When dealing with insurance claims dispute assistance, policyholders often face a daunting maze of paperwork and procedures. Whether you’re a property owner in Austin or manage multifamily complexes in San Antonio, navigating an insurance claim after a disaster like a fire or hurricane can be overwhelming. This introduction will provide a snapshot of how to approach these disputes effectively.

-

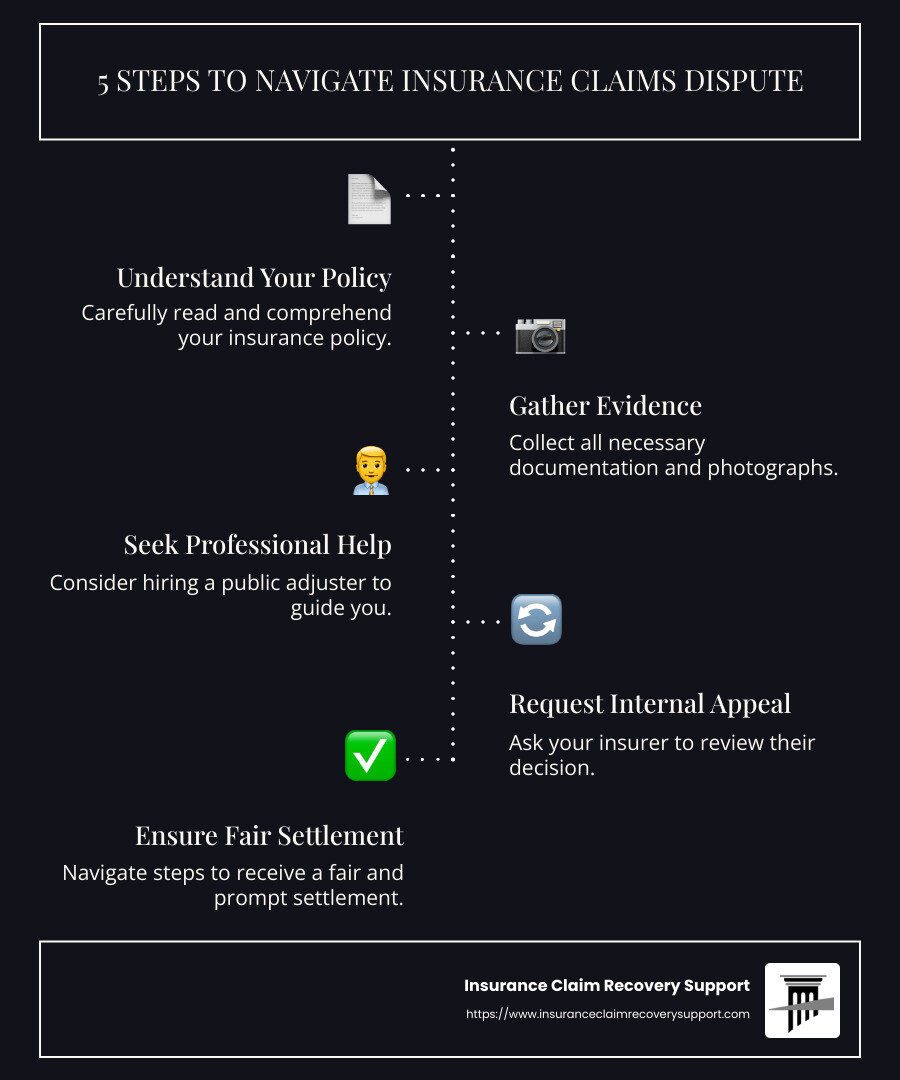

Understand Your Policy: Read your insurance policy carefully.

-

Gather Evidence: Collect all necessary documentation and photographs.

-

Seek Professional Help: Consider hiring a public adjuster to guide you.

-

Request Internal Appeal: Ask your insurer to review their decision.

Navigating these steps can help ensure you receive a fair and prompt settlement without unnecessary litigation.

As Scott Friedson, CEO of Insurance Claim Recovery Support, I have assisted policyholders in settling over $250 million in claims. My focus is on providing robust insurance claims dispute assistance to ensure you get the settlement you deserve. Up next, we’ll dive into more detailed assistance methods.

Understanding Insurance Claims Dispute Assistance

When it comes to insurance claims dispute assistance, understanding the appeal process, gathering evidence, and knowing when to seek professional help are key elements in resolving disputes effectively.

Appeal Process

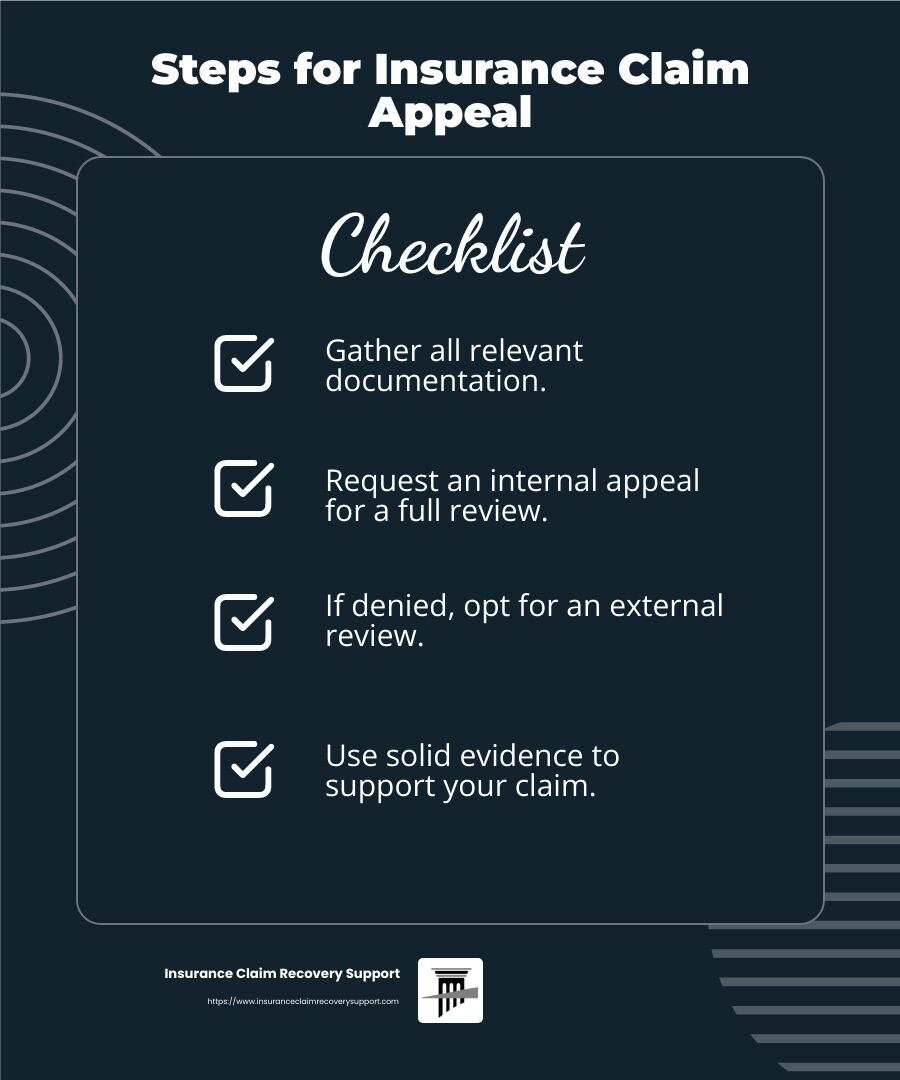

If your insurance claim is denied, you have the right to appeal. An internal appeal involves asking your insurance company to review their decision. This process requires the insurer to conduct a full and fair review. If your situation is urgent, they must expedite this process.

Should the internal appeal not lead to a satisfactory outcome, you can request an external review. This involves a third party examining your case, ensuring the insurance company does not have the final say on whether your claim is valid.

Evidence Support

Supporting your appeal with solid evidence is crucial. Start by gathering all relevant documentation, such as repair estimates, photographs of the damage, and any correspondence with your insurer. This evidence not only strengthens your case but also helps clarify any misunderstandings about the scope and cost of the damage.

Consider this: disputes often arise from differing interpretations of policy clauses. By presenting clear evidence, you can challenge any discrepancies and push for a fair resolution.

Professional Help

Navigating the complexities of insurance disputes can be overwhelming. This is where professional help becomes invaluable. Hiring a public adjuster or an insurance claim dispute resolution lawyer can significantly level the playing field. These professionals have the expertise to question your insurer’s stance, negotiate on your behalf, and ensure that you receive the maximum settlement possible.

At Insurance Claim Recovery Support, we understand the stress and frustration associated with insurance disputes. Our team is dedicated to providing comprehensive insurance claims dispute assistance, advocating for your rights, and ensuring a fair settlement.

By understanding the appeal process, gathering strong evidence, and seeking professional help when necessary, you can effectively steer the maze of insurance disputes. Next, we’ll explore the steps to resolve these disputes through various methods, including filing complaints and understanding your state’s insurance department procedures.

Steps to Resolve Insurance Disputes

When you face a disagreement with your insurance company, knowing the steps to resolve it can save time and stress. Whether it’s filing a complaint or exploring alternative dispute resolution (ADR) methods, each step brings you closer to a fair outcome.

File a Complaint

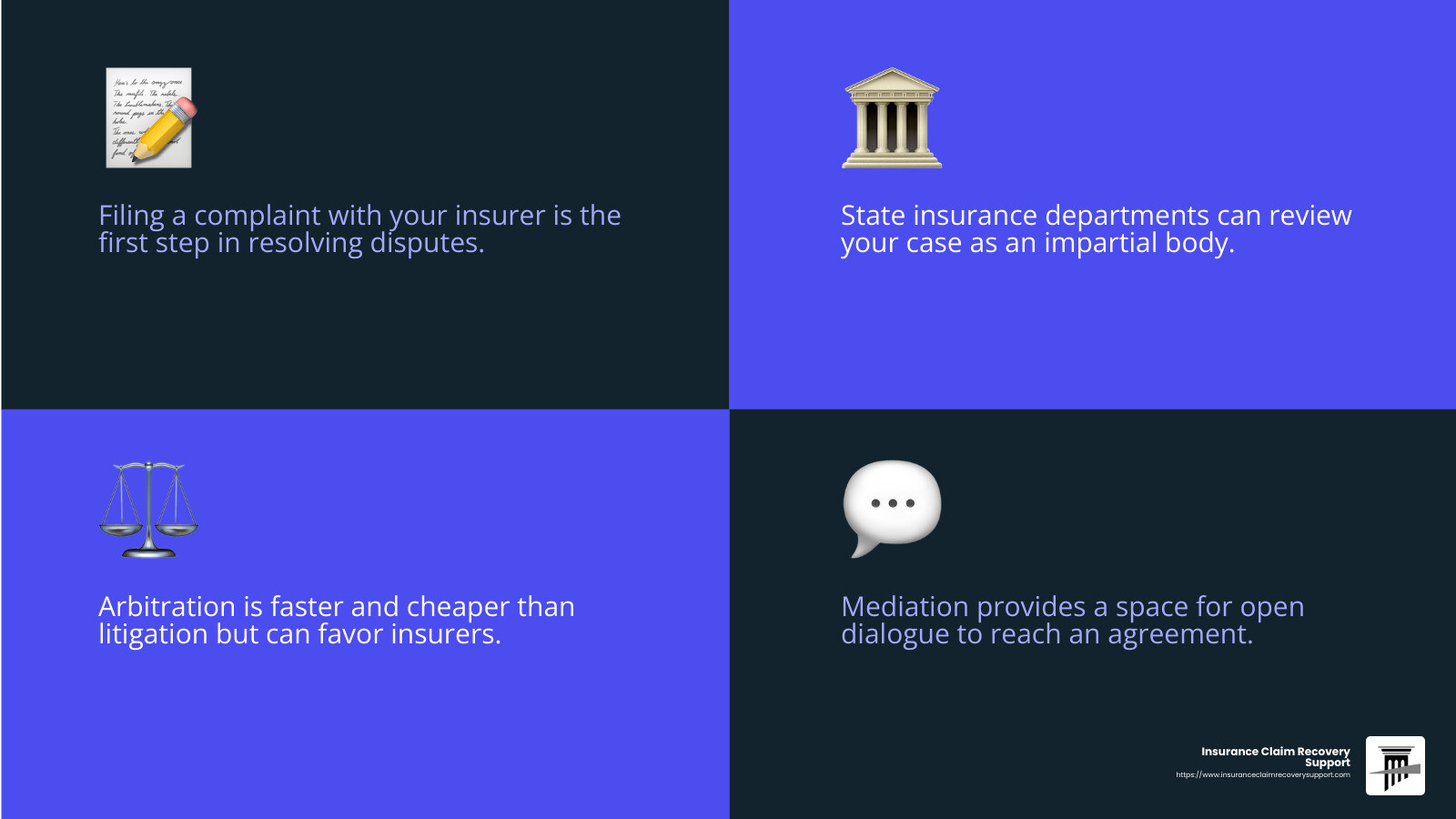

Your first move should be to file a complaint with your insurance company. Let them know you’re unhappy with their decision. Be clear about your reasons and back them up with evidence. If this doesn’t resolve the issue, you can take your complaint to your state insurance department.

State Insurance Department

State insurance departments are vital in handling disputes. They act as an impartial body to review your case. While they may not solve every issue, filing a complaint with them officially records your dissatisfaction. This step ensures your voice is heard and may prompt further investigation.

Arbitration

Arbitration offers a way to settle disputes without going to court. An independent arbitrator reviews your case and makes a decision. It’s often faster and less expensive than litigation. However, results can sometimes favor insurance companies, so weigh the pros and cons carefully.

Mediation

Mediation involves a neutral third party who helps both sides reach an agreement. It’s less formal than arbitration and allows for more open dialogue. Mediation is known for being quick and cost-effective. Yet, keep in mind that settlements may not always reflect the full value of your claim.

Litigation

If other options fail, litigation might be necessary. This involves taking your case to court, where a judge or jury will make a binding decision. While litigation can be lengthy and costly, it provides a formal setting to present your evidence and arguments.

Understanding these steps can empower you in resolving insurance disputes. Each path has its own set of advantages and challenges. Choose the one that aligns best with your situation and goals.

Up next, we’ll dive into alternative dispute resolution methods, including appraisal, mediation, and arbitration, to explore their unique benefits and drawbacks.

Alternative Dispute Resolution (ADR) Methods

When it comes to insurance claims dispute assistance, Alternative Dispute Resolution (ADR) methods offer a way to resolve conflicts without heading to court. These methods can save both time and money while keeping the process less adversarial. Let’s break down the main ADR methods: appraisal, mediation, and arbitration.

Appraisal

Appraisal is like calling in a referee to decide how much your claim is worth. Both you and the insurance company select an appraiser. If these two can’t agree, they bring in a third party, known as an umpire, to make the final call.

Pros:

– Typically faster and less costly than litigation.

– Focuses solely on the value of the loss, not whether the loss is covered.

Cons:

– Limited to disputes over the amount of the loss, not coverage issues.

– The decision is binding, which means you can’t appeal it later.

Mediation

Mediation involves a neutral third party who helps both sides come to an agreement. It’s a more informal process that encourages open communication.

Pros:

– Quick and cost-effective compared to going to court.

– Allows for creative solutions that both parties can agree on.

Cons:

– The mediator doesn’t make a decision; both parties must agree to the outcome.

– Settlements might not always cover the full value of your claim.

Arbitration

Arbitration is more formal than mediation but less so than a court trial. An arbitrator reviews your case and makes a binding decision.

Pros:

– Faster and cheaper than litigation.

– Private process, keeping details out of the public eye.

Cons:

– The arbitrator’s decision is final, with no right to appeal.

– Can sometimes favor insurance companies.

Each ADR method has its own set of advantages and challenges. When deciding which path to take, consider the specifics of your dispute, your resources, and your goals. ADR can be a powerful tool in resolving insurance disputes, offering a streamlined and less adversarial path to resolution.

Next, we’ll answer some frequently asked questions about insurance claims dispute assistance, so you can be better prepared for any challenges you might face.

Frequently Asked Questions about Insurance Claims Dispute Assistance

How do I fight an insurance claim against me?

Fighting an insurance claim against you can feel daunting, but knowing the right steps can make it manageable. First, avoid using key phrases that might suggest liability or guilt when communicating with the insurance adjuster. Instead, stick to the facts and provide clear, concise information.

If you’re challenging a claim, consider hiring a professional, like an attorney or a public adjuster, to help steer the process. They can offer guidance and ensure your rights are protected. The goal is to present a strong, evidence-backed case to support your position.

What to do when an insurance claim is denied?

A denied insurance claim isn’t the end of the road. Start by reviewing the denial letter carefully to understand why it was rejected. Then, gather evidence that supports your claim. This might include photos, repair estimates, or expert opinions.

Next, appeal the decision. Write a detailed letter to your insurance company explaining why you believe the denial was incorrect, and include the evidence you’ve gathered. Be sure to follow any specific appeal procedures outlined in your policy.

If the internal appeal doesn’t work, you can seek an external review. An independent third party will evaluate the dispute, and their decision is often binding on the insurer.

How to file a complaint with your state department of insurance?

If you’re still unsatisfied after trying to resolve the dispute with your insurer, filing a complaint with your state department of insurance is a viable option. Here’s how to steer the complaint process:

-

Gather Documentation: Collect all correspondence, policy documents, and evidence related to your claim and dispute.

-

Visit Your State’s Insurance Department Website: Most state departments have an online form or instructions for filing a complaint.

-

Submit Your Complaint: Fill out the form with all necessary details and submit it along with your documentation. Be clear and concise in describing your issue.

-

Follow Up: After submission, monitor the status of your complaint. The department may contact you for additional information or updates.

Filing a complaint can sometimes prompt the insurance company to reconsider their decision, especially if they fear regulatory scrutiny. This step can be crucial for ensuring your rights as a policyholder are respected.

By understanding these processes, you can approach insurance disputes with more confidence and clarity, knowing you have options to pursue a fair resolution.

Conclusion

Navigating insurance claims can be challenging, but at Insurance Claim Recovery Support, we are dedicated to making the process easier for you. Our commitment to policyholder advocacy means we stand by your side, ensuring you receive the attention and settlement you deserve.

We specialize in assisting with property damage claims, especially in the wake of Texas’s frequent fire and storm events. Our team is here to guide you, whether you’re in Austin, Dallas, Houston, or anywhere else in Texas, and beyond. We understand the stress these situations can bring, and we’re here to help you through every step of the insurance claim process.

Our focus is on securing the maximum settlement possible for our clients. We achieve this through meticulous documentation, expert negotiation, and a deep understanding of insurance policies. Our goal is not just to settle claims but to build lasting relationships with our clients.

If you find yourself in the midst of an insurance dispute, you don’t have to face it alone. With the right support and guidance, you can confidently steer the process and achieve a fair resolution.

For more information on how we can assist you with your insurance claims, visit our Public Adjuster Services page. Let us be your trusted partner in securing the settlement you need to move forward.