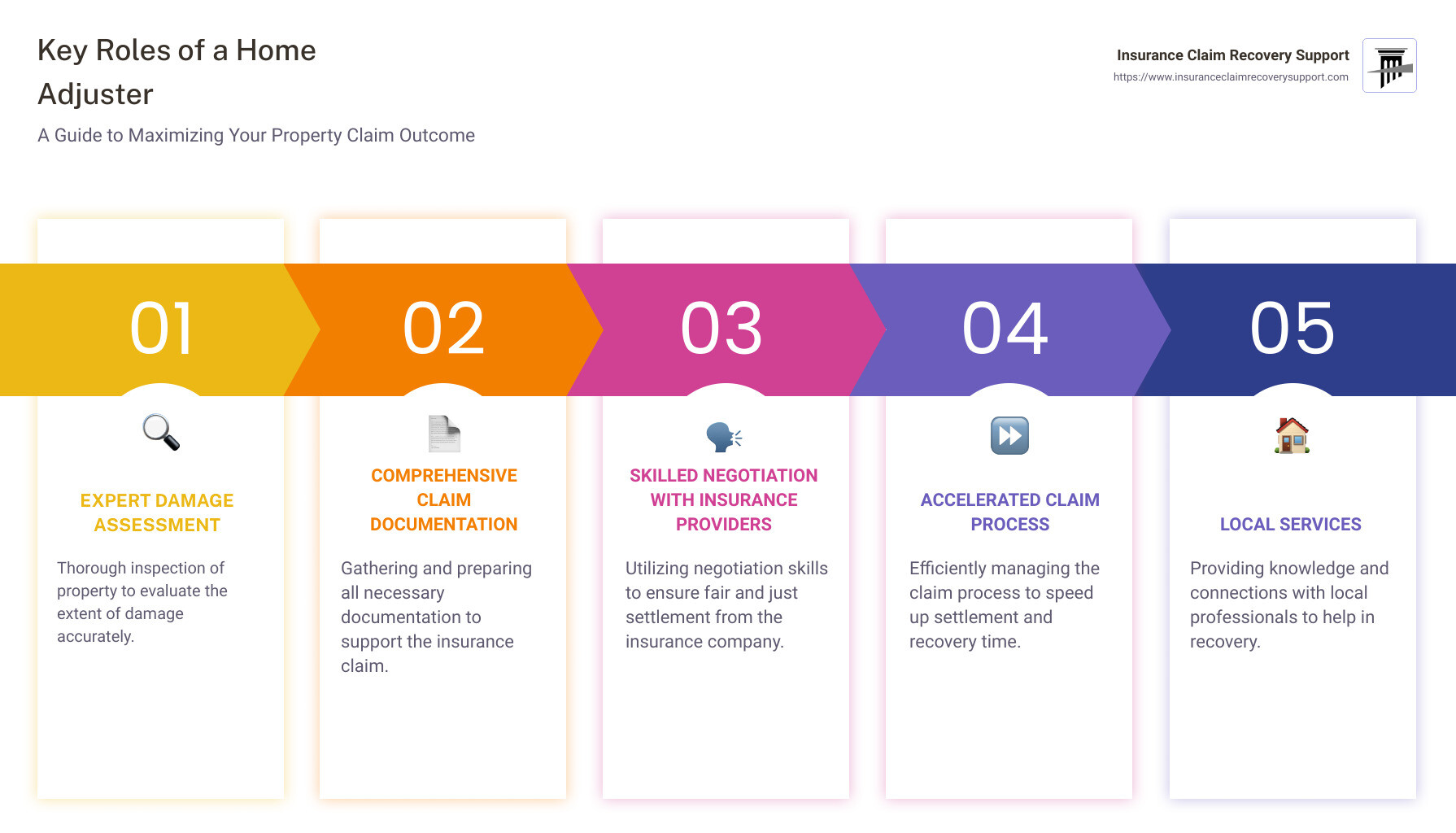

Looking for home adjuster services? Here’s a quick guide to what every home adjuster should offer:

– Expertise in your specific type of property damage (fire, hail, hurricane, tornado, flood).

– Navigation through the insurance claim process, ensuring fairness and prompt settlement.

– Advocacy on your behalf against insurance companies.

– Local services if you’re searching for “home adjuster near me”.

When unexpected property damage occurs, it’s not just the physical loss that affects property owners; the ensuing claim process can be equally daunting. For commercial, multifamily, or apartment property owners grappling with the aftermath of natural disasters, finding a qualified home adjuster becomes crucial.

The right adjuster can bridge the gap between despair and recovery, ensuring your insurance claim is handled with the expertise and dedication it demands. This role is more than just assessing property damage; it’s about fighting for the policyholder’s right to a fair and timely settlement, navigating the labyrinth of insurance jargon, and lifting the burden of documentation and negotiation from the property owner’s shoulders.

But what exactly should you know about home adjusters to make an informed decision? Here’s a succinct guide.

Understanding Policy Details

When it comes to insurance, the devil really is in the details. For home adjusters, a deep understanding of policy details is not just beneficial—it’s absolutely crucial. Let’s dive into the essentials around coverage limits and exclusions.

Coverage Limits: This is the maximum amount an insurance company will pay for a covered loss. Knowing this figure is crucial for home adjusters, as it directly influences the claim settlement process. It’s important for home adjusters to communicate these limits clearly to policyholders to manage their expectations regarding the payout.

Exclusions: Just as important as knowing what is covered is understanding what is not. Exclusions are specific conditions or circumstances that are not covered by the insurance policy. For home and business adjusters, being well-versed in exclusions helps prevent surprises during the claims process and ensures policyholders are adequately informed about what their policy does and does not cover.

Why It Matters: For home damage adjusters and home public adjusters, an in-depth knowledge of policy details facilitates accurate claim evaluation and helps in guiding policyholders through the claims process. It also aids in identifying any potential areas where additional coverage or endorsements might be necessary, offering a more comprehensive service to policyholders.

Practical Tip for Policyholders: If you’re in the process of filing a claim or considering hiring a ‘home adjuster near me’, take the time to review your policy details. Understanding your coverage limits and exclusions will equip you with the knowledge needed to navigate the claims process more effectively.

By focusing on policy details, home and business public adjusters play a pivotal role in bridging the gap between policyholders and insurance companies. This not only ensures a smoother claims process but also maximizes policyholder satisfaction through clear communication and transparent handling of claims.

As we move into the next section on accurately assessing property damage, keep in mind how integral a thorough understanding of policy details is in setting the stage for a fair and efficient adjustment process.

Continuing to the next section, we’ll delve into the importance of Assessing Property Damage Accurately—a critical step that relies heavily on the groundwork laid by understanding policy details.

In the realm of home adjusting, accurately assessing property damage is not just a duty—it’s an art that requires keen observation, technical knowledge, and a deep understanding of the unique circumstances surrounding each claim. Here are some key insights for home adjusters, home and business adjusters, and especially home public adjusters on how to master this critical aspect of their role.

Inspection Techniques

The first step in accurate damage assessment is meticulous inspection. Here are some techniques that can help:

- Visual Inspection: Start with a comprehensive visual examination of the property. Look for obvious signs of damage and also for subtle indicators that might not be immediately apparent.

- Use of Technology: Drones and thermal imaging can reveal damages that are difficult to see with the naked eye, such as roof damage or water leakage behind walls.

- Detailed Documentation: Take notes and photographs of all damages. This documentation will be invaluable when creating your damage report.

Damage Assessment

Once you’ve inspected the property, the next step is to assess the damage accurately. This involves:

- Understanding the Types of Damage: Know the difference between structural damage, water damage, fire damage, and so on. Each type of damage requires a different approach.

- Estimating Repair Costs: Use updated insurance cost software to estimate the repair costs accurately. This helps in making a fair offer of settlement to the insured.

- Considering Depreciation: Understand how to calculate the depreciation of damaged items. This is crucial for determining the actual cash value of a claim.

Key Takeaways for Home and Business Public Adjusters

- Be Thorough: A detailed inspection leaves no stone unturned. Even minor damages can have significant implications for a claim.

- Stay Updated: Use the latest tools and technologies to assist in your assessments. This not only improves accuracy but also efficiency.

- Keep Learning: Every claim is a learning opportunity. The more you understand about different types of damages and their implications, the better you’ll become at your job.

Finding a Home Adjuster Near Me

For policyholders looking for professional assistance, finding a ‘home adjuster near me’ or ‘home and business public adjusters’ can make a significant difference in the claims process. Professionals bring expertise and objectivity to the table, ensuring fair and thorough damage assessments.

In conclusion, accurately assessing property damage is a cornerstone of the home adjusting process. It requires a blend of technical skill, attention to detail, and a comprehensive understanding of the types of damage and their repair costs. For home damage adjusters and especially home public adjusters, mastering these aspects is key to maximizing policyholder satisfaction and ensuring the integrity of the claims process.

Continuing on, the next section will explore the role of public adjusters in more detail, shedding light on their advocacy and negotiation skills essential for navigating the claims process.

Navigating the claims process is a pivotal part of the work done by home adjusters, home and business adjusters, and especially home public adjusters. This stage requires meticulous attention to documentation, strict adherence to deadlines, and clear, continuous communication with policyholders. Here, we’ll break down these aspects to provide a clear understanding of how to effectively navigate the claims process.

Documentation

Thorough documentation is the backbone of a successful claims process. This involves:

-

Collecting Evidence: Photos, videos, and detailed notes on the damage. This visual and written evidence is crucial for accurately assessing the claim.

-

Gathering Receipts and Estimates: Collecting receipts for any immediate repairs or replacements and obtaining estimates for future work is essential. This information helps in accurately determining the claim amount.

-

Filing a Detailed Claim: The more detailed the claim, the easier it is for an adjuster to process and for the insurer to understand the extent of the damage and the compensation required.

Deadlines

Meeting deadlines is critical in the claims process for both the adjuster and the policyholder. This includes:

-

Claim Submission Deadlines: Ensuring that the claim is submitted within the insurance company’s specified timeframe.

-

Documentation Deadlines: Submitting all required documents and evidence in a timely manner to avoid delays in the claim process.

-

Response Times: Adhering to the insurer’s and policyholder’s response times to ensure a smooth and speedy claims process.

Policyholder Communication

Effective communication with the policyholder is vital throughout the claims process. This includes:

-

Initial Contact: Explaining the claims process clearly and providing a list of needed documentation and important deadlines.

-

Regular Updates: Keeping the policyholder informed about the status of their claim, any issues encountered, and the expected timeline for resolution.

-

Clarifying Doubts: Being available to answer any questions the policyholder may have, clarifying policy details, and explaining decisions regarding the claim.

-

Finalizing the Claim: Clearly communicating the outcome of the claim, the settlement amount, and any next steps required from the policyholder.

Utilizing Technology

Incorporating technology can significantly streamline the claims process. Tools such as mobile apps for documenting damage, software for managing claims, and platforms for virtual communication can enhance efficiency and accuracy.

Conclusion

Navigating the claims process effectively requires a strong foundation in documentation, an adherence to deadlines, and excellent communication with policyholders. By focusing on these aspects, home adjusters and home public adjusters can ensure a smoother, more transparent, and efficient process, leading to higher satisfaction for policyholders and more accurate outcomes for claims. This approach not only benefits the policyholders but also reinforces the integrity of the claims process.

As we delve into the next section, we’ll explore the Role of Public Adjusters, highlighting their advocacy, negotiation skills, and how they play a crucial role in representing the policyholder’s best interests throughout the claims process.

The Role of Public Adjusters

Transitioning from understanding the initial steps of the claims process, it’s pivotal to focus on the essential players who can significantly impact the outcome of an insurance claim. Public adjusters stand out as champions for policyholders, navigating the often complex terrain of insurance claims. Their role is multifaceted, emphasizing advocacy and negotiation skills that are critical in securing a fair settlement for home and business adjusters.

Advocacy: Your Shield in the Claims Process

At the heart of a public adjuster’s mission is advocacy. Unlike company or independent adjusters, who are hired by insurance companies, public adjusters work exclusively for the policyholder. This distinction is crucial, as it means public adjusters’ sole focus is to represent your interests. They step into the policyholder’s shoes, navigating the claims process with a keen eye on maximizing the claim payout.

As highlighted by experts, including those at Insurance Claim Recovery Support, public adjusters bring a wealth of knowledge and expertise in insurance policies and the claims process. This expertise allows them to identify coverage details that policyholders might overlook, potentially unlocking thousands of dollars in additional claim funds.

Negotiation Skills: Maximizing Your Settlement

Negotiation is where public adjusters truly shine. With an in-depth understanding of insurance policies and the claims process, they are equipped to negotiate with insurance companies assertively. The goal is not just to settle a claim but to ensure that the settlement is fair and just, reflecting the true extent of the damage and the policyholder’s entitlements under their insurance policy.

For example, in the aftermath of a disaster, the initial offer from an insurance company might not fully cover the extent of the damage. Public adjusters, with their sharp negotiation skills, can challenge these offers, armed with detailed assessments and justifications for a higher payout. Their ability to negotiate effectively is often rooted in their comprehensive understanding of insurance laws and regulations, as well as their experience with various types of claims, from fire and storm damage to structural assessments.

The Bridge to a Fair Settlement

Public adjusters serve as the bridge between policyholders and insurance companies. They ensure that the policyholder’s voice is heard and that their claim is treated fairly. This role is especially crucial in situations where the damage is extensive, and the claim process becomes complex and daunting for the average homeowner or business owner.

Hiring a public adjuster can make a significant difference in the outcome of your insurance claim. Whether it’s a home adjuster near me search or seeking referrals for home and business public adjusters, finding a skilled and experienced public adjuster can provide peace of mind and a more favorable claim settlement.

It’s essential to keep in mind the legal and ethical considerations that guide the work of public adjusters. Their adherence to fair claims practices and state regulations not only ensures that they operate within the bounds of the law but also that they uphold the highest standards of professionalism and integrity in their advocacy and negotiation efforts.

Next, we’ll delve into the crucial aspects of Legal and Ethical Considerations in the insurance claims process, further underscoring the importance of choosing the right public adjuster to represent your interests.

Legal and Ethical Considerations

When it comes to managing insurance claims, home adjusters, including home public adjusters, must navigate a complex landscape of legal and ethical standards. These standards are not just guidelines but are crucial for ensuring fair treatment of policyholders and maintaining the integrity of the claims process.

Fair Claims Practices: Every state has regulations designed to protect consumers against unfair claims practices. These practices include failing to act promptly on claims, denying claims without a reasonable investigation, and not providing a clear explanation for claim denial or settlement offers. Understanding and adhering to these practices is essential for home adjusters to serve their clients effectively. The National Unfair Claim Settlement Practices Act provides a framework that many states adopt and customize, ensuring that home adjusters across the country are held to high standards of fairness and accountability.

State Regulations: The requirements and regulations for home adjusters can vary significantly from one state to another. For instance, holding a license in one state allows a public adjuster to practice there, but to operate in another state, they might need to meet additional requirements unless there is a reciprocity agreement. This complexity underscores the importance for home and business public adjusters to be well-versed in the specific laws and regulations of the states where they operate. The varying regulations can impact how claims are handled, from documentation to settlement negotiations.

Home and business adjusters must prioritize ethical practices in their work. This includes providing honest assessments, acting in the best interest of the policyholder, and avoiding any actions that could be construed as misrepresenting facts or policy provisions. For example, an adjuster must not advise a policyholder to inflate a claim or submit false documentation.

Ethical Considerations: Beyond legal requirements, home damage adjusters are expected to adhere to a code of ethics that emphasizes honesty, integrity, and professionalism. They should treat all parties involved in a claim with respect and dignity, ensuring that their actions do not disadvantage any party. Ethical considerations also extend to how adjusters manage conflicts of interest, maintain confidentiality, and communicate transparently with policyholders.

Maximizing Policyholder Satisfaction: At the heart of ethical considerations is the goal of maximizing policyholder satisfaction. This involves not only ensuring that policyholders receive the benefits they are entitled to under their insurance policies but also that they are treated fairly and with respect throughout the claims process. Home adjusters play a critical role in this process by acting as advocates for the policyholder, negotiating settlements, and helping navigate the complexities of the insurance claim process.

For home adjusters, including those looking for a “home adjuster near me” or “home and business public adjusters,” understanding and adhering to legal and ethical considerations are not just about compliance. They are about building trust with policyholders, ensuring fair and equitable treatment, and ultimately, contributing to the integrity of the insurance industry as a whole.

In the next section, we’ll look at how technology is being utilized by home adjusters to streamline the claims adjustment process, improve accuracy, and enhance overall policyholder satisfaction.

Maximizing Policyholder Satisfaction

Ensuring the satisfaction of policyholders is a cornerstone in the role of home adjusters, including home and business adjusters, home damage adjusters, and home public adjusters. Achieving high levels of satisfaction hinges on effective customer service and efficient claim resolution strategies. Here’s how adjusters can excel in these areas:

Be Clear and Communicative

Clear communication is key. Policyholders appreciate when home adjusters keep them informed about the status of their claim and what steps are involved. This includes explaining the claims process in simple terms, setting realistic expectations for resolution times, and being transparent about potential challenges.

Act with Empathy and Understanding

Dealing with home damage can be a stressful experience for policyholders. Home adjusters who approach their interactions with empathy can significantly impact the policyholder’s experience. Listening actively and acknowledging the policyholder’s concerns can build trust and facilitate a smoother claims process.

Utilize Technology for Efficiency

Technology, such as claims management software and mobile apps, can greatly enhance the efficiency of the claims process. For instance, policyholders can submit evidence of damage through apps, and adjusters can use software to organize and track claims. This not only speeds up the process but also reduces the potential for errors.

Offer Personalized Solutions

No two claims are the same. Home adjusters who tailor their approach to the unique needs of each policyholder can significantly improve satisfaction. This may involve providing additional support for complex cases or offering flexible communication methods, such as text updates or video calls.

Follow-Up After Claim Resolution

The relationship with the policyholder doesn’t end once the claim is resolved. Following up to ensure that they are satisfied with the outcome and addressing any post-resolution concerns reinforces the policyholder’s value and can lead to positive referrals.

Educate Policyholders

Knowledge is power. Home adjusters who take the time to educate policyholders about their policies, including coverage limits and exclusions, empower them to make informed decisions in the future. This proactive approach can prevent misunderstandings and disputes down the line.

By focusing on these areas, home adjusters, including those searching for “home adjuster near me” or “home and business public adjusters,” can maximize policyholder satisfaction. Satisfied policyholders are more likely to view their insurance experience positively, which benefits both the policyholder and the adjuster in the long term.

In the next section, we’ll delve into how technology is revolutionizing the way home adjusters perform their duties, from assessment tools to software that streamlines the entire claims process.

Utilizing Technology in Claims Adjustment

In today’s world, technology plays a crucial role in almost every profession, and the field of home adjusting is no exception. Home adjusters, home and business adjusters, and particularly home public adjusters have at their disposal an array of software tools and mobile apps designed to make their jobs more efficient and effective. Let’s explore some key technological advancements that are transforming the way home damage adjusters work.

Software Tools

-

Estimation Software: Estimation software has become indispensable for home adjusters. These programs allow adjusters to quickly assess the cost of repairs for home and business properties with precision. They often include updated pricing databases that reflect current market rates for labor and materials, ensuring that estimates are as accurate as possible.

-

Claims Management Systems: These comprehensive platforms help adjusters manage their caseloads more efficiently. They can track the progress of multiple claims, set reminders for important deadlines, and store essential documents all in one place. This centralized approach streamlines the process, reducing the risk of errors and oversight.

-

Digital Inventory Tools: In the aftermath of a disaster, creating an inventory of lost or damaged property can be a daunting task for policyholders. Digital inventory tools simplify this process, allowing adjusters and policyholders to document items electronically, often with the ability to upload photos and receipts directly into the system.

Mobile Apps

-

Damage Assessment Apps: Mobile apps have made on-site assessments more straightforward and thorough. Adjusters can now use their smartphones or tablets to take photos, record voice memos, and even fly drones to capture aerial footage of roof damage or large-scale property loss. These apps often integrate with estimation software, allowing for real-time data entry and analysis.

-

Communication Apps: Effective communication with policyholders is key to a smooth adjustment process. Mobile apps that facilitate secure messaging, video calls, and document sharing help keep all parties informed and engaged throughout the claims process. This level of transparency builds trust and can lead to higher policyholder satisfaction.

-

Virtual Reality (VR) and Augmented Reality (AR): While still emerging in the field, VR and AR technologies offer exciting possibilities for home adjusters. These tools can simulate damage scenarios, provide virtual tours of properties to assess conditions remotely, or overlay repair estimates onto real-world images of damage, providing a more dynamic and informative assessment process.

In Conclusion, the adoption of technology by home adjusters, including those looking for a ‘home adjuster near me’ or ‘home and business public adjusters,’ is not just about keeping up with the times. It’s about leveraging the best tools available to provide accurate assessments, streamline the claims process, and ultimately, enhance the experience for policyholders. As technology continues to evolve, so too will the ways in which home adjusters perform their critical work.

In the next section, we’ll examine the importance of staying up-to-date on legal and ethical considerations to ensure fair and equitable claims practices.

Handling Large and Complex Claims

Dealing with large and complex claims like fire damage, storm damage, and structural assessments requires a unique set of skills and knowledge. Here’s what every home adjuster needs to know to manage these challenging situations effectively:

Fire Damage

Fire damage is one of the most complex types of claims due to the extensive and varied damage it can cause. From charred structures to smoke and water damage, a comprehensive approach is necessary. According to Insurance Claim Recovery Support (ICRS), a thorough understanding of fire damage and the claims process is crucial. This includes recognising ensuing water damage, asbestos, and other additional damages potentially caused by efforts to extinguish the fire. It’s imperative to act swiftly to mitigate further damage and accurately document all aspects of the loss.

Storm Damage

Storm damage claims can involve a wide range of issues, from roof damage due to hail to flooding. Home adjusters must be adept at assessing the full scope of damage, which often requires an eye for both the obvious and subtle impacts of the storm. This might include hidden water intrusion or wind damage that’s not immediately apparent. Quick, thorough inspections and accurate damage assessment are key to ensuring policyholders receive fair compensation for their losses.

Structural Assessments

Structural damage, whether from a fire, storm, or other cause, requires a detailed understanding of construction and engineering principles. Identifying the signs of structural instability or damage is critical. Home adjusters may need to work closely with engineers and construction experts to evaluate the extent of the damage and the necessary repairs. Knowledge of building codes and the latest repair techniques is also essential for accurate claim handling.

Key Strategies for Home Adjusters Handling Large Claims:

– Rapid Response: Time is of the essence. Quick action can prevent additional damage and expedite the claims process.

– Thorough Documentation: Detailed records of all damages, communications, and assessments are vital for accurate claim processing.

– Expert Consultation: Don’t hesitate to consult with specialists, such as structural engineers or fire damage restoration experts, to understand the full extent of the damage.

– Clear Communication: Keep the policyholder informed throughout the process. Transparency builds trust and helps manage expectations.

– Understand Policy Details: Be well-versed in the policyholder’s coverage. This ensures that all entitled benefits are considered during the claim process.

For home public adjusters, tackling large and complex claims is a significant responsibility. The ability to navigate these challenges not only helps policyholders recover from catastrophic events but also reinforces the importance of skilled home adjusters in the insurance industry. Continuing education and adaptation to new technologies will remain crucial for home adjusters to stay effective in this critical role.

In our next section, we’ll delve into the legal and ethical considerations that are fundamental to maintaining fair claims practices and ensuring the integrity of the claims adjustment process.

Continuing Education and Certification

For home adjusters, insurance claims is ever-changing. Laws evolve, new types of damage emerge, and insurance policies update. To keep pace, continuing education and certification are not just beneficial—they’re essential.

Why It Matters

Continuing education ensures that home and business adjusters stay updated on the latest industry trends, laws, and techniques. It’s about sharpening your skills to serve policyholders better. For home damage adjusters, knowing the current best practices for assessing damage can make a significant difference in the accuracy of a claim.

Certification, on the other hand, acts as a badge of expertise and trustworthiness. It tells policyholders, “You’re in capable hands.”

Training Programs

There’s a variety of training programs available for home public adjusters. These programs cover everything from basic insurance principles to advanced claims handling techniques. For those looking to specialize, courses on fire damage, storm damage, and structural assessments are invaluable.

Several reputable institutions and online platforms offer these courses. For instance, Insurance Schools, Inc. and AdjusterPro provide extensive training materials designed to prepare students for their state’s licensing examinations.

Licensing Requirements

Becoming a licensed home adjuster near me means meeting state-specific requirements. This could include passing an exam, submitting fingerprints, and completing a certain number of education hours. For example, in Texas, aspiring adjusters must pass an exam, submit fingerprints, and apply online with an application fee of $50. Each state has its own set of rules, so it’s important to research the specific requirements where you plan to work.

In states like California, additional steps such as completing a background check and executing a surety bond are necessary.

The Role of Continuing Education Credits

To maintain their licenses, home and business public adjusters must complete a certain number of continuing education (CE) hours. These courses keep adjusters informed about changes in policies, regulations, and claim handling procedures.

Staying compliant isn’t just about keeping your license; it’s about being a responsible and competent adjuster. Your knowledge and skills directly impact the outcomes of the claims you handle. Thus, investing in continuous learning is critical.

Conclusion

For home adjusters, the journey doesn’t stop at certification. The landscape of insurance adjusting is dynamic, and staying ahead requires a commitment to ongoing education and professional development. Embrace it, and you’ll not only enhance your career but also improve the service you provide to policyholders.

Remember that continuous learning and ethical practice set the foundation for success in the insurance adjusting field.

In our next section, we’ll explore the importance of legal and ethical considerations in maintaining the integrity of the claims adjustment process.

Building a Network of Professionals

In home adjusters, the journey doesn’t end at assessing damages and filing claims. A robust network of professionals including contractors, restoration services, and legal experts can significantly enhance the quality of your service. Here’s why and how to build such a network:

Why a Strong Network Matters

- Quick Response: After a disaster, a strong network allows home and business adjusters to quickly mobilize the necessary professionals, ensuring a faster recovery for the policyholder.

- Quality Repairs: Working with trusted contractors ensures that repairs meet a high standard, which is crucial for both policyholder satisfaction and the integrity of the claims process.

- Expert Insights: Complex claims often require specialized knowledge. Legal experts and restoration services can provide the expertise needed to navigate these intricacies, from legal considerations to the technical aspects of restoration.

Who to Include in Your Network

- Contractors: Reliable contractors who are experienced in repairing home and commercial property damages are invaluable. They not only execute repairs but also help in accurately estimating costs.

- Restoration Services: Experts in fire, water, and mold restoration can offer specialized assessments and services that ensure a comprehensive recovery from various types of damage.

- Legal Experts: Lawyers familiar with insurance law can offer guidance on complex claims, helping home damage adjusters navigate potential legal pitfalls.

Building Your Network

- Attend Industry Events: Conferences and seminars are great places to meet professionals in related fields.

- Leverage Social Platforms: Platforms like LinkedIn or industry-specific forums can be useful for connecting with potential network members.

- Seek Recommendations: Ask colleagues or satisfied policyholders for referrals to high-quality professionals they’ve worked with.

- Offer Value: Networking is a two-way street. Consider how you can offer value to your contacts, perhaps by referring policyholders in need of their services.

Maintaining Your Network

- Stay in Touch: Regular check-ins, even just to share industry news or say hello, keep relationships warm.

- Collaborate on Training: Jointly attending or hosting educational sessions can strengthen your professional relationships and keep everyone updated on best practices.

- Provide and Seek Feedback: After working with someone in your network, offer constructive feedback—and be open to receiving it too. This helps everyone improve.

For home public adjusters, a strong network isn’t just a list of contacts—it’s a crucial support system that enhances your ability to serve your clients effectively. Whether you’re a seasoned home adjuster near me or new to the field, investing time in building and nurturing professional relationships is time well spent. It not only elevates your service quality but also contributes to a more resilient and responsive recovery ecosystem for policyholders.

Frequently Asked Questions about Home Adjusting

Navigating the intricacies of home adjusting can often lead to questions, especially when you’re dealing with the aftermath of property damage. Here are some frequently asked questions that can help clarify the role and decisions surrounding home adjusters, home public adjusters, and the claims process.

What not to say to an insurance adjuster?

When interacting with insurance adjusters, it’s crucial to communicate effectively to safeguard your interests. Here are a few tips:

– Avoid Guessing or Speculating: If you don’t know the answer to a question, it’s better to say “I don’t know” rather than guessing. Incorrect information can complicate the claims process.

– Don’t Admit Fault: Even if you think you might be at fault, let the adjuster investigate and determine liability.

– Limit Personal Information: Stick to the facts of the claim. You’re not obligated to share unrelated personal details.

– Be Wary of Quick Settlement Offers: Don’t rush into accepting the first offer. Ensure it fully covers your damages.

Is using a public adjuster a good idea?

Hiring a public adjuster can be beneficial under certain circumstances. If your claim is complex, involves significant damage, or if you feel the insurance company’s offer is inadequate, a public adjuster can advocate on your behalf. Public adjusters are skilled in negotiating with insurance companies to ensure you receive a fair settlement. As noted in the information from Insurance Claim Recovery Support, a trustworthy public adjuster can provide peace of mind and assist in managing the claims process efficiently. It’s important to understand their fees and how they operate before engaging their services.

What does an adjuster do?

Adjusters play a key role in the insurance claims process. Their primary responsibilities include:

– Inspecting Property Damage: They assess damage to determine the extent and cause.

– Reviewing Policies: Adjusters review your insurance policy to determine what coverage applies to your claim.

– Determining Fault and Liability: For claims involving liability, they help determine who is at fault.

– Estimating Repair Costs: They estimate the cost of repairs or replacement of damaged property.

– Negotiating Settlements: Adjusters negotiate with the policyholder, and sometimes with public adjusters, to reach a settlement amount.

Home and business adjusters, including home damage adjusters and home and business public adjusters, focus on ensuring that the claims process is conducted fairly and efficiently, aiming for a resolution that satisfies all parties involved. Whether you’re working directly with insurance home adjusters or considering hiring a home public adjuster near me, it’s crucial to stay informed and proactive throughout the claims process.

Conclusion

Navigating home insurance claims can be a daunting task, whether you’re a seasoned policyholder or facing property damage for the first time. It’s a journey that requires understanding, accuracy, and advocacy—qualities embodied by professional home adjusters. As we’ve explored, from assessing property damage accurately to maximizing policyholder satisfaction, the role of home and business adjusters is pivotal in ensuring a fair and efficient claims process.

For those considering the support of home public adjusters, it’s evident that their expertise can offer invaluable guidance through complex claims, particularly when dealing with substantial property damage. Their role in advocating for the policyholder, coupled with their negotiation skills, can significantly influence the outcome of a claim.

It’s also clear that home damage adjusters must continuously adapt to the evolving landscape of insurance claims, integrating technology and ongoing education into their practice to serve their clients best. Moreover, building a robust network of professionals, including contractors and legal experts, is crucial for home and business public adjusters to provide comprehensive support to policyholders.

In summary, whether you’re a policyholder looking for a home adjuster near me or a professional in the field striving to enhance your practice, the core of successful claims adjustment lies in understanding, advocacy, and a commitment to fairness. At Insurance Claim Recovery Support, we’re here to guide you through every step of your claim, ensuring you receive the support and settlement you deserve. Our team of experienced adjusters is dedicated to advocating for your rights as a policyholder, providing you with peace of mind during what can often be a stressful time.

Navigating insurance claims need not be an overwhelming ordeal. With the right support and expertise, you can successfully manage the process, ensuring a resolution that meets your needs and allows you to move forward from property damage.