If you have found yourself in the unexpected and often stressful situation of having your property damaged by hail and stuck in the midst of a frustrating hail damage insurance claim process, you’re not alone. The damage caused by a sudden hailstorm can range from minor in your property’s shingles to significant harm to your commercial or multifamily flat or tile roof, all of which can pose a financial headache if not handled appropriately. The process of dealing with insurance companies following hail damage can be both confusing and exasperating. Especially, when left to face bureaucratic obstacles, delayed reimbursements, and, in some cases, unfair denials of valid claims.

This is where we at ‘Insurance Claim Recovery Support’ assist you, offering you a helping hand to navigate these complexities. We are hail claim adjusters vigorously working for policyholders, not the insurance company. We are here to ensure you receive a fair settlement, sparing you unnecessary delays, underpayments, or wrongful denial.

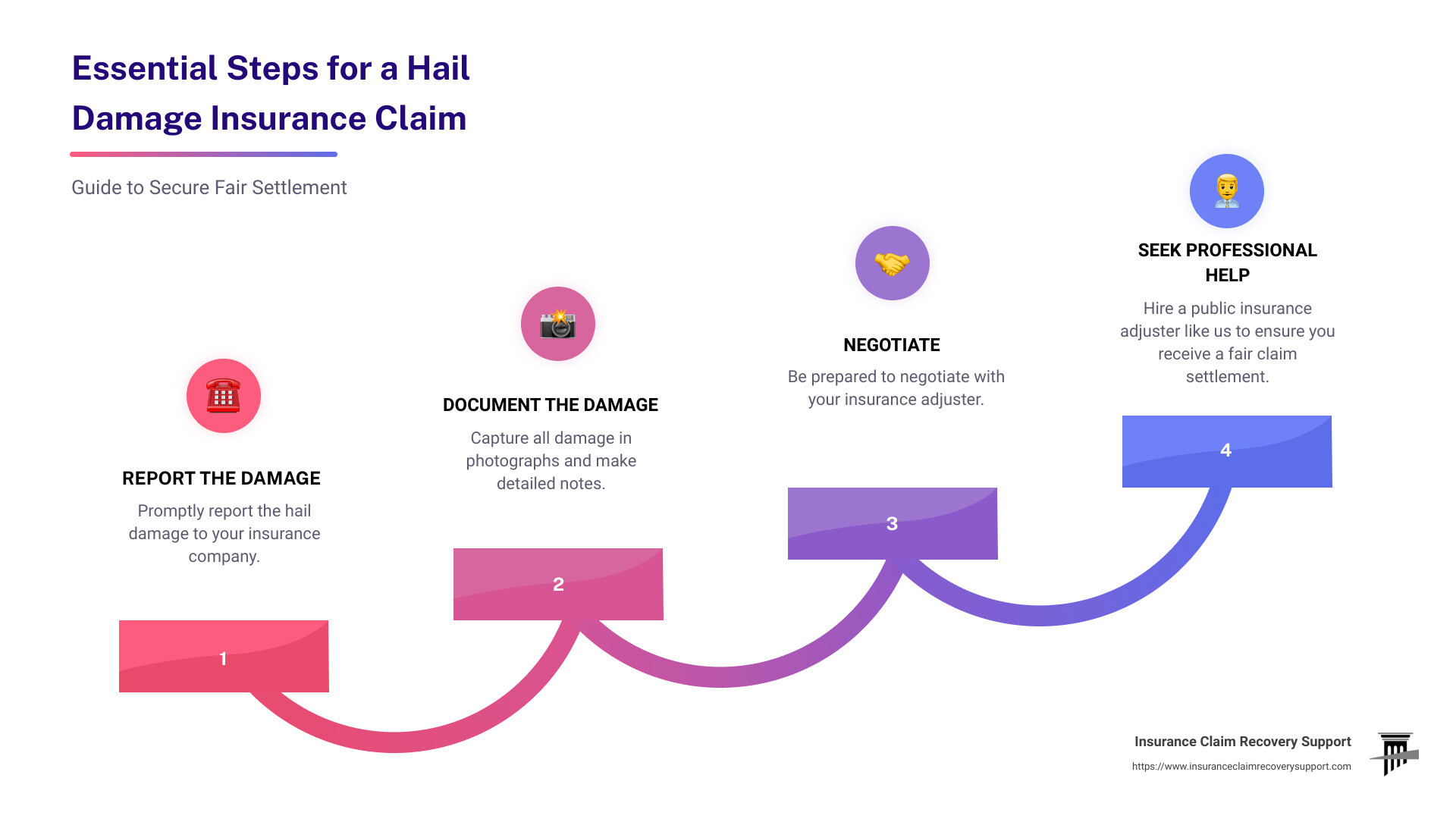

At a glance, here are the critical points to keep in mind when facing the hail damage insurance claim process:

- Report the damage promptly to your insurance company.

- Carefully document all damage, taking photographs and making notes.

- Be prepared to negotiate with your insurance adjuster.

- Know that your claim may be denied or underpaid for several reasons, including not meeting the deductible, pre-existing damage, failure to maintain the roof, age of the roof, dispute over the cause of the damage, incomplete or inadequate documentation.

- Seek professional help from a public insurance adjuster like us to ensure you receive a fair claim settlement.

This comprehensive guide will take you through the steps of recognizing hail damage, understanding your insurance coverage, and detailing the hail damage insurance claim process. Whether you are a commercial, multifamily or apartment property owner, we are here to ensure your journey towards recovery is as smooth as possible. Let’s delve in!

Recognizing Hail Damage

Effectively managing a hail damage insurance claim process begins with properly recognizing the signs of hail damage. The severity of hail damage can vary greatly depending on several factors such as hail size, wind speed and direction, and the type of materials damaged.

Identifying Hail Damage on Roofs

Roof damage is the most common type of damage during a hailstorm. The signs of hail damage on a roof can manifest in several ways:

- Asphalt Shingles: For asphalt shingles, hailstones striking the surface can cause fractures or punctures. Look for dark spots or dents, often referred to as bruises, where the granules have been knocked off and the underlying bitumen layer is exposed. In severe cases, hail can cause the shingle to crack.

- Metal Roofs: On metal roofs, hail impacts can be more apparent. Look for dents or pockmarks in the metal.

- Roof Vents and Flashing: These are usually made of soft metal and can easily be dented when hit by hail.

- Gutters and Downspouts: Dents in gutters and downspouts can also indicate hail damage.

Roof inspections can be hazardous and should always be performed by a professional. At Insurance Claim Recovery Support, we recommend having your roof inspected prior to storm season to prevent exacerbating existing damages.

Signs of Hail Damage on Outdoor Decorations

Hail can also cause significant damage to your outdoor decorations, landscaping, and other exterior features. Look for dents in metal lawn furniture, chipping or cracking in patio stones, and damage to plants or trees. Pay particular attention to air conditioning units which can be severely damaged by hail, leading to potential mechanical issues.

Understanding the Impact of Hail Damage on Property Value

Hail damage can significantly decrease the value of your property if not addressed promptly. Even seemingly minor cosmetic damage can lead to serious problems over time, such as leaks and structural damage. These issues can deter potential buyers or lower the price they’re willing to pay.

In addition to the physical damage, the fact that a property has a history of hail damage can also affect its value. Potential buyers may be concerned about the potential for future hail events and the associated cost of insurance.

As a property owner, it’s crucial to understand how to identify hail damage and its potential impact on your property’s value. Armed with this knowledge, you can take the appropriate steps to restore your property, protect its value, and successfully navigate the hail damage insurance claim process.

The Role of Policyholder’s Insurance in Hail Damage

Insurance plays a vital role in managing financial risks associated with hail damage. If your property is protected under the right policy, you can receive a fair settlement for damages incurred during a hail storm.

Coverage for Hail Damage

A comprehensive insurance policy typically covers hail damage. The claim payout is based on the market value of the property at the time of the loss. For commercial property owners, comprehensive insurance can cover hail damage to pay to repair or replace damages by a hail storm.

However, the specifics of how insurance covers hail damage can vary greatly depending on the policy and the insurance company. For example, some insurance policies have a deductible that must be met before the insurance company will pay for the damage. It’s essential to familiarize yourself with these details to avoid surprises during the claim process.

Importance of Reviewing Your Insurance Coverage

Understanding your insurance coverage is the first step towards a successful claim process. We at Insurance Claim Recovery Support strongly recommend regularly reviewing your policy to understand what is covered and what isn’t. Knowing the limits of your coverage and the amounts of your deductibles can be crucial in the event of a hail damage claim.

Moreover, it’s also important to be aware of any specific requirements in your policy. For instance, many insurance policies require property owners to take proactive measures to prevent further damage after a hail storm. Failure to do so could potentially lead to a denial of your claim.

How Age and Condition of Roof Affects Insurance Coverage

The age and condition of your roof can significantly affect your insurance coverage. Older roofs or those in poor condition may not be fully covered under your insurance policy. Some insurance companies may only cover the depreciated value of the roof, rather than the full replacement cost.

Additionally, if your roof has been neglected or poorly maintained, your insurance company may not cover the damage caused by a hail storm. That’s why regular maintenance and prompt repairs are essential to ensure your roof is always in good shape and adequately covered.

At Insurance Claim Recovery Support, we stand ready to help you navigate these complexities, ensuring that you understand your coverage, and receive a fair and prompt settlement. Our goal is to help you successfully navigate the hail damage insurance claim process and recover the maximum amount you are entitled to under your policy.

The Hail Damage Insurance Claim Process

If your property has suffered from hail damage, the next crucial step is to initiate the insurance claim process. At Insurance Claim Recovery Support, we understand that this process can be confusing and overwhelming, especially when dealing with the aftermath of property damage. Therefore, we provide you with expert guidance at every stage of the hail damage insurance claim process.

Initiating the Claim Process

The first step in the insurance claim process is to document the damage. This includes taking photographs of all damages and making a comprehensive list of affected items. Once you have gathered this evidence, contact your insurance company as soon as possible to inform them of your intent to file a hail damage insurance claim. Prompt notification is crucial as many insurance policies have a time limit within which claims can be filed.

Working with a Public Insurance Adjuster

As part of our services, we provide you with a public insurance adjuster. These are licensed professionals who work on behalf of policyholders to help settle insurance claims. They play a crucial role in the hail damage insurance claim process by assessing the damage, preparing an estimate of the repair costs, and negotiating with the insurance company to ensure you receive a fair settlement.

The Role of an Insurance Adjuster in Assessing Damage

The insurance adjuster’s role is to inspect the damage to your property and make an evaluation. They will determine whether the damage was indeed caused by hail and estimate the cost of repairs. It’s important to have your own public adjuster during this process to ensure an unbiased assessment. They can help challenge any underestimation of damage or repair costs by the insurance company’s adjuster.

Understanding Actual Cash Value and Replacement Cost Value

In the event of a successful claim, the insurance company will typically offer a payout based on either the Actual Cash Value (ACV) or the Replacement Cost Value (RCV) of your roof. ACV is the depreciated value of your roof, whereas RCV represents the cost of a new roof. Depending on your insurance policy, you would receive either the ACV or RCV.

Providing Proof of Repair or Replacement

After receiving the payout from the insurance company, you should commence the repair or replacement work promptly. Once completed, provide the insurance company with proof that the work was done. This could be in the form of invoices or receipts from the contractor.

Navigating the hail damage insurance claim process can be complex, but with the right guidance and support, you can ensure a fair and prompt settlement. At Insurance Claim Recovery Support, we’re committed to helping you through this process, advocating for your rights as a policyholder, and ensuring you receive the maximum amount you’re entitled to under your policy.

Navigating the Hail Damage Claim Process with Insurance Claim Recovery Support LLC

When you’re dealing with a hail damage insurance claim, it’s crucial to have someone knowledgeable and experienced on your side. At Insurance Claim Recovery Support, we’re dedicated to providing the support and representation you need to navigate the hail damage insurance claim process successfully.

How Insurance Claim Recovery Support Advocates for Policyholders

As a commercial or multifamily property owner, dealing with the aftermath of a hail storm can be overwhelming. We understand that each claim is unique and requires a personalized approach. As your advocates, we work tirelessly to ensure your claim is given the attention it deserves.

Our team, with over 15 years of experience and $300M+ settled in large loss claims, will gather evidence of the hail damage, take proactive measures to prevent further damage, and be prepared for when the claims adjuster assesses your property’s damage. We refuse to give recorded statements without proper legal counsel and anticipate negotiations to ensure a fair settlement.

The Unique Approach of Insurance Claim Recovery Support in Settling Property Damage Claims

We pride ourselves on our unique approach to settling property damage claims. We believe that your insurance policy is a contract, and its language, endorsements, exclusions, and provisions should be understood and adhered to. We take great measures to protect your interests against the army of insurance company representatives working to minimize your claim.

We guide you through each step of your claim process, ensuring careful planning, meticulous documentation, and strategic negotiation. We stand firm on the principle that a successful settlement involves more than just filing a claim.

Case Studies of Successful Hail Damage Claims Handled by Insurance Claim Recovery Support

Our team has successfully handled a multitude of hail damage claims. For example, we’ve worked with property owners who initially received a low settlement offer from their insurance company. In these cases, we stepped in to negotiate with the insurance company, resulting in a significantly increased payout for our clients.

We approach each case with the same level of dedication and commitment, ensuring our clients receive the maximum payout they’re entitled to under their policy. Our proven track record demonstrates our ability to successfully navigate the complexities of the hail damage insurance claim process.

In conclusion, navigating a complex insurance claim doesn’t have to be a daunting task. With Insurance Claim Recovery Support on your side, you can rest assured that you have a reliable and experienced advocate that will significantly lessen the burden and assist you throughout the hail damage insurance claim process. With our help, you can achieve peace of mind and secure a claim that fully compensates for your loss.

Hail Damage Insurance Claim Statistics and Trends

Navigating the insurance landscape can be a complicated task, and it’s important to arm yourself with as much information as possible. Let’s take a look at some statistics and trends in hail damage claims that can offer insight into the process and what to expect.

Average Insurance Payout for Hail Damage Roof

As per the Insurance Information Institute, homeowners insurance companies pay an average of nearly $12,000 for wind and hail home insurance claims. This figure can vary based on several factors such as the extent of the damage, the type of coverage you have and your deductible. Keep in mind, however, this is just an average. Some claims may result in higher payouts, while others may be lower.

Top States for Hail Damage Claims

Hail damage is more prevalent in specific regions. According to data from the National Insurance Crime Bureau, Texas tops the list of states with the most wind and hail insurance claims. Other states that frequently experience hail damage include Colorado, Nebraska, Minnesota, and Illinois. Being aware of the frequency of hailstorms in your area can help you understand the risk and better prepare for potential claims.

Impact of Hail Damage Claims on Insurance Rates

Hail damage claims can have an impact on your insurance rates. The extent of this impact largely depends on your insurer’s policies and the frequency of such claims in your area. In regions where hailstorms are common, insurance companies might increase premiums to offset the higher risk. However, at Insurance Claim Recovery Support, we believe in fair compensation for policyholders. We advocate for you, ensuring your claim is properly assessed and that you receive a fair settlement without undue increases in your insurance premiums.

In conclusion, understanding these trends and statistics can help policyholders set realistic expectations during the hail damage insurance claim process. Moreover, seeking professional help from a public insurance adjuster can make the process less stressful and more profitable, ensuring you receive the compensation you’re entitled to.

Conclusion

Dealing with hail damage and navigating the insurance claim process can be a daunting task. However, understanding the ins and outs of the hail damage insurance claim process can make the journey a lot smoother. Whether it’s identifying the damage, understanding your insurance policy, or negotiating with the insurance company, every step is crucial to ensure you get a fair settlement.

At Insurance Claim Recovery Support, we are committed to standing up for policyholders and advocating for their rights. We understand that each claim is unique, and we tailor our approach to meet the specific needs and circumstances of each client. Our years of experience and expertise enable us to effectively navigate the complexities of the insurance claim process and secure the best possible settlement for our clients.

It’s not just about getting a settlement; it’s about getting what you rightfully deserve. Don’t hesitate to seek legal counsel if you feel your claim is being unjustly denied or underpaid. As we’ve seen from the client testimonies, having a professional by your side can make a significant difference in your hail damage insurance claim process.

In conclusion, while hail damage can be devastating, you don’t have to face the aftermath alone. With a clear understanding of the claims process and the right professional help, you can turn a stressful situation into a manageable one. At Insurance Claim Recovery Support, we’re here to help you every step of the way, making sure you get the fair settlement you deserve.

Frequently Asked Questions

In this section, we’ll address some common questions about the hail damage insurance claim process. Whether you’re wondering about the impact of a claim on your insurance rates or how to negotiate a hail damage claim, we’ve got you covered. Stay tuned for the answers to these questions and more.

If you’re dealing with hail damage and need help navigating the insurance claim process, don’t hesitate to contact us at Insurance Claim Recovery Support. We’re here to help you get the fair settlement you deserve.

Frequently Asked Questions

How to Negotiate Hail Damage Claim?

Negotiating a hail damage claim can be challenging, but there are a few steps you can take to increase your chances of a favorable outcome.

Firstly, gather evidence of the hail damage, such as photos and videos. Take proactive measures to prevent further damage, like covering broken windows or damaged roofs with tarpaulins.

The next step is preparing for the claims adjuster’s assessment of your property’s damage. Be ready to discuss your documentation and demonstrate the extent of the damage.

Avoid giving a recorded statement without legal advice, as this can be used against you later in the process.

Don’t be surprised if the insurer proposes a lower settlement than expected; this is part of the negotiation process. If you’re not satisfied with the offer, consider seeking legal advice.

You don’t have to accept the first settlement offer. Be patient and prepared for negotiations.

For more insights on the process, check out our guide on hail damage claims.

What Happens if Your Property is Totaled from Hail Damage?

If your property is totaled from hail damage, your insurer will pay the claim based on the market value of the property at the time of the loss. However, if the payout does not cover the outstanding mortgage or loan amount, you will be responsible for covering the difference.

Do Insurance Companies Have to Match Siding After Hail Damage?

The answer to this question can vary based on your location and specific insurance policy. Some states require insurance companies to replace all siding if a reasonable match isn’t found. It’s recommended to review your policy and consult with your insurance adjuster or a legal expert to understand your rights.

Does a Hail Damage Claim Raise Homeowner’s Insurance Rates?

Filing a hail damage claim can potentially raise your homeowner’s insurance rates. However, the impact on your rates will depend on several factors, including your location, your insurance company’s policies, and whether you’ve filed previous claims. It’s best to discuss this with your insurance provider to understand how a claim might affect your premiums.

We at Insurance Claim Recovery Support understand the complexities of the hail damage insurance claim process. We’re here to help you navigate the process, ensuring you receive a fair and prompt settlement. Visit our website for more information and resources on hail damage claims.