail marks within a 10×10 square ft. area. Keep all damage-related invoices, billing statements, and receipts as they can provide valuable proof for your claim.

Your insurance company will only compensate for the damage you can prove. Therefore, thorough documentation is key. But, safety should always come first. After a hailstorm, walking on a roof can be very dangerous. Instead, consider hiring a licensed contractor to assess the condition of your roof and document the damage.

Preparing for the Adjuster’s Assessment: Reviewing Your Insurance Policy and Warranties

Next, you need to prepare for the adjuster’s assessment. Ensure you’re on time for your appointment and participate fully in this meeting. Show the adjuster your evidence and discuss the extent of the damage. Before the appointment, review your insurance policy to understand what is covered.

While it’s important to cooperate with the adjuster, be cautious about providing a recorded statement. You are under no obligation to do so. Stick to the facts and share basic information such as your policy number.

Negotiating the Settlement: Asking for a Detailed Explanation and Not Accepting the First Offer

Finally, be prepared to negotiate. The insurance adjuster’s first offer might not account for all aspects of your covered losses. If that’s the case, you have the right to negotiate for a better offer. Don’t hesitate to ask for a detailed explanation of the settlement and don’t feel pressured to accept the first offer.

Understanding your policy, having solid evidence, and knowing the cost of your damages are key to successful negotiations. If you’re not satisfied with the offered settlement, consider seeking legal advice or hiring a public adjuster to advocate for you.

In our next section, we’ll guide you on how to choose the right hail damage adjuster. But for now, remember these three steps: gather evidence, prepare for the assessment, and negotiate the settlement. As your partner in the claims process, we at Insurance Claim Recovery Support are here to help maximize your hail damage insurance claim.

Choosing the Right Hail Damage Adjuster

When dealing with hail damage, selecting the right adjuster is crucial to ensure you receive a fair and just settlement. The right adjuster can make the difference between a smooth claim process and a stressful, drawn-out ordeal. To help you make this critical decision, here are some factors to consider:

Factors to Consider When Hiring a Hail Damage Adjuster

When it comes to selecting a hail damage adjuster, not all are created equal. It’s essential to look beyond their basic credentials and delve into their expertise, experience, and reputation. Here are a few key factors to consider:

-

Credentials and Licensing: Ensure the adjuster holds proper licensing and certification in your state. This ensures they are trained and qualified to handle insurance claims.

-

Experience and Expertise: Ascertain their experience in handling hail damage claims specifically. An adjuster with a track record of successfully navigating hail damage claims can make the claim process smoother and more efficient.

-

Reputation and Reviews: Look for testimonials or reviews from previous clients. This can give you a sense of their professionalism, responsiveness, and efficacy in handling claims.

-

Fee Structure: Understand their fee structure. Some adjusters charge a percentage of the claim payout, while others may have a flat fee. Be sure you’re comfortable with their payment terms.

The Role of Experience and Specialization in Handling Hail Damage Claims

The experience and specialization of a hail damage adjuster play a significant role in the claim process. An adjuster who has handled numerous hail damage claims will know what to look for, how to properly document the damage, and how to present the claim to the insurance company to maximize your settlement. At Insurance Claim Recovery Support, we’re proud of our extensive experience in handling hail damage claims and our success in recovering fair settlements for our clients.

The Importance of Local Knowledge: Understanding Hail Damage in Texas Cities

Hail damage can vary significantly across different geographic regions. A hail damage adjuster with local knowledge will understand the unique challenges presented by hailstorms in Texas cities like Austin, Dallas, Fort Worth, San Antonio, Houston, Lubbock, San Angelo, Waco, Round Rock, Georgetown, and Lakeway.

They’ll be aware of the diverse nature of weather conditions in these cities, and how these different weather conditions can impact the extent of hail damage. They’ll also understand local building codes, which can impact the cost of repairs and the amount of your claim. At Insurance Claim Recovery Support, we’re well-versed in the unique challenges presented by hail damage in Texas and are ready to use our expertise to help our clients get the compensation they deserve.

In conclusion, choosing the right hail damage adjuster is a crucial step in securing a fair and just settlement for your hail damage claim. By considering factors such as credentials, experience, reputation, and local knowledge, you can ensure you’re making the best possible choice. As your partner in this process, we at Insurance Claim Recovery Support are here to support and guide you every step of the way.

Case Study: Insurance Claim Recovery Support LLC

Overview of Insurance Claim Recovery Support LLC and Their Commitment to Policyholders

At Insurance Claim Recovery Support LLC, we’re more than just a public insurance adjuster firm. We stand as a beacon of hope for policyholders navigating the rough seas of insurance claims. Our commitment is to you, the policyholder, not the insurance company.

With a nationwide service based out of Texas, we specialize in complex commercial and multifamily property insurance claims. We operate on a simple principle: no recovery, no fee. This means we’re as committed as you are to ensuring a successful claim. Our high rating for customer satisfaction is testament to our dedication to our clients.

How Insurance Claim Recovery Support LLC Can Help in Hail Damage Claims

Navigating a hail damage claim can be a complex and stressful process. This is where we come in. We have over 15 years of experience and $300M+ settled in large loss claims. We’re experts at gathering evidence, taking proactive measures to prevent further damage, and being prepared for when the claims adjuster assesses your property’s damage. We refuse to give recorded statements without proper legal counsel and anticipate negotiations to ensure a fair settlement.

Our unique approach to settling property damage claims sets us apart. We believe your insurance policy is a contract that should be understood and adhered to. We take great measures to protect your interests against the army of insurance company representatives working to minimize your claim. We guide you through each step of your claim process, ensuring careful planning, meticulous documentation, and strategic negotiation.

Success Stories of Insurance Claim Recovery Support LLC in Settling Hail Damage Claims

Our track record speaks for itself. We’ve worked with countless policyholders, helping them to successfully navigate their hail damage claims and achieve fair settlements. Our approach is tailored to each claim, understanding that each one is unique and requires a personalized strategy.

While we can’t disclose specific client information due to confidentiality, we’ve successfully managed a wide range of hail damage claims. From assessing and documenting damage, to liaising with insurance companies, to ensuring the maximum possible settlement, we’ve been there for our clients every step of the way.

In conclusion, if you’re in the midst of a hail damage claim and feeling overwhelmed, remember you’re not alone. With Insurance Claim Recovery Support by your side, you’ve got a committed, experienced, and successful team ready to fight for your rights as a policyholder. Reach out to us today for a free case review.

Conclusion

Recap of the Importance of Hiring a Hail Damage Adjuster

Throughout this guide, we’ve highlighted the significant role a hail damage adjuster plays in the insurance claim process. When faced with the aftermath of a hail storm, navigating the complexities of an insurance claim can feel overwhelming. That’s where the expertise of a hail damage adjuster comes in.

A proficient hail damage adjuster can help in identifying and documenting damage, understanding the terms of your insurance policy, and negotiating a fair settlement. They can be your strongest advocate, ensuring you get the compensation you deserve without falling prey to common insurance company underpayment tactics.

Final Thoughts on Maximizing Your Hail Damage Insurance Claim with the Right Adjuster

At Insurance Claim Recovery Support, we believe that each policyholder deserves a fair and prompt settlement. Our team of experienced hail damage adjusters is committed to standing up for your rights, navigating the complexities of the insurance claim process, and securing the best possible settlement for you.

We understand that dealing with hail damage can be stressful, but you don’t have to face the aftermath alone. With the right help and a clear understanding of the claims process, you can turn a daunting situation into a manageable one.

It’s not just about getting a settlement; it’s about getting what you rightfully deserve. If you feel your claim is being unjustly denied or underpaid, don’t hesitate to seek professional help.

For more insights and information, explore our articles on why hail and wind property damage insurance claims get denied or underpaid and how to choose a public adjuster for hurricane damage.

In conclusion, hiring a hail damage adjuster can be a game-changer, turning a stressful situation into a manageable one. At Insurance Claim Recovery Support, we stand ready to support and guide you every step of the way, ensuring you get the fair settlement you deserve.