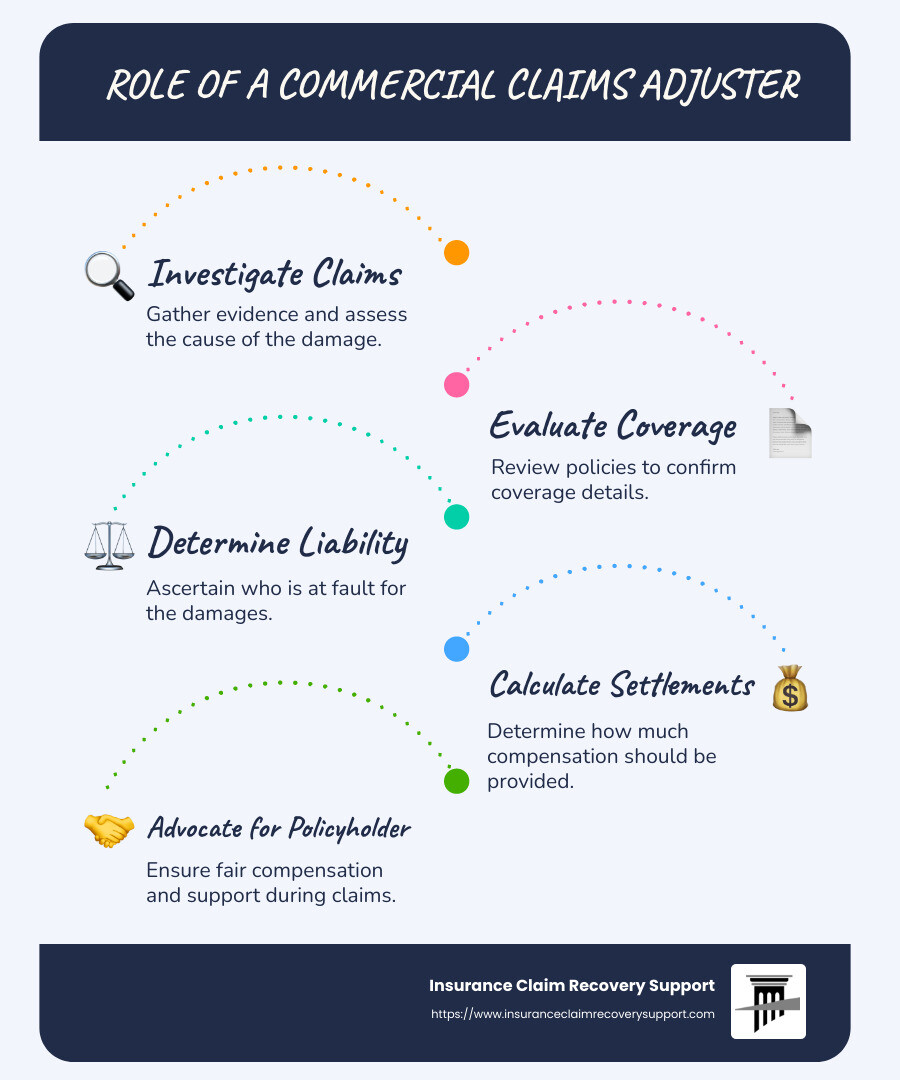

What does a commercial claims adjuster do? In simple terms, a commercial claims adjuster plays a crucial role in the insurance industry by ensuring that policyholders receive appropriate compensation for damages. Here’s a quick overview of their responsibilities:

- Investigate Claims: Gather evidence and assess the cause of damage.

- Evaluate Coverage: Review policies to confirm what’s covered.

- Determine Liability: Ascertain who is at fault for the damages.

- Calculate Settlements: Determine how much compensation a policyholder should receive.

A commercial claims adjuster is your ally in navigating insurance claims. They help you understand your insurance liability, ensuring you get the compensation you deserve for covered losses. Their role is vital, especially during stressful times following disasters like fires, floods, or hurricanes.

I’m Scott Friedson, a seasoned public adjuster and CEO of Insurance Claim Recovery Support. With a track record of settling over 500 large-loss claims valued at more than $250 million, I’ve digd extensively into understanding what does a commercial claims adjuster do and how they serve to protect your interests in claims negotiations.

Learn more about what does a commercial claims adjuster do:

- how to become a commercial claims adjuster

- what is the average salary for a commercial claims adjuster

What Does a Commercial Claims Adjuster Do?

Investigating Claims

A commercial claims adjuster’s first task is to investigate claims. This means they gather all the necessary details to understand what happened. They start by inspecting the damage. Whether it’s a broken window or a collapsed roof, they need to see it to assess the situation accurately.

Next, they interview witnesses. Speaking with people who saw the event can provide valuable insights. This might include employees, neighbors, or even passersby who were around when the incident occurred.

Finally, the adjuster collects and reviews any evidence. This can be photos, videos, or documents like police reports. All this information helps them build a complete picture of the claim.

Evaluating Coverage

Once the investigation is complete, the adjuster moves on to evaluating coverage. They carefully review policy terms to see what’s covered and what’s not. This step is crucial because it determines how much of the damage the insurance company is responsible for.

They also assess coverage limits. Every insurance policy has limits, and the adjuster ensures that the claim falls within those boundaries. This step protects both the insurance company and the policyholder from unexpected costs.

Determining Liability

Determining who is at fault is a significant part of the adjuster’s job. This fault assessment involves analyzing all the collected data to see who should be held responsible for the damages.

After figuring out liability, the adjuster works on settlement calculation. They estimate how much compensation the policyholder should receive based on the policy terms and the extent of the damage. This calculation must be fair to both parties, ensuring the policyholder gets what they deserve without overburdening the insurance company.

Through these steps, a commercial claims adjuster ensures that claims are handled fairly and efficiently. Their work is essential in helping businesses recover from losses and continue operations smoothly.

Skills and Qualifications for Success

To be a successful commercial claims adjuster, you need a unique blend of skills. This section will dive into the essential skills that help adjusters excel in their role.

Analytical Skills

Analytical skills are vital. Adjusters must evaluate the damage and estimate costs accurately. Imagine a storm damages a commercial building. The adjuster must assess not just visible damage but also hidden issues like water ingress.

Having a keen eye for detail helps in damage evaluation. They need to inspect the affected areas thoroughly and understand the implications of each type of damage. This ensures nothing is overlooked.

Cost estimation is another crucial aspect. Adjusters must determine repair costs using industry-standard tools. This ensures the settlement reflects the true cost of repairs.

Communication Skills

Strong communication skills are a must. Adjusters interact with policyholders, explaining complex terms in simple language. This helps build trust and keeps everyone informed.

Policyholder interaction is more than just talking. It’s about listening and understanding their concerns. This empathy helps in managing expectations and easing stress during a difficult time.

Negotiation is a big part of the job. Adjusters must advocate for fair settlements while balancing the insurance company’s interests. This requires clear, persuasive communication to reach an agreement beneficial to all parties.

Detail-Oriented

Being detail-oriented is non-negotiable. Adjusters must ensure documentation accuracy. Every piece of evidence, from photos to reports, must be carefully recorded. This accuracy is crucial for a fair settlement.

Evidence collection involves gathering all necessary documents, photos, and witness statements. This comprehensive approach ensures no detail is missed, leading to a thorough and fair claims process.

By mastering these skills, commercial claims adjusters play a crucial role in navigating the complexities of insurance claims, ensuring fair outcomes for all involved.

Next, let’s explore the claims process from filing to settlement.

The Claims Process

Navigating the claims process can feel overwhelming, but understanding each step can make it smoother. Let’s break down the journey from initial claim filing to receiving a settlement offer.

Initial Claim Filing

The first step in the claims process is contacting your insurance company. When you notice damage to your property, reach out to them immediately. Be sure to have your policy number and any relevant documents handy. This helps speed up the process and ensures you meet any reporting deadlines.

If the damage involves theft or vandalism, filing a police report is crucial. This not only adds credibility to your claim but also provides essential documentation for the insurance company.

Adjuster Investigation

Once your claim is filed, an insurance claims adjuster will step in to investigate. Their job is to review what happened and estimate the claims payment. This involves:

- Inspecting the damage: The adjuster will visit your property to assess the situation firsthand. Being present during this inspection ensures that nothing is overlooked.

- Gathering evidence: They’ll collect all necessary documents, photos, and witness statements. This comprehensive approach helps in determining the insurance company’s liability.

- Evaluating coverage: The adjuster will review your policy to see what is covered and assess the coverage limits.

Mark Snyder, a claims expert, emphasizes that adjusters document and quantify the resulting damages. This thorough investigation is vital for determining the insurance company’s liability.

Settlement Offer

After the investigation, the adjuster will calculate a settlement offer. This involves determining how much you should receive to cover the damages. The adjuster balances your needs with the insurance company’s guidelines to come up with a fair amount.

If you agree with the offer, you can accept it. If not, you might need to negotiate or provide additional documentation, like professional estimates or new photos.

Kenny Taylor, a public adjuster, notes that both independent and staff adjusters are responsible for ensuring every penny paid out is justified under the terms of the policy. This ensures that the settlement reflects the true cost of repairs.

By understanding these steps, you can be better prepared to steer the claims process and work towards a fair settlement. Next, we’ll explore some frequently asked questions about commercial claims adjusters.

Frequently Asked Questions about Commercial Claims Adjusters

How Stressful is Being a Claims Adjuster?

Being a claims adjuster can be quite stressful. Imagine a storm hits, causing widespread damage. Suddenly, adjusters have a surge of cases to handle. They often work long, unpredictable hours to process claims quickly.

High stress comes from dealing directly with individuals who have experienced loss or damage. These conversations can be emotionally charged. Adjusters must steer these interactions with empathy and professionalism, all while managing their own stress levels.

Deadlines are also a constant challenge. Adjusters need to process claims efficiently to meet both the claimants’ and the insurance company’s expectations. This pressure is especially high after major events like natural disasters.

What is the Purpose of a Claims Adjuster?

A claims adjuster’s main role is to investigate insurance claims and determine the extent of the insurance company’s liability. They ensure that claims are processed fairly and accurately, and that policyholders receive the appropriate compensation for covered losses.

Here are the key responsibilities of a claims adjuster:

- Investigating Claims: Review and assess the validity of claims.

- Evaluating Coverage: Determine the extent of coverage based on the policy.

- Determining Liability: Investigate to find out who is at fault.

- Calculating Settlements: Figure out how much the insurance company should pay.

- Negotiating Settlements: Work with all parties to reach a fair settlement.

- Documenting Claims: Keep detailed records of findings and settlements.

- Customer Service: Communicate with policyholders and claimants to explain the process and provide updates.

What Skills Does a Claims Adjuster Need?

Analytical skills are crucial. Adjusters need to assess damages accurately and determine the cost of repairs. For example, if a tree falls on a property, a skilled adjuster will look beyond visible damage to assess hidden issues.

Communication skills are essential. Adjusters interact with policyholders, claimants, and other parties. They must explain findings clearly and negotiate settlements effectively.

Detail-oriented individuals excel in this role. Adjusters must document every aspect of their investigation carefully to ensure nothing is missed.

Interpersonal skills help adjusters manage emotionally charged situations. They need to handle conversations with empathy and professionalism, especially when dealing with individuals who have experienced loss.

By understanding these aspects, you can appreciate the complexity and demands of the job. Next, we’ll dig into the skills and qualifications necessary for success as a commercial claims adjuster.

Conclusion

At Insurance Claim Recovery Support, we are dedicated to advocating for policyholders. Navigating the complex world of insurance claims can be overwhelming, especially when dealing with commercial property damage. Our mission is to ensure that you receive the maximum settlement you deserve.

We understand that every claim is unique. Whether it’s damage from a fire, hurricane, or flood, our team carefully documents and evaluates every detail. We don’t just settle for what’s offered; we fight for the fullest possible compensation.

Being located in Texas, we are familiar with the challenges faced by businesses across Austin, Dallas-Fort Worth, San Antonio, Houston, and beyond. We serve clients nationwide, bringing our expertise to those who need it most.

Our approach is simple: we stand by you, the policyholder. Our commitment is to make sure you are not shortchanged and that your recovery process is as smooth as possible. Let us be your guide and advocate in securing the settlement you need to move forward.

For more information on how we can assist you with your commercial property insurance claim, visit our Commercial Property Public Insurance Adjusters page. We’re here to help you rebuild and recover without financial strain.