When hurricanes hit Texas, they leave a path of destruction in their wake, affecting countless homes and businesses. If you’re a property owner in Texas and have experienced hurricane damage, understanding the role of a Texas public adjuster could be critical in navigating the complex insurance claim process successfully. Texas weather is notorious for its unpredictability, with hurricanes posing a significant threat nearly every year. Handling insurance claims for such damage can be overwhelming, adding to the stress of the situation.

A public adjuster serves as your advocate, bringing expertise in damage assessment, policy interpretation, and negotiation to ensure you receive a fair settlement. Unlike insurance company adjusters, who work for the insurer, public adjusters work exclusively for policyholders. This distinction means they are focused on your best interests, helping to level the playing field against insurance companies that might seek to minimize payouts.

For property owners dealing with hurricane damage, a Texas public adjuster can be a lifeline, helping to avoid unnecessary litigation, delays, and underpayments. They’re equipped to handle the complexities of the claim process, from document preparation and damage assessment to negotiation with insurance companies.

In the aftermath of a hurricane, the last thing you want is to face the insurance claim process alone. Engaging a Texas public adjuster can provide the guidance and support needed to navigate these challenging times, ensuring you receive the compensation necessary to rebuild and recover.

Understanding Hurricane Damage in Texas

Hurricanes are no strangers to Texas. The state has faced some of the most devastating storms in recent history. Each hurricane has left its mark, teaching us the importance of being prepared and understanding the complexities of insurance claims. Let’s dive into the significant hurricanes and their impacts.

Hurricane Harvey (2017)

Harvey hit Texas like a freight train, becoming one of the costliest natural disasters in the United States with damages estimated at $125 billion. The hurricane’s unprecedented rainfall caused catastrophic flooding, especially in the Houston area, displacing thousands and damaging countless homes and businesses.

Hurricane Maria (2017)

While Maria primarily devastated Puerto Rico, its effects were felt along the Gulf Coast, including Texas. The hurricane highlighted the interconnectedness of weather systems and the widespread impact hurricanes can have, even if they don’t make direct landfall in the state.

Hurricane Laura (2020)

Laura, another Category 4 monster, wreaked havoc along the Texas-Louisiana border. With winds of up to 150 mph, it caused severe damage to structures, leading to a significant rebuilding challenge. Laura’s rapid intensification from a Category 1 to a Category 4 hurricane within just 24 hours served as a stark reminder of the unpredictability and power of these storms.

Hurricane Delta (2020)

Following closely on the heels of Laura, Delta added insult to injury, complicating recovery efforts and causing additional damage to an already battered region. The back-to-back nature of these storms stressed the importance of continuous preparedness and the challenges of recovery.

Gulf Coast and Caribbean

The geographical location of the Gulf Coast and the Caribbean makes them particularly susceptible to hurricanes. These areas have faced the wrath of numerous storms over the years, underscoring the need for robust disaster preparedness and recovery plans.

The Takeaway

Understanding the impact of these hurricanes is crucial for homeowners in Texas and the surrounding regions. Each storm teaches valuable lessons in preparedness, resilience, and recovery. They also highlight the critical role of Texas public adjusters in navigating the complex insurance claim process following such devastating events. Public adjusters specialize in maximizing your claim, ensuring you have the necessary resources to rebuild and recover.

After witnessing the destruction caused by hurricanes Harvey, Maria, Laura, and Delta, it’s clear that the right support and knowledge can make all the difference. Engaging a Texas public adjuster can provide the guidance and support needed to navigate these challenging times, ensuring you receive the compensation necessary to rebuild and recover.

The Role of a Texas Public Adjuster

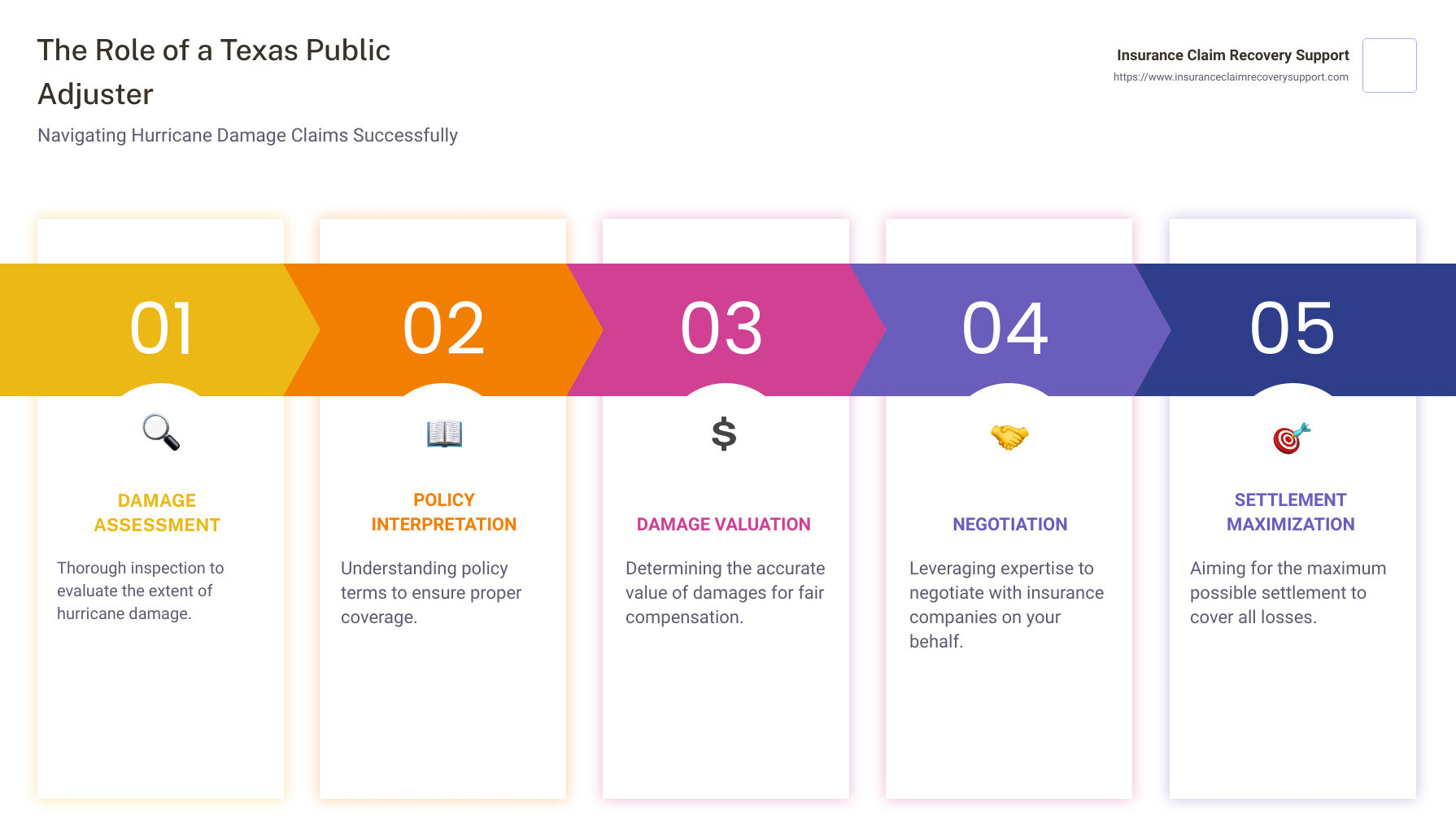

When a hurricane hits, it leaves a trail of destruction that can be overwhelming. This is where a Texas public adjuster steps in, playing a crucial role in helping you manage the aftermath. Let’s break down their role into clear, straightforward parts:

Damage Assessment

First things first, assessing the damage is key. A public adjuster inspects your property to identify all the hurricane-caused damages. This isn’t just a quick look-over. They dive deep to uncover not only the obvious damages but also the ones that aren’t immediately apparent. This thorough evaluation ensures that every affected part of your property is accounted for in the claim.

Policy Interpretation

Insurance policies can be complex, filled with jargon that’s hard to understand. A public adjuster becomes your translator, interpreting your policy to clarify what is covered and what isn’t. They ensure you fully understand your rights and the insurance company’s obligations, preventing any surprises down the line.

Damage Valuation

Once the damage is assessed, the next step is to put a price tag on it. Public adjusters are skilled in accurately valuing the damage. They consider current market prices, the cost of repairs, and even the value of lost items. This ensures you get a fair and just valuation that reflects the true extent of the damage.

Negotiation

Negotiating with insurance companies can be daunting. Public adjusters take this burden off your shoulders. Armed with detailed damage assessments and valuations, they negotiate on your behalf. Their goal is to secure a settlement that covers all your losses, ensuring you have the funds needed to rebuild and recover.

Settlement Maximization

The goal of a Texas public adjuster is to maximize your settlement. They leverage their expertise in damage assessment, policy interpretation, and negotiation to fight for the best possible outcome. With a public adjuster by your side, you stand a better chance of receiving a fair settlement that fully covers your hurricane damages.

In the wake of the destruction caused by hurricanes like Harvey, Maria, Laura, and Delta, the role of a Texas public adjuster cannot be overstated. They provide invaluable support, guiding you through each step of the claims process. From assessing damage to negotiating settlements, they work tirelessly to ensure you receive the compensation you deserve. Engaging a Texas public adjuster means having an expert advocate who is fully committed to your recovery.

Why Choose a Public Adjuster for Hurricane Damage Claims

When dealing with the aftermath of a hurricane in Texas, navigating the insurance claim process can feel like facing a second storm. It’s here that the role of a Texas public adjuster becomes crucial. Let’s break down why choosing a public adjuster is a smart move for handling your hurricane damage claims.

Advocacy

First and foremost, a public adjuster is your advocate. Unlike insurance company adjusters, who work in the best interest of their employer, public adjusters work for you. They are dedicated to ensuring your voice is heard and your needs are met. This means they will go the extra mile to make sure you understand every aspect of your claim and are fairly represented.

Fair Settlement

Achieving a fair settlement is the ultimate goal of filing an insurance claim. Public adjusters are skilled in negotiating with insurance companies to ensure you receive the maximum payout you’re entitled to under your policy. Their experience and knowledge in handling claims specifically related to hurricane damage in Texas give them an edge in these negotiations.

Policyholder Rights

Understanding your rights as a policyholder is crucial. Public adjusters are well-versed in the fine print of insurance policies and the legal aspects surrounding them. They ensure that your rights are not overlooked and that the insurance company fulfills its obligations to you, the policyholder.

Insurance Company Adjusters

It’s important to understand the difference between public adjusters and insurance company adjusters. The latter are employed by the insurance company and their primary goal is to minimize what the company pays out. In contrast, public adjusters work on your behalf to maximize your claim settlement.

Request for Proof of Loss

A Request for Proof of Loss is a formal document outlining the extent and value of your damages. Completing this document accurately is critical. Public adjusters have the expertise to accurately document and submit this proof, ensuring that nothing is overlooked or undervalued.

Reservation of Rights Letter

Receiving a Reservation of Rights Letter from your insurance company can be daunting. This letter is a way for the company to protect itself, not you. A public adjuster can help you navigate this complex situation, advising you on the best course of action and ensuring your claim is not unjustly denied or reduced.

Examination Under Oath

An Examination Under Oath (EUO) can be a critical step in the claims process. It’s a formal proceeding where you’re questioned by the insurance company’s attorney. Having a public adjuster by your side during this process can be invaluable. They can prepare you for the types of questions you’ll be asked and ensure your rights are protected throughout the examination.

Choosing a public adjuster for your Texas hurricane damage claim is about ensuring you have an expert advocate who can navigate the complexities of the insurance claims process. From advocating for your rights to negotiating the fair settlement you deserve, a public adjuster is an indispensable ally in your recovery journey. Their expertise and dedication can make all the difference in the outcome of your claim, allowing you to focus on rebuilding in the aftermath of a hurricane.

Common Challenges in Filing Hurricane Damage Claims

Navigating insurance claims after a hurricane hits can be a daunting task. Especially in Texas, where hurricanes can bring unprecedented damage. Here, we’ll explore some common hurdles you might face when filing a claim for hurricane damage and how a Texas public adjuster can help overcome them.

Denied Claims

It’s not uncommon for insurance companies to deny hurricane damage claims. Reasons can range from the insurer claiming the damage was due to pre-existing conditions or lack of maintenance rather than the hurricane itself. This can be a significant blow when you’re counting on that support to rebuild.

Inadequate Settlements

Another frequent issue is receiving an inadequate settlement. This occurs when the insurance company’s payout offer is far less than what’s needed to cover the repair costs. It can leave policyholders in a tough spot, struggling to bridge the gap between the settlement and the actual repair expenses.

Pre-existing Damage

Insurance companies often scrutinize claims to identify any damage that might have existed before the hurricane. If they determine that the damage was pre-existing, they may use this as a basis to deny the claim. This can be particularly frustrating when you know the damage was indeed caused by the hurricane.

Lack of Maintenance

Similarly, claims can be denied due to alleged lack of maintenance. Insurers might argue that the damage resulted from the homeowner’s failure to properly maintain their property, rather than from the hurricane itself. This can be a challenging accusation to refute without detailed records and evidence.

Policy Exclusions

It’s crucial to understand your policy’s exclusions. Many homeowners are surprised to learn that their insurance does not cover certain types of damage. For instance, windstorm damage, a common consequence of hurricanes, may not be covered under standard policies, especially in high-risk areas.

Windstorm Damage Coverage

In Texas, some areas require a separate policy for windstorm damage. This can be a source of confusion and frustration for many homeowners who assume their standard homeowner’s insurance policy covers all hurricane-related damages. Understanding and navigating these nuances can be complex.

Overcoming These Challenges

Facing any of these challenges can be overwhelming, but you don’t have to tackle them alone. A Texas public adjuster specializes in handling hurricane damage claims and can be your advocate, ensuring your claim is accurately filed and fairly settled. They understand the ins and outs of insurance policies, including the often complex provisions related to hurricane damage.

By meticulously documenting the damage, negotiating with the insurance company, and leveraging their expertise in Texas insurance laws, a public adjuster can help you overcome these common hurdles. Their goal is to ensure you receive the maximum settlement possible, enabling you to rebuild and recover from the hurricane’s devastation.

After a hurricane, your focus should be on recovery and rebuilding, not battling with insurance companies. Enlisting the help of a Texas public adjuster can make a significant difference in the outcome of your hurricane damage claim, helping you navigate these common challenges with greater ease and confidence.

Moving forward, be prepared and informed about the role of public adjusters and how they can assist in maximizing your hurricane damage claim in Texas.

Maximizing Your Hurricane Damage Claim in Texas

When faced with hurricane damage in Texas, understanding how to maximize your insurance claim is crucial. The process involves detailed documentation, evidence gathering, and leveraging the expertise of a Texas public adjuster. Here’s how to ensure you’re fully compensated for your losses.

Documentation is Key

Start by documenting every aspect of the damage as soon as it’s safe to do so. Use your smartphone or camera to take clear photos and videos from multiple angles. This visual evidence should cover all affected areas, including any structural damage, water intrusion, and damaged possessions.

Gathering Evidence

In addition to photos and videos, gather any other forms of evidence that can support your claim. This could include:

- Weather reports proving the hurricane’s presence in your area.

- Witness statements from neighbors or local authorities.

- Receipts or bank statements for any immediate repairs or protective measures you had to undertake.

Assessing Structural Damage

A professional assessment can significantly bolster your claim. Consider hiring an expert, such as a structural engineer, to evaluate the extent of the damage. Their report can provide an authoritative perspective that strengthens your case.

Inventory of Lost or Damaged Items

Create a detailed inventory of all damaged or lost items. For each item, note its description, purchase date, cost, and if possible, attach any receipts. This meticulous record-keeping is vital for claiming the full value of your losses.

Dealing with Broken Equipment

If hurricane damage has led to broken equipment, especially in commercial properties, document the equipment’s make, model, and serial number. Obtain repair or replacement quotes from reputable service providers to substantiate your claim.

Negotiation Skills

Negotiating with insurance companies can be daunting. This is where a Texas public adjuster comes in. They possess the negotiation skills needed to advocate on your behalf, ensuring you receive a fair and just settlement.

Leveraging Local Expertise

Texas public adjusters bring invaluable local expertise to the table. They are familiar with Texas insurance laws and the specific challenges posed by hurricanes in the Lone Star State. Their knowledge can be a game-changer in how your claim is processed and settled.

Understanding Texas Insurance Laws

Texas has specific laws and regulations governing insurance claims, including deadlines for filing claims and provisions for dispute resolution. A Texas public adjuster will navigate these laws, ensuring your claim complies with all legal requirements and maximizes your entitlements.

By focusing on thorough documentation, evidence gathering, and leveraging the expertise of a Texas public adjuster, you can significantly enhance your chances of a favorable outcome. The goal is not just to repair the damage but to fully restore your property and possessions to their pre-hurricane state. With the right approach, you can navigate the complexities of hurricane damage claims in Texas with confidence.

Frequently Asked Questions about Texas Public Adjusters

Navigating the aftermath of a hurricane in Texas can feel overwhelming. That’s why many turn to Texas public adjusters for help with their hurricane damage claims. Here, we’ll tackle some of the most common questions to demystify the process and roles involved.

What does an insurance adjuster do after a hurricane?

After a hurricane, an insurance adjuster’s job is to assess the damage to your property. They look at everything: from structural damage to lost items. They’re like detectives for damage, piecing together what happened and how much it will cost to fix it. But, not all adjusters are the same. A Texas public adjuster works for you, not the insurance company. They’re on your side, making sure you get what you deserve to rebuild and recover.

What are the negatives for using a public adjuster?

Let’s keep it real. Hiring a Texas public adjuster for hurricane damage isn’t without its downsides. Firstly, they charge a fee, usually a percentage of your claim settlement. In Texas, this can be up to 10%. It might seem like a lot, but think of it as investing in getting a fair payout. Secondly, the process might take a bit longer. They’re thorough, which means they’ll take the time to get every detail right. Lastly, there’s a small chance it could cause a bit of tension with your insurance company. But, a good public adjuster knows how to navigate these waters smoothly.

How much can a public adjuster charge in Texas?

In Texas, the law has your back. Public adjusters can’t just charge whatever they feel like. They’re typically limited to charging about 10% of your claim settlement. This cap is there to protect you from excessive fees. It’s a fair deal considering they’re fighting to maximize your claim, often leading to a better settlement than you might get on your own.

Dealing with hurricane damage is tough, but you don’t have to do it alone. A Texas public adjuster can be a valuable ally, helping you through the process and working towards the best possible outcome for your claim. They bring expertise, advocacy, and peace of mind when you need it most.

Conclusion

Dealing with the aftermath of a hurricane in Texas can be an overwhelming experience. From the initial shock of seeing the damage to your property, to the daunting task of filing an insurance claim, it’s a journey filled with challenges. This is where Insurance Claim Recovery Support LLC steps in, offering a beacon of hope and professional guidance.

We understand the complexities of hurricane damage insurance claims like no one else. Our team of seasoned Texas public adjusters specializes in navigating these turbulent waters, ensuring that you, the policyholder, are fairly compensated. With our deep understanding of Texas insurance laws and a steadfast commitment to advocating for your rights, we’re here to ensure that your claim is not just another statistic.

Why Us? Because we’ve been in your shoes. We’ve seen the devastation that hurricanes can cause and the uphill battle that follows with insurance companies. Our mission is simple: to level the playing field and ensure that you receive the full benefit of your insurance policy. Our track record speaks volumes, with countless claims settled that have allowed Texans to rebuild their lives and businesses.

Our Approach is thorough and meticulous. We start by assessing the damage, understanding your policy inside out, and then crafting a claim strategy that maximizes your settlement. We handle all the heavy lifting, from documenting damages to negotiating with insurance companies, so you can focus on what truly matters – recovery and rebuilding.

When you choose Insurance Claim Recovery Support LLC, you’re not just getting a public adjuster; you’re gaining a partner who’s committed to your recovery. Our no recovery, no fee policy means we’re as invested in your claim as you are. We believe in transparent communication, empathy, and relentless pursuit of what’s fair.

In the wake of a hurricane, it’s easy to feel lost and uncertain about the future. But with Insurance Claim Recovery Support LLC by your side, you have a team that’s dedicated to helping you navigate through this challenging time. We invite you to explore our services and see how we can help you rebuild, restore, and recover.

Whether it’s hurricane damage or any other form of property loss, you don’t have to face it alone. Reach out to us, and let’s start the journey towards recovery together.

Insurance Claim Recovery Support LLC – Your ally in the face of disaster, dedicated to ensuring you receive the settlement you deserve.